Is End Of Financial Year (EOFY) taxing for you?

EOFY need not be a time of stress.

The secret?

Tax planning.

Because you have the right to organise your finances so that you can minimise the tax you’ll pay in a completely legal way.

Jump straight to…

What is Tax Planning?

Tax planning, or tax-effective investing, is a process to minimise the amount of tax you owe on your income, assets, and wealth.

Simply said, it is a strategy that enables you to successfully handle your tax liabilities by making use of tax credits and deductions that are available for you — without the hassle!

Read on to know why and how you can reap the benefits of tax planning.

What is the importance of tax planning?

Let me ask you this:

Are you OK with spending your hard-earned money by paying more tax than you need to?

Definitely NOT, right?

Here’s why you should consider tax planning as an integral part of financial planning:

- Saves you money

- Prevents you from paying more tax than necessary

- Makes it easier for you to see the returns on your investment and enable future growth

You put time and effort into developing the best possible tax strategy when you plan your taxes.

There isn’t a one-size-fits-all approach but the goal is the same:

Reduce your taxable income to minimnise the tax you need to pay

and

maximise the amount of money you have left over to spend on whatever you want.

Who needs tax planning?

Executives, professionals, sole proprietors, business owners, trades people, employees, and even athletes benefit greatly from tax planning by strategically lowering their taxable income.

Individuals and businesses generally try to structure their financial transactions to decrease their tax payable, identify where they can claim deductions and avoid overpaying while still being compliant with Australian tax regulations.

Here’s why:

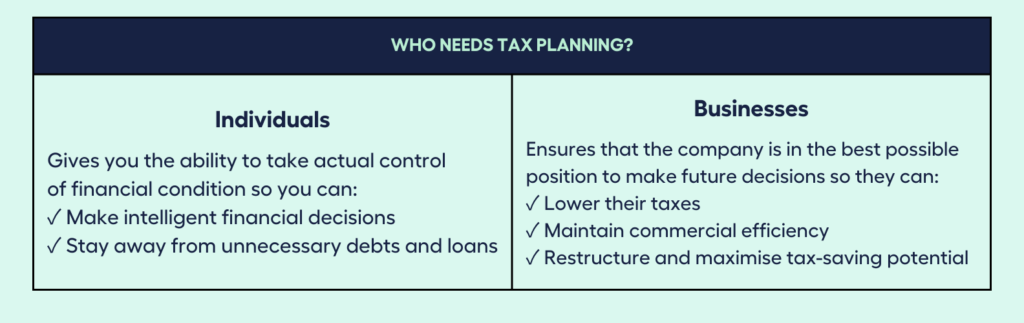

1. For Individuals

Tax planning gives you the ability to take actual control of your financial condition by making intelligent financial decisions and staying away from unnecessary debts and loans.

2. For Businesses

Tax planning is a technique to ensure that the company is in the best possible position to make future decisions. Tax experts have emphasised the importance for firms to have a proper long-term plan in place to lower their taxes and maintain commercial efficiency.

For businesses and organisations, tax planning and re-structing can make it simpler to maximise their tax-saving potential.

Are you ready to gain the benefits of tax planning?

Let’s get the ball rolling…

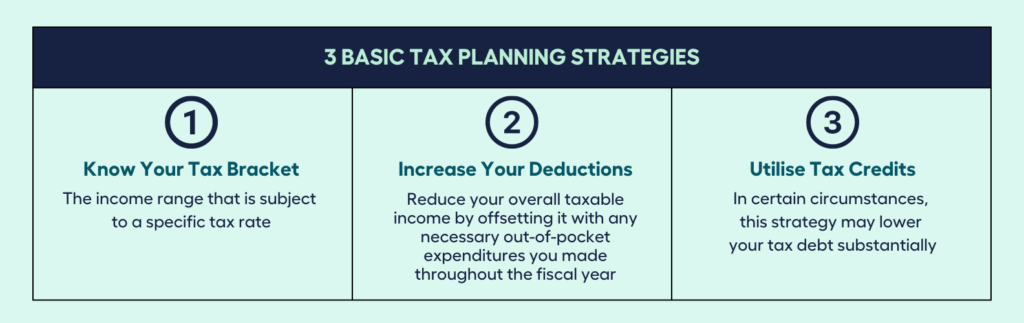

3 Basic Tax Planning Strategies

Take a closer look at these basic strategies that may enable you to increase your savings:

