Are you torn between paying off your mortgage or investing your extra income?

It’s a typical financial dilemma that many homeowners face. One advantage of paying off your mortgage early is the feeling of security and financial freedom it might bring. On the other hand, investing your extra money can potentially result in higher returns and help you reach your financial goals faster.

So, how do you decide which route to take?

The key to accumulating wealth is to adopt a broader perspective on your financial strategy and explore the various options available to you.

In this article, we’ll explore the pros and cons of each option and provide tips to help you make the best decision for your unique financial situation.

Jump straight to…

How to Spend Extra Income for Maximum Financial Impact

Whether you got a bonus, a raise or just have some leftover cash after paying your bills, it’s important to know how your extra income can work for you.

Let’s explore two key strategies for maximising the financial impact of your surplus income:

Considering your short and long-term financial goals

and

deciding whether to pay off debt or invest.

Consider Your Short & Long-Term Financial Goals

Considering your short and long-term financial goals can help you make the most of your extra income by giving you a clear sense of direction.

Short-term goals are things you want to achieve within the next year or two, while long-term goals are things you want to achieve five, ten, or more years down the line. You may prioritise where to spend your excess money to have the biggest impact by giving your goals some thought.

- For example, those who have a short-term goal to create an emergency fund might decide to invest their spare money in a high-yield savings account.

Alternatively, those with a long-term objective to live comfortably in retirement, may want to put their surplus cash into an account that provides both tax benefits and compound interest.

By considering your financial goals, you can create a roadmap for your financial future and make informed decisions about how to spend your extra income to achieve maximum financial impact.

Should You Pay Off Debt Before Investing?

Paying off debt before investing could be an option worth considering when you have extra income to spend.

- If you have high-interest debt, such as credit card debt, it is generally prudent to pay it off as quickly as possible before investing. This is because the interest rates on debt can be much higher than the potential returns on investments, which means you could end up losing money if you invest while carrying a lot of debt.

- However, if your debt has low interest rates, such as a low-interest personal loan or mortgage, it may be more beneficial to invest your extra income instead of paying off the debt early. This is because the potential returns on investments may be higher than the interest you’re paying on the debt, allowing you to make more money in the long run.

Ultimately, whether you should pay off debt before investing depends on your personal circumstances and goals. It’s important to carefully consider the interest rates on your debt, the potential returns on your investments, as well as any costs attributed to either option, and the taxation implications, before making a decision.

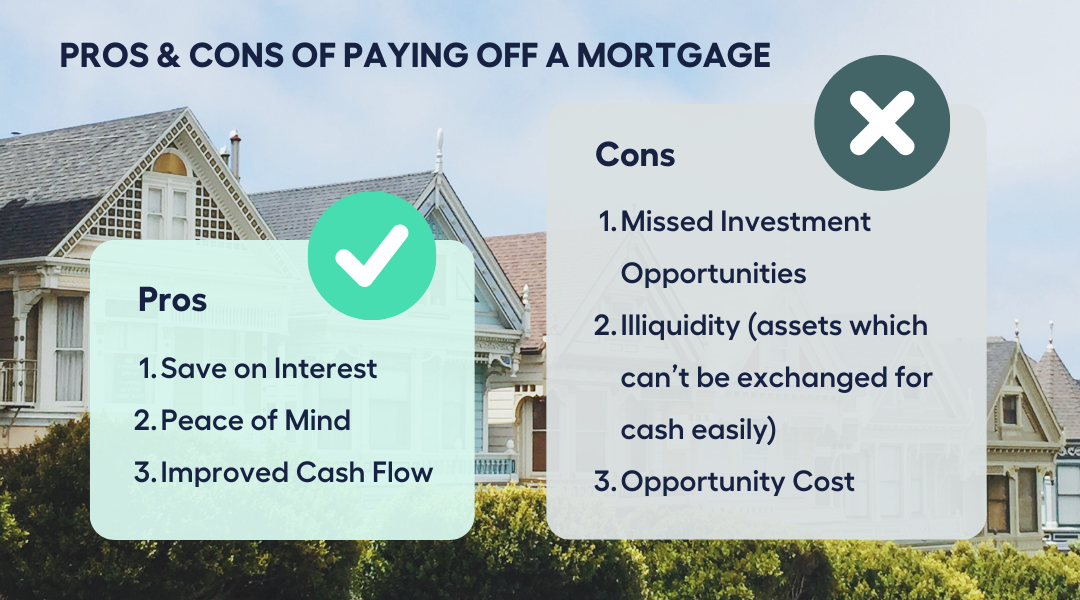

Pros & Cons of Paying Off a Mortgage

Paying off your mortgage early can be a good idea if you have surplus income, but it also has some drawbacks.

