Have you ever tried searching for home loan information but you end up feeling like you’re looking for a needle in a haystack?

Wouldn’t it be nice to have all the home loan information you need in one location?

We heard you!

The ultimate home loan advice guide is here to answer all your questions, plus provide answers to questions you’ve never thought of.

What’s more, we included links to other sites and pages should you need more information, and links to contacts should you wish to speak to someone asap.

Jump straight to…

Why Getting the Right Home Loan Advice is Important

While this ultimate home loan advice tries to answer all your questions, nothing can replace a specialist’s advice on giving you the best home loan options.

Why?

First of all, this ultimate home loan advice looks at the general situation of the home loan market in Australia.

On the other hand, a licensed mortgage broker aims to answer all your individual needs pertaining to a home loan.

With a licensed mortgage broker, you have the advantage of a professional acting in your best interest, explaining your mortgage choices, and helping you make the right decision.

What You Need to Know Before Buying a Home

Buying a house is one of the most important purchases you’ll ever make. But getting a pre-approval letter from a mortgage lender isn’t the only way to figure out the right price range.

If you’re a first time home buyer, you might be shopping around based on how much a financial institution is willing to lend and fail to consider other costs. This could potentially make it hard for you to meet your monthly repayments.

When you miss your monthly repayments, you won’t like the possible consequence:

You might lose your home.

Therefore, you need to think about more than just the monthly mortgage repayment when deciding on a house to buy.

If you don’t do the maths ahead of time, you can end up with a nice house but no money, which can likely cause all kinds of financial problems. Think about how much your dream will cost before you commit to it.

The Costs of Buying a Home

Although most of us are aware that purchasing a home requires a significant initial financial outlay, few of us are aware of how lengthy the process might take.

Despite the fact that the federal and state governments are giving out incentives left, right, and centre, you still need to perform a thorough cost analysis before purchasing a property.

Consider the upfront costs that go with a deposit such as stamp duty, transfer fees, council rates, and agent’s fee.

Deposit

The biggest amount a home buyer needs to save for is the deposit on the property, whether it be 20%, 10% or 5% of the property price.

However, you’ll need to budget for more than your deposit amount since there are other costs involved in purchasing a house which we’ll discuss next.

Stamp Duty

Stamp Duty aka transfer duty will be your biggest upfront cost after the deposit. Transfer duty is a government tax charged for acquiring property.

This includes the following in real estate:

- Signing a contract to acquire property; or

- Gifting a portion of your property to someone; or

- Creating a trust for your children or family members over land that you previously owned in your own right.

Each Australian state has a different transfer duty rate, although as a rule of thumb, it’s 3-4% of the property’s value.

But if you want to know the exact transfer duty for your situation, it’s best to ask your mortgage broker to figure it out or call your local government office.

Transfer Fees

Transfer fees aka Government Registration Fees are imposed by the Titles Office Administration to change the land ownership into the new owners’ names.

Government registration fees also vary according to state and territory.

Council Rates

When you purchase a property, you must pay the vendor the remaining yearly or quarterly fees, such as water and land. These will start from the date of settlement and will be specific to the property and locality.

Buyer’s Agent Fee

Although you are not required to use a buyer’s agent, it is a cost to consider. A buyer’s agent works solely for you to locate, negotiate, and acquire a home that meets your preferences and needs.

They have all of the research tools and contacts at their disposal and are committed to finding the perfect home for you, usually within a 45-60-day time frame. Homebuyers typically take six months to complete the same task.

- Buyer’s Agents can frequently pounce on houses that aren’t even on the market yet, putting you ahead of the competition.

The Costs of Having a Mortgage

A mortgage payment usually consists of two parts:

- Principal

- Interest

The Principal is the sum that is deducted from your outstanding loan balance.

Interest is the cost of borrowing money. Your interest rate and loan balance impact the amount of interest you pay, which is why it’s always a good idea to check comparison rates of lending institutions.

However, there are other costs attached to a mortgage that a financial institution charges such as:

- Lenders Mortgage Insurance,

- Mortgage Registration Fee,

- Mortgage Application Fee,

- and Home Loan Fees.

Lenders Mortgage Insurance

Lenders’ Mortgage Insurance (LMI) is normally not required if you have a 20% deposit. Homebuyers with a lesser deposit, on the other hand, will.

- This is a one-time fee that ranges between 1% and 3% of your loan amount.

Mortgage Registration Fee

A mortgage registration fee applies when you register the physical property as the security on a home loan.

This is significant since it helps buyers determine whether or not there are any claims against the existing property. When a home loan is established or cancelled, the fee is paid. The cost of the mortgage registration charge differs by state.

Mortgage Application Fee

Mortgage application fee aka loan establishment fee is the fee charged by your lender to set up your mortgage and can vary drastically.

- Certain banks may not charge any home loan application fee, while the average is roughly $150.

Home loan application fees are non-refundable one-time expenses that must be paid in full.

Home Loan Fees

There are many home loan costs that may be levied upfront if you have a house loan. Lenders make every effort to make their fees and charges visible to borrowers, but each lender may term their costs something different, and certain fees may still surprise you.

As a result, it is critical that you enquire with your broker about the comparison rate schedule for your home loan product to determine how other fees affect the true cost of the loan.

Fees for home loans that may be assessed include:

- valuation/security assessment fee,

- security guarantee fee,

- rate lock fee,

- document preparation fee.

Valuation/Security Assessment Fee

Your lender will hire an outside valuer to assess the property you’re buying. As a borrower and future homeowner, this will influence how much the lender is willing to lend you.

Rate Lock Fee

A rate lock fee is a cost paid by fixed-rate borrowers when they apply for a mortgage. By paying a rate lock fee, your rate will be locked from the moment you apply and will not increase before you begin your first repayment.

Document Preparation Fee

Before the contract is approved, your lender may charge a fee to prepare your home loan documentation.

Other Home or Loan Costs to Consider

Aside from the costs of buying a home and getting a mortgage, a home buyer needs to consider the expenses associated with getting a contract made up, the services required when purchasing a new home, insuring its contents, and running your new home.

Legal and Conveyancing Fees

When buying a property, it would be wise to hire a solicitor or conveyancer who will prepare all the required documentation and be your go-between with the bank and the vendor you’re buying the property from.

It will cost between $700 and $2500, depending on the complexity. Learn more at the website of the Australian Institute of Conveyancers.

Building and Pest Inspections

It is strongly encouraged to get a building and pest inspection for houses and separate dwellings, or a strata report inspection for units and strata dwellings.

