Are you looking to diversify your portfolio?

Whether it’s your family home, an investment property, or even through a listed real estate fund, property could be considered a valuable addition to any investment strategy.

Things may seem a little rocky right now with the uncertain economic climate, rising interest rates, and real estate investment trusts (REITs) struggling with higher debt costs and reduced property values, but tough times can actually present opportunities for savvy investors.

So, the real question is:

Are you ready to seize those opportunities? And if so, where do you start? Should you go for REITs or direct real estate investing?

Let’s find out!

Jump straight to…

What is the difference between an REIT and a real estate fund?

You can get into the property market in different ways:

You can opt to buy a property directly as an individual or through a partnership

or

You can buy shares from real estate investment trusts (REITs) or real estate investment funds (real estate funds).

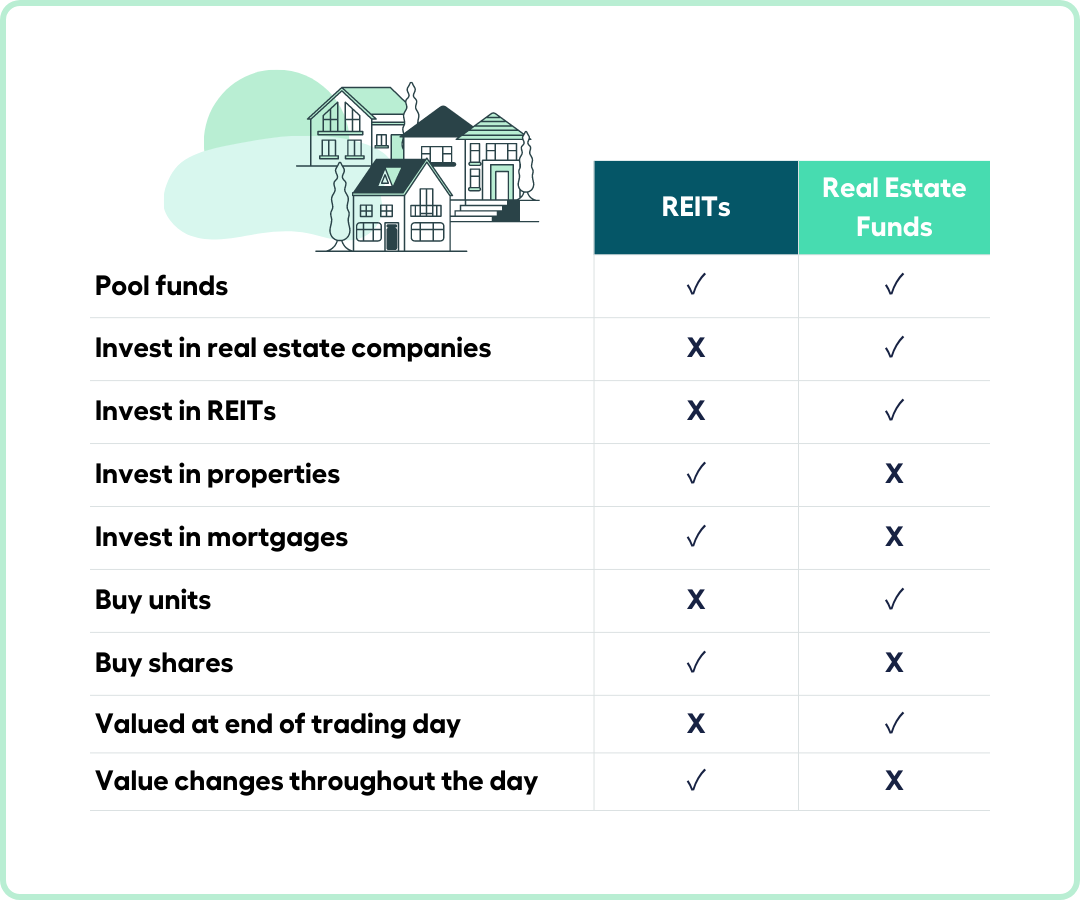

Although both require buying shares from a company, REITs and real estate funds are different, and one shouldn’t be confused with the other.

An investment fund is a company created to pool investor funds and collectively buy securities such as shares, bonds, or real estate.

- Therefore, a real estate investment fund is a pooled source of funds used to invest in real estate, particularly REITs and real estate operating companies.

