Are you tired of being tied down by your mortgage?

Want to be free of those monthly payments sooner?

Well, take a look at these tips to help you pay down the balance of your mortgage faster!

Imagine the feeling of having extra cash in your pocket and the peace of mind that comes with being mortgage-free. With a little bit of effort and discipline, it’s possible to make that dream a reality.

So, let’s dive in and discover how to pay off your home loan faster!

Jump straight to…

What are the fastest ways to pay off your mortgage?

Paying off your mortgage is a significant milestone that many homeowners aspire to achieve. However, the thought of being in debt for decades can be daunting.

But don’t throw in the towel just yet! There are ways to get ahead of your home loan repayments from simple strategies like looking for better interest rates (especially when there’s a cash rate upward trend) and making extra repayments to more advanced strategies like refinancing.

Switch to Weekly or Fortnightly Repayments

If you want to pay off your home loan faster and save some money, switching to weekly or fortnightly repayments is one way to go.

Here’s why:

When you make monthly repayments, you’re making just 12 payments a year. But (depending on how your lender calculates their repayments) if you switch to fortnightly repayments, you’ll be making 26 payments a year (that’s half your monthly payment every two weeks). And if you switch to weekly repayments, you’ll be making 52 payments a year (that’s a quarter of your monthly payment every week).

Making more frequent repayments means you’re paying an extra month’s worth of repayments each year. That’s right, you’re smashing out an extra month of repayments!

And guess what?

- Making more frequent repayments also means you’re reducing the amount of interest you pay over the life of your loan. See, when you make more repayments, you’re reducing the amount of time that interest can accrue on your outstanding balance.

Make Extra Mortgage Repayments

Making extra repayments is a faster way to pay off your home loan because it reduces the amount of interest you pay over the life of your loan and helps you pay off your loan faster.

When you make extra repayments, you’re paying more than the minimum required payment. This means you’re reducing the outstanding balance of your loan faster, which means you’ll be paying less interest over time. The less interest you pay, the more of your payment goes towards reducing your loan balance.

For example:

