You’ve always wanted to buy your dream home in a beautiful Australian suburb in Brisbane, Perth, Sydney, or Melbourne.

The property market offers many opportunities, but you need to secure a sufficient deposit to get started. This initial financial commitment can feel as daunting as a major obstacle.

Fortunately, there’s another way to get your dream home!

Homeownership can also be attained through the rent-to-buy scheme. Rather than buy property, which is the traditional process, you rent it first. What makes it even more enticing for some is the chance to purchase and own the same property in the future.

In this guide, we’ll learn more about the rent-to-buy scheme – a creative way to unlock the door to your dream home.

Jump straight to…

Can you rent to buy in Australia?

Rent-to-buy schemes, also known as rent-to-own homes, are essentially a real estate transaction that combines two components: a standard rental agreement with the option to purchase the property outright in the future.

Typically, prospective first home buyers often find themselves in a situation where they may not immediately be able to secure financing or a deposit for a home. A rent-to-buy agreement for property makes it feasible for them to own a home in Australia.

With a rent-to-buy arrangement, you can rent a property with the option to buy it when the lease expires for a pre-determined sale price. Normally, this rental period lasts from two up to five years.

A potential benefit of rent-to-buy schemes is that a portion of the rent paid can go towards building equity in the property. This means that over time, the tenant gets on the property ladder by accumulating an ownership stake in the home.

During this time, you (as a tenant home buyer) pay a market rent, just like in a regular rental agreement, plus additional payments on top of the rent payments. The additional rent payment is known as the option fee and can help you build equity in the home.

Later, you can obtain a mortgage from a bank and pay off the rent-to-own platform’s outstanding balance.

Within the rent-to-own contract, there is usually an agreed price at which you can buy the property at a future date. If the property’s value increases, you have the potential to capture capital gains when you eventually purchase it.

Is rent-to-buy illegal anywhere in Australia?

It’s important to be aware that different parts of Australia have different laws regarding rent-to-own schemes.

For instance, only the South Australian Housing Authority (SAHA) is legally permitted to provide rent-to-buy options in South Australia. Additionally, certain vendor finance plans and rent-to-buy contracts have been outlawed in Victoria.

As of now, rent-to-own schemes remain unrestricted in states and territories across Australia, except for South Australia and Victoria.

Thus, it is advisable that people are strongly advised to carefully evaluate the risks involved before entering a rent-to-own agreement and seek professional legal advice.

How does a rent-to-buy scheme work?

In a rent-to-buy transaction, the seller and the buyer sign a rental agreement with a higher rent rate. When the lease expires, the home buyer can exercise their “option to buy” if they secure the financing to cover the remaining balance of the agreed purchase price and have complied with the terms of the contract.

Here’s a step-by-step guide to purchasing a home through a rent-to-own scheme:

- You choose the home you desire, and the rent-to-own company you have engaged purchases it.

- You then pay the rent-to-own company a nominal deposit or starter fee, which is typically about 1-3% of the property’s value. Depending on the company, this deposit may or may not be applied to your home equity.

- For the first few years that you live in the property, you pay a fixed, above-market rent to the rent-to-own firm. Rent is frequently greater than market pricing as you will typically pay an ‘option to buy’ fee which is a percentage of the property’s purchase price. When you start the process, the purchase price you’ll eventually pay for the home is locked in. While the price is fixed, it can be subject to annual percentage hikes.

- You can choose to buy the house after a few years of renting and before the rental period expires. The equity you’ve built up through the deposit and rental payments essentially serves as a deposit on a typical loan.

- If you do not want to buy the property, you can sell it. If the value of your home rises, you may be able to recuperate part of your investment. However, if the property’s value has dropped, you may receive nothing.

Financial Considerations

Aside from the rental payments and starter fee, most contracts generally require an aspiring homeowner to pay for costs such as repairs and maintenance, council rates, strata fees, property taxes, and insurance.

