Getting ready to buy a home?

Whether you’re buying a home as investment property or to live in as an owner occupier, your borrowing power could serve as the foundation of your decision to buy a home.

The term “borrowing power” refers to how much you can borrow for a loan depending on your financial situation. You can obtain greater credit limits or loan amounts if you have better borrowing capacity.

This article aims to help you know all about borrowing power, how much you can borrow for a home loan, how much you need for a deposit on a home, and how borrowing power is calculated

Dig in and get started on your mortgage research journey by learning about borrowing power!

Jump straight to…

Understanding Borrowing Power

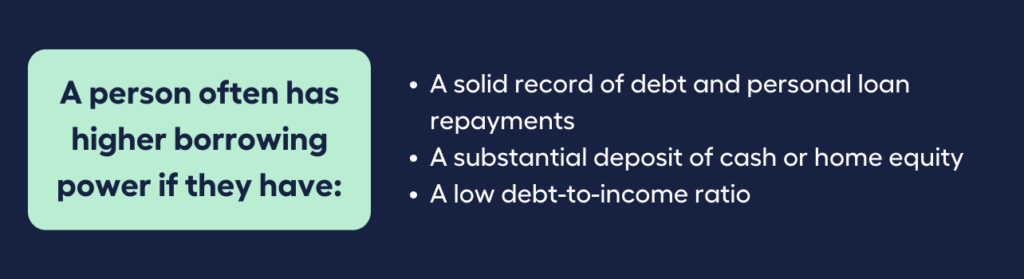

Lenders and creditors consider borrowing power when evaluating loan applications and how much money they would be prepared to loan a borrower. Being aware of the factors that increase or decrease how much you are able to borrow will help you present your best financial case and obtain a loan approval.

Your borrowing power depends on a number of variables that factor into a lender’s credit criteria.

Your borrowing capacity may also be impacted by additional elements including interest rates and loan terms.

Here’s the lowdown on the factors that can help increase your borrowing power:

1. Debt and Loan Repayments

A solid record of debt and personal loan repayments frequently goes hand in hand with a high credit approval rate.

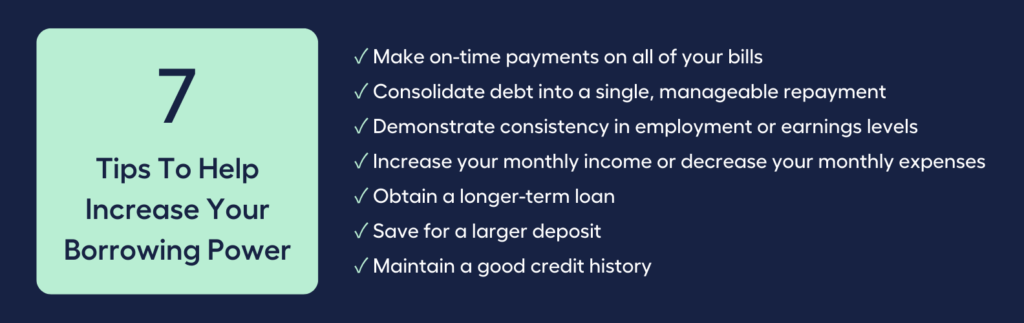

Regular monthly bill payments made on time and in full help build good credit. So it’s crucial to settle your utility bills or mobile phone bills on time in order to build good credit.

Do you know that being debt-free can actually reduce your ability to borrow money?

It can be beneficial to demonstrate that you have previously had financial commitments and have met them on time. Lenders want a point of comparison when determining how risky a borrower you are.

But if you do take on debts, be sure to do so within your limits and manage your personal loans well.

If you are aiming to build a credit history, only take on a debt that you can afford to repay. The goal here is to increase, not lower, your borrowing power.

2. Cash Deposit or Home Equity

All else being equal, the higher your cash deposit, the greater your borrowing power.

Some lenders may require a deposit of 10-20% for 30-year home loans with low interest rates.

Other lenders, on the other hand, offer home loans with as little as a 5% deposit. This may result in slightly higher interest rates, but it may allow you to purchase your new home sooner.

Equity in your home can also increase the amount you are able to borrow in place of a cash deposit.

For the purposes of home ownership, home equity is the difference between the current market value of your property and the amount you still owe on your home loan.

Example:

So, if your property currently has a market value of $1,000,000 and your home loan balance is $600,000, the equity in your property is $400,000.

| Current Market Value of Property | $1,000,000 |

| Less Mortgage Balance | – $600,000 |

| Equals Home Equity | $400,000 |

Equity can be used to obtain borrowing power without having to sell the property.

