The worth of financial advice is both tangible and intangible, and it means different things to different people.

For some, the worth of financial advice and financial planning will be determined by how much tax was saved, the age at which retirement was attained, the increase in benefit entitlements, or the final value of an investment portfolio.

Many people will weigh the worth of advice against the cost of paying for it.

Others will give worth to a sense of well-being, peace of mind, financial security, and control over decisions made.

The intangible value of financial advice is more difficult to quantify and cannot be easily weighed against the cost of that advice.

For example:

How much should you pay for financial freedom and peace of mind?

This will lead to the next question:

Is it worth paying for a financial advisor?

The answer will differ from person to person. So, let’s find out!

Jump straight to…

What is a Financial Advisor?

A financial advisor (aka financial adviser or financial planner) is a professional who provides personal financial advice to clients on financial matters, personal finances, and investments.

Financial advisors can work independently or for a larger financial institution.

To conduct business with clients, registered advisors must meet standards set by the Treasury, pass one or more exams, and be properly licensed by the Australian Securities and Investments Commission (ASIC).

Unlike stockbrokers, who simply execute market orders, financial advisors provide guidance, financial planning, and advice to their clients so they may make informed financial decisions.

While there are fee-only financial advisors, some earn a commission, profit-percentage structure, or a combination of these can be used to pay a financial advisor for financial planning services provided.

Acquiring the services of a financial advisor is akin to investing in their wealth management skills. And client-investors would want to know how much return they’d get on this “investment” or “business venture”.

What Return Should I Expect From a Financial Advisor?

Research from the University of Melbourne found that the majority of Australians (77%) have financial regrets.

The top three of these regrets are behaviour-related (e.g., not saving, investing, or budgeting), whereas the fourth most frequent regret is “not learning more about finances and money.”

In fact, 1 in 5 Australians and 1 in 2 had savings totalling less than $1,000 and $10,000, respectively.

Professional advice can play an important role in changing this outcome financially, emotionally, and behaviourally.

Benefits of Getting Help from a Financial Advisor

Benefit #1: Financial

Some estimates from industry experts show that financial advisors can provide 5.2% p.a. in financial benefits or more of value to clients each year. This means that a financial advisor charging a $3,250 advice fee to a client with a $250,000 balance could potentially deliver $13,250 in value.

That’s an extra $10,000 in value for the client.

Benefit #2: Emotional

Financial advice can have a significant impact on one’s overall happiness and financial security. With the assistance of a qualified financial advisor, you can achieve greater peace of mind and better financial management.

Benefit #3: Behavioural

One of the most valuable services a financial advisor can offer their clients is behavioural coaching.

A good financial advisor can assist you in maintaining a long-term perspective and remaining disciplined in the pursuit of your long-term goals.

Clearly, a professional financial planner can make a significant emotional, behavioural, and financial difference in you as you go through the process of defining financial goals, sorting current financial situations, and planning a financial future.

The Financial Planning Journey

Stage 1:

Defining Financial Goals

The first stage of financial planning is to define your goals and objectives and place them into a framework of short, medium, and long-term.

Before putting together a strategy to assist you in achieving your financial goals, a good financial advisor works with you to understand your needs and clearly define your goals.

Your budget, cash flow management, savings plan, superannuation, tax planning, home loan repayments, debt management and reduction, insurance, investments, and retirement are all things that a financial planner may assist you with.

| Financial Concerns Where a Financial Advisor Can Help | |

| budget cash flow management savings plan superannuation tax planning | home loan repayments debt management and reduction insurance investments retirement |

Your financial goals will undoubtedly change as you age. Your financial plan should be tailored to the stage of life you are in.

Once a financial advisor has helped you identify your financial goals, it’s time to determine your financial situation. After all, you can’t begin a journey without knowing where to start.

Stage 2:

Sort Your Current Financial Situation

The next step in financial planning is to determine your financial situation.

If your current financial affairs are unclear, it will be challenging to create a clear and cohesive financial plan to reach your financial goal.

