Property investment is a popular avenue to increase wealth and provide financial security. It may be intimidating for new property investors to navigate the industry, but with the right investment strategy, you can make wise choices that lead you towards success.

In the next sections, we’ll examine the core ideas behind property investment and deliver insightful tips for individuals just starting out in the business.

Understanding the essential concepts will provide you with the knowledge necessary to be a successful property investor, whether you’re looking to purchase your first investment property or fine-tune your current investment strategy.

Jump straight to…

Everything You Need to Know to Start Investing in Property

Making the appropriate investment property choice is essential. Location, type, condition, and prospective rental income are important considerations. It is wise to concentrate on real estate in places with strong infrastructure, population growth, and restricted supply that has the potential for capital gain.

It is essential to carry out extensive study before investing in property. Understand different types of properties, become familiar with the real estate market, and keep up with current market trends. With this information, you’ll be better equipped to pick the investment strategy that best suits your objectives.

Consider that investing in property is a long-term commitment. In the world of property investment, patience is a virtue, and a well-thought-out investment strategy may help you deal with market volatility.

Is property investment worth it in Australia?

For first-time property investors, the Australian real estate market’s next cycle will bring both opportunities and challenges for first-time property investors.

After a challenging year, the Australian real estate market is beginning to recover. The positive outlook for real estate investments is expected to help the market gain momentum.

According to CoreLogic’s Home Value Index, Australian real estate prices have largely recovered, increasing by an average of 0.8% in September 2023.

House prices in major cities are expected to rise by 3-7% or possibly more over the course of the year, suggesting the possibility of capital growth and profits for real estate investors.

For those thinking about investing in real estate, this trend and the possible likelihood of interest rate reductions by the Reserve Bank of Australia point to a positive future.

However, it is important to note that these are only projections and that the Australian real estate market may behave differently from time to time. The market may be impacted by variables, such as interest rates, the direction of the global economy, governmental policies and regional factors.

Best Types of Investment Property for Beginners

Understanding the different property investment types and your investment strategy is essential whether you are a first-time property investor in real estate or an experienced investor seeking to expand your portfolio.

Residential real estate properties, which include houses, apartments, and townhouses, are the most popular choice for first-time buyers in Australia. These homes typically provide steady rental income, which attracts novice property investors.

Their potential for long-term capital growth is what makes them so alluring because it has the power to gradually increase your investment portfolio. To maximise returns, you must carefully choose the area and the type of property.

Houses represent an excellent choice for beginners aiming for long-term growth. They often have higher land value, allowing for renovation or subdivision opportunities to enhance their worth. However, it’s crucial to assess the location carefully and consider factors like proximity to essential amenities and schools, as these can significantly impact rental income and capital growth potential.

Apartments, units or flats are a practical option for novice investors due to potentially lower maintenance costs compared to houses but can also attract expenses such as strata fees or special levies. They typically provide steady rental income and are often located in high-demand areas. When investing in apartments, focus on factors such as building amenities, proximity to public transport, shopping centres, and employment hubs to ensure reliable rental income.

Commercial properties present an enticing opportunity for those seeking higher rental yields. This category includes office buildings, retail spaces, and warehouses. While they may yield greater returns, they also come with increased risks, such as longer vacancies and more extensive maintenance requirements. Beginners should exercise caution and conduct thorough research before venturing into the commercial property market.

Industrial properties, comprising factories, warehouses, and distribution centres, offer a combination of high rental yields and potential long-term capital growth. These properties typically require substantial upfront investments but can generate substantial income in return. It’s advisable for beginners to seek expert guidance when considering industrial properties due to their unique challenges and complexities.

What type of property is most profitable?

It’s necessary for property investors to concentrate on numerous important elements when determining what kind of property is most profitable for real estate investment.

In 2023, units are a highly lucrative business. Compared to houses, units can often offer a larger rental income, which means they produce more rental income in relation to their purchase price. Additionally, units are often simpler to maintain and operate, saving investors time and money.