Here are some advantages and disadvantages to consider:

Pros

1. Save on interest: If you pay off your mortgage early, you may be able to save thousands of dollars in interest over the life of your loan.

2. Peace of mind: Knowing that you own your home outright can provide a sense of security and peace of mind.

3. Improved cash flow: By reducing your mortgage payments or eliminating them altogether, you can free up more of your income for other expenses, such as retirement savings or travel.

Cons

1. Missed investment opportunities: If you use your surplus income to pay off your mortgage, you may miss out on other investment income opportunities that could provide higher returns.

2. Illiquidity (assets which can’t be exchanged for cash easily): When you pay off your mortgage early, you tie up a large portion of your wealth in your home, which can limit your ability to access cash when you need it.

3. Opportunity cost: The money you use to pay off your mortgage early could be used for other purposes, such as building an emergency fund, saving for your children’s education, or investing in your business.

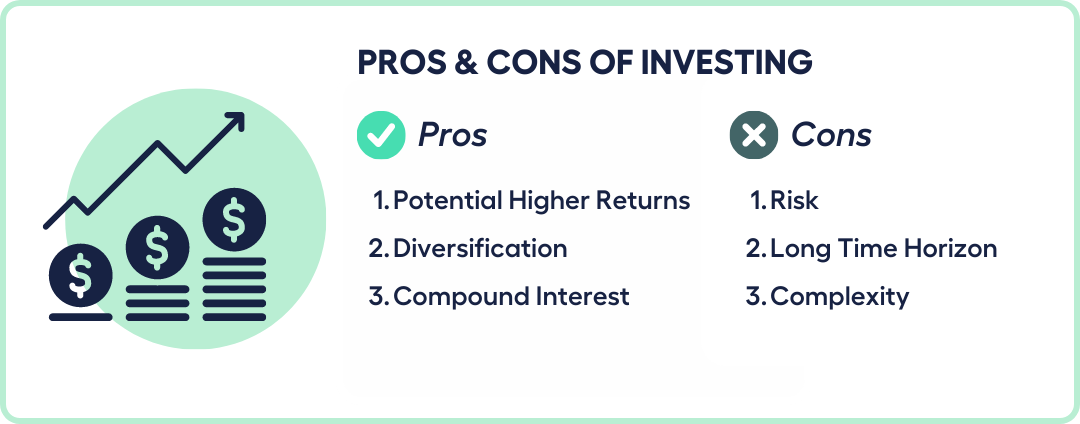

Pros & Cons of Investing

Investing your surplus income can be a great way to accumulate wealth over time, but there are both pros and cons to consider before making any investment decisions.

Pros

1. Potential for higher returns: By investing your money, you have the potential to earn higher returns compared to just keeping it in a savings account. This can help your money grow faster over time.

2. Diversification: By investing in different types of assets (like shares, bonds, and real estate), you can spread your risk and potentially reduce the impact of any single investment performing poorly at any given time.

3. Compound interest: When your investments earn interest or dividends, that money can be reinvested to earn even more money over time.

Cons

1. Risk: All investments come with some level of risk, and there is always a chance you could lose money if your investments don’t perform well.

2. Long Time Horizon: Investing often requires a longer time horizon, meaning you may need to leave your money invested for several years at least to see significant growth.

3. Complexity: Investing can be complicated, and it’s important to understand the risks and potential rewards of each investment before making any decisions.