Many people take out home equity loans, with the underlying property serving as security or collateral. The proceeds of a home equity loan can be used for whatever purpose you require the funds for subject to the terms and conditions of the loan.

Some people take out a home equity loan to improve, add value to, or repair their home. This can help to restore some of the equity accessed by increasing the home’s market value.

3. Debt-to-Income Ratio (DTI)

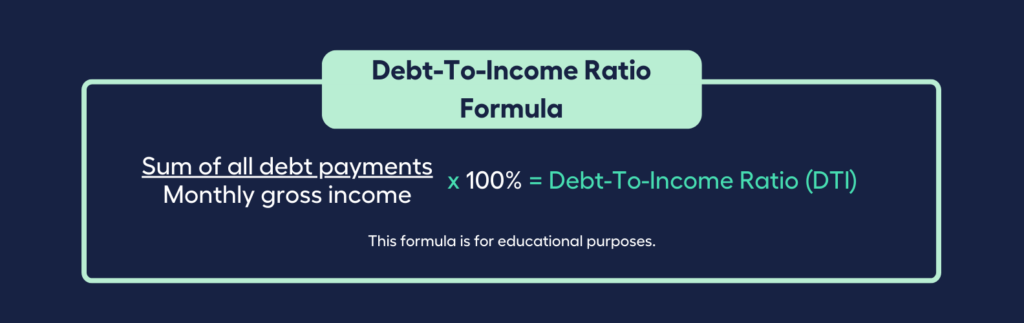

Your debt-to-income ratio (DTI) compares your monthly debt payments to your monthly income.

The debt-to-income ratio refers specifically to the portion of your gross monthly income (before taxes) that is spent on rent, a home loan, credit card bills, or other debt.

How To Calculate Your Debt-To-Income Ratio:

Step 1

Add up all of your monthly debt payments, such as:

- monthly mortgage repayments or rent

- child support payments made each month

- monthly payments for student, vehicle, and other loans

- monthly payments on credit cards (use the minimum payment)

- Other debts

*Note that typically speaking, taxes and monthly living expenses

such as groceries, utilities, and gas are not included.

Step 2

Divide the total of your monthly debt payments by your gross monthly income,

which is your income before taxes.

Step 3

The result is your debt-to-income ratio in percentage.

The lower your DTI, the less risky you are as a borrower.

Example:

If your monthly gross income is $7,000 and your monthly debt payment is $2,000; that pegs your debt-to-income ratio at approximately 29%.

| Sum of all debt payments | $2,000 |

| Divide by Monthly Gross Income | $7,000 |

| Multiply Result by 100% | 0.2857 x100% |

| Debt-to-Income Ratio | 29% |

Now you know how a debt-to-income ratio is calculated, lets look at how lenders factor this in when reviewing your loan application?

General Guidelines Used By Lenders To Review Home Loan Applications

A DTI of 35% or less: Looking Good.

Your debt is manageable in relation to your income. You have money left over for saving or spending after you’ve paid your bills.

A DTI of 36% to 49%: Room for improvement

You should lower your DTI to put yourself in a better position to deal with unexpected expenses. If you want to borrow money, keep in mind that lenders may require you to meet additional eligibility criteria.

A DTI of 50% or more: Take Action

With more than half of your income going toward debt payments, you may not have much left over to save, spend, or deal with unforeseen expenses.

Now that you have a general idea of how lenders evaluate your debt to income ratio, it’s time to consider how much you are able to borrow for a home.

How Much Can You Borrow for a Home?

Earlier we mentioned that the amount you can get for a home loan depends on your borrowing power.

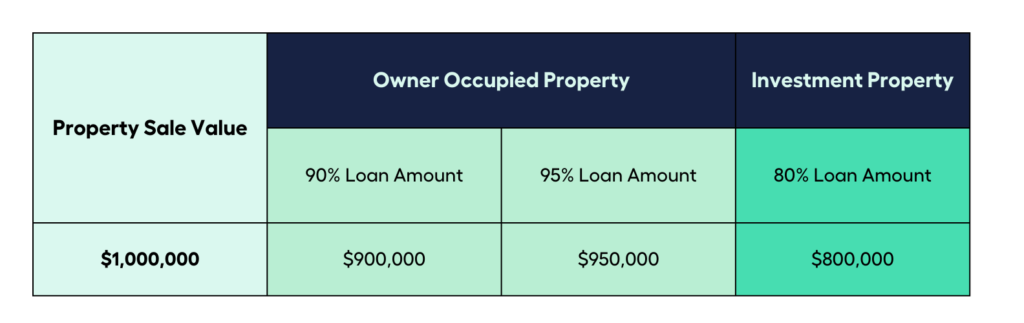

In addition, the home loan amount will also depend on your purpose for buying a house, which will determine the type of home loan you can access.