However, it’s crucial to recognise that a number of factors might affect how profitable an investment property is. These variables include the location of the property, its state, and the current state of the rental market.

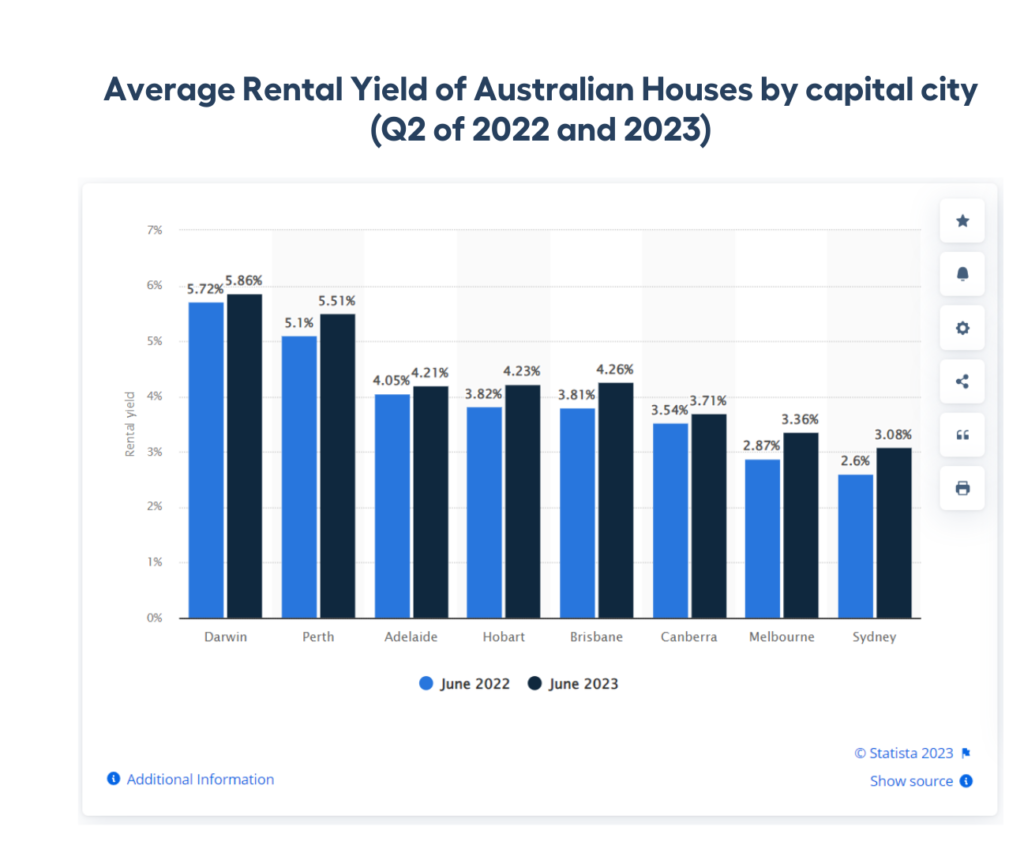

What is the average return on property investment in Australia?

When it comes to property investment in Australia, beginners often wonder about the average return on investment. Based on the ASX report in partnership with Russell Investments, historical data indicates an average return of 6.8% over the past century. However, it’s crucial to understand that this figure represents a historical average and shouldn’t be solely relied upon for future investment decisions.

To make informed investment choices, conducting thorough research and considering all relevant factors is crucial. Seeking guidance from a qualified financial advisor and a property specialist is highly recommended, as they can assess your specific situation and tailor an investment strategy that aligns with your goals and the ever-evolving property landscape. Remember that property investment can be a rewarding long-term venture, but careful planning and professional advice from property specialists are essential for success.

Property Investment Strategies

For first-time property investors, understanding effective property investment strategies is crucial. Property investment involves purchasing property with the intention of generating rental income and achieving capital growth. These investment properties can be a source of reliable rental income, offering the potential for long-term capital gains.