These studies will provide information on the structural integrity of the building, including pest infestations for dwellings, and will alert you to any issues that may necessitate costly repairs in the future.

A strata report inspection for a unit block will tell you what work has been done on the building and if any further work is scheduled including all costs paid and due to be paid.

Connecting Gas, Electricity and Telecommunications

When a homeowner moves out, utility services are usually disconnected and reconnected under the name of the new owner. Depending on the provider, an account set-up or connection fee may apply.

Moving Charges

Moving costs can vary greatly depending on how much you have and how far you’re travelling. It is advisable to shop around and obtain at least three quotations.

Strata and Body Corporate Fees

If you buy an apartment, unit, or townhouse, you have to pay body corporate or strata fees.

These fund the upkeep of common areas on and around the property, building insurance, and administration fees to run the body corporate/strata management.

Note that the building insurance does not cover the contents of your apartment. You’ll have to get separate insurance for your belongings.

Home and Contents Insurance

Building insurance is required by lenders as part of the loan application procedure.

When you need to have your building insurance sorted out will vary depending on the state or territory you live in, as well as your contract. In general, you must obtain building insurance on the property from the time both parties sign the contract of sale, or by settlement.

It’s also a good idea to get contents insurance, which covers all of the contents of the house, including your furniture, electronics, and so on.

Regular Maintenance and Repairs

As a homeowner, you’ll also need to budget for routine property upkeep and repairs. These expenses do not occur on a regular basis, but you need to budget for them because they can quickly add up.

Maintenance can include:

- servicing your air conditioners,

- painting the property,

- landscaping,

- and cleaning out the gutters, among other things.

Repairs may involve replacing a damaged hot water system, repairing an air conditioner that breaks down in the middle of summer, repairing a leaking washing machine, repairing screen doors, and so on.

What You Need to Qualify for a Home Loan

When you apply for a home loan, your lender will make sure that you meet the requirements for getting a home loan. They need to make sure that you are a good candidate for a loan.

Home loan requirements can be different from one lender to the next, but you can bet that they’ll want to know about you, the property, how much you want to borrow, and your current financial circumstances.

Your lender will want to know everything about you, like your full name, family status, age, address, and so on.

To get a mortgage in Australia, you have to be at least 18 years old. However, if you are an older borrower, your age can also be a factor.

Older borrowers will have to show that they will be able to pay off their mortgage for the full length of the loan.

- For example, if you are 60 years old and want to get a home loan, you might not be a good candidate for a 30-year loan term.

Whether you’re young or old, the lender needs to know that you’ll be able to pay back your loan without any trouble during the loan term.

To apply for a home loan, you must also be an Australian citizen or permanent resident.

If you are in a de facto relationship or married to an Australian citizen or permanent resident, you may also be able to apply for a mortgage.

Your lender will probably also want to know how many people are applying for the mortgage, if any of the applicants are married, and if you have any children who depend on you.

If you want to know if you qualify for a home loan, you can talk to the MMSTeam for free so you can be matched with the right Mortgage Broker.

Property Details

The lender will also require additional details regarding the property you intend to purchase.

Property details could consist of, but not be limited to:

- How much the property is worth

- In what location (metropolitan, rural)

- The type of property (house, unit, townhouse, granny flat, studio apartment, tiny house)

- How old the property is

- The size of the property (especially for units or flats, where the lender may have a minimum square footage requirement)

Some lenders impose limitations on the kind of properties they would accept as collateral for loans.

Homes in urban and suburban locations are typically favoured since they may be simpler to sell later on and are less prone to depreciate.

On the other hand, rural and tiny properties might provide challenges because it can be difficult to estimate their value.

Also, properties in areas prone to natural disasters, such as flood zones, may be undesirable to lenders.

Loan Amount

The lender will often take into account how much you need to borrow in relation to the value of the property.

This affects the loan-to-value ratio (LVR), the possibility of having to pay LMI, and your ability to pay back your mortgage.

Consider requesting a $300,000 loan for a $400,000 house.

- This indicates that you have a $100,000 deposit and a 75% LVR. You won’t have to pay LMI because you have a deposit on the house that is greater than 20%. This is due to the possibility that you are a “less risky” borrower.

In light of this, the lender will assess your suitability for the loan based on your financial condition, the specifics of your property, and any other eligibility requirements.

Your Financial Situation

Lenders must guarantee that a mortgage is appropriate for the borrower. They will examine a number of indicators to determine your financial situation, including your income, employment, assets and liabilities, and credit score.

1. Income

Your current income, including your gross annual pay, rental income, or any other supplementary income, as well as your spending patterns, work history, and other factors, will be examined.

- This enables lenders to assess if you can actually afford the loan amount you have requested.

Your repayments will typically need to be less than 30% of your salary because the typical mortgage stress threshold is roughly 30% of your household income (before taxes).

2. Employment

The length of your employment, the nature of your employment (full-time, self-employed, etc.), and the sector you work in will all be taken into consideration.

Typically, lenders require your home loan application to be submitted with the last three months’ worth of payslips.

If you are self-employed, you might not be able to submit these records, therefore you’ll need to provide alternative paperwork instead, such as your tax returns.

Before qualifying for a mortgage, you should typically have held your current position for at least six months, although staying in the same role for two years can be advantageous.

This is so that the lender can be sure you’ll have a stable job and, consequently, stable income when you take out a mortgage.

- Self-employed applicants might have to clear a few more hurdles before being authorised for a mortgage.

3. Assets and Liabilities

To make sure you can afford a mortgage, your lender will also consider your assets and obligations as well as your monthly expenses.

Assets may consist of:

- Other properties or assets you may own

- The number of cars or vehicles you own

- Your current home’s contents

- Personal financial investments

Liabilities that could exist include:

- existing debt (car loan, personal loan, home loan)

- credit card limits

Your daily living expenses, such as food, bills, entertainment costs, and other financial responsibilities, will also be taken into account by your lender.

Your lender can conclude that you can’t afford to manage a home loan if your living expenses are excessive or you have little spare cash flow.

Additionally, a lender can determine that you can’t manage a mortgage if your debt-to-income ratio is too high, meaning you have too many other loans or debts to repay.

4. Credit Score

- Your credit score is an indicator of your borrower responsibility.

To be eligible for a house loan, you may need to have achieved a minimum predetermined credit score with some lenders.

In general, your chances of getting a mortgage are decreased the lower your credit score. On the other hand, your likelihood of approval increases with your credit score.

With an ordinary credit score, you might still be able to get a mortgage, but you may have to pay a higher interest rate and have fewer desirable loan terms.

