Have you ever looked around your house and imagined what it would look like if you had an interior designer or a builder on hand to help you renovate it?

Getting your house renovated with the right help could be within reach if you secure the funds to cover the costs.

In this article, we’ll discuss the best ways to get a home renovation loan.

Jump straight to…

What is a Home Renovation Loan?

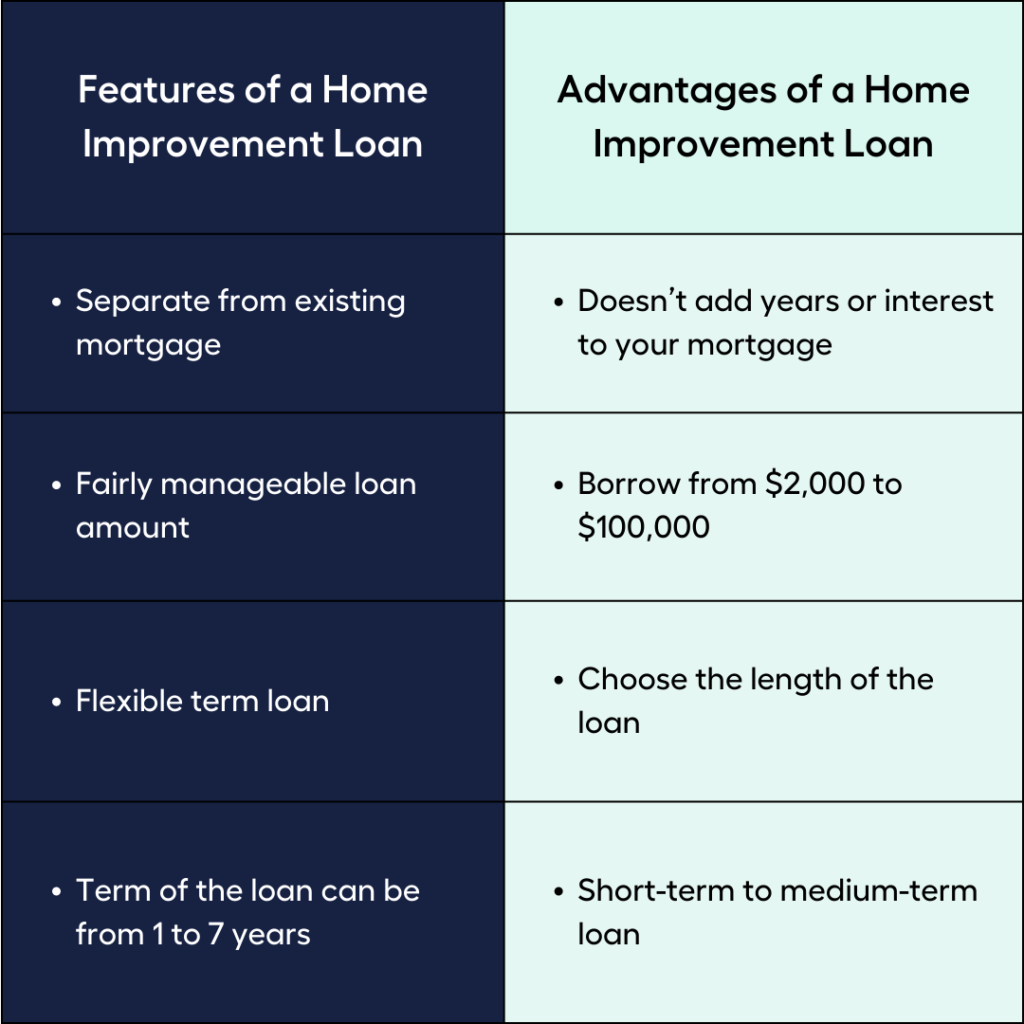

Home renovation loans, also known as home improvement loans, are personal loans you can take out to finish your home improvement projects.

It can be used for building or do-it-yourself projects like adding an extra room, redesigning your bathroom, fixing doors and windows, landscaping the garden, or getting new fixtures or appliances.

With a home improvement loan, you won’t have to add to your existing home loan balance and pay more interest over the life of the mortgage.

You can borrow as little as $2,000 or as much as $100,000 to use around your home as you see fit.

You can also choose the duration of the loan to ensure that you can afford the repayments. It doesn’t have to be 30 years like a mortgage, but can typically be anywhere from 1 to 7 years. This means you’ll likely pay much less in interest.