Investors purchase real estate fund units, which are bought or exchanged at the fund’s current net asset value (NAV). NAVs are calculated once a day and are based on the closing prices of the underlying securities in the fund’s portfolio. A real estate investment trust (REIT) is a company or trust that directly invests in real estate through properties or mortgages. REITs can be bought and sold like shares at any time on the ASX. REITs pay dividends as part of their business model.

REITs and real estate investment funds can be very attractive, particularly for those who are just starting out in property investing.

Are REITs better than owning real estate?

It may be too early to decide which investment vehicle is better suited for you. You may want to check first the general differences between the two.

As an individual investor, you can profit from real estate through REITs without owning or managing physical properties. However, direct real estate provides larger tax benefits than REIT investments and gives investors more decision-making power. Then again, REITs are easier to buy and sell than traditional real estate because many REITs are listed on the ASX.

Right now, your decision lies on your general preference. But before you say one is better than the other. Let’s take a deep dive into the benefits and disadvantages of both.

REITs

Earlier we mentioned that real estate investment trusts (REITs) are publicly traded investment companies that provide exposure to property assets such as office locks, shopping centres, industrial buildings, and even hotels and cinemas.

It is a unitised portfolio of property assets that is listed on the Australian Stock Exchange (ASX). It’s an alternative to direct property investment and can be used to diversify a portfolio. REITs might include a mix of property types in their holdings or specialise in just one.

What makes REITs popular among investors?

REITs are popular among investors because they often have consistent income flows and dividend payments, as well as some prospects for capital growth.

REITs can invest in property either locally in Australia or abroad, and investors can benefit from any increase in the value of the underlying asset as well as regular rental income generated by the properties owned.

Advantages of Investing in REITs

REITs can provide a variety of potential benefits, such as:

- diversification,

- consistent income,

- and capital growth.

1. Diversification

Investing in a REIT could give you immediate access to a large collection of properties for a small amount of money up front. Depending on the REIT you choose, it may also offer diversification across property sectors, geographic areas, and asset types.

2. A regular income

Many REITs are made to provide a steady stream of income, with monthly or quarterly payouts based on rental income. Depending on the investment and the state of the economy, they might offer a better return than a home or some other investments that are meant to bring in money. But it’s important to keep in mind that this higher income may come with a higher risk.

3. Liquidity

REITs are easier to buy and sell on the ASX than direct real estate investments. They can be bought and sold just like shares. And, unlike direct property, they let you build or sell parts of your portfolio over time instead of having to buy or sell the whole thing.

4. Tax planning

REITs can sometimes make tax-deferred payments when their distributable income is higher than their taxable income because of deductions like depreciation, capital allowances, and renovation costs. This could give owners more control over when they have to pay their taxes, possibly until their marginal tax rate is lower.

But taxation legislation can be hard to understand, and everyone’s case is different, so it’s important to talk to an expert before you invest.

Disadvantages of Investing in REITs

As with any investment, there are risks to consider, including the possibility of negative returns.

1. Concentration

Some REITs give you access to a diverse portfolio, but others focus on a few large assets or a single sector, which makes the risks higher.

2. Property cycles

Real estate can be affected by the economy as a whole and by market cycles, which can hurt your returns when the market is bad.

3. Volatility

REITs may also be affected by changes in the stock market as a whole, which can make them more volatile than direct property investments. So, the market value of a REIT might not always match the net asset value of the property collection it is based on.

4. Gearing

Some REITs may borrow funds to buy or develop a property portfolio, which creates gearing. Gearing can make capital gains bigger when the value of an asset goes up (positively geared investments), but it can also make losses bigger when the value of an asset goes down (negatively geared investments).

5. Rate of Interest

Rising interest rates can hurt the performance of Australian real estate investment trusts (A-REITs), both because they raise interest costs and because they make fixed-income investments more appealing to income-focused investors, which could lower demand overall.

Direct Real Estate

Buying a house or a unit might seem like a less complicated investment option than others. But for you to determine if buying an investment property is right for you, you need to know how it works.

Investment property is real estate that is bought with the intention of getting some kind of income from it. The income can come from renting the property to a person or business. It can also be for capital gains, like when the property is sold for a profit. Most of the time, people buy property for both of these reasons.

- The main goal of an investment property is to make money and build wealth.

This means that the things you should look for in a good investment can be very different from the things you should look for in a house you want to live in.

