Are you considering investing in real estate to make money?

Real estate is widely known as an investment option that can offer a sense of security as it is tangible bricks and mortar. However, before you sell your investment property and cash in on your returns, it’s important to consider the potential tax implications.

Capital gains tax on an investment property can be a complex topic, but with the right guidance and knowledge, you can learn how to calculate it without a sweat.

In this article, we’ll explore everything you need to know about calculating capital gains tax on an investment property.

Jump straight to…

- Need Tax and Financial Planning Help? Book a FREE 15 min Call or Send Us Your Questions!

- Want more financial tips and insights? Subscribe to our Newsletter for more great ways to get your money sorted straight into your inbox.

- Want to Get Started n Building a Property Investment Portfolio? Book a FREE 15min Call or Send Us Your Questions!

What is Capital Gains Tax?

Before we discuss what capital gains tax is, let’s first define capital gains.

Capital gain is the amount you get when you sell an asset for more than what you paid for it.

- If you sell an asset for less than it cost you, you have a capital loss.

Your assets are the items you own. These can be cash or things that can be converted into cash, such as real estate, automobiles, equipment, and goods or materials you own and intend to sell.

For example:

- If the purchase price of your property is $500,000 and you sell it five years later for $600,000, your capital gain is $100,000 (excluding purchase and sale costs).

Your capital gain is your profit—the amount you earned from the sale.

- Capital gains tax is a tax that you pay on any profit you make when you sell an asset.

Note that it is only the chargeable gain that is subject to tax, not the total amount received. The taxable capital gain is usually the difference between the amount you paid for the asset and the price you sold it for.

So from our above example, the $100,000 profit is your taxable capital gain, not the $600,000 sale price.

Why Do We Pay CGT?

In 1985, the Australian Parliament introduced the Capital Gains Tax (CGT), which was mostly meant to stop people from turning their income into capital to avoid paying taxes on it.

The revenue collected by the Australian Taxation Office (ATO) on behalf of the Australian Government funds community services such as:

- health care,

- education,

- emergency services,

- infrastructure,

- the Australian Defence Force, welfare

- and disaster relief.

Having the services we all value requires everyone to pay the appropriate amount of tax.

What is the formula for calculating capital gains tax?