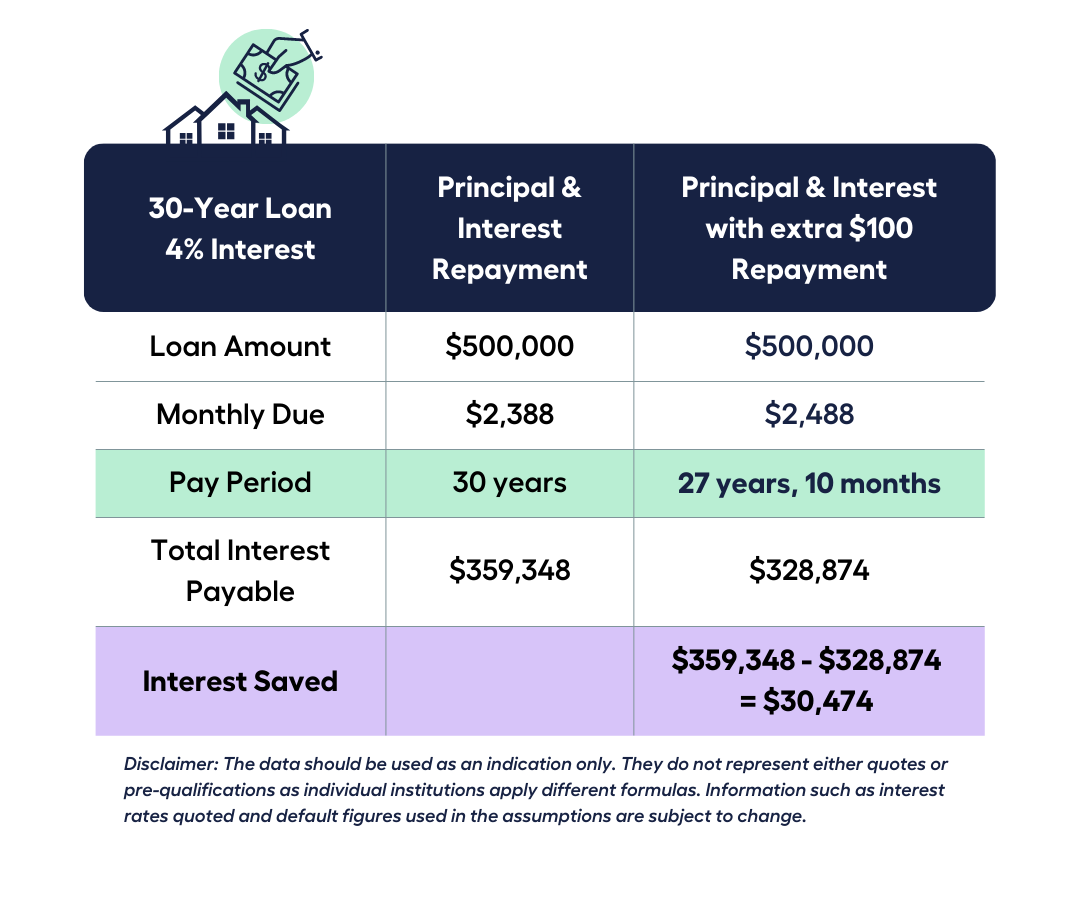

- Let’s say you have a $500,000 mortgage with a 4% interest rate over 30 years. By making an extra repayment of $100 per month, you could pay off your home loan 2 years earlier and save over $30,000 in interest.

Using the My Money Sorted (MMS) Repayment Calculator, you’ll end up with these figures:

Plus, making extra repayments can also help you build equity in your home faster. Equity is the difference between your home’s value and the amount you owe on your home loan. The more equity you have, the more flexibility you have in your finances and the more options you have for future investments.

Refinance to a Lower Interest Rate

If you want to pay off your home loan faster, refinancing to a better rate could be another option.

When you refinance, you’re essentially replacing your current loan with a new one. And if you can find a loan with a lower interest rate, you could save yourself thousands of dollars in interest over the life of your loan.

For example:

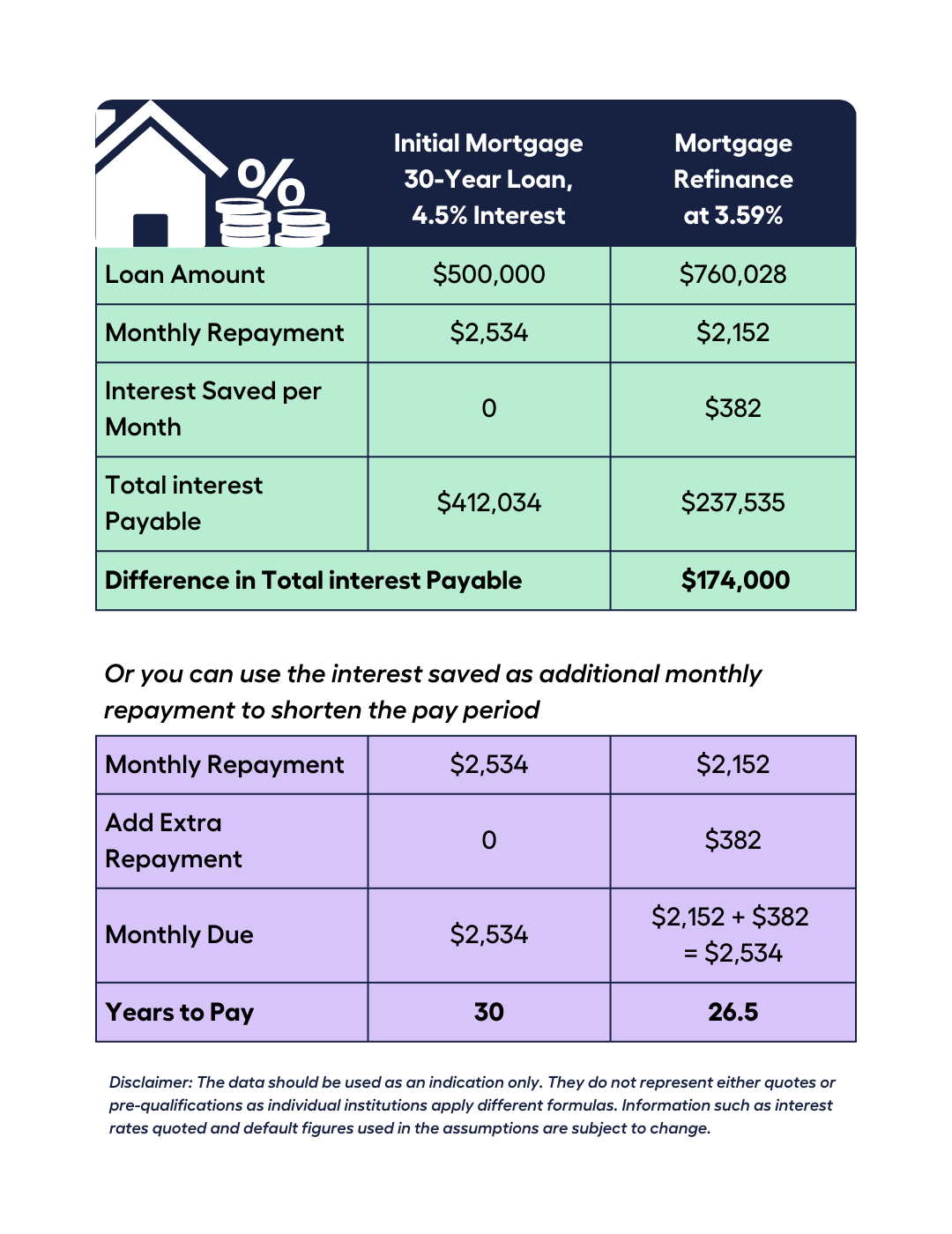

- Let’s say you have a $500,000 home loan with a 4.5% interest rate over 30 years. If you refinance after the 5th year (with an outstanding balance of $455,790) and find a loan with a 3.59% interest rate, you could save over $86,000 in interest and pay off your loan nearly 6 years earlier.

Using the My Money Sorted (MMS) Refinance Calculator, you’ll end up with these figures:

- Plus, with a lower interest rate, more of your monthly repayments go towards paying off your loan balance, rather than towards interest. That means you’ll be able to pay off your loan faster and build equity in your home quicker.

Now, refinancing can seem like a difficult undertaking, but it doesn’t have to be. Just remember to do your research, compare your options, and find a loan that suits your needs and goals.

And don’t forget to factor in any fees and charges associated with refinancing such as break cost, settlement and application fees.

Consider an Offset Account

Opening an offset account is another option worth considering to pay off your home loan faster.

- An offset bank account is a type of bank account that’s linked to your home loan. Any money you deposit into your offset bank account is taken into account when your lender calculates the interest you owe on your mortgage.

This means that the more money you have in your offset bank savings or transaction account now, the less interest you’ll pay on your home loan.