However, before you decide which type of loan is best for you, you need to consider if you’re eligible for a renovation loan.

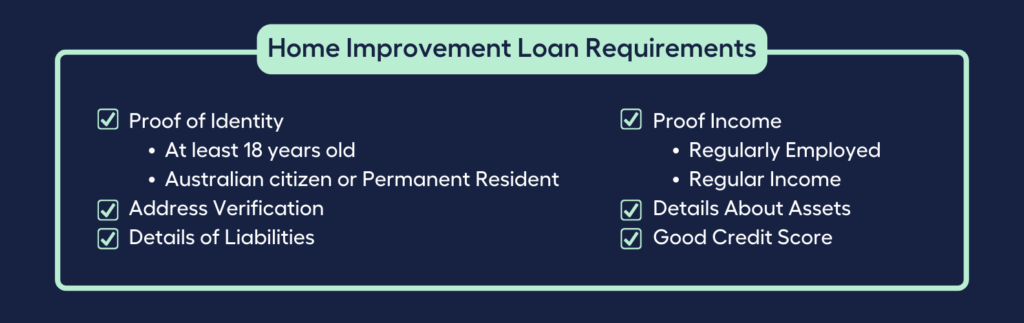

Although the eligibility requirements for each lender are different, most loans for home improvements need you to be:

- 18 years or older

- An Australian citizen or permanent resident

- Have a good to great credit score, depending on the lender

- Regularly employed

- Getting money on a regular basis

For a renovation, you will need to show the following things:

- Proof of Identity. A valid driver’s licence or passport from Australia.

- Address Verification. This could be a bill for a service or a bank statement.

- Proof of Income. This could include the name and contact number of your employer.

- Details About Assets. You will have to show proof that your home and other assets belong to you.

- Details Regarding Liabilities. You will need to list any loans or credit card debts that you still have to pay.

Three Types of Personal Loans for Home Improvement

When it comes to home renovations, there are three types of personal loans available to eligible homeowners.

1. Secured Personal Loans

A secured personal loan gives you access to the amount you need for renovation by using something you own as collateral, such as your car or your house.

You can borrow up to $100,000 with a secured personal loan. But this will depend on how much your asset is worth and whether or not you meet the lender’s eligibility criteria.

Often, the interest rate on a secured personal loan is less than on other types of personal loans. This is because the lender is less likely to lose money given you’ve put up collateral. When the risk is low, the lender has a reason to offer a better rate.

The length of a loan can also go up to 10 years.

2. Unsecured Personal Loans

With an unsecured personal loan, you don’t have to put up any assets as security.

Unsecured loans have higher interest rates and fees than secured loans because you are borrowing money without putting anything up as collateral.

You could borrow as much as $50,000, but some lenders may lend more.

- Terms typically last between 1 and 7 years.

You could choose between a fixed interest rate or a variable rate. Your rate will also be based on your credit score.

3. Green Loans

A green loan is a personal loan that is used to make green or environmentally friendly changes to a property.

A green loan is a fairly new loan product in the market and is available at relatively low interest rates and more flexible repayments when compared to other types of personal loans. It is offered as an incentive for people to switch to products that are better for the environment and use less energy.

Green loans can either be secured or unsecured, and the length of loans ranges from 6 months to 7 years.

You can also change the amount you can borrow based on the improvements you need to make.

It can be used to buy a solar power system, a solar hot water system, or appliances that use less energy. You could also use it to add energy-efficient heating and/or cooling, insulation, and double-glazed windows.

| Three Types of Personal Loans for Home Improvement | ||

| Secured Loan | Unsecured Loan | Green Loan |

| Has collateral | No collateral | With/without collateral |

| Borrow up to $100,000 | Borrow up to $50,000 | Variable Amount |

| Lower Interest Rate | Higher Interest Rate | Lower Interest Rate |

| Term up to 10 years | Term is up to 7 years | Term is up to 7 years |

| Flexible use | Flexible use | Limited to Green improvement |

Can I Borrow Money to Buy a House to Renovate?

The old saying, “purchase the worst house on the best street”, may have its merits. You can pay less for a property now and fix it up later.

However, you may not be able to use a regular home loan to buy a real estate listing that uses phrases like “fixer-upper,” “renovator’s dream,” or “bring your builder”.