Risk for Buyers

The scheme may represent a high-risk arrangement for buyers since their name becomes registered on the property’s title only once they’ve fully bought the property. In some rent-to-buy agreements, it’s mentioned that the buyer could forfeit all payments made and won’t have any ownership claim on the property if even a single payment is not made on schedule.

Property Price

Although the real estate market generally experiences long-term value growth, short-term prospects may not be as positive. Property values, much like any market, are influenced by supply and demand, leading to fluctuations in both directions.

Property Finance

You must still undergo a finance approval process. Securing finance approval remains a significant challenge for potential buyers, including those engaged in rent-to-buy programs. Ensure that you present yourself in the most favorable way to enhance your chances of approval. If uncertain, consulting with a mortgage broker can be beneficial to ensure all necessary preparations are in place for your application.

It’s crucial for anyone considering a rent-to-buy scheme to conduct due diligence. Seek independent legal advice to fully understand the terms and conditions outlined in the lease purchase agreement, including any hidden fees in the fine print.

Do you need a deposit for the right to buy scheme?

There is a nominal deposit for the rent to buy scheme. However, it is much lower than the 20% home loan deposit that banks and lenders normally require.

Advantages & Disadvantages of Rent-to-Buy

If you’re looking for a way to become a homeowner, the rent-to-buy scheme might be for you. However, there are pros and cons to consider.

In order to make an informed choice, prospective homeowners must carefully consider these advantages and disadvantages before entering into a rent-to-buy agreement.

What are the advantages of rent-to-buy?

![The Significant Benefits of Rent-to-Buy]](https://mymoneysorted.com.au/wp-content/uploads/2023/11/BLOG-Rent-to-buy-1-1024x576.png)

Fixed Purchase Price

The ongoing increase in real estate prices poses a significant obstacle to saving for a deposit while renting. This may increase the amount of time it takes to raise the required funds. However, the purchase price is predetermined with a rent-to-own home.

As a result, potential buyers can budget for and save money for the required deposit as well as set up financing with a lender. The home buying process is more transparent and predictable when the purchase price is predetermined.

Trial Before Purchase

The ability for prospective buyers to experience a property as renters before deciding to buy it is another appealing feature of rent-to-own agreements. They can then determine whether the house would be a good fit for them as their future residence.

Finding out after only a few weeks of ownership that a property falls short of your expectations can be depressing. With rent-to-buy, you can make sure the property fits your needs before committing to a long-term arrangement, helping you to avoid this situation.

Exiting Agreement Flexibility

Rent-to-buy agreements frequently provide flexibility, depending on the specific terms of your contract. You might be able to work out a way to end the contract without being obligated to buy the property if you discover that the property isn’t what you expected or if your circumstances change. This flexibility can offer comfort and lower the risk involved with conventional real estate purchases.

Rent Contributions Towards Principal Balance

In some rent-to-buy agreements, tenants have the opportunity to start paying down the primary balance of the property. This feature is highly advantageous, as it’s a key goal for any mortgage holder.

As the primary balance decreases, it improves your financial situation significantly. It also lowers your Loan-to-Value Ratio (LVR), resulting in reduced overall payments over the life of the loan. This means you’ll save money in the long run and build equity in the property more quickly.

No Obligation to Purchase

Rent-to-Buy schemes give the tenant the option but not the obligation to purchase the property when the lease expires. This provides flexibility for those who may still be uncertain about their long-term housing needs.