2 Easy Steps to Determine Your Current Financial Standing

- Assess Your Net Worth

- Calculate Your Debt-to-Income Ratio

Step #1

Assess Your Net Worth

The first step in organising your money is to determine your net worth or how much money you actually have. Here’s how to calculate your net worth:

1. Write down every major item you own. Cars, money in savings and transaction accounts, investments like superannuation, the current value of your home, and other real estate you own will all fall under this category.

*Don’t list your income as part of your assets.

2. Write down every debt you have. Debt might include outstanding credit card balances, medical expenses, mortgage payments, home equity line of credit obligations, car loans, and student loans.

3. Deduct the total debt from the total assets. This figure represents your net worth.

Step #2

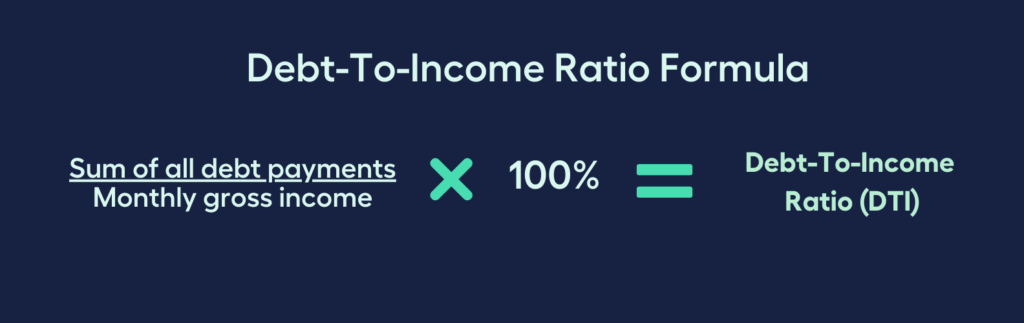

Calculate Your Debt-to-Income Ratio

Your debt-to-income ratio (DTI) compares your monthly debt payments to your monthly income.

Some of the most typical monthly debt payments are:

- rent or mortgage payments

- car loan

- payment of student loans

- medical expense

- Amount owed on credit card repayments

Here’s how to calculate your debt-to-income ratio:

1. Add up all of your monthly debt payments.

2. Divide the total of your monthly debt payments by your gross monthly income.

3. The result is your debt-to-income ratio in percentage. The lower your DTI, the less risky you are as a borrower.

As a general rule, a debt-to-income ratio of

35% or less is good

36% to 49% needs improvement

50% or more needs discipline

Once it’s clear what your financial situation is in terms of net worth and debt-to-income ratio, your financial planner can guide you in planning for your financial future.

Get help from a financial planner in creating a feasible plan for you to achieve your short-term, mid-term, and long-term financial goals by booking a complimentary call with our team to get your money sorted.

Manage your money better by having a quick chat with your MMS Money Mentor today!

Stage 3:

Plan Your Financial Future

Financial decisions will be haphazard without financial planning. Depending on your needs, you can seek different types of financial services and financial advice.

Types of Financial Advice

- General Advice

- Personal Financial Advice

- Single Issue Advice

- Comprehensive Financial Advice

- Ongoing Advice

1. General Advice does not consider your unique situation, aspirations, or potential personal consequences. But it does help to educate you on your options and the important matters to consider when selecting a service provider.

2. Personal Financial Advice is in your best interests and is customised to your financial circumstances and goals. It may consist of:

- Single Issue Advice: A financial advisor gives advice or a financial plan with a particular financial concern, such as how much money to put into your super, identifying a financial product that matches your risk tolerance, or providing you with strategies to pay off credit card debt.

- Comprehensive Financial Advice: A financial planner assists in creating a good financial plan to achieve your future goals. This includes topics like retirement planning, life insurance, superannuation, investing, and savings.

- Ongoing Advice: A financial advisor regularly monitors and assesses your financial affairs, tweaking your financial strategy to help you manage your money and investments better, and which financial products to invest money in according to your individual circumstances.

It is worth noting that personal financial advice may be delivered person-to-person or it may be delivered as automated financial advice from robo-advisors.

When Should a Financial Advisor Be Used?

A recent Financial Services Council (FSC) report evaluated the value of various levels of advice.

It has noted that:

Financial advice is not only beneficial to the wealthy; those with less economic wealth may benefit more from it than the wealthy.