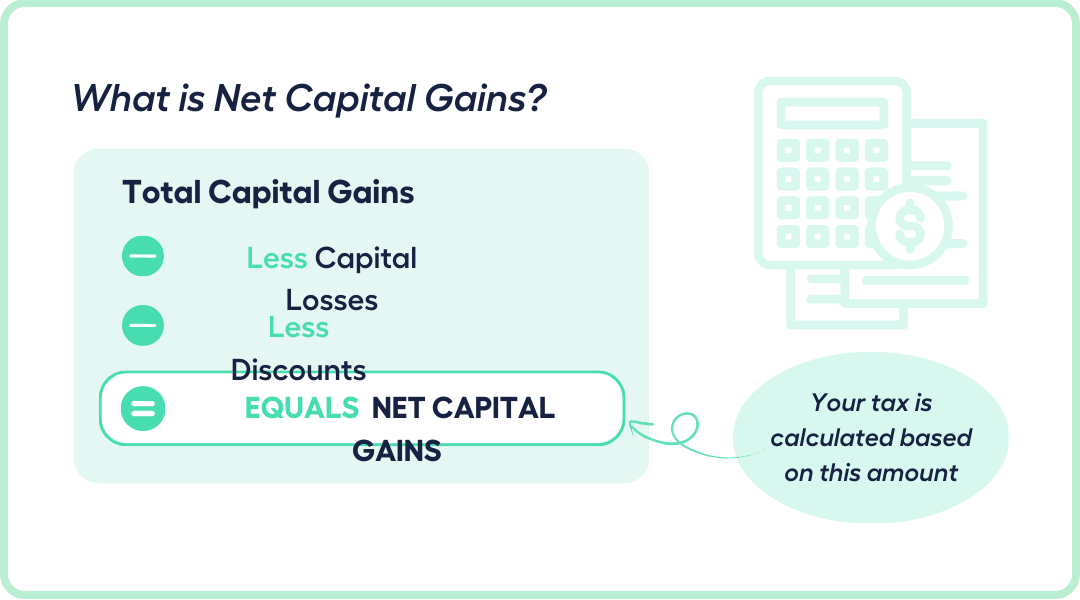

Earlier, we mentioned that the profit you make from the sale of an asset is the amount subject to capital gains tax. However, you need not pay CGT on the full amount of the profit if you meet certain conditions. First of all, you only pay tax on your net capital gains.

- This means you can deduct from your total capital gains any capital losses and any discounts you are entitled to on your gains.

Additionally, if you own an asset for 12 months or more, there is a 50% capital gains tax (CGT) discount. This means you only pay tax on half of the asset’s net capital gain.

Lastly, certain assets, such as your residential home, are exempt from CGT.

Now that you have a better understanding of what items are considered when calculating capital gains tax, let’s go through the step-by-step process of calculating CGT by yourself.

Step 1: Figure out what you got for the asset

This is your capital gain. It is the amount you earn when you sell the asset or when another CGT event occurs to it, such as when the asset is destroyed and you receive an insurance settlement.

If you give an asset away or sell it to a friend for less than its market value, your capital proceeds are the asset’s market value.

Step 2: Calculate the asset’s costs

This is the cost base of your asset. It is the purchase cost of acquiring the asset plus some other expenditures incurred in acquiring, holding, and disposing of the asset.

If you made a loss on the asset, you calculate the loss using the lower cost basis.

If you bought the asset before September 21, 1999, and made a profit on it, you can adjust the cost for inflation up to that date instead of using the CGT discount to lower your capital gain.

- In some cases, such as if you also have capital losses, this may result in a lesser net capital gain.

Step 3: Deduct the costs (Step 2) from the amount received (Step 1)

- If the result is greater than zero, you have a capital gain on this asset.

- If the result is less than zero, you have a capital loss on this asset (make sure you used the reduced cost base at step 2).

Step 4: If you have more than one CGT event

Repeat steps 1–3 for each CGT event that occurred during the relevant financial year, such as the sale of another asset or when the asset is destroyed and you receive an insurance settlement.

Step 5: Deduct your capital losses from your capital gains

Skip to step 7 if you have no allowable capital losses.

Subtract any net capital loss carried forward from previous years first.

You can choose which capital gains to deduct your losses from. If you have capital gains that are ineligible for the CGT discount, deduct your losses first.

- This will yield the lowest CGT.

Step 6: If the remaining amount is…

- Greater than zero, proceed to step 7.

- Less than zero, this is your net capital loss. Continue to step 8.

Step 7: Apply the 50% CGT discount to any remaining eligible capital gains

In general, if you are an Australian resident and have owned the asset for at least 12 months, you are eligible for the CGT discount.

- A capital gain on an asset owned for less than a year cannot be discounted.

The discount is available only to individuals and trusts, not businesses.

You cannot apply the discount if you acquired the asset before September 21, 1999 and elected to index its cost base at step 2.

Step 8: Include your net capital gain or loss in your income tax return

- If you have a net capital gain, you must pay tax on it at your applicable marginal tax rate.

- If you have a net capital loss, you cannot deduct it from your other income, but you can carry it forward to reduce future capital gains.

Let’s clarify the process of calculating CGT using our earlier example:

- You bought a property for $500,000 and sold it five years later for $600,000. You have no other capital gains or losses.

Step 1: The capital proceeds from the CGT event are $600,000.

Step 2: The cost base is $530,000, made up of:

Purchase costs of $500,000 + $15,000 stamp duty + $1,200 conveyancing fees.