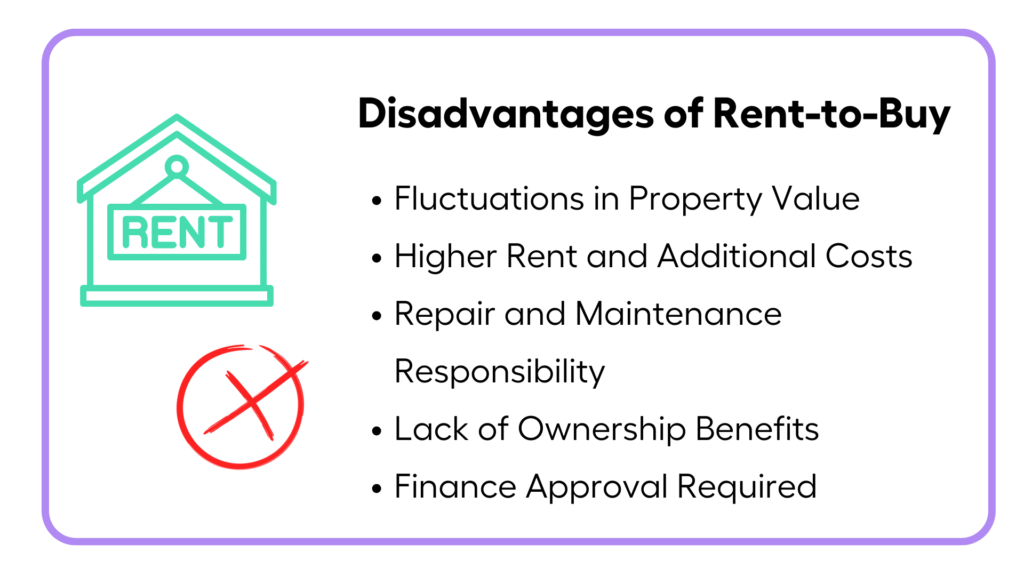

What are the disadvantages of rent-to-buy?

Fluctuations in Property Value

Even if you’ve locked in a purchase price, it’s still possible for the property’s value to drop. Property values may fluctuate in the short term depending on supply and demand, which may not correspond to long-term market trends.

Higher Rent and Additional Costs

Rent-to-own plans frequently have higher rental prices compared to the typical prices. They frequently include fees for the option to purchase, which typically range from 1-5% of the purchase price.

While the rent-to-own process can provide a path to homeownership for those with bad credit or financial challenges, it’s essential to be aware of any additional costs such as building maintenance responsibilities.

Repair and Maintenance Responsibility

As a tenant in a rent-to-buy situation, you may be responsible for paying the costs of repairs and maintenance on the property depending on your specific agreement. To prevent unforeseen costs, it’s crucial to comprehend your agreement in its entirety.

Lack of Ownership Benefits

Rent-to-buy tenants are not listed on the property’s title. This indicates that they are not entitled to the same legal protections and advantages as property owners, such as more equity access.

Renters may face eviction if they are unable to pay their rent, but property owners have the option of using their equity in such a situation.

Finance Approval Required

People participating in rent-to-buy schemes need to obtain financing approval, just like conventional home buyers. To improve your chances of being approved, it is essential to present a solid financial profile.

Furthermore, it’s critical to comprehend the ramifications of a finance denial, especially if you’ve paid higher fees or rent in order to have the option to purchase. Understanding what happens to these payments in such circumstances is crucial.

What is the help-to-buy scheme?

Additionally, the Australian government will implement the help to buy scheme in 2024.

The right to buy scheme assists qualified candidates in entering the housing market. In accordance with this scheme, the government lends either 30% or 40% of the purchase price for established properties or new builds. As a result, the bank loan is effectively reduced to 60% or 70% of the total purchase price.

The significant benefit of the help-to-buy schemes is that they enable individuals to take steps towards homeownership despite credit rating issues. They provide an alternative to traditional deposit home loans.

This reduced loan aims to make it easier for people to secure a home loan, often faster than they would without government assistance. With a smaller bank loan, monthly home loan repayments are lower.

Additionally, the requirement for a deposit is only 2% of the total home purchase price, which can make a significant difference, potentially saving applicants tens of thousands of dollars, from $20,000 to $200,000.

