“Sorry, you’ve got less than twelve months to live.”

“We have bad news for you, your partner passed away at 7:46 a.m.”

If you were at the receiving end of this kind of news, how would it make you feel?

Jump straight to…

The world will probably stand still, with multiple thoughts running through your mind:

How can we pay for our bills and debts?

How about our children’s education?

And our dream of travelling the world?

Don’t let a terminal illness or death leave your loved ones devastated. Leave them with peace of mind with a Term Life Insurance.

What Is Term Life Insurance?

If, like in the earlier example, you are given a terminal diagnosis or you pass away before the policy expires, it can safeguard your family (or any of your chosen beneficiaries who depend on you financially) by helping sustain their way of life.

Monthly bills? Check.

Mortgage payments? Check.

Education fund for the kids? Check.

You may not have superpower to predict the future, but a term life insurance can be your best defence against the unforeseeable.

Things can go wrong, but you don’t have to be caught off guard.

How Term Life Insurance Works

We all have Buckley’s chance of predicting the future.

At this point you realise:

Before I were to unexpectedly pass away or be diagnosed with a terminal illness,

what is the wisest move I could make for the financial security of my loved ones?

The answer:

Get Term Life Insurance.

Term Life Insurance, or sometimes called death cover, is a ‘no worries’ type of insurance to understand.

Here’s why:

- The policy expires after a predetermined time, typically a number of years or when you reach a particular age.

- You specify a benefit amount, or the amount of money you want to be insured for which will be given as a lump sum to assist with ongoing living expenses, funeral fees, or other necessary expenses.

Common Features of Term Life Insurance

Is life term insurance cheap as chips?

Well, almost mate!

Fact:

As a policy holder you can take advantage of these features:

- Flexibility: The policy can be modified to fit your financial and evolving needs. You may request to increase the death benefit when facing increased financial commitments; conversely, it can also be decreased as the obligations lessen.

- Cost-effective: You only have to pay for the insurance part of the premium.

- Regular reviews: To help ensure that you are not over or under insured as circumstances in your life change (such as marriage, starting a family, divorce, death of spouse, paying for education fees, or getting a new mortgage), modifications to the sum insured can typically be made.