STRATEGY 1: Know Your Tax Bracket

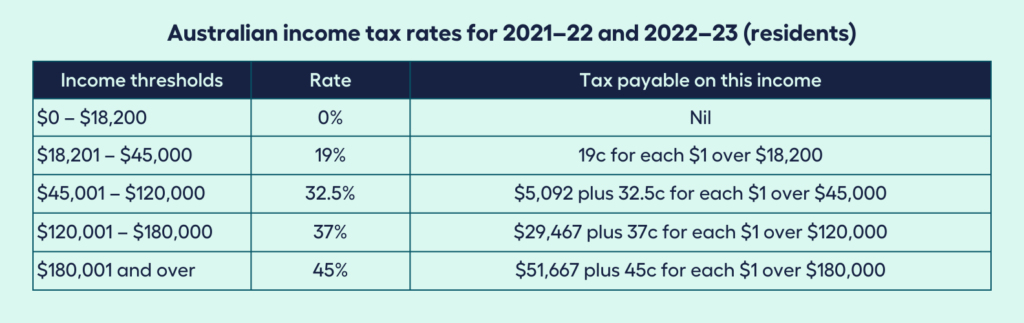

Tax bracket is an income range that is subject to a specific tax rate. Australia uses a progressive tax system, which means that as an individual’s income grows, the amount of tax they must pay progressively increases.

Check out below the income tax rates and brackets for Australian residents for the previous year and the current financial year. Do note that these rates do not yet include the Medicare levy surcharge.

STRATEGY 2: Increase Your Tax Deductions

In Australia, tax deductions give you the opportunity to reduce your overall taxable income by offsetting it with any necessary out-of-pocket expenditure you’ve made throughout the fiscal year.

What does this mean for you?

You may be able to claim enough deductions to reduce your taxable income, hence securing a bigger tax refund.

Refer to these Criteria for Tax Deductions:

- The expense must directly relate to your employment or source of income.

- Your company/employer cannot have already reimbursed you for the cost.

- You’ll need the appropriate bank statement or receipt as proof.

- You must be the one who made the purchase.

What type of tax deductions could you claim?

- Vehicle and travel expenses which may include:

- traveling to various offices or locations as your job demands

- car expenses when you need to execute your job duties

- lodging costs when you have to travel for work

- Work related clothing, laundry and dry-cleaning: the cost of any uniforms, protective gear, or work attire you purchased particularly for the job, along with any associated cleaning charges, are eligible for deduction from your taxes

- Home office expenses: working from home due to lockdowns during the coronavirus crisis, many had accrued expenses like using computers, phones or other work-related equipment

- Education: enrolling and studying work-related courses

- Gifts and donations to an organisation (charity) are subject to conditions. Refer to the ATO website to know more about gifts and donations you can claim.

- Other work-related expenses like:

- Books, periodicals, and digital information subscriptions

- Safety goggles and protective sunglasses

- Overtime meals

- Union fees and subscription to associations and bargaining agents fees

- COVID-19 tests used for work-related purpose (e.g. to know if you can attend work)

7. Investment income – you may be able to claim further tax deductions if you received:

- Interest payments on your savings

- Dividends from your investments in shares

- Rental payments from an investment property

- Another type of investment income

STRATEGY 3 Utilise Tax Credits

Tax credits allow taxpayers to deduct an amount from the income taxes they must pay, dollar for dollar.

These credits don’t affect your taxable income and can:

✓ assist you in reducing your tax liability

✓ be deducted from your total amount owed

In other words, this tax planning strategy could significantly reduce your tax debt.

Here are the Tax Credit Options for individuals in Australia:

- Superannuation contributions

Personal super contributions that you made from your after-tax income, such as from your bank account to your super fund directly, may be eligible for a tax deduction.

All you need to do is submit a Notice of intent to claim or vary a deduction for personal contributions form (NAT 71121) to your super fund. You have to wait for an acknowledgement from your fund before you can claim a deduction for your personal super contributions.

There are also other requirements for eligibility that you must meet which you can find at the ATO website.

- Interest Expense

Another option for tax credit is interest paid on loans used to purchase shares and other related investments from which you get assessable interest or dividend income.

However, only interest costs incurred to generate revenue are tax deductible.

In cases where your loan was utilised for both personal and income-generating purposes, you must divide the interest among them.

- Income Protection Insurance Premium

The premiums you pay for insurance against the loss of your employment income are also tax deductible. Deductions can only be applied to the premiums you pay to safeguard your income. You are also required to report on your tax return any payment you get from an income protection policy.

Utilising tax credits is a complex aspect of tax planning and you should always seek professional advice from a tax accountant who is qualified to provide tax advice.

In conclusion, tax planning can be quite beneficial for both businesses and individuals. And to avoid legal issues, it should be carried out within the Australian tax system’s legal framework.

What if you could tap into the wisdom of an experienced financial adviser instead of taking the all too common ‘hit-and-hope’ approach?

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Financial Adviser for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your money matters

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with the right financial adviser who can help simplify your family’s journey to financial wellness

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Finance Adviser that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Financial Adviser

It’s that easy!