If you’re preparing to submit an application for a home loan or have questions, speak with the MMS Team to guide you for free.

How Much Money Should You Save Before Buying a House?

Considering that you probably need to get a home loan to buy a house, it would be best to determine how much you can afford to borrow before you start saving for a deposit.

Be sure to include in any home purchase expenses like conveyance fees and stamp duty.

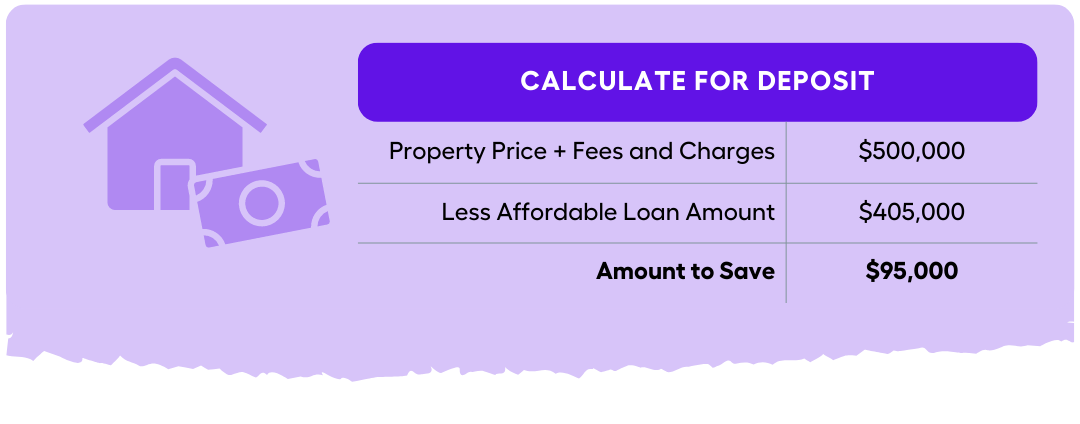

To calculate the deposit you need to save for:

- Add the property price to the fees and charges

- Subtract the amount you can afford to borrow

Most lenders prefer a deposit worth 20% of a home’s purchase price, plus enough to cover the cost of buying a home.

Although some lenders require a deposit as low as 5%, a smaller deposit means a larger loan and the need to pay for LMI.

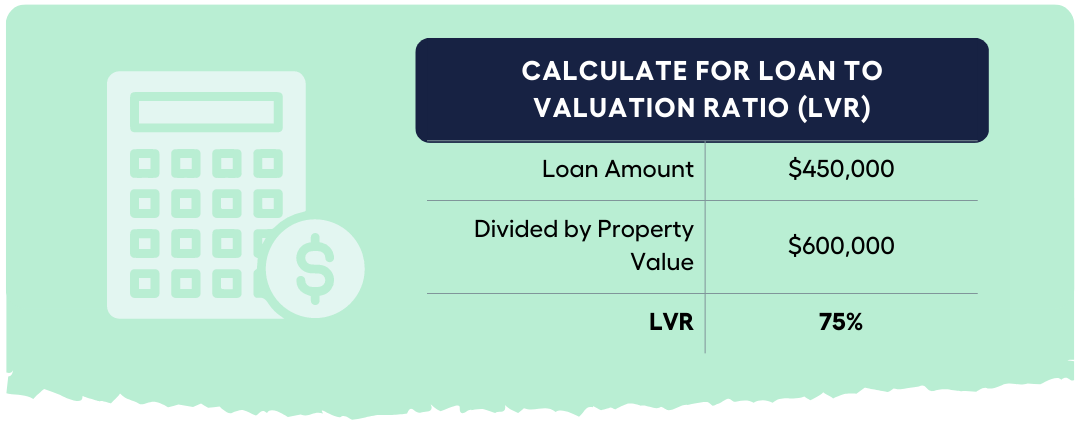

The higher your deposit, the lower your loan-to-value ratio (LVR). Your LVR is the loan amount divided by the property’s purchase price or appraised value.

- For example, your LVR would be 75% if you were buying a $600,000 house with a $450,000 loan.

Also, a larger deposit demonstrates to lenders that you are a good saver and capable money manager.

A large deposit and a low LVR improves your chances of being granted a mortgage.

What happens if you, for some reason, can’t save for a 20% deposit?

- You might be eligible for government assistance if you’re buying your first house.

The government has several financial assistance schemes for qualified first time home buyers.

Are Any House Buying Costs Tax Deductible?

The majority of the costs you incurred when purchasing your property are regrettably not tax deductible in the year of purchase.

You cannot claim any tax deductions if you own a home and live in it without using it to generate revenue.

However, if it’s an investment property, there are items which you can claim under property development, building and renovating.

According to the Australian Taxation Office (ATO), your tax duties and entitlements will depend on how you build or renovate properties (for instance, as a one-time or ongoing activity).

In any event, you need think about your responsibilities for:

If you’re not clear whether your purchase will be considered for business or personal acquisition, check this ATO link, or speak with the MMS Team to guide you for free.

What Should You Do Before Buying a Home or to Improve Your Chances of Getting a Home Loan?

Given that a home is a significant financial investment, it is only prudent to get your finances in order while looking for a home.

Save for a Deposit

If the need to save money for that deposit keeps getting in the way, take these 6 steps into account. Saving for a deposit might not take as long as you think if you approach it the right way.

Step 1

Set a Goal Amount

Estimating the amount you’ll need for a deposit and other up-front expenses for a home can motivate you because it gives you a target amount to strive for.

Look at home prices in areas where you want to purchase to determine your target amount, and then use our borrowing power calculator to figure out how much you could borrow.

Step 2

Track Your Spending

Look at your transactions from the last 90 days and do a self-audit to get a good idea of how you spend your money. You’ll be able to see where you can cut back by categorising where you spend your money. Even the smallest details matter.

Step 3

Set a Realistic Budget

Let’s be honest:

If you take away all of your treats, you’re more likely to give up and save nothing. Choose one or two things every month that you won’t feel guilty about – a movie, a massage, a night out – and savour them.

Saving for a house deposit will become less difficult with a more realistic budget.

Step 4

Choose a High Interest Savings Account

Choose a savings account that has a competitive interest rate. Some savings accounts offer a higher interest rate in exchange for good savings habits such as not making withdrawals or regularly depositing a minimum amount.

Step 5

Transfer Funds Automatically to Your Savings Account

Setting up an automatic transfer from your main bank account to your savings account every payday saves you time and helps make you less likely to spend your savings on impulse purchases.