However, it’s essential to be aware of various factors, including property management, ongoing costs, and tax implications. To create a successful property investment strategy, it’s necessary to consider the property’s market value, rental yield, and the potential for capital gains.

Capital Growth Strategy

One of the keys that can significantly impact your success as a beginner is understanding the concept of capital growth. This aspect of property investment focuses on strategies aimed at increasing the value of your investment property over time.

To put it simply, the goal here is to see your property’s worth grow steadily, potentially leading to substantial capital gains in the future. Achieving this growth involves a range of tactics, including making smart property improvements, having a long-term investment horizon, and selecting properties in areas with promising growth prospects.

Rental Yield and Income

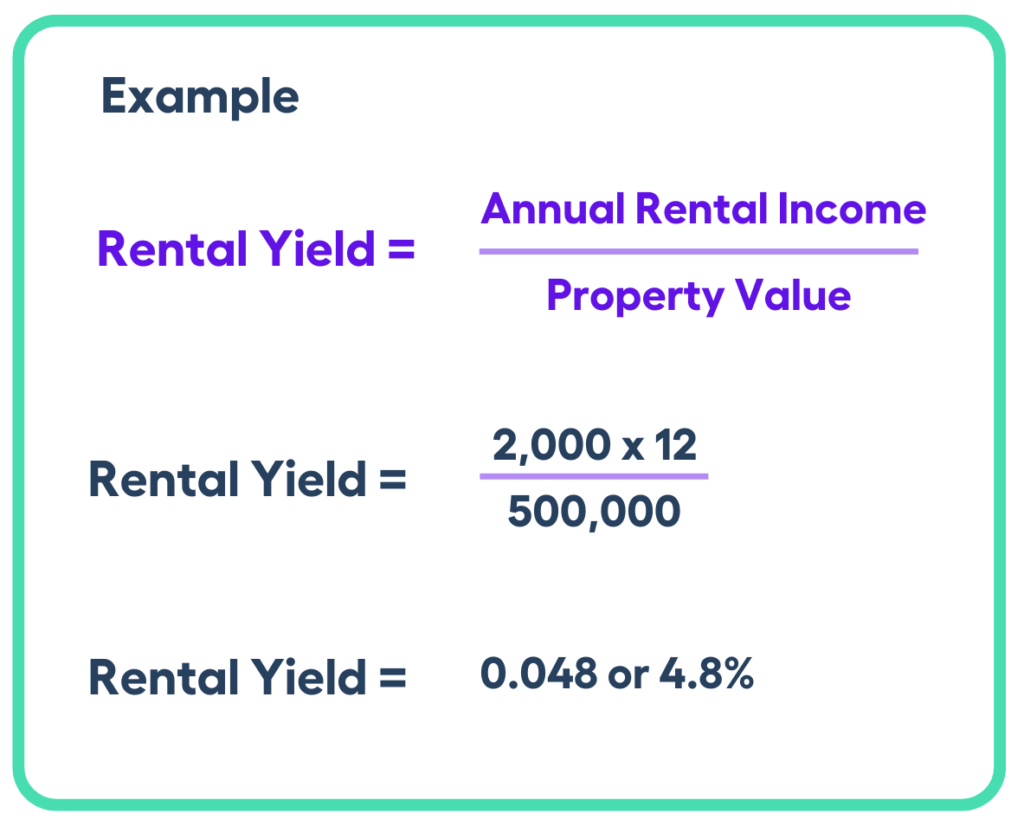

Rental yield is a percentage that shows how much money a property can make from renting it out. Rental yield is calculated by dividing the property’s annual rental income by its value or purchase price, expressed as a percentage.

Suppose you purchased a property for $500,000 and rented it out for $2,000 per month. The rental yield would be calculated as follows:

This indicates that you may anticipate a 4.8% yearly return on your investment.

In general, rental yield helps property investors see how much they might earn, but other factors like property value growth and location should also be considered for smart investment decisions.