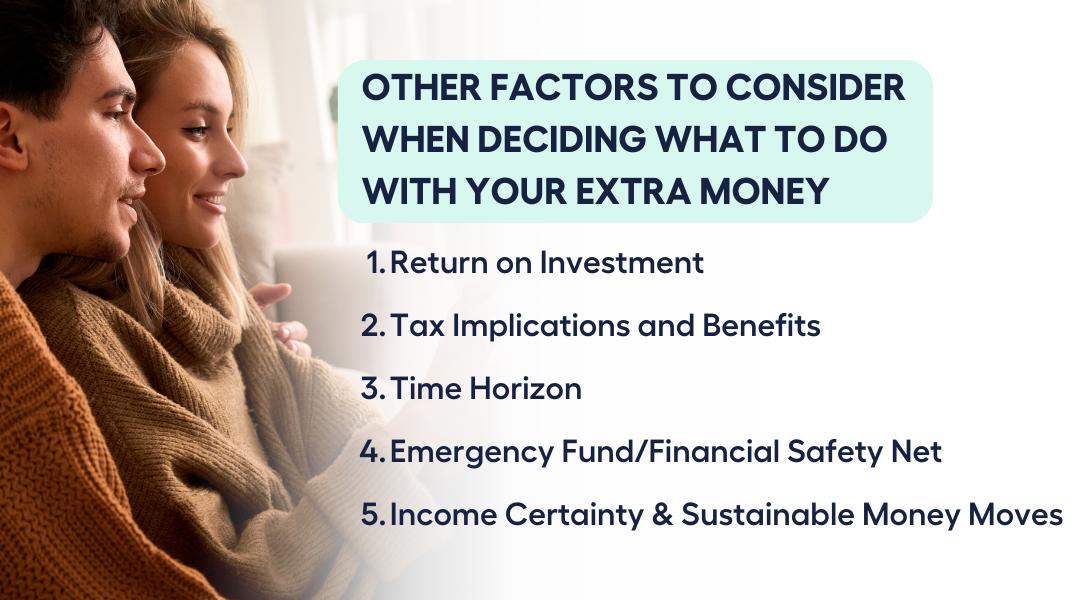

Paying Off a Mortgage or Investing Extra Money? Other Considerations to Think About

When it comes to deciding whether to pay off your home loan or invest your extra money, there are many benefits as well as risks to consider than just the dollars and cents.

- Sure, paying off your mortgage can be a great feeling, but what about your lifestyle goals? And while investing can be a powerful wealth-building tool, what if it causes you to lose sleep at night?

Let’s look at other important factors to consider when making this big decision so you can have a clear idea of what’s best for you and your financial goals.

1. Return on Investment

Before we dive in, let’s first define what Return on Investment or ROI is.

- Return on Investment is a measure of how much money you make on an investment, expressed as a percentage of the amount you invested. In other words, it’s a way of calculating how much bang for your buck you’re getting.

Now, let’s say you’ve got some extra cash each month and you’re trying to decide whether to use it to pay off your mortgage or to invest it. If you put the money towards your home loan, you’ll reduce your debt and save on interest payments.

On the flip side, if you invest the money, you have the potential to earn a higher return than the interest rate on your mortgage.

So how do you decide what to do?

That’s where ROI comes in. You need to look at the potential ROI of both options and compare them.

- Let’s say your mortgage interest rate is 3%, and you’re considering investing in a low-risk investment with an expected ROI of 5%. In this case, it would make more sense to invest the money, as you’re likely to earn more than you would save by paying down your mortgage.

- However, if you’re considering a higher-risk investment with an expected ROI of 8%, it might be worth considering paying down your mortgage instead. While you could potentially earn more by investing, the risk is also higher, and you might end up losing money instead.

Your unique situation, including your financial goals, risk tolerance, and the interest rates on your mortgage and potential investments, will ultimately determine whether you decide to pay off your mortgage or invest your extra money. Yet, by taking ROI into account, it can help you to make a well-informed choice that will enable you to maximise your financial resources.

Therefore, remember to always compare the ROI of different options as part of your financial decision-making process.

2. Tax Implications and Benefits

While there are no tax advantages to paying down your mortgage, you will save money on interest, which is great. Yet if you invest, you can be qualified for tax benefits like deductions in your income tax.

- For example, if you have an investment property and incur expenses as a direct result of owning that property you could be eligible for tax deductions, or your shares may include fully franked dividends.

These deductions can help reduce your taxable income, which means you’ll pay less tax. This is something you definitely want to take advantage of.

But please note that not all investments offer the same tax benefits. Also, it’s important to note that income earned from investments counts towards your taxable income for the financial year. This means that you will have to pay tax on investment income, just like you would for any other income you earn.

- Investment income is taxed at your marginal tax rate. Your marginal tax rate is the rate at which your last dollar of income is taxed. It depends on your total taxable income for the year, including any income you earn from investments. In Australia, the tax rates are structured in a progressive manner, meaning that the more you earn, the higher the percentage of tax you will pay.