Sale costs of $1,300 conveyancing fees + $12,500 agent’s commission.

Step3: Your capital gain on the investment property is $600,000 − $530,000 = $70,000

Step 4: You have no other capital gains or losses, so we skip to Step 7.

Step 5: Not applicable.

Step 6: Not applicable.

Step 7: You can use the 50% CGT discount to reduce your capital gain because you are an Australian resident and have owned the asset for at least 12 months: $70,000 × 50% = $35,000.

Step 8: You report a net capital gain of $35,000 in your income tax return, and will pay tax on this gain at your marginal income tax rate.

The ATO has an online free calculator and record-keeping tool you can use. You can also access ATO’s tool and save your data through your myGov account.

However, going through the steps and knowing how to get your estimated capital gains tax will help you keep track of your expenses, file them properly, and make it easier for you to go through the calculation once you’ve put your investment property on the market.

Are capital gains tax based on income?

From our example, you can see that capital gains tax is part of your income tax return.

- Capital gains tax is not an additional tax; it is actually a component of your income tax.

This means that your taxable income may increase if you have a capital gain.

So when you sell an investment property, it would be wise to calculate the amount of tax you will owe and set aside money to pay it.

Do I have to pay capital gains tax immediately?

You pay capital gains tax only after you sell an asset. Having said that, keep in mind that the capital gain on a property occurs on the date of the sale contract, not the date of settlement.

- For example, if you exchange contracts on 7 June 2023 and settlement occurs on 8 July 2022, you have to declare your capital gain in your income tax return for the fiscal year ending 30 June 2023.

Know that penalties may be imposed if a tax return is not submitted on time. Interest may also accumulate, increasing the total amount owed.

Tips for Minimising Capital Gains Tax

When selling an investment property in Australia, individuals must generally pay Capital Gains Tax.

We already mentioned that if you own an asset for 12 months or more, there is a 50% capital gains tax (CGT) discount.

However, there are also CGT exclusions available, and no Capital Gains Tax will be paid if the conditions are met.

Capital Gains Tax Exemptions

It is important to keep in mind that most personal property, such as your owner-occupied home, are exempt from Capital Gains Tax. This implies that if you sell your family home, you do not have to pay Capital Gains Tax.

However, you can also designate your former home as your main residence for tax purposes even if you use your former home to generate revenue (for example, as a rental property), and you can keep it as your primary residence for up to six years after you move out. This is referred to as the ‘6-year rule’.

Don’t forget that you can’t choose a different home as your main residence during the six-year period. If you do, the exemption would be voided.

- Capital Gains Tax does not apply to assets purchased before 20 September 1985, including real estate.

You can sell an investment property or other assets acquired before this date without paying Capital Gains Tax.

- A property purchased through a Self-Managed Super Fund has some special tax advantages.

If an SMSF sells an investment property after retirement, the sale is exempt from Capital Gains Tax.

However, if there are some members in the accumulation phase and some in the retirement phase, it is a little more complicated and you should seek professional assistance.

At what age do you not pay capital gains?

There’s an old saying that goes, ‘In this world, nothing is certain except death and taxes.’

It’s a common misconception that retirees, pensioners, or those over the age of 65 are exempt from paying CGT, however, in Australia, there is no such limitation.

- Individuals in Australia must still pay Capital Gains Tax regardless of age unless they qualify for another exemption such as those mentioned earlier.

Need Tax and Financial Planning Help? Book a FREE 15 min Call or Send Us Your Questions!

If you’re one of the many Aussie’s who’s into joint property ownership you must be wondering how the CGT is calculated on a joint property.

Calculating your CGT depends on the type of shared ownership you have.

Tenants in Common

When two or more people own an asset in defined shares, they are said to be “tenants in common”, and their shares may be equal or unequal.

When a CGT event happens, like when the investment property is sold, the capital gain or loss is split between the owners based on the percentage they own.