Advantages of Direct Real Estate Investing

There are many benefits to investing in real estate, but it’s important to have a plan and make decisions based on what will make you the most money.

Let’s discuss the things that make an investment property attractive to most people.

1. No expertise necessary

Property is often seen as a safer investment than other types of investments because you don’t need any particular specialised knowledge to invest in property. Even if you study the stock market, you still need expert knowledge to know how to invest and do it well. Regardless of whether you have specialised knowledge or not, it’s still a good idea to complete your due diligence and seek advice from experts to guide you through this process, including a real estate agent,conveyancer, and financial planner.

2. Less volatile

Compared to shares or other assets, real estate can be less volatile.

While investing in stocks can provide significant long term capital appreciation, it can be more volatile and uncertain than investing in real estate. As a result, it doesn’t sit well with low-risk takers, particularly those who are unfamiliar with how the stock market operates.

3. Capital growth opportunities

Capital growth is how much the value of your property has gone up over time. You can figure this out by comparing the current market value to what you paid for the property.

For example:

If you spent $400,000 on a property ten years ago, and it is now worth $700,000, you have made $300,000 in capital.

4. Rental income

While capital growth might take years to reach your bank account, rental yield provides more immediate benefits.

Rental yield is ultimately the difference between the money you get from renting out your property and the total costs associated with your investment property. Rental yield can be calculated in both gross and net terms.

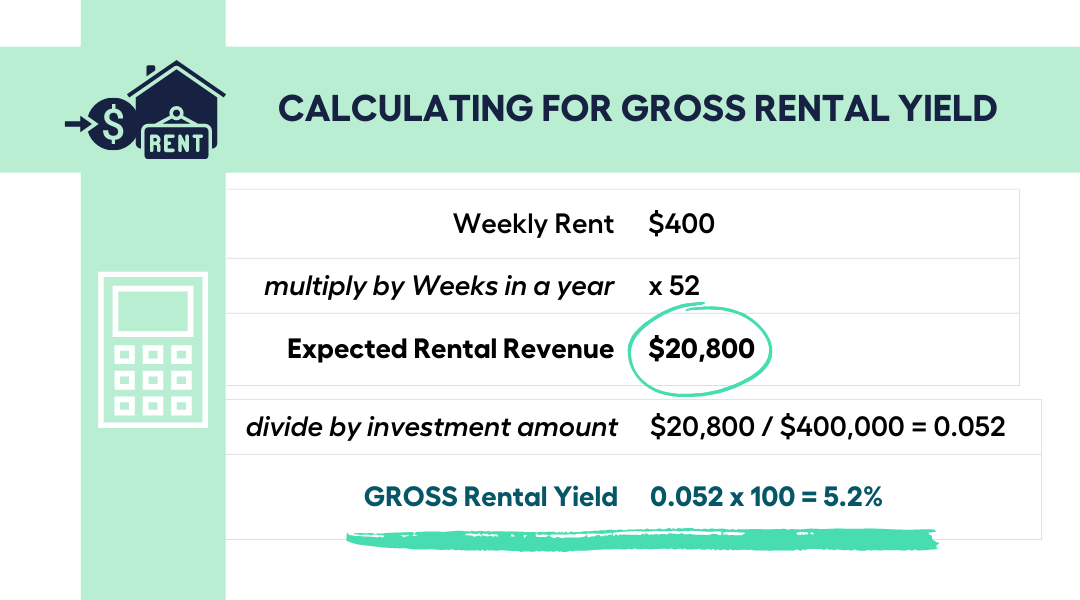

The gross rental yield is calculated by dividing the property’s total value by the anticipated yearly rent and multiplying the result by 100 to get a percentage.

For example:

The gross rental yield for a $400,000 investment property with a $400 weekly expected rental revenue is: $20,800 ($500 x 52) / $400,000 = 0.052 x 100 = 5.2%.