So, before you make any decisions, make sure you do your research and speak to a professional financial adviser to understand the tax implications of different investments.

3. Time Horizon

Time horizon is another factor to consider when deciding whether to pay off your mortgage or invest your surplus income.

Your time horizon is simply the length of time you plan to hold onto an investment. The longer your time horizon, the more risk you may be able to afford to take. If you have a longer time horizon, you can ride out the ups and downs of the share market and potentially earn higher returns.

When it comes to your mortgage, paying it off early can be a great feeling, but it may not always be the best financial decision. If you have a long time horizon and can afford to make the monthly mortgage payments, investing your surplus income may be a smarter choice.

Do you know why?

- For example, you have a mortgage with a 3% interest rate. If you make extra payments towards your mortgage, you will save on interest charges and pay off your loan faster. However, the return on your investment is only the 3% interest rate you are saving.

- On the other hand, if you invest your surplus income in the share market, you have the potential to earn higher returns over the long run.

Of course, investing comes with risk, and the share market can be volatile. But if you have a long time horizon, you may be able to ride out any bumps in the road and potentially earn higher returns.

So, what’s the bottom line?

Consider your time horizon before deciding whether to pay off your mortgage or invest your surplus income. If you have a long time horizon, investing may be the smarter choice. If you have a short time horizon or are risk-averse, paying off your mortgage may be the better option. However, before you make any decisions, make sure you do your research and speak to a professional financial adviser.

4. Emergency Fund/Financial Safety Net

When you’re trying to decide whether to pay off your mortgage or invest your surplus income, having an emergency fund or a financial safety net is a key factor to consider.

It’s a stash of cash you have set aside to cover unexpected expenses or emergencies, like car repairs or medical bills. It’s not money you invest in the stock market or put towards your mortgage payments.

Why is this so?

- Unexpected expenses can pop up at any time, and if you don’t have an emergency fund, you may be forced to use credit cards or personal loans with a higher rate to cover those costs.

- Having an emergency fund can also give you peace of mind, knowing that you’re prepared for whatever life throws your way.

- It can help you avoid taking on unnecessary debt or dipping into your investments, which can set you back financially.

So, how much should you have in your emergency fund?

As a general rule of thumb, aim to save up 3-6 months’ worth of living expenses. If you have dependents or work in a job with irregular income, you may want to aim for a higher amount.

Once you have your emergency fund sorted, then you can start thinking about whether to pay off your mortgage or invest your surplus income.

5. Income Certainty & Sustainable Money Moves

The last factor you need to consider when deciding whether to pay off your mortgage or invest your surplus income is income certainty and sustainable money moves.

What’s the difference between the two?

- Income certainty is simply having a stable and reliable source of income that you can count on. This could be a steady paycheck from a full-time job or rent income from an investment property. When you have income certainty, you can plan for the future with more confidence, knowing that you’ll have the money you need to cover your expenses and invest for the long term.

- Sustainable money moves refers to making financial decisions that are smart, responsible, and aligned with your values and goals. Sustainable money moves can include paying off high-interest debt, building an emergency fund, investing for the long term, and living within your means.

If you have a stable source of income and are making sustainable money moves, you may be able to afford to invest your surplus income for the long term.

On the other hand, if your income is uncertain, or you’re not making sustainable money moves, it may be smarter to focus on paying off your mortgage first. This can help reduce your monthly expenses and give you more financial flexibility in the short term.

As such, the decision to pay off your mortgage or invest your surplus income will also highly depend on your income certainty and your commitment to sustainable money moves. Make sure you have a stable source of income and are making smart financial decisions, and then decide what makes the most sense for your long-term financial goals.

It also pays to be prudent by seeking the help of a professional financial adviser before making any big financial decisions.

Looking for ways to maximise your money? Book a FREE 15-min Call or Send Us Your Questions!

I Want to See All My Options with the Help of a Finance Expert

Book a FREE Call TodaySOURCES:

nab.com.au/personal/life-moments/home-property/pay-off-home-loan/should-i-pay-off

firstfinancial.com.au/investing-vs-paying-off-your-mortgage/

westpac.com.au/personal-banking/home-loans/investing-in-property/6-things-to-look-for-investment/