Regardless of wealth, the sooner and younger an investor or individual gets advice, the greater the potential benefit. The typical objective of obtaining financial advice is to increase one’s available funds at retirement.

At any age and financial stage of life, financial advice will most likely add value to an individual’s superannuation and personal wealth by the time they retire.

Financial Stages of Life

- Early career

- Middle-aged

- Pre-retirement

- Retirement

Having said that, there are certain stages and decisions in life where financial planning, financial strategies, and a relationship with a financial advisor is more crucial than other stages in life.

Find a financial advisor that’s a good fit for your financial stage of life and money situation by booking a complimentary call with our team to get your money sorted.

Money Matters a Good Financial Advisor Can Help With

I’ve identified five live events where engaging the services of a financial advisor would make the most of your money if not save you a lot of money.

Money Matter #1

Buying a Home or Refinancing a Mortgage

Buying a home is a big long-term investment for anybody. Getting professional help from an advisor makes choosing from a list of financial products easier.

Proper financial planning could help you:

✓ manage your home loan better

✓ take advantage of favourable interest rates

✓ pay off the mortgage sooner

Refinancing a home loan is a good time to obtain professional advice because you’ll be tweaking your financial plan, which may open up opportunities to pay off a loan sooner and move additional funds into an investment. For this, you’ll need sound investment advice.

Money Matter #2

Life Insurance and Income Protection

Many advisors remind their clients that the life insurance in their superannuation is not enough.

For starters, life insurance in super is group insurance. If you’re young and healthy, chances are you’re covering the premium of older and less healthy members. And recent rising claims have led to jumps in premiums.

Industry super insurance is also not guaranteed renewable, death policies expire at ages 65 or 70, and super insurance premiums erode retirement savings.

Additionally, the benefit term for income protection provided by your super fund may be limited to two years. This contrasts with retail policies, which may offer benefit terms of 5 years or till age 65 while you are employed.

You are your biggest source of income, consult with a financial advisor and make sure you’re protected properly for life.

Money Matter #3

Wealth Building with Investments

Wealth building entails investing in a variety of diverse financial products with short, mid, and long-term time frames. It would be impossible to manage and account for the growth of each without factoring these into your overall financial plan.

Managing and maximising a broad range of investments requires meticulous financial planning if you want each investment to contribute to the achievement of your financial goals.

A financial planner can help you manage your investments to achieve this objective.

Money Matter #4

Super and Retirement Planning

Australia’s super is highly regarded worldwide. It’s a retirement income system that sits in the top 5 in the world in terms of it’s ability to provide a robust safety net for pensioners. Super coupled with the age pension can ensure retirees maintain a modest living standard during retirement years.

Nevertheless, you still need to plan for your retirement because:

- You don’t know how long you’ll live after retirement

- You don’t know how healthy you’ll be or how much health care will cost in the future

- You don’t know if inflation will reduce your money’s buying power

Consult with a financial advisor for a retirement plan that allows you to live comfortably and feel confident about your future.

Money Matter #5

Estate Planning – Secure Your Family’s Financial Future

Estate planning is the process of organising your affairs in advance to guarantee that your estate, being your property, assets, and liabilities, is distributed in an efficient and effective manner following your passing.

Although there are no inheritance or estate taxes in Australia, you still need to determine if the money or assets your loved ones inherit or will have access to are subject to tax.

A proper estate plan prepared by an expert can ensure that your desires are carried out, safeguard your family and close relationships, and minimise taxation on asset transfers.

Financial advice can provide you with the peace of mind that professionals are looking out for your best interests and that you are financially prepared for the future.

Furthermore, the financial benefits of consulting with a professional advisor frequently outweigh the costs.

Take the Guesswork Out of Finding the Right Finance Expert – Talk to the Team at My Money Sorted!

When you book a call with our MMS concierge, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with the right financial advisor who can help create a feasible plan for you to achieve your short-term, mid-term, and long-term financial goals

My Money Sorted is your stress-free pathway to getting ahead with your money. Here’s what your journey will look like:

Step 1: Start off with a quick money matters call with our team

Step 2: Get matched with a Finance Expert that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by a Finance Expert

It’s that easy!

Do You Need Financial Advice? Book a complimentary call with our team today!