Step 6

Use a Debit Card Instead of a Credit Card

Using a debit card instead of a credit card limits your spending to the funds in your bank account. You also avoid the interest charges that come with credit cards, and you may avoid paying an annual fee entirely.

Budget for Mortgage and Home-Related Costs

Your deposit is just one of the up-front expenses you’ll need to take into account when setting your home-buying budget.

Additionally, there are closing costs that must be paid, including valuation fees, application fees, and establishment fees for your lender.

Closing expenses typically represent 2% to 5% of your purchase price.

- For instance, you might anticipate paying between $4,000 and $10,000 in closing expenses for a home with a $200,000 purchase price.

For a more accurate account of how much you need to set aside for mortgage and home-related costs, consult with a mortgage broker.

If you haven’t started checking for mortgage brokers, speak with the MMS Team for free to match you up with a mortgage broker and get expert home loan advice.

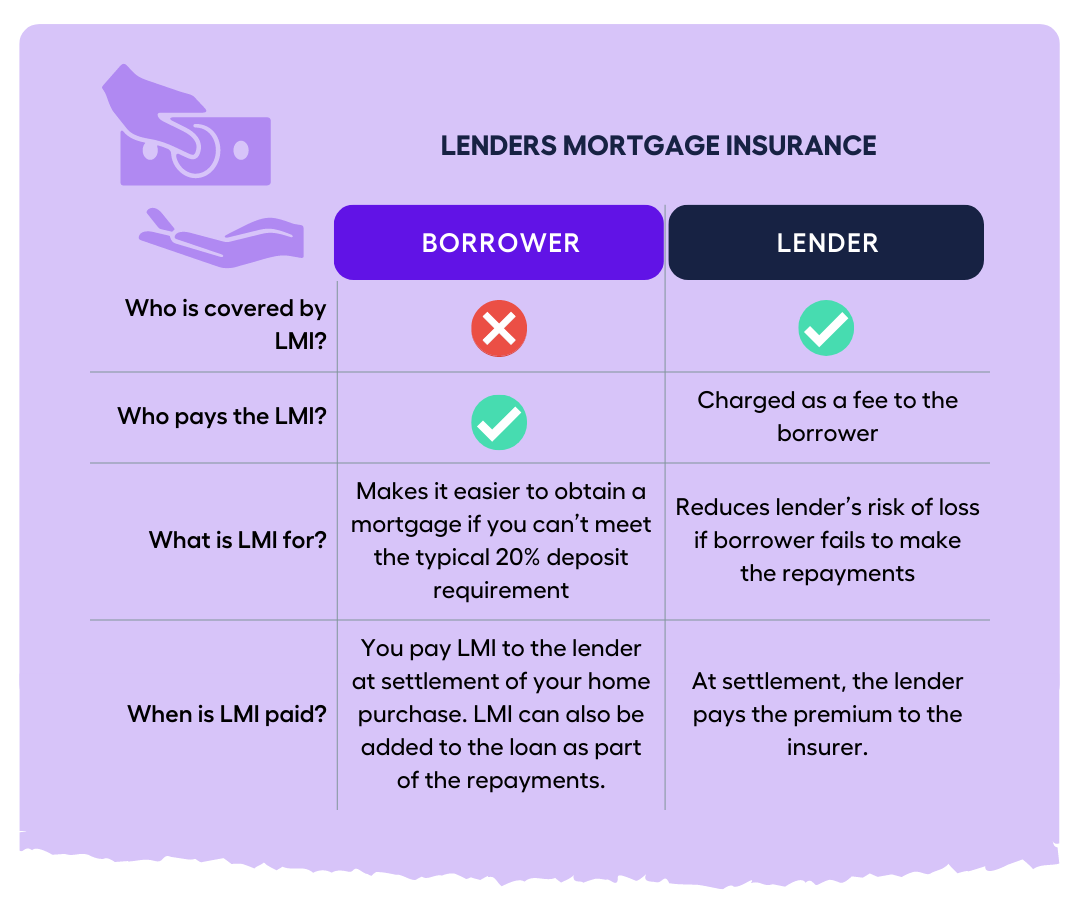

Understand Lenders Mortgage Insurance

Lenders Mortgage Insurance (LMI) covers the lender, not you (or any guarantor), even though the lender will usually pass the cost of LMI on to you. This means that you cannot make a claim under the LMI; only the lender can.

LMI makes it easier for you to obtain mortgage financing if you meet lender requirements but lack a substantial deposit.

LMI accomplishes this by reducing the lender’s risk of loss if you fail to make your home loan repayments.

At settlement, when you buy a home, the lender will pay the LMI premium to the insurer.

- This one-time payment covers the lender for the entire loan period, which can be up to 30 years.

The cost of this LMI premium will typically be charged to you as a fee by the lender. This is because the cost of LMI is part of what the lender has to pay to give you a loan.

You can pay this cost to the lender at settlement of your home purchase. You might be able to add it to the loan value, too, and the cost of LMI will be added to your loan payments over the life of your loan.

LMI is not the same as mortgage protection insurance, which you may purchase separately to protect yourself against the risk of not being able to make loan repayments.

Get Your Life Insurance & Income Protection Sorted

Australians are getting into a lot of debt, which can put borrowers in a tough spot.

What would happen if something bad happened to you and you couldn’t meet your financial responsibilities?

For almost all homeowners, it makes sense to have life insurance in place as financial protection. If the worst happens and you own a home, your mortgage is probably going to be the biggest debt you leave behind. Having a policy in place can help give you peace of mind.

- If you and your partner buy a house together, your mortgage affordability could be based on both of your salaries.

If you or your partner died while you still owed money on your mortgage, would one of you be able to pay the mortgage on your own?

If you die during the length of your policy, life insurance can help by paying out a cash lump sum that can be used to help pay off the remaining mortgage, and it means that your family can stay in your home without having to worry about the mortgage.

In the same way, income protection insurance pays for your living expenses if you can’t work because of a serious illness or injury.

With income protection insurance, you pay a premium based on how much you will receive as a monthly benefit, how long you need to wait until these payments come into effect (aka waiting period), and the maximum amount of time the payments will last (aka benefit period).

- If you can’t work due to illness or injury, you’ll receive a payment of up to 70% of your salary to cover bills, mortgage payments, education, and rehabilitation.

The income protection insurance slightly differs from an “industry” or “salary continuation” fund offered by your employer superannuation.

- Salary continuation plans are typically less comprehensive than income protection.

Also, income protection and mortgage protection are often confused. Mortgage protection insurance only covers mortgage repayments. It cannot pay bills, groceries, or expenses.