Benefits of Term Life Insurance

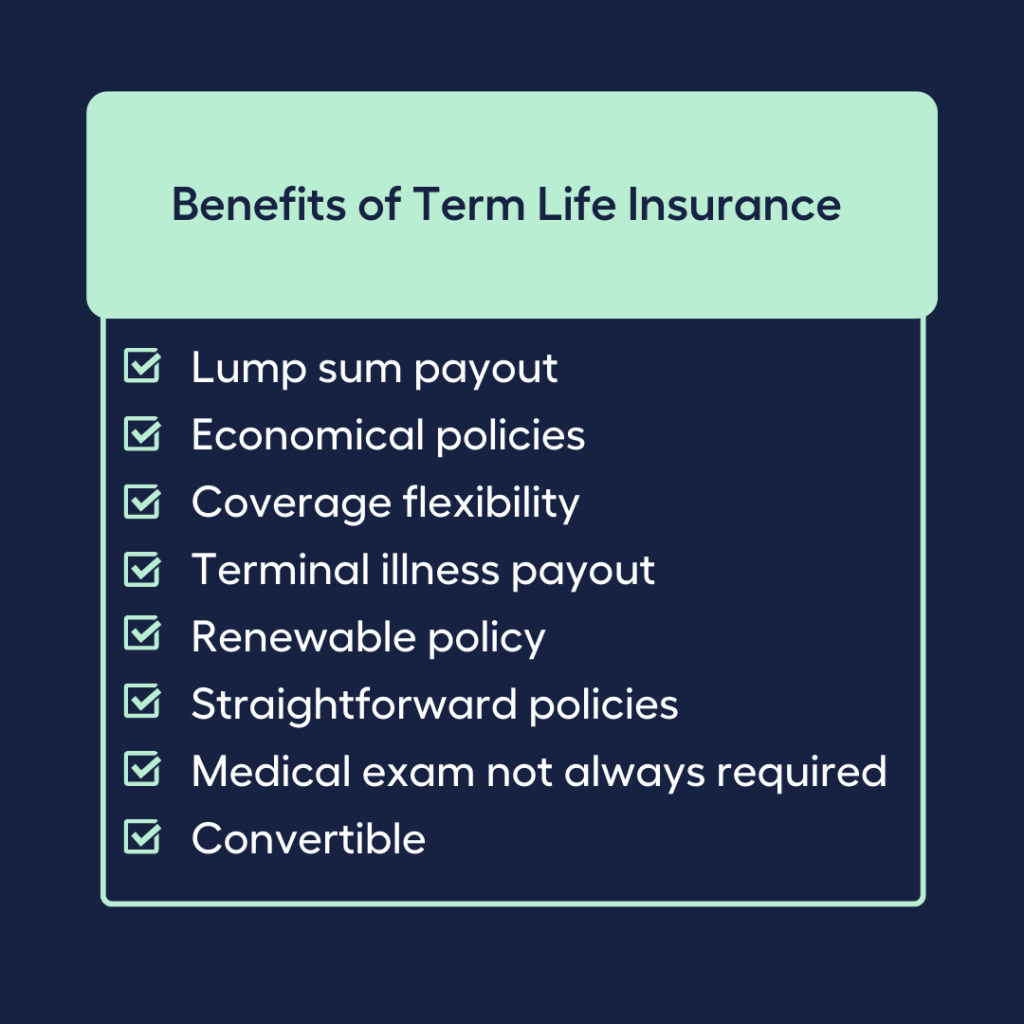

Term Life Insurance is an easy and affordable way to safeguard the future financial independence of your loved ones.

Here are the benefits of this budget-friendly term life cover:

- Lump sum payout. Your beneficiary(ies) receive the policy payout in one go and they can use it to pay off debts or support your family’s lifestyle. And in most cases, it is tax-free.

- Economical policies. A term life policy tends to be more affordable because it provides you coverage for a set period of time. It does not accrue cash value which makes your premiums cheaper. This also makes it ideal for young families seeking temporary coverage.

- Coverage flexibility. You can buy term life insurance coverage for one, five, 10, 15, 20, 25 or 30 years. These flexible coverage terms can be utilised to:

- Help pay your short-term debts or current expenses (one to five years term)

- Pay mortgages (10 to 30 years term)

- Terminal illness payout. If a medical practitioner diagnoses you with a terminal illness and could pass away within 12 months, you will receive an advance payment as your policy benefit.

- Renewable policy. Most policies can, if needed, be extended until you turn 99.

- Straightforward policies. It has a relatively small number of exclusions. A common exclusion is a suicide death that occurs within the first 13 months of a policy.

- No medical exam. You will not always be required to get a medical exam. This exam-free policy can cost extra but you won’t have your coverage rejected because of your health.

- Convertible. If you anticipate changes in your finances or want to explore a cash-value policy, you can switch to a Whole life policy.

Who Needs Term Life Insurance?

Your personal circumstance can determine if you would need Term Life Insurance cover in the event of terminal sickness or unexpected death.

| Personal Circumstances That Help Determine If You Need Term Life Insurance |

| Are you… |

| engaged and getting married soon? |

| purchasing a home to fulfill a dream? |

| expecting your first born? |

| paying a long-term debt? |

| sending your children to college? |

| a single provider for your family? |

| a caregiver of an elderly or disabled family member? |

| in need of a large amount of life insurance coverage but have a limited budget? |

These are some life milestones and challenges that indicate that a Term Life Insurance is a good match for you.

However, you might not need Term Life Insurance if no one is financially dependent on you and your family would not be financially strained after your passing or if you were diagnosed with a terminal illness.

Types of Term Life Insurance

A Term Life Insurance coverage tailored to your family’s particular needs is one of the best money moves you can make.

So remember:

Let’s dig a little deeper into the types of term life policies that can best fit your needs:

- Level term life: Considered as the right choice for many people since it is one of the most common types of term life insurance.

Best features:

- Premiums and death benefits remain the same every year.

- You can specify the length of the cover and the level of coverage you desire.

- Renewable term life: Although premiums may increase when you renew, it is usually recommended for people who have a brief life insurance need such as covering a short-term loan. A common type is the Annual Renewable Term (ART) life insurance.

Best feature:

After the term expires, you have the option to renew even if your health would otherwise prevent you from purchasing a new policy.

- Decreasing term life: A temporary type of term life insurance intended to cover a particular need, typically a loan or other form of unpaid financial obligation. It costs less than level term premiums and has a progressive reduction of death benefit over time.

Best features:

- Steady premiums

- More affordable than level term

- May be used to pay off debt and other financial obligations (mortgages)

How Much Term Life Insurance Do I Need?

The amount of Term Life Insurance you’ll need will vary depending on a number of factors.

Why is this so?