Let’s use the information of the previous example to calculate CGT for tenants in common.

You and Bill bought a property for $500,000 and sold it five years later for $600,000. You have no other capital gains or losses. You own 60% of the property and Bill owns 40% of the property and you split the costs 60-40.

Step 1: The capital proceeds from the CGT event are $600,000.

Step 2: The cost base is $530,000, made up of:

- purchase costs of $500,000 + $15,000 stamp duty + $1,200 conveyancing fees

- sale costs of $1,300 conveyancing fees + $12,500 agent’s commission.

Step3: The capital gain on the investment property is $600,000 − $530,000 = $70,000

Your capital gain (60%) is $42,000, while Bill’s (40%) is $28,000.

Step 4: You have no other capital gains or losses, so we skip to Step 7.

Step 5: Not applicable.

Step 6: Not applicable.

Step 7: You can use the 50% CGT discount to reduce your capital gain because you are an Australian resident and have owned the asset for at least 12 months.

Your discounted amount (50% x $42,000): $21,000.

Bill’s discounted amount (50% x $28,000): $14,000.

Step 8: You report a net capital gain of $21,000 in your income tax return, and will pay tax on this gain at your marginal income tax rate.

Joint Tenants

Joint tenants each own an equal amount of the asset. So, a CGT event gives each person an equal share of any capital gain or loss.

Let’s use the information of the previous example to calculate CGT for joint tenants.

You and Bill bought a property for $500,000 and sold it five years later for $600,000. You have no other capital gains or losses. You own 50% of the property and Bill owns 50% of the property and you split the costs 50-50.

Step 1: The capital proceeds from the CGT event are $600,000.

Step 2: The cost base is $530,000, made up of:

- purchase costs of $500,000 + $15,000 stamp duty + $1,200 conveyancing fees

- sale costs of $1,300 conveyancing fees + $12,500 agent’s commission.

Step3: The capital gain on the investment property is $600,000 − $530,000 = $70,000

Your capital gain (50%) is $35,000, while Bill’s (50%) is $35,000.

Step 4: You have no other capital gains or losses, so we skip to Step 7.

Step 5: Not applicable.

Step 6: Not applicable.

Step 7: You can use the 50% CGT discount to reduce your capital gain because you are an Australian resident and have owned the asset for at least 12 months.

Your discounted amount (50% x $35,000): $17,500.

Bills discounted amount (50% x $35,000): $17,500.

Step 8: You report a net capital gain of $17,500 in your income tax return, and will pay tax on this gain at your marginal income tax rate.

When you get into a joint property investment structure, keeping records is doubly important specially if you don’t diligently split costs according to your shares in the property.

Earlier we mentioned that tenants in common can have equal or unequal shares in an asset, while joint tenants each own an equal amount of the asset.

What differentiates these two further is that joint tenants have a right of survivorship. In other words, when one co-owner dies, their share of the property automatically goes to the joint tenant who is still alive.

Whereas for when a tenant in common dies, the ownership of the share is inherited by the deceased’s heirs.

Want more financial tips and insights? Subscribe to our Newsletter for more great ways to get your money sorted straight into your inbox.

Want to Get Started n Building a Property Investment Portfolio? Book a FREE 15min Call or Send Us Your Questions!

I want to see all my options with the help of a Finance Expert

Call Our Team TodaySOURCES:

aph.gov.au/Parliamentary_Business/Committees/Senate/Finance_and_Public_Administration/Completed_inquiries/1999-02/btr/report/c04#:~:text=4.1%20Capital%20gains%20tax%20(CGT,exploit%20its%20tax%2Dfree%20status.

ato.gov.au/individuals/capital-gains-tax/list-of-cgt-assets-and-exemptions/

ato.gov.au/Calculators-and-tools/Capital-gains-tax-record-keeping-tool/

ato.gov.au/individuals/capital-gains-tax/calculating-your-cgt/cost-base-of-assets/