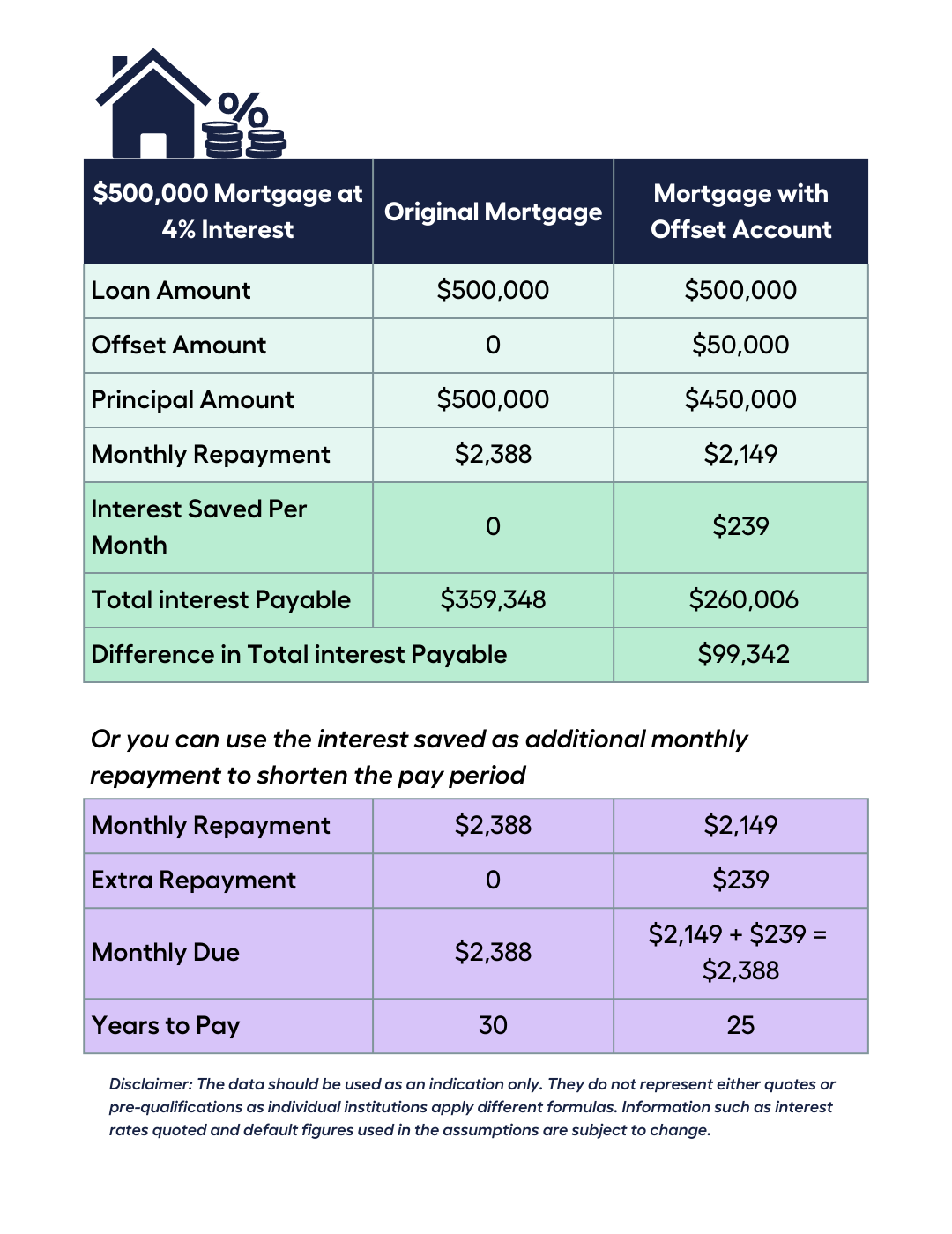

Let’s say you have a home loan of $500,000 with an interest rate of 4%. If you have $50,000 in your offset bank account, the same interest rate on your home loan will be calculated on $450,000 rather than $500,000.

This means you’ll pay less interest each month, which can help you pay off your mortgage faster.

Another benefit of an offset account is that the money you deposit into it is still accessible, just like your savings in a regular bank account. This means you can use the money in your offset or savings account for day-to-day expenses, while still reducing the amount of interest you pay on your home loan.

Choose a Principal and Interest Loan

Choosing a principal and interest loan is another way to speed up your mortgage repayments.

First, let’s break down what a principal and interest loan is. When you take out a home loan, you borrow a certain amount of money from a bank or lender. The amount you borrow is called the principal, while the charge you make to the lender for extending credit is known as the interest.