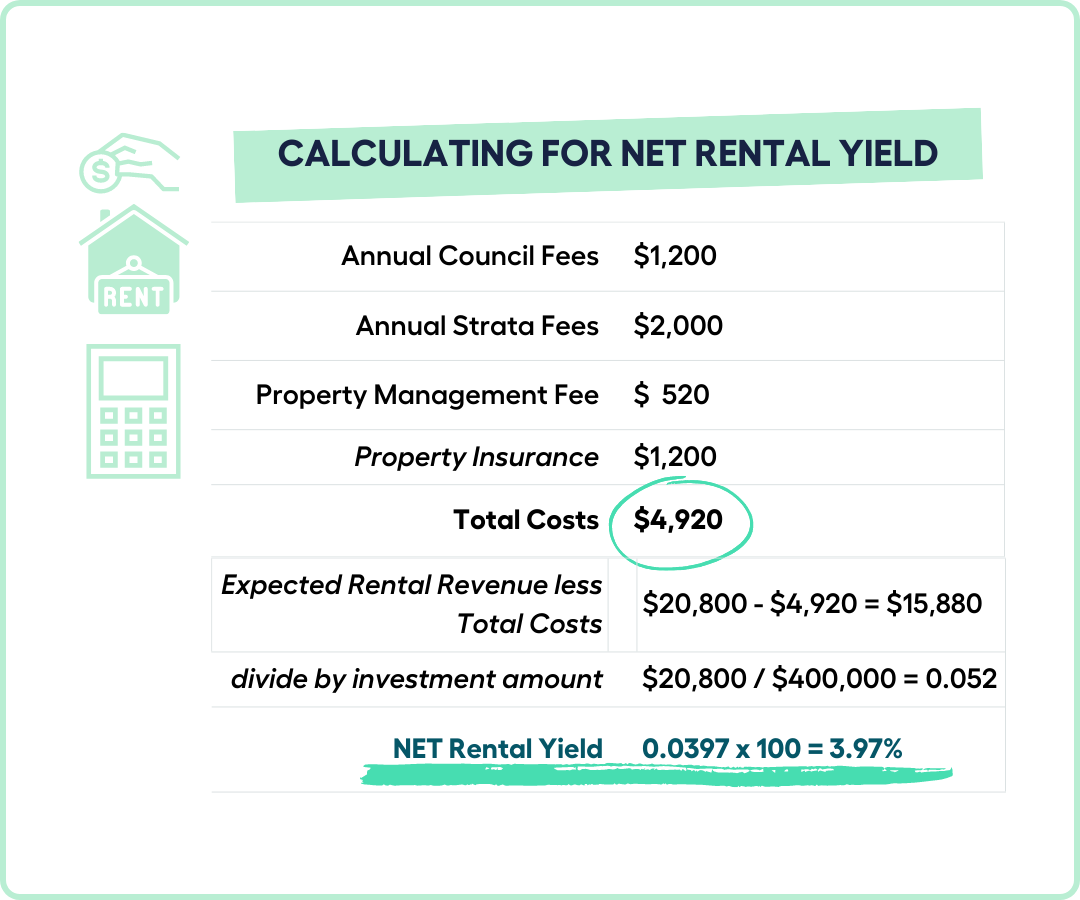

The calculation of net rental yield is a little more complicated because it includes all of your expenses, including depreciation, council and water rates, building insurance, landlord insurance, body corporate fees, property management fees, repairs and maintenance costs.

Using the same example as above, with $1,200 council fees, $2,000 strata fees, $520 management costs, and $1,200 property insurance, total costs add up to $4,920. The net rental yield of the property would be: $20,800 ($400 x52) – $4,920 / $400,000 = 0.0397 x 100 = 3.97%.

It is crucial that you take into account the rental property’s prospective rental yield if your goal is to lease your space to lessors.

5. Tax deductions

If you rent out your property, you can claim a tax deduction on a variety of the expenses you incur during these periods.

One tax advantage is for negatively geared properties.

- According to the Australian Taxation Office (ATO), if your deductible expenses are higher, and you do not generate a profit from renting out your property, it is termed to be “negatively geared.”

A negatively geared property has a net rental loss as its total tax result. In this situation, you may be able to deduct the entire amount of your rental costs from your rental and other income, such as salary, wages, or business income. If your other income is insufficient to cover the loss, you can carry it forwards to the next tax year.

Another tax break available to investors is the capital gains tax (CGT) discount. It’s crucial to keep in mind that you cannot claim the CGT discount if the asset is your residence and you began using it for rental or business purposes less than 12 months before you sold it.

6. Physical asset

For some people, the notion that real estate is a tangible, physical asset is a key motivator for investing in it. People can actually see their investment, unlike with shares.

Investors can feel a greater sense of confidence and control thanks to this tangibility, which is something that cannot be guaranteed while making stock market investments.