Why?

Its value may not be enough to secure the mortgage.

Fortunately, there’s a loan that can accommodate such a situation…

- A construction home loan, sometimes also referred to as a renovation loan.

Unlike in a traditional mortgage where you could collect all the funds at once, your bank will provide you with funds in small amounts as your property is being renovated. These payments are also called “progressive drawdowns” or “progressive payments.”

As your builder finishes each part of the job, he or she will give you an invoice that you need to sign and send to your bank or broker. Once the paperwork is done, the bank will pay the builder for the work that has been completed.

During this time, interest will only be calculated on the money that has been used.

- So, if you’ve only used $100,000 of a $300,000 loan, you’ll only have to pay interest on that $100,000.

Once the renovation project on your property is complete, and you’ve made the last progress payment, you’ll typically switch from paying interest only to paying both principal and interest.

At this point, your loan term will also start, for example 25 years.

Do renovation loans have a higher interest rate?

Interest rates for construction loans (aka renovation loans) are often higher than those on regular home loans.

Due to the fact that it’s more difficult for a lender to appraise a property that hasn’t yet been fully built, they frequently raise interest rates to cover this risk.

Construction loans may also have greater costs in addition to the higher interest rate.

A typical expensive cost is a valuation charge, which is more expensive with a construction loan because the lender must value your property after each stage of construction.

Additionally, there may be increased upfront costs and administrative fees.

Which loan is best for a house renovation?

The best renovation loan for you depends on your circumstances and the type of property improvements you intend to make.

- If you sense that your property needs extensive renovations and you’ve calculated that you need a budget greater than $100,000 to cover the renovations costs, then a construction loan will give you the best deal.

The interest rate on a construction loan will typically be lower than a personal loan. Just remember to keep track of your costs, and pass the builder’s invoice to your bank immediately so they can collect on their payment to avoid delays.

- If you’re going green with your renovations, opting for environment friendly and sustainable fixtures, then it would be wise to take advantage of a green personal loan.

- If your project involves smaller renovations and you don’t have or don’t wish to put up collateral then an unsecured personal loan may be the best option even if the interest rate is slightly higher.

- If your project requires smaller renovations and you want a loan with lower interest rates, then a secured personal loan may be the best deal for you as long as you can back up your personal loan with an asset for collateral.

| Needs | Construction Loan | Secured Personal Loan | Unsecured Personal Loan | Green Loan |

| Amount Less than $50,000 | ✅ | ✅ | ✅ | ✅ |

| Amount more than $50,000 | ✅ | ✅ | ❌ | ✅ |

| Amount more than $100,000 | ✅ | ❌ | ❌ | ❌ |

| Collateral / Deposit | ✅ | ✅ | ❌ | ✅ |

| No Collateral / Deposit | ❌ | ❌ | ✅ | ✅ |

The Benefits & Risks of a Home Renovation Loan

Now that we’ve identified the different loan options for home renovation, let’s have a quick look at their pros and cons.

Benefits of a Home Renovation Loan

Personal loans are ideal for smaller renovations that cost less than $100,000 dollars.

- The terms are flexible and you can choose to secure or not secure your loan with collateral. You can use a variety of things as collateral for the loan, such as term deposits, vehicles, and real estate.

- You get to separate your renovation costs from your home loan balance. Having an expense account for renovation separate from mortgage repayments can make managing your money a lot simpler.

For construction loans, you don’t have to pay interest on your entire loan amount during the renovation period.

- You only pay interest on construction funds as they are drawn down.

- When it comes to loan terms, construction loans are more flexible than other types of loans.

- You can make the loan terms fit your project’s needs.

- Lending parameters aren’t just there to cover the lender’s risk. They are there to assist you to finish your project on time and within budget.

| Pros of Home Renovation Loans | |

| Personal Loans for Home Renovation | Construction Loan for Home Renovation |

| Ideal for small renovations Flexible Terms Secured or Unsecured Separate from existing mortgage | Big ticket projects Flexible Terms Pay interest only on used funds Finish project within budget and on time |

Risks of Home Renovation Loan

Personal loan interest rates are relatively high compared to mortgage products, and keeping track of your separate loan and mortgage repayments is additional work.

There’s a limit to the amount that can be borrowed, which can be lower than the actual cost of the renovation.

Most importantly, defaulting on a secured loan may mean losing the asset you set up as collateral.