To begin with, if you were diagnosed with a terminal illness, you have to think about the final expenses that need to be covered such as:

- medical bills

- estate planning costs

Then, in the event that you pass away, consider the expenses and needs of your dependent(s) or beneficiary(ies), such as:

- funeral costs

- loan or mortgage payments

- ongoing living expenses of your household

- significant future expenses like school fees

Also, these two will have an impact on your decision on how much term life cover you will need:

- Life stage

- If you are the family breadwinner or are a single parent, then providing for your loved ones is extremely important. A term life insurance benefit in the event you fall critically ill, become paralysed, or pass away will greatly ease their burden.

- If you are older and have more assets to pass on via inheritance based on your will and overall estate planning, your family may be less dependent on a term life insurance payout.

- Budget – both now and in the future, this is a crucial component of long-term financial planning because:

- The level of coverage you select will affect the cost of your term life insurance premium.

- You must be sure that you can afford the premiums if you choose a high level of term life insurance protection.

So the bottom line is:

Term life insurance is a great way to increase protection and provide additional peace of mind during periods of significant financial commitment.

How Much Does Term Life Insurance Cost?

One of the many aspects you must consider when buying Term Life Insurance is the level of protection you require.

Factors that affect your Term Life Insurance premiums and eligibility:

- Your choice of insurer

- The terms of the policy

- Numerous other circumstances that are particular to you, and

- Any limitations that may be applicable

Moreover, these are the variables that have an impact on the cost of your term life cover:

| Cost Variables of Term Life Insurance |

| Age Occupation Gender Pre-existing medical conditions Lifestyle Required amount and Period coverage Smoking status |

- Age – higher premium if you’re older

- Occupation – you pay a higher premium if you have a high risk occupation

- Gender – premium rates vary between genders at different ages

- Pre-existing medical conditions – the nature of your condition and current treatment affect cost of premium

- Lifestyle – you pay higher premiums if you engage in risky hobbies/activities like car racing or sky-diving

- Required amount and period cover – the bigger the amount and the longer the period coverage means higher premiums

- Smoking status – smokers are viewed as high-risk individuals and must pay higher premiums; some insurers will lower premium rates if you stop smoking for at least a year

What to Consider When Taking Out Term Life Insurance

Before we go any further, keep these two points in mind when you take out a Term Life Insurance:

- Duration of the insurance term

How long should your Term Life Insurance be?

Take into account significant dates and milestones in your life and the life of your family where your death would leave your loved ones in a tight situation.

And you know what else?

You have to be mindful of:

- The length of your mortgage (if you have taken one)

- How old your children are (if you have any)

- The needs of your partner and/or children moving forward

- Extent of insurance coverage

What should your insurance policy pay for?

Basically, your term life policy should cover:

- Income that would be lost if you were to die or are terminally ill

- Debt payments (mortgage, rent, personal loans, etc.)

- Childcare (education, caregiver, etc.)

- Daily living expenses

- Taxes

- Funeral costs and financial planning

When you carefully consider your future needs, you may decide on the Term Life Insurance that best fits you and your family.

Look at these primary distinctions of term life insurance, permanent life insurance, and convertible term life insurance:

Term Life Insurance vs. Permanent Life Insurance

| Term Life Insurance | Permanent Life Insurance | |

| Policy Period | Expires at the end of the agreed period or fixed term | Expires upon your death |

| Cash Value | No cash value or savings component | Accrues cash value via savings account or super |

| Premiums | Based on cover holder’s selected cover level, age, gender, smoking status, health and lifestyle Costs less than other insurance policies | Typically fixed and does not change relative to economic or health reasons Has higher premium costs |

| Benefits | Pays beneficiaries or estate if policy holder dies or diagnosed with terminal illness while the policy is active | Has a guaranteed death benefit, a tax-deferred cash value growth and a tax-free access to the cash portion |

- Policy period

- Term Life – expires at the end of the agreed period or fixed term

- Permanent Life – expires upon your death

- Cash value

- Term Life – has no cash value or savings component

- Permanent Life – accrues cash value via savings account or super

- Premiums

- Term Life – based on cover holder’s selected cover level, age, gender, smoking status, health and lifestyle; costs less than other insurance policies

- Permanent life – typically fixed; does not change relative to economic or health reasons; has higher premium costs

- Benefits

- Term Life – pays beneficiaries or estate if policy holder dies or diagnosed with terminal illness while the policy is active

- Permanent Life – has a guaranteed death benefit, a tax-deferred cash value growth and a tax-free access to the cash portion