- With a principal and interest loan, you make regular repayments that include both the principal and the interest.

Now, how may selecting a principal and interest loan speed up the repayment of principal and interest on your mortgage?

It’s because this option is designed to reduce your debt over time. Each repayment you make goes towards paying off the principal amount you borrowed as well as the interest charges. Over time, as you make these regular repayments, you’ll pay less in interest because your outstanding balance is decreasing.

- This means that a better rate and more of your repayments are going towards paying off the principal, which in turn reduces the amount of interest you need to pay over the life of the loan, creating a “snowball effect”. A snowball effect accelerates the repayment process and can help you pay off your mortgage in a shorter period of time.

In addition to paying off your home loan faster, there are other benefits of choosing a principal and interest loan. For example, you may be eligible for a lower interest rate compared to an interest-only loan, and you’ll also have the peace of mind of knowing that your debt is reducing over time.

- Just make sure you’re comfortable with the repayment amounts and consider getting advice from a professional financial advisor to ensure it’s the right choice for your personal circumstances.

Fixed vs Variable Rates

- Making a smart choice between fixed and variable interest rates could help you pay off your mortgage more quickly.

Let’s first understand the difference between fixed and variable interest rates.

- A fixed interest rate means that the interest rate on your loan will stay the same for a determined period of time, usually between 1-5 years, regardless of interest rate rises.

- A variable interest rate, on the other hand, means the interest rate on your loan can change depending on market trend and conditions and the lender’s discretion.

A variable interest rate can also give you some flexibility in your budget as you’ll have the choice to make extra repayments or use the extra money for other expenses.

If you’re willing to take on some risk with potential interest rate hikes and want the potential to save money and pay off your home loans faster, a variable rate could be a better option.

Ultimately, choosing between fixed and variable interest rates is a personal decision that may be made based on your own financial goals, values, priorities, and preferences. It’s important to do your research and speak with a professional financial advisor to ensure you make the right choice for your situation.

What You Need to Know About Paying Off a Mortgage Early

Paying off your mortgage early can have many benefits, but it’s also important to understand the implications of this option so you can make an informed decision.

Do extra payments automatically go to principal?

When you make an extra payment on your mortgage, it’s important to understand how the payment is applied.

- Typically, the extra payment will automatically go towards paying off the principal amount of your loan.

This can help reduce the amount of interest you pay over the life of the loan and shorten the repayment period. However, it’s important to check with your lender to confirm their policy on extra payments and ensure that they are being applied correctly.

Is it possible to pay off my mortgage in 5 years?

While paying off your mortgage in five years is possible, much will rely on your financial condition and the amount you owe. You would potentially need to change your lifestyle and most likely need to make additional payments on top of your usual repayments in order to do this (depending on the size of your loan). It’s vital to keep in mind that everyone may not be able to pay off their home loans this quickly, so it’s crucial to set realistic objectives that are doable given your financial situation.

Are there downsides to paying off your mortgage faster?

- Paying off your mortgage faster can have many benefits as well as some downsides you need to consider.

For example, if you focus all your extra money on paying off your mortgage, you may miss out on other investment opportunities that could potentially provide higher returns.

Additionally, some home loans may have prepayment penalties, so it’s important to check with your lender before making extra payments.

Lastly, paying off your mortgage too quickly could potentially leave you with limited cash reserves for emergencies and a savings fund, so it’s important to find a balance that works for you.

Want to Pay Off Your Mortgage Faster & Book a FREE 15-min Call or Send Us Your Questions!

I Want to See All My Options with the Help of a Finance Expert

Book a FREE Call TodaySOURCES:

tradingeconomics.com/australia/interest-rate

nab.com.au/personal/life-moments/home-property/pay-off-home-loan/pay-off-faster

moneysmart.gov.au/home-loans/pay-off-your-mortgage-faster

westpac.com.au/personal-banking/home-loans/investing-in-property/6-things-to-look-for-investment/