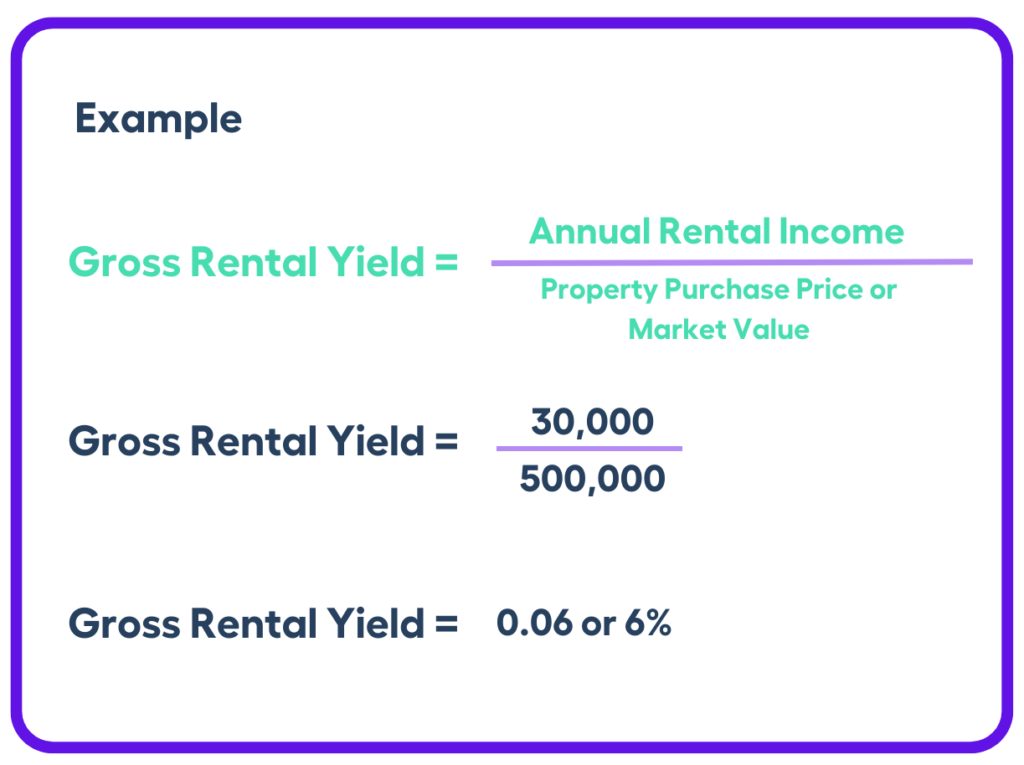

Gross Rental Yield

Gross rental yield is a percentage that represents the annual rental income generated by a property relative to its purchase price or market value. It provides insight into how effectively your investment property is performing in terms of rental income. It also allows you to compare different investment properties to determine which one might be more financially promising. Properties with higher yields may be more attractive.

Let’s say you’re considering purchasing your first investment property. The property’s purchase price is $500,000, and you anticipate an annual rental income of $30,000 from tenants.

In this example, the gross rental yield for the property is 6%. This means that, based on the current market value or purchase price, you can expect a 6% return on your investment in the form of rental income annually.