These are the Two Types of Home Loans:

1. Owner Occupied Home Loan

If you’re buying a home or apartment and you wish to reside in the property, lenders can loan you as much as 90% to 95%, or in rare cases 100% of the price of the property.

If you’re buying a house worth $1,000,000 you may be able to get loan amounts from $900,000 up to $950,000.

2. Investment Property Loan

If you’re buying a property that you won’t live in, but intend to lease to someone for rent income, lenders can loan you as much as 80% of the property price.

This means if you’re looking at an investment property worth $1,000,000 you may be able to get a loan amount only up to $800,000.

Interest rates on investment loans are slightly higher than owner occupied home loans. This is because investment property borrowers miss monthly repayments more than residential property owners, leading to more defaults in home loan repayments, making investment property loans a riskier prospect for lenders.

Indeed, you can borrow a significant amount of cash from lenders when you have a good financial standing. Which leads us to the amount of cash you need to shell out for a house deposit.

How Much Do You Need For a House Deposit?

Generally, home buyers will need 5% to 10% of the purchase price of the house as a deposit to get a home loan.

| Property Purchase Price | 5% Deposit | 10% Deposit |

| 500,000 | 25,000 | 50,000 |

| 750,000 | 37,500 | 75,000 |

| 1,000,000 | 50,000 | 100,000 |

Do note that additional funds will be required to cover applicable fees and charges, such as stamp duty and conveyancing, which typically amount to an additional 5% of the purchase price, along with bank fees and charges.

If you have information on the house you wish to purchase, try our online stamp duty calculator to get an estimate of how much additional costs may be required.

If you’re slightly low on cash and don’t have home equity, there might be certain benefits that are available to you, which can reduce your stamp duty and fees and charges, and help you pay slightly less cash.

1. First Home Owner Grant

The First Home Owner Grant (FHOG) is a national program funded by the states and territories and managed under their own laws.

The scheme provides a one-time grant of $10,000 to first-time home buyers who meet all of the eligibility criteria.

2. First Home Loan Deposit Scheme

The First Home Loan Deposit Scheme is aimed at assisting first-time home buyers in purchasing a home sooner by lowering the deposit required to secure an eligible home loan.

When approved for the scheme, the National Housing Finance and Investment Corporation (NHFIC) essentially acts as a guarantor on up to 15% of your deposit, which means you can buy with as little as a 5% deposit and avoid paying Lenders Mortgage Insurance (LMI).

The number of places available for the First Home Loan Deposit Scheme is subject to change each year.

3. First Home Super Saver Scheme

The First Home Super Saver Scheme allows you to save for a deposit on a home through your super fund while reducing your taxable income.

Eligible first-home buyers can use up to $15,000 in voluntary super contributions each fiscal year to help with the purchase of their first home.

It is advantageous because you may pay less tax than when you rely on savings from after-tax income to build up your deposit.

4. Family Home Guarantee

The Family Home Guarantee is a federal program that allows eligible single parent borrowers to purchase a home with a 2% deposit and avoid lenders mortgage insurance, whether they are first-time buyers or not.

The number of places available for the Family Home Guarantee is subject to change each year.

4. One-off Transfer Duty Concessions

One-off Transfer Duty Concessions are available to first-home buyers who didn’t qualify for any of the above mentioned grants. The one-off transfer duty concession allows you to pay a discounted amount of stamp duty on your purchase, potentially saving you thousands.

With all these schemes and grants available to you, it will be helpful to talk

to a Finance Expert who can help make your home buying journey stress-free.

Reach out to the My Money Sorted to simplify the process

of looking for a Finance Expert that’s right for your needs.

There are different home loan repayment schemes available too, such as principal and interest payments and interest only payments. You can learn more about these when considering a variable rate home loan.

But for now, let’s take a look at how lenders make a decision about your credit approval.

