If you’re looking to kickstart your financial goals, one important step is choosing the right savings accounts.

But how many savings accounts should you have, and which ones are the best for your needs?

- The answer is not as simple as one-size-fits-all.

In this article, we will explore the benefits of having multiple savings accounts and provide tips on how to choose the best savings accounts to meet your financial goals.

Jump straight to…

Is It Good to Have Multiple Savings Accounts?

It can be a smart financial move to have multiple savings accounts. Structured properly, having more than one savings account could help you reach your financial goals faster, and it could also help you stay organised and motivated to save.

The Benefits of Having Multiple Savings Accounts

Let’s talk about the advantages of having more than one savings account. It can work wonders for your financial goals – especially if you’re a dedicated saver.

1. Saving for different goals

If you’re saving up for different things, it can be smart to have more than one savings account. This is called the ‘bucket’ approach – have one account dedicated to your dream holiday, another for that shiny new car or your first home, and maybe even a separate one for emergencies.

- By separating your savings like this, you can stay motivated and focused, track your progress, and it also makes it easier to celebrate your wins along the way.

And let’s face it, who doesn’t love celebrating a win, especially when it comes to money?

But here’s a pro tip – you don’t have to spread your accounts across different banks. Holding multiple savings accounts with the same bank can make it easier to see all your balances in one place – but make sure to do your due diligence before committing to anything.

2. Earning high interest rates

If your current bank isn’t offering a competitive rate on savings, opening a savings account with another bank might be the solution.

However, there’s a catch:

- Many banks have a laundry list of conditions you need to meet in order to earn bonus interest on your savings. You might have to make minimum monthly deposits into the savings account or a linked transaction account (with the same bank) to earn the highest rate of interest; and if you don’t meet these conditions in a given month, your savings could earn a much lower base rate of interest.

Now, imagine juggling all these different conditions across several accounts – not exactly a walk in the park, right?

But fear not. If you plan on using multiple bank accounts to grow your savings, it’s worth looking for savings accounts that consistently offer a healthy return without all the hoops to jump through.

Also, the Australian Government’s Financial Claims Scheme guarantees to cover up to $250,000 for savings deposits in the unlikely event that your bank, credit union, or building society goes belly up. Plus, get this, the guarantee applies per person and per institution. So, you can sleep soundly knowing that your hard-earned cash is protected.

3. Organisation

Managing your savings can be a tricky task, especially when you have multiple financial goals to work towards. By setting up separate accounts for each of your goals, you can easily track your progress towards each one. This not only helps you stay organised but also ensures that you don’t dip into funds that are earmarked for other purposes.

So, if you’re looking to take control of your finances and achieve your savings goals, consider opening multiple savings accounts. It’s a small step that could make a big difference in the long run – if used right.

As a result, you will only have to make one set of periodic payments over a specific time at one interest rate. You may be able to make greater progress towards lowering your overall debt if the interest rate on the new personal loan is lower than the interest rate on your current debts.

How many savings accounts can you have?

There is no hard-and-fast rule on how many savings accounts you should have.

However, it’s important to balance the benefits of having multiple accounts with the potential downsides, such as having to manage multiple accounts and potentially paying fees on each account.

Multiple savings accounts in the same bank

It’s possible to open multiple savings accounts with the same bank.

This can be beneficial because it can make it easier to transfer money between accounts and avoid transfer fees. Additionally, having multiple accounts with the same bank can make it easier to manage your accounts online or through a mobile app.

When opening multiple savings accounts with the same bank, it’s essential to check if there are any limitations.

- Some banks may only allow a certain number of accounts per customer, and others may limit the number of accounts that are eligible for high-interest rates.

Overall, having multiple savings accounts can be a smart financial move, but it’s crucial to consider your personal objectives and financial situation before opening additional accounts. By understanding the benefits and potential drawbacks, you can make an informed decision that will help you reach your savings goals faster.

Best Savings Accounts to Kick Financial Goals

When it comes to choosing the best savings accounts to achieve your financial goals, there are a few things to consider, such as the interest rates, type of interest rate, bonus rate and minimum deposit conditions, account fees, and any other criteria that are important to you.

Let’s take a look at a savings account that could potentially help you reach your financial goals faster.

High Interest Savings Accounts

Over the last few years, savings rates have been scraping the bottom of the barrel due to the historically-low cash rate.

Now that the RBA has started lifting interest rates again, high interest savings accounts are beginning to yield a better return again.

The cash rate has been bumped up not once, not twice, but NINE times since May 2022, with the latest lift in February 2023 bringing it up to a healthy 3.35%.

And guess what?

Many savings accounts have started to jack up their rates as a result, and they’re still on the rise!

Back in 2022, you’d be lucky to find an account offering more than a measly 1.5% p.a.

But fast-forward to the start of 2023, and there are now several accounts paying out 4.00% or more.

What is a high interest savings account?

A high interest savings account is a type of savings account that offers a higher interest rate than a standard savings account. These accounts can offer interest rates of over 4%, compared to typical transaction account rate of 0% to 1%.

Why choose a high interest savings account?

The primary benefit of a high interest savings account is the ability to earn a higher interest rate on your savings. This can help your money grow faster and reach your savings goals sooner. High interest savings accounts can also be a good option if you want to keep your savings separate from your everyday transaction account, as they often come with fewer fees and restrictions than transaction accounts.