Reduce Debts & Financial Liabilities

Could you comfortably afford to add monthly mortgage repayments to your current debt repayments?

If the answer is NO, it may be wiser to prioritise debt relief before putting money aside for your deposit.

Otherwise, you may find it more difficult to pay off debt once you have mortgage repayments and other expenses related to property ownership.

3 Reasons Why Paying Off Debt is a Good Idea

- It improves your borrowing power

- You save on interest repayments

- It improves your mortgage application

- Managing your financial commitments helps you pay down your debt and shows a potential lender that you can be trusted.

Through your credit report, lenders can see how many times you’ve applied for credit, missed payments, defaulted, and how much you’ve paid back. Having a clean credit report and making payments on time will give your lender confidence that you will meet your home loan obligations.

If you’re not sure how you can reduce your debts while saving for a deposit, speak with the MMS Team to match you up with a financial advisor for free.

Should You Speak to a Financial Advisor Before Buying a House?

We all need housing, but we need to be practical with our decisions and not succumb to the desire of having a large, fancy house with all the modern luxuries.

Consulting with a financial advisor can provide you with unbiased clarity and allow you to see the big picture and the long view.

Your financial advisor can walk you through the various reasons, risks, and consequences associated with a given decision or opportunity, as well as show you other avenues to your goals.

How a Financial Advisor Can Help You When Buying a House

A Financial Advisor can:

- Work with a mortgage broker to determine all of your home loan options, including the best mortgage structure for you.

- Determine affordability by considering deposits, stamp duty, ongoing costs, ownership structure, and cashflow.

- Use a strategic plan to incorporate this purchase into your “life plan,” along with your personal goals and financial objectives.

When it comes to purchasing property, a financial advisor can assist you in making sound decisions, allowing you to spend more time enjoying life rather than busting your budget to pay off your mortgage.

If you wish to know more about how a financial advisor can incorporate a home purchase with your other financial goals, speak with the MMS Team to match you up with a financial advisor for free.

What Should a First-Time Home Buyer Know?

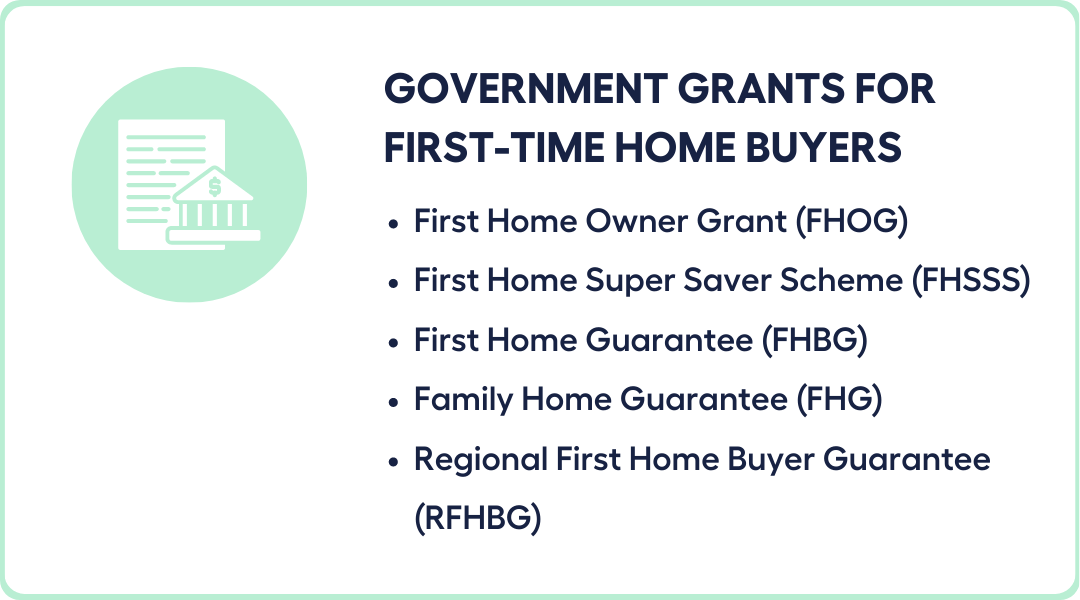

First-time home buyers shouldn’t fret if they find it challenging to raise the required deposit on their home. The Australian government provides financial assistance to first-time home buyers in various ways.

Financial Assistance & Schemes to Help FTHB

Before buying or building your first home, you should determine whether you are eligible for assistance from the Australian government as well as your state or territory.

You might be eligible for assistance from the government if you’re buying your first house.

First Home Owner Grant (FHOG)

The First Home Owner Grant (FHOG) scheme was started by the Australian government in July 2000. Its objective was to offset the impact that the goods and services tax (GST) had on homeownership.

Through the grant, potential new homebuyers may benefit in a number of ways, including a waiver of transfer duty.

Home buyers must fulfil a number of standards. They include investing up to $1 million in their first house in Australia.

In terms of aspects of the home, such as purchasing a new or renovated home, the FHOG is subject to additional conditions.

To check if you are eligible or to get more information about the FHOG, please select the state or territory where you intend to purchase your home.

First Home Super Saver Scheme (FHSSS)

The First Home Super Saver Scheme (FHSSS) is a programme run by the Commonwealth government that enables qualified first-time homeowners to increase their savings by making additional superfund contributions.

In this arrangement, contributions are taxed at the superannuation tax rate rather than the initial income tax rate.

- Under the FHSSS, first-time homebuyers who have voluntarily put up to $15,000 per financial year into their super can withdraw these amounts (plus earnings, less tax) from their super fund to help pay for a deposit on their first home.

If you are eligible, the most you can take out of your voluntary contributions under the scheme is $50,000 for an individual.

First Home Guarantee (FHBG)

Under the First Home Guarantee (FHBG), previously called First Home Loan Deposit Scheme (FHLDS), first-time homebuyers who qualify can buy or build a new home with as little as a 5% deposit. This rate requires a much smaller deposit than the usual 20%.

- Best of all, you don’t have to get LMI (lender’s mortgage insurance) if you qualify.

The FHBG is run by the National Housing Finance and Investment Corporation (NHFIC). It backs up a participating lender for up to 15% of the cost of a home bought with a loan for a first-time buyer.

If you want to be part of this programme, you must meet certain requirements such as age, whether you own or rent your home, and how much money you have saved. You must also buy your home through a lender who is part of the scheme.

All over Australia, you can find these lenders. So, it’s important to find one that serves your state or territory financially.

Family Home Guarantee (FHG)

In May 2021, the government of Australia said it would start a new programme for single parents.