The amount of paperwork you need to fill out to get a construction loan could be seen as a problem. To get a construction loan, you have to do a lot of paperwork and ensure your builder is willing to be paid by the bank under the terms of the loan.

Another possible downside is that this type of loan may require a much larger deposit than a standard mortgage.

Also, the interest rate on some construction loans might be higher than the interest rate on a regular mortgage. But once the property is finished being built, your lender may allow you to revert the total loan amount back to a normal home loan interest rate.

| Cons of Home Renovation Loans | |

| Personal Loans for Home Renovation | Construction Loan for Home Renovation |

| Higher interest rate compared to home loansLimit to amount that can be borrowedThreat of loss of asset due to default | Higher interest rate compared to home loansTedious paperworkA bigger deposit than a standard mortgage |

Do you need a deposit to remortgage?

A construction loan can fund the expenses of a significant renovation project, such as an extension.

2 Ways You Can Get a Construction Loan:

(Depending on the requirements of the lender and what best matches your needs)

1. A second mortgage in addition to the existing mortgage on your property.

2. Refinance your current mortgage to become a construction loan.

In most cases, you don’t have to pay a deposit to refinance your mortgage. Instead, equity is one of the elements that will decide your eligibility to refinance.

Equity is the amount that remains after subtracting your debt from the value of your property.

Equity serves as collateral for your new loan and lowers the financial risk to the lender. If you have at least 20% equity in your property, you may be eligible to refinance.

Even with less equity, refinancing is still an option. However, you might need to consider alternatives in this situation, such as getting a guarantor or paying lender’s mortgage insurance (LMI).

Alternatives to Fund a House Renovation

Considering that a house is the biggest investment for most Australian home owners, alternative loan options are available for renovating a house into the home of their dreams.

Using Equity in Your Home

No matter how big or small your project, you may need to borrow money. Using the equity on your current home is one way to finance your renovation project.

Equity is the difference between the property value and your loan balance. Equity can grow over time if your home’s value has gone up or if you’ve paid down your loan balance.

- As an example, if the current value of your property is $600,000 and your mortgage balance is $200,000, then the difference, which is $400,000, is your equity in your property.

You can borrow against your equity to fund your renovation.

| Calculate the Equity of a Property | |

| Property Value | $600,000 |

| Less Home Loan Balance | $200,000 |

| Equals Home Equity | $400,000 |

Withdrawing from a Redraw Facility

If you’re used to paying more than your minimum scheduled home loan repayments, you’ll have money available to take back out – provided you have a redraw facility attached to the loan. This process is called redraw and you can use it to fund your renovation expenses.

However, not all mortgages have a redraw facility. If you have a fixed rate loan, redraw is only available at the end of the fixed rate period, which is when the rate becomes variable.

Using Credit Cards

If your project is likely to involve smaller regular expenses, you could consider using your credit card.

Although credit cards typically come with higher interest rates and fees than other loan products. Thus, it may not be suitable for renovations where you might not be able to repay the funds quickly.

What home upgrades are not worth it?

It might be hard to imagine, but some home improvements could actually lower the property values of houses. Consider if the following renovations can add to the property value or not of your home.

Odd Furniture Fixtures or Colours

If you want to make money when you sell, you might want to stick to modern and neutral decor. This is because your tastes might not match those of a possible buyer.

Bad DIY

DIY is a great way to save money, but it can sometimes go wrong. If you don’t know what you’re doing, you might make things worse instead of better. In situations like this, it might be best to hire a pro.

Swimming Pools

Swimming pools can be perceived as being high-maintenance and challenging to remove. If you want to add a pool to your property, you should think about whether or not that’s a good idea where you live. You should also think about how long you plan to live there.

Joining Rooms

Taking down a wall and connecting two smaller rooms can be a great way to give your home more space and lighting. But this means you have fewer rooms, which can lower its property value.

Illegal Renovations

Make sure that all of your renovations adhere to the regulations. You should make it a point to get permission from the council if you need it. If you add rooms to your house that the city council doesn’t like, you won’t be able to sell your property with those rooms.

If you need help to sort out your loan options for home renovation, talk to My Money Sorted for free!

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your home loan options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Mortgage Broker

It’s that easy!

Looking for the Right Mortgage Broker? Chat with My Money Sorted to Learn How to Find the Right Financial Advice.