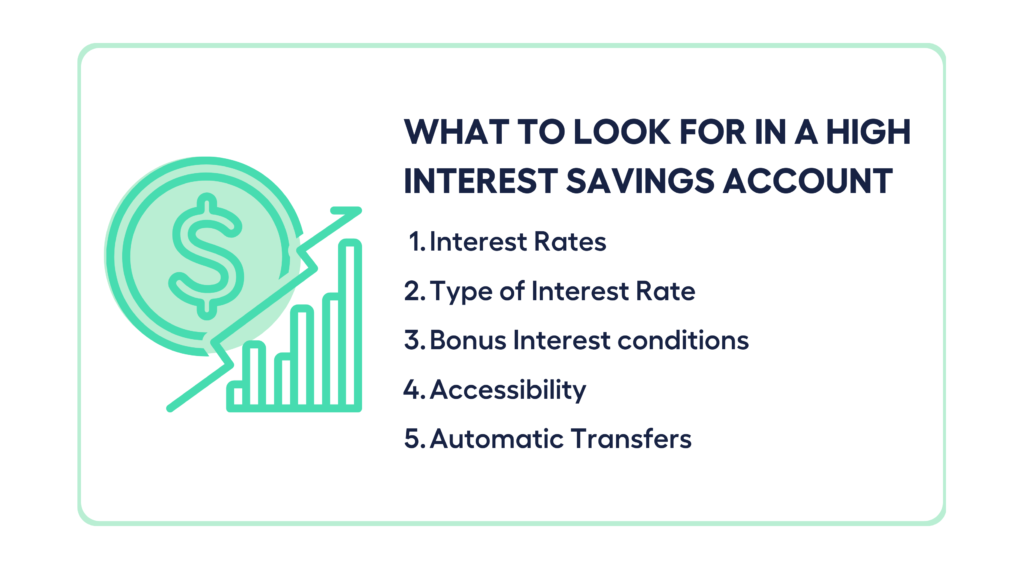

What to look for in a high interest savings account?

When comparing high interest savings accounts, there are a few key features to consider:

1. Interest rates

A competitive interest rate is essential to maximising your savings. There are various options available, with some accounts offering attractive short-term introductory rates called honeymoon interest rates.

However, it’s important to check the ongoing rate or base rate (aka standard variable rate) to ensure that the account will remain competitive over the long term once the introductory period (typically 3-4 months) has ended.

The ongoing rate will also take effect if you don’t meet the conditions (like depositing a specific amount monthly, not making any withdrawals for the month, or making a minimum number of transactions from a linked account) for earning a bonus interest.

2. Type of interest rate

Savings account rates are variable and can fluctuate based on the market. If you want a fixed interest rate, you may want to consider comparing term deposits instead, as the interest rates on these accounts remain fixed for the specified term.

3. Bonus Interest conditions

Many high interest savings accounts require you to meet certain conditions, such as depositing a set amount each month or linking your account to an everyday transaction account with the same provider (that may require a minimum number of monthly transactions), to benefit from the bonus interest and, therefore, earn the highest interest rate.

4. Accessibility

With most high interest savings accounts, your money is available for withdrawal at any time. However, some accounts may require you to maintain a certain balance to earn interest, so be careful not to dip into your funds too frequently.

5. Automatic transfers

Some high interest savings accounts may require you to maintain a minimum monthly balance to qualify for a higher interest rate. To avoid missing the deadline, set up periodic transfers into the account through online banking.

Check the Account Fees

In order to access the best savings rates, there are banks that require customers to open both a savings account and a linked transaction account so you can easily transfer money between accounts. By using the linked account for regular transactions and depositing into it, customers can often earn bonus interest on their savings.

- While high interest savings accounts typically don’t have account-keeping fees, the linked transaction account might have fees and other charges.

Regardless of the option you choose, be sure to check the fees and features of the linked accounts before signing up.

Don’t Forget Your Emergency Fund

Building an emergency fund is a crucial part of any financial plan. This fund should ideally cover three to six months of your living expenses in case of an unexpected job loss, medical emergency, or other major expense.

- When choosing savings accounts for your emergency fund, look for accounts that are easily accessible and don’t limit the number of withdrawals.

With the right savings accounts and a solid financial plan, you can start building wealth and achieving your financial goals.

Ready to start achieving your savings goals?

Get Your Money Sorted & Hit Your Savings Goals by Booking a Free 15 minute call with Your Money Mentor Today!

I want to see all my options with the help of a Finance Expert

Call Our Team TodaySOURCES:

https://www.target.com/p/the-100-day-financial-goal-journal-by-alyssa-davies-hardcover/-/A-79651636

https://www.bookdepository.com/Real-Life-Money-Journal-Clare-Seal/9781472279033

https://www.refinery29.com/en-us/kakeibo-japanese-money-saving-method-breaking

Kakeibo: The Japanese Art of Budgeting Saving Money by Fumiko Chiba | Goodreads

Disclosure: Links on this page are affiliate links, which means that if you click on the link or make a purchase using the link, the owner of this website may earn a commission. When you make a purchase, the price you pay will be the same whether you use the affiliate link or go directly to the vendor’s website using a non-affiliate link. By using the affiliate links, you are helping support this website, and your support is genuinely appreciated. Please note that any product or service recommendations on this website are based on personal experience or research.