The Family Home Guarantee (FHG) aims to assist eligible single parents with at least one dependent child in purchasing a home, whether they are first-time home buyers or previous home owners.

For the period of 1 July 2022 to 30 June 2023, 5,000 FHG spots are open to qualified single parents with at least one dependent.

NHFIC guarantees a maximum of 18% of the property’s value (as assessed by the Participating Lender) of an eligible home buyer’s home loan from a Participating Lender under the FHG.

This allows an eligible home buyer to buy a home with as little as a 2% down payment and avoid paying LMI.

Regional First Home Buyer Guarantee (RFHBG)

The Regional First Home Buyer Guarantee (RFHBG) is intended to assist eligible regional first-time home buyers in purchasing a home in a region.

Through the NHFIC, the Australian Government guarantees up to 15% of the home’s value to the lender. This allows an eligible home buyer to buy a home with as little as a 5% down payment and avoid paying LMI.

- 10,000 RFHBG places are available to eligible regional first home buyers from 1 October 2022 to 30 June 2023.

If you need mortgage advice about government grants and schemes, speak to the MMS Team who can match you with a licensed Mortgage Broker for free.

You’ve Bought a House: What Happens Now?

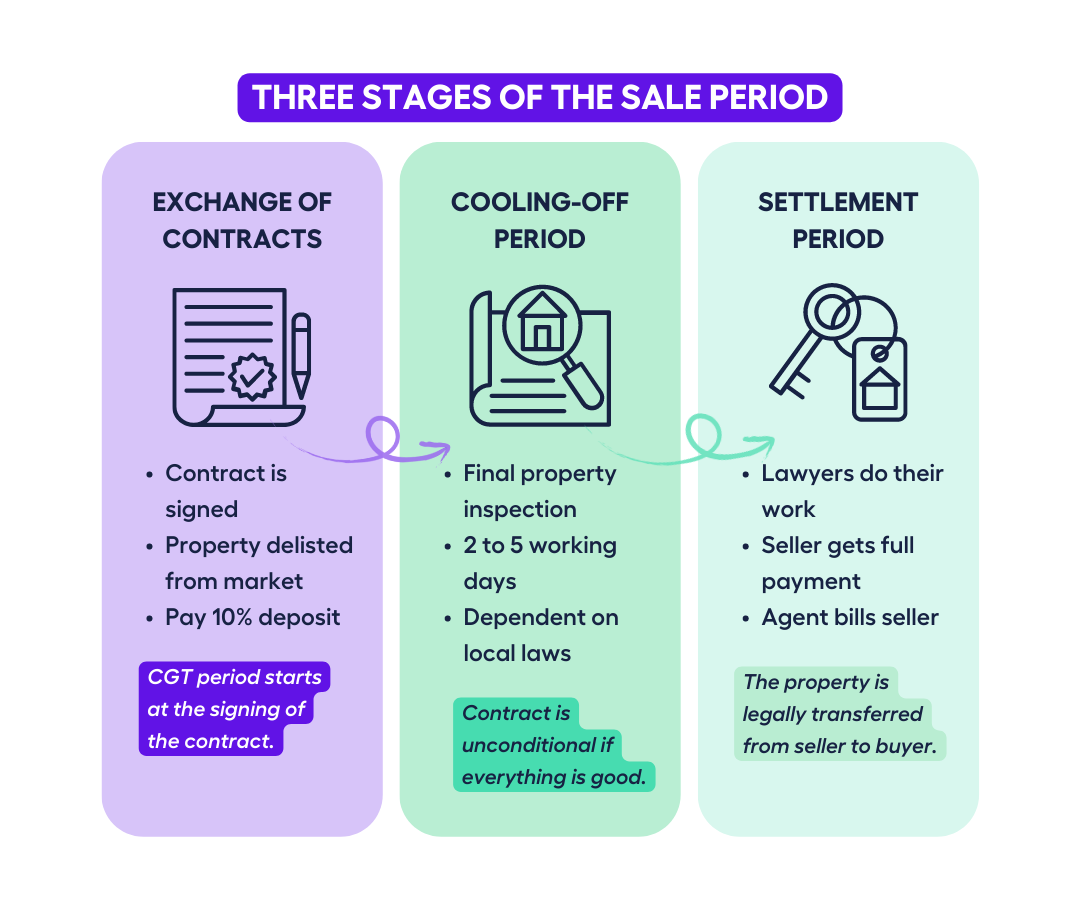

You’ve gone through the three stages of the sale period.

- You exchanged contracts, paid your deposit.

- You went through the cooling off period and did your final property inspection.

- Settlement day has come. The buyer is paid and you get the keys to the house.

What happens now?

When you move into a new house, you must take immediate action to ensure that you will be a successful homeowner now and in the future.

Let’s discuss some of the first steps to take after purchasing a new house.