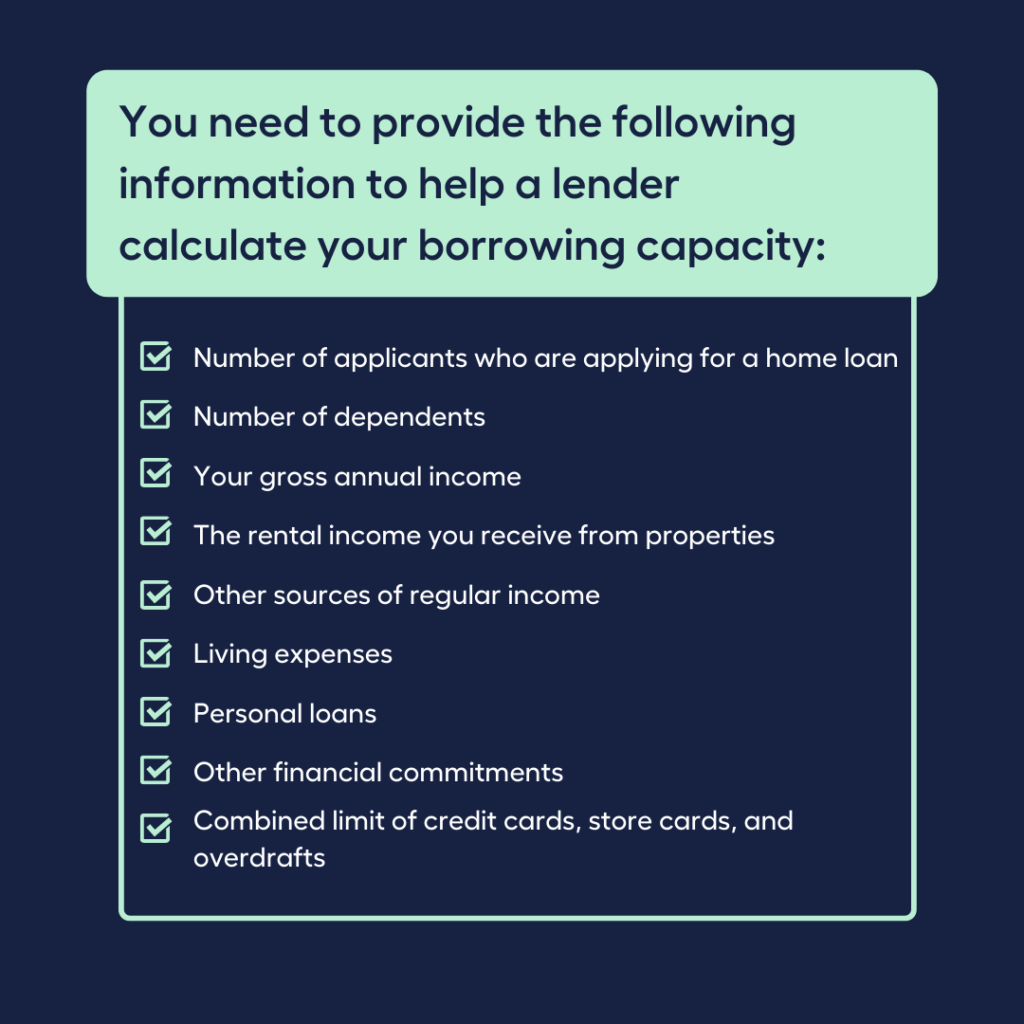

How is Borrowing Capacity Calculated?

When evaluating your home loan application, lenders compute your borrowing capacity using an evaluation rate.

Your borrowing capacity may differ from one lender to another because each lender has their own evaluation rate that is based on their risk appetite.

In addition to the assessment rate, a lender may take into account other elements, load your current debt with a buffer to reduce their lending risk, and take into account all of your incomes.

When determining your borrowing ability, your financial dependents are also taken into account.

With all the information needed by a lender, you can see that a high annual income doesn’t necessarily equate to higher borrowing power.

Is a Mortgage Based on Salary?

Although it’s important to have a consistent source of income when applying for a home loan, it’s not as simple as the more you earn, the more you could borrow.

A lender will have a lending criteria that considers variables that make up your personal financial circumstances. These variables are likely to have the same impact on how much you could borrow as your salary.

Check Your Borrowing Power with MMS Mortgage Calculator

Knowing your borrowing power is just the first step. A mortgage is a big investment of both time and money, which is why It’s often best to receive guidance from a financial expert like a mortgage broker.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by an experienced Mortgage Broker.

It’s that easy!

Get Ahead Of Your Home Loan by Speaking with My Money Sorted Today