One of the main advantages is that you have more control over your assets. You can make improvements to your property or purchase a property with a unique feature that could result in speedy capital growth.

- If your investment property isn’t generating high profits, you can increase its worth by renovating it or furnishing it to appeal to tenants.

In other words, by caring about your property and being aware of and accommodating the demands of potential tenants, you may directly affect your return.

Disadvantages of Direct Real Estate Investing

Are you already eyeing that dream property to invest in?

While property investment has its numerous perks, there are a few tough nuts to crack before sealing the deal. First, let’s talk about the elephant in the room – the upfront fees, entry costs, and decisions that come with buying real estate.

Don’t be discouraged just yet! By knowing what to expect, you can navigate through these challenges with ease and secure your ideal investment.

Here are some important things to consider to ensure your investment pays off:

1. High entry and exit costs

There’s a perception that it’s becoming more and more difficult to enter the housing market as property prices continue to rise. Would-be investors could get discouraged by the hefty entry costs, which also make it challenging to start if you don’t have a disciplined savings plan and some capital on hand.

The property market, unlike the share market, is both financially difficult to enter and exit.

There are significant costs, such as

- stamp duty,

- legal fees,

- and real estate agent commissions.

Additionally, you cannot easily sell your home off if you need money now, whereas you can with shares.

2. Fluctuating property market

Even while the real estate market isn’t nearly as erratic as the share market, its value fluctuates over time. Additionally, because real estate is a long-term investment, it is expected that a property’s value moves up and down.

Therefore, even while investing at a time of market weakness may seem attractive to potential investors, there are significant risks involved, such as higher interest rates, more expensive mortgages, and a lack of market competitiveness that may encourage vendors to decide not to sell at all.

3. Lack of tenants and property managers

While rental income can be a lucrative opportunity, it’s important to understand the challenges involved when managing rental properties.

One major obstacle is finding reliable tenants who consistently pay rent.

- Plus, managing a rental property comes with its own set of costs, from maintenance costs to marketing for new tenants when the property is vacant. If you decide to manage your investment properties yourself, be prepared to take on all of these responsibilities.

Alternatively, outsourcing to a property management company is a common choice, but it’s important to factor in the additional recurring expense. Even with the help of property managers, tenant issues and periods of vacancy can still arise. Without landlord insurance or sufficient cash flow for your property investment, this could spell trouble for your finances.

So, before diving into the world of rental property investment, make sure you’ve done your homework and are prepared for the challenges that come with it.

4. Inflexible and lack of diversification

We’ve established that selling property requires time, so if you urgently need money, selling off a portion of the investment (like a bedroom) is unfortunately not an option.

Due to the hefty entry cost, it is also typical for beginning investors to put all of their money into one investment property. If the market changes unexpectedly or your investment doesn’t perform as you had hoped, this lack of diversity could be a concern. Naturally, the solution to this is to own the proper kind of property, a sort whose value doesn’t change dramatically as the market shifts.

Performance: REIT vs Direct Real Estate

All businesses suffered during the pandemic, including REITs. With exposure to malls and office buildings, the ASX300 REIT index fell 37% in March 2020.

Although the sector continues to trail the broader Australian equity market recovery, REITs have since recovered significant ground as REIT performance is inextricably linked to the Australian economy.

There is an opportunity for investors to focus on the long term as international tourists and immigration have returned.

As for the property market, there have always been peaks and valleys but the house value has always risen through the years.

- In fact, over the past 25 years, the median house value nationally has risen by 412%.

Clearly, there is an opportunity for both REITs and real estate investors to earn income and make capital gains in the long term.

Your choice of whether to invest in REITs or investment properties may boil down to your financial situation. However, you should still seek advice regarding your investment options as you’ll need to determine which REITs or property funds are best to invest in. The same help may be needed when choosing the right property type, location, and mortgage.

It would be worth considering seeking property investment advice from realtors, mortgage brokers and financial planners

Looking for the Right Investment Advice? Book a FREE 15 min Call or Send Us Your Questions!

I Want to See All My Options with the Help of a Finance Expert

Book a FREE Call TodaySOURCES:

ato.gov.au/individuals/capital-gains-tax/cgt-discount/

https://www2.asx.com.au/blog/investor-update/2021/six-trends-to-drive-a-reit-opportunities

aussie.com.au/content/dam/aussie/documents/home-loans/aussie_25_years_report.pdf