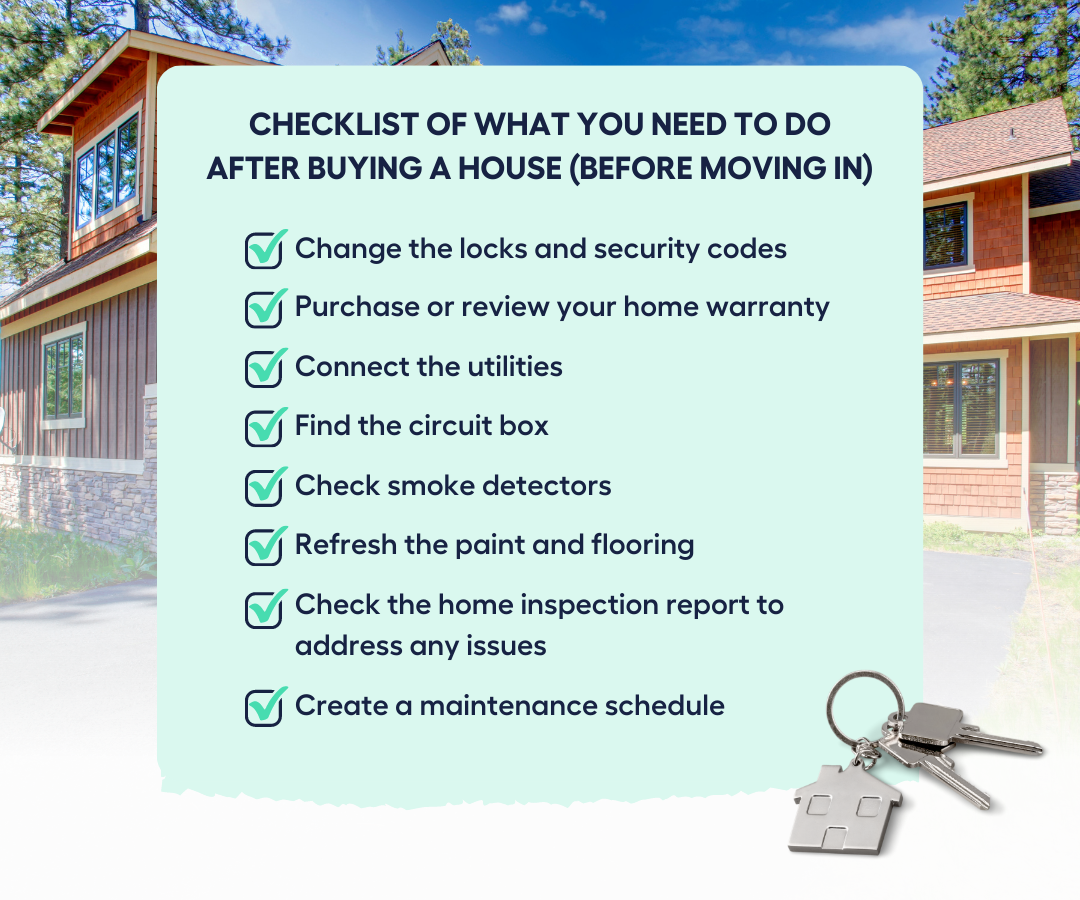

First Thing To Do After Buying A House

The first thing to do after buying a house and before moving in is to secure your home.

Securing your home makes living in it safe and comfortable to live in. Here’s a checklist of what you need to do:

Change the Locks and Security Codes

Before you move into your new home, make sure you change all of the locks, garage codes, and security codes. You don’t want the previous homeowners (or their pals) to have access to your residence because you forgot this vital step.

- Make extra keys so you can get back in if you get locked out!

You don’t want to break one of your new screens or windows by crawling through when you’re stuck outside.

Reset any security codes – garages, alarms, and even locks can have security codes, so make sure you change all of them before moving in.

Review Your Warranties

Homebuyers should receive a building defect warranty for structural defects on a newly built property, or renovations on a property, typically for up to 6 years after completion of work.

Alternatively, there may be product warranties on electrical appliances such as the air conditioning or kitchen fittings that come with the property you purchase.

If either of these apply to you, it’s a good opportunity to check the specifics, so you’ll know what’s covered and how to file a claim.

Connect the Utilities

It’s a good idea to connect all of your necessary utilities, such as water, gas, and electricity, before you move in.

This can help ensure a smooth move-in process and that you have the necessities while you’re settling in.

Find the Circuit Box

Even if your new home is not brand new, it is brand new to you! Thus, understanding how things work is critical.

When you buy a house, one of the first things you should do is locate the emergency shut-offs and circuit-breaker box. Label the individual circuits if the box isn’t labelled so you know which ones correspond to which room or appliance.

Also, find your water main and learn how to turn it off.

Finally, review your appliance manuals so you understand how everything works.

Check Smoke Detectors

Make sure all smoke and carbon monoxide detectors are in good working order to keep you and your family safe in your new home. Installing new batteries or replacing complete units may be necessary.

- Ideally, smoke detectors should be positioned in the corridor leading to your bedrooms, and in your kitchen and laundry area.

If you reside in a multi-story home, ensure there is at least one smoke detector on each floor.

Refresh the Paint and Flooring

Giving a house a fresh coat of paint is one of the simplest and most cost-effective ways to make it your own.

If you paint before moving in your furniture, you won’t have to reposition it and worry about splatter getting on your possessions.

- Refreshing or refinishing flooring, like repainting walls, is less expensive and easier to perform while your property is still empty.

Flooring may significantly improve the aesthetic of a property.

If yours is in disrepair, consider removing old carpets or refinishing existing hardwoods before you move in.

Check the Home Inspection Report to Address any Issues

After you purchase a home, take care of any issues that were noted on the home inspection report but were not addressed by the seller.

- Make a list of things to fix, update, or maintain in the future, ranking them from most important to least urgent, using the home inspection report as a guide.

Items that could cause difficulties later, such as unclean gutters, leaky pipes, or doors and windows that need to be resealed, should be addressed.

Create a Maintenance Schedule

Consider home maintenance as a marathon rather than a sprint.

Instead of attempting to complete all maintenance work at once, think about what has to be done over time.

This may include changing air filters, cleaning gutters, pressure washing the exterior, and other tasks.

After The First 12 Months

- After a year of living in your new home, it’s time to take into stock what you’ve got and review some items.

Have an Emergency Fund for Maintenance and Upkeep

Schedule upgrades in your house or put them off until you can afford it.

Prioritise repair and maintenance as emergencies involving your utilities are unavoidable, and it’s best not to be caught off guard.

It would be wise to have an emergency fund for repairs. Avoid using your credit card and adding on to your debt.

Check your Finances

You did your due diligence before tacking on a home loan into your budget, but a lot can happen in a year.

Do you need additional insurance?

Check with your agent if your home insurance policy should be increased or reviewed, and whether there are more competitive deals on the market if you bundle different policies, for example, home insurance, car insurance and pet insurance.

Do you need to adjust your spending?

Now that you have a home, your priority has changed to making your monthly repayments and saving for the future.

If you start struggling to contribute to either one, you may need to revisit your budget and cut down on your spending.

Get Help With Your Taxes

If your property is an investment property, it will change your tax situations significantly, as well as the deductions you are qualified to claim.

Hiring a professional accountant to manage your tax affairs correctly whilst also making sure that you maximise your refund should pay off in the long run.

Stay In Touch with Your Financial Team

Your mortgage broker and your financial advisor will get in touch with you regularly to keep you updated on new financial products, interest rates, and to align your portfolio with your short-term, mid-term, and long-term financial goals.

Make the most of these encounters to learn from your financial team.

How to Find the Best Home Loan For You

To secure the best mortgage, determine how much you can afford and shop like a bargain hunter.

It may not be as exciting as shopping for shoes, clothes, or phones, but the time and energy you put in could pay off financially.

We simplified the process for you by putting together the Seven Steps to Choosing the Ideal Home Loan:

- Figure Out How Much You Can Afford

- Set a Savings Goal for the Upfront Costs

- Consider the Length of the Mortgage

- Choose the Right Type of Mortgage

- Know How Mortgage Interest Rates Work

- Shop for Mortgage Lenders

- Get a Mortgage Broker

1

Figure Out How Much You Can Afford

Given that you’re looking at a six-figure purchase, you’re undoubtedly thinking if it’s truly within your financial means.