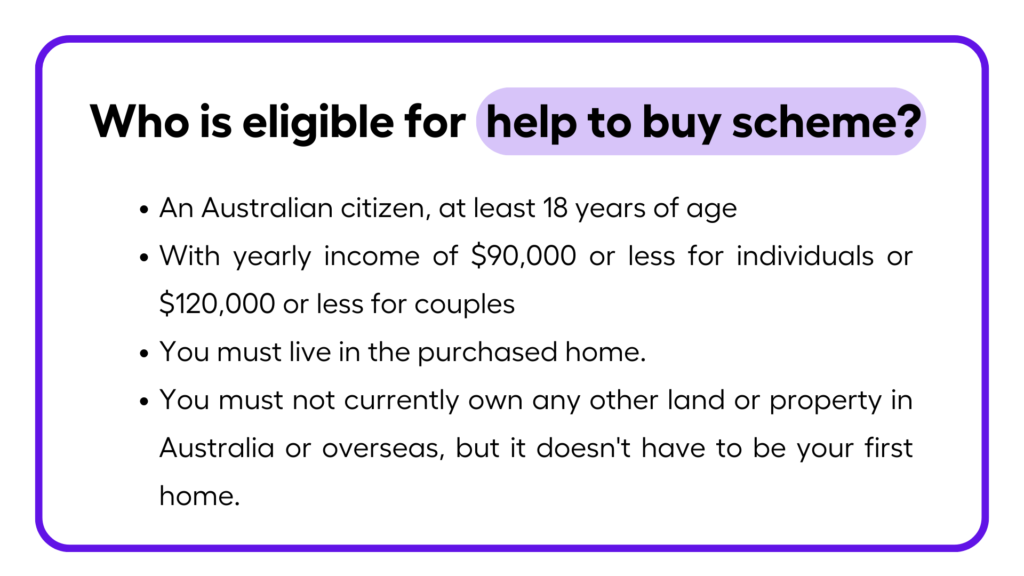

Who is eligible for the help to buy scheme?

The Help to Buy scheme has specific requirements for participation. First off, there are only 10,000 applicants allowed per year for a total of four years. These locations are dispersed throughout various areas rather than being all gathered in one place.

The eligibility varies by location in terms of the cost of the property. Homes in Sydney and other significant regional centres in New South Wales, for instance, must be under $950,000 in value to qualify. The maximum allowed property price in the remaining portion of New South Wales is $750,000.

The scheme is available to people with incomes up to $90,000 and couples with combined incomes up to $120,000. It’s important to note that previous home ownership does not disqualify you from the scheme because people can return to the rental market due to changes in their personal circumstances. You cannot, however, apply for this scheme and be the owner of another property at the same time.

Candidates must demonstrate their ability to obtain financing for the remaining balance of the home’s purchase price and offer a deposit of at least 2%. They must also pay for related expenses like utilities, body corporate fees, rates, and stamp duty. It’s significant to note that participants are not required to pay rent on the government’s equity stake in the property.

Check Your Borrowing Power with MMS Mortgage Calculator

Don’t let the barriers of homeownership hold you back. Explore rent-to-buy schemes and assess your borrowing power with MMS Mortgage Calculator today. Your path to owning your dream home in Australia may be closer than you think.

Learn More About Property Investment with My Money Sorted!

Our team works hard to provide a variety of resources to help you build the financial future you deserve:

✓ Our Property Wealth Investment Plan is perfect for would-be property investors!

✓ Our Australian Property Show Podcast is FREE to listen to and shares a wealth of knowledge every episode!

✓ Sign up to our Newsletter to receive FREE resources, tips and finance updates direct to your inbox each month!

My Money Sorted is your stress-free pathway to getting ahead sooner – if you’re unsure of what you need you can book a FREE call to find out more.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a financial advisor or broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense.

It’s that easy!

Get Your Money Sorted Today by Speaking with a My Money Sorted Team Member