Term Life Insurance vs. Convertible Term Life Insurance

| Term Life Insurance | Convertible Term Life Insurance | |

| Policy Period | Expires at the end of the agreed period or fixed term | Indefinite, as long as the policyholder continues to pay the premium |

| Cash Value | No cash value or savings component | Accrues a cash value in the form of dividends |

| Premiums | Based on cover holder’s selected cover level, age, gender, smoking status, health and lifestyle Costs less than other insurance policies | Typically more expensive than a term life for the same amount of coverage due to the built-in option of converting without a medical exam |

| Benefits | Pays beneficiaries or estate if policy holder dies or diagnosed with terminal illness while the policy is active | May vary according to the policy converted to, such as a permanent life insurance that has a tax-deferred cash value growth and tax-free access to the cash portion |

- Policy period

- Term Life – expires at the end of the agreed period or fixed term

- Convertible Term Life – indefinite, as long as the policyholder continues to pay the premium

- Cash value

- Term Life – has no cash value or savings component

- Convertible Term Life – accrues a cash value in the form of dividends

- Premiums

- Term Life – based on cover holder’s selected cover level, age, gender, smoking status, health and lifestyle; costs less than other insurance policies

- Convertible Term Life – typically more expensive than a term life for the same amount of coverage due to the built-in option of converting without a medical exam

- Benefits

- Term Life – pays beneficiaries or estate if policy holder dies or diagnosed with terminal illness while the policy is active

- Convertible Term Life – may vary according to the policy converted to, such as a permanent life insurance that has a tax-deferred cash value growth and tax-free access to the cash portion

What Is the Difference Between Term Life and Whole Life Insurance?

Would you rather have an insurance that lasts for a set number of years or one that lasts for your entire life?

The second one is unquestionably good, right?

However, this insurance, known as Whole Life Insurance, that lasts for your entire life is no longer available.

In Australia, both Term Life and Whole Life insurance are popular types of life insurance. Whole Life Insurance was considered as the most well-liked life insurance and investment plan product in Australia up until 1991. But by 1992, Australian superannuation had become mandatory and whole life insurance was no longer offered.

Effectively, term life insurance took the place of whole life insurance. Therefore, the only people who still have whole life insurance are those who bought it before 1992.

How different are these two types of insurance?

Key Comparisons of Term Life Insurance and Whole Life Insurance

| Term Life Insurance | Whole Life Insurance | |

| Policy Period | Automatically renewed each year as long as you pay the premiums, until the cover expiry age | Lasts for the whole term of the cover holder’s life |

| Benefit | If policyholder passes away or is diagnosed with a terminal disease while the policy is valid and in effect, up to the maximum expiry age, the insurance pays a nominated death benefit to beneficiaries or the estate | Guaranteed death benefit |

| Cash Value | No cash value | Includes a cash value component that may be used for investments, collateral for loans (in some circumstances), or to pay for future monthly premiums |

| Premiums | Policy holder’s level of cover choice, age, gender, smoking status, health and lifestyle are considered when determining cost of premiums | Premiums remain unchanged despite economic or health factors |

- Policy period: Term Life is automatically renewed each year as long as you pay the premiums, until the cover expiry age. Whole Life, as its name implies, lasts for the whole of the cover holder’s life.

- Benefit: If the Term Life policyholder passes away or is diagnosed with a terminal disease while the policy is valid and in effect, up to the maximum expiry age, the insurance pays a nominated death benefit to beneficiaries or the estate. Moreover, the death benefit is guaranteed for the Whole Life cover holder.

- Cash Value: Whole Life insurance includes a cash value component that may be used for investments, collateral for loans (in some circumstances), or to pay for future monthly premiums. While Term Life has no savings component, hence no cash value.

- Premiums: Term Life policy holder’s level of cover choice, age, gender, smoking status, health and lifestyle are considered when determining cost of premiums. Whole Life insurance premiums remain unchanged despite economic or health factors.

Do You Get Your Money Back at the End of a Term Life Insurance Policy?

As a type of insurance that provides a set amount of cover for a set amount of time, Term Life protects your family who is financially dependent on you.

These two conditions: if you are diagnosed with a terminal illness and could die within 12 months or your unforeseen death, guarantee that your family will receive a lump sum payout as a benefit.

However, there is no cash out or death benefit if:

- you outlive your term insurance policy, or

- when the term ends

This is the main reason why term life insurance is competitively priced.

Still not sure where to start, or want help securing the right insurance faster?

That’s okay!

Many people may be unaware of this…but just like you, 41% of Aussies have said they intend to get financial advice, according to an Australian Securities and Investments Commission (ASIC) report.

You can reach out to My Money Sorted to help you!

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial circumstances

✓ have an idea of your financial goals

✓ be matched with the right finance expert who can help simplify your search for an insurance policy that fits your needs

Find the best policy for your needs by speaking to My Money Sorted!