You can use our mortgage calculator to figure out how much you can afford.

- If you have a good credit score, lenders will likely be more enthusiastic than you are about the mortgage you can afford.

However, keep in mind that their job is to market a loan; your job is to repay it. So make room in your budget for interest rate movements, increases in cost of living as well as enjoying life.

2

Set a Savings Goal for the Upfront Costs

Lenders want you to be able to take out a large loan, but they also want you to have money saved up for a substantial deposit and other settlement fees.

The deposit may sound like a lot to ask, but it’s in your best interest to put down as much as you can safely afford in order to provide some initial home equity to help offset the cost of your purchase.

Otherwise, you risk having a large loan and a home that is worth less than what you owe if you put down a small deposit and there are market fluctuations. It’s not a terrific position to be in if you have to sell your home.

3

Consider the Length of the Mortgage

You probably choked a little bit when you first heard this term:

“30-year mortgage”.

That requires a long-term commitment. If you find it too long, worry not because there are alternatives you can choose from.

- Whilst the typical loan term is 25-30 years, lenders can offer loan terms as short as 10-15 years or as long as 40 years.

Here are Two Possible Benefits If You Pay for a Shorter-Term Loan:

- A substantial decrease in the total amount of interest paid over the course of the mortgage

- A better interest rate

4

Choose the Right Type of Mortgage

Making the appropriate mortgage choice is essential to making sure you can pay off your home loan in the long run.

There are two basic types of home loans:

Principal and Interest Loans and Interest-Only Loans.

Principal and Interest Loans

With principal and interest loans you make recurring repayments on the amount borrowed (the principal), plus interest. The loan is repaid over a predetermined time period (loan term), such as 25 or 30 years.

Interest-only Loans

For interest-only loans, the first few years (say, five years), your repayments will only cover the interest on the borrowed amount. Your debt doesn’t get smaller because you aren’t repaying the borrowed principal. During the interest-only phase, payments may be reduced, but they will increase after that.

5

Know How Mortgage Interest Rates Work

When looking for a good home loan deal, the interest rate is a crucial consideration because it has an impact on the total cost of the loan and the amount of repayments. A higher interest rate means higher repayments, and a lower interest rate means lower repayments.

- A reduced interest rate can also save thousands of dollars in interest charges over the course of the loan.

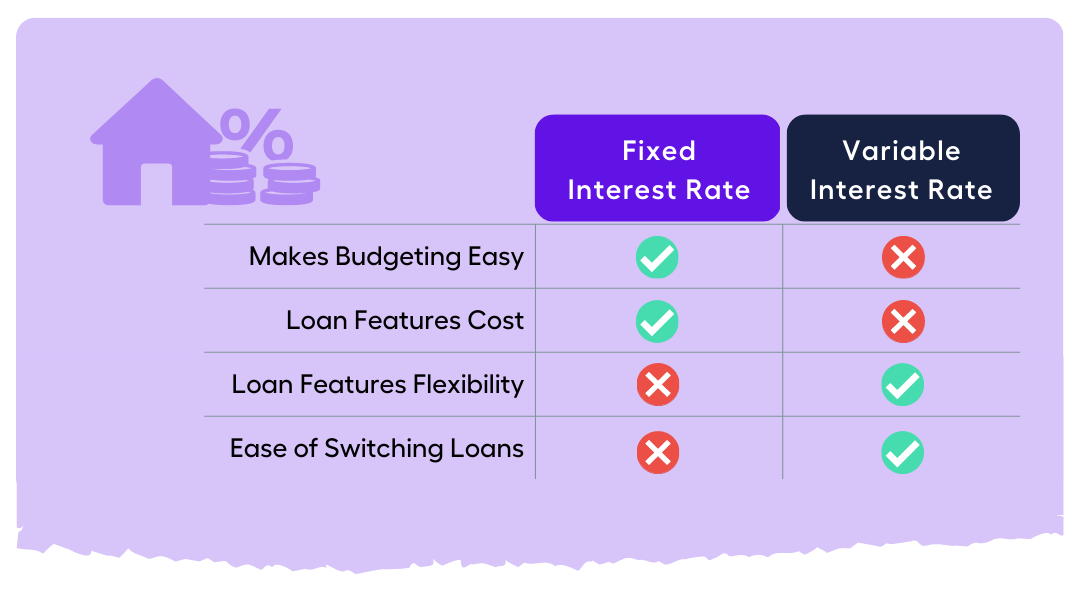

Compare interest rates and weigh the advantages and disadvantages of fixed and variable interest rates to determine which is best for you.

Fixed Interest Rate

A fixed interest rate remains unchanged for a set period (for example, five years). The rate then becomes a variable interest rate, or you can negotiate another fixed rate.

A fixed interest rate makes budgeting easier as you know what your repayments will be over a fixed period, and fewer loan features could cost you less in product fees.

However, you won’t get the benefit of interest rates going down or being able to make additional payments to your loan. Plus, if you’re charged a break fee should you decide to switch to a variable interest rate, it may cost more to switch loans later.

Variable Interest Rate

A variable interest rate can go up or down as the lending market changes (particularly when the official cash rates change).

More loan features that go with variable interest rates may offer you greater flexibility, and it’s usually easier to switch loans later, if you find a better deal.

However, it makes budgeting harder as your repayments could go up or down, plus more loan features could cost you more.

Partially-fixed Rate

If you aren’t sure if a fixed or variable interest rate is best for you, think about a mix of the two.

With a partially fixed rate (split loan), part of your loan has a fixed rate and the rest has a variable rate. You can decide how the loan will be split, such as 50/50 or 20/80.

6

Compare Mortgage Lenders

Check out at least three mortgage lenders. Shop as you would for a new car or whichever item you are most likely to enthusiastically bargain hunt for.

Although you may find this exercise time consuming, getting the best mortgage rate and the lowest origination fee you can find will help you when you compare these with what your mortgage broker comes up with.

7

Get a Mortgage Broker

You may decide to work with a mortgage broker to cut through the confusion because there are so many lenders to choose from.

A mortgage broker works for you as a go-between with banks or other lenders to arrange a home loan.

- They also work to find you the best home loan product with an interest rate and payment schedule that you can afford.

You can find a licensed mortgage broker through a mortgage broker professional association, online research, or recommendations from people you know.

Or you can talk to the MMS Team for free!

Need help with your mortgage? Learn more About Your Options & Book a FREE 15 min Call or Send Us Your Questions!