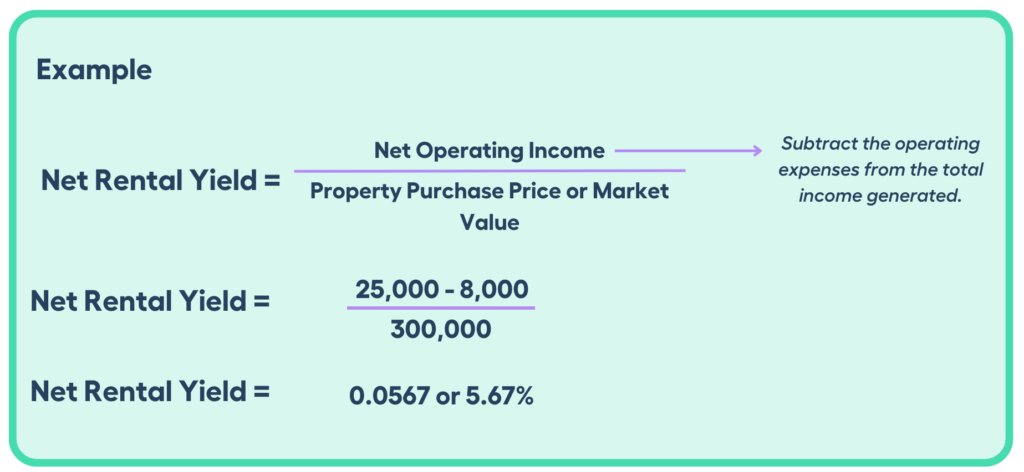

Net Rental Yield

Net rental yield helps assess the profitability of an investment property. It tells you how much money you can expect to make from your property after deducting various costs like property management, maintenance, insurance, and property taxes.

Let’s say you have an investment property with an annual rental income of $25,000 and operating expenses of $8,000. If the property’s market value is $300,000, you can calculate the net rental yield as follows:

In this example, the net rental yield is 5.67%. This means that, after accounting for all operating costs, you can expect a 5.67% return on your investment property.

Tax Benefit Strategies

Understanding tax benefit strategies is crucial for property investors. These approaches cover a variety of methods and factors that can help you get the most out of your rental property. You may maximise your rental income, reduce taxable income, and eventually create a profitable property investment portfolio by negotiating the complexities of capital gains tax, negative gearing, tax deductions, and other tax implications.

We will thoroughly examine various tax advantage options, giving you important information to help you make wise choices as you begin your property investment journey.

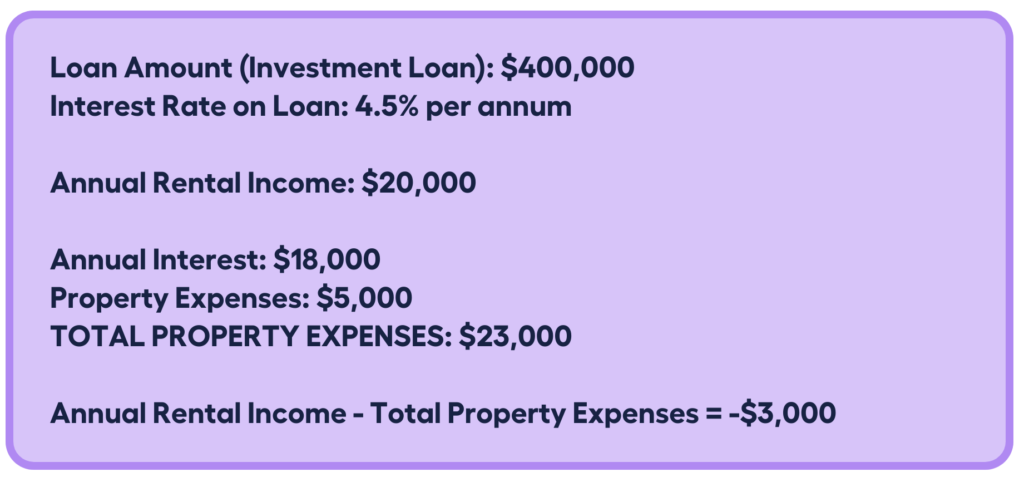

Negative Gearing

Negative gearing is a strategy used by property investors where the rental income generated from an investment property is less than the expenses associated with owning and maintaining that property.

The difference between the rental income and the expenses is referred to as a “negative cash flow.” Investors often use negative gearing to offset their taxable income and potentially reduce their overall tax liability.

Imagine you purchased an ideal investment property with a home loan of $400,000. You secure an investment loan with an interest rate of 4.5% per annum. In this scenario, your annual rental income is $20,000.

However, your total annual property expenses amount to $23,000—with an interest loan of $18,000 and annual property management fees, maintenance, and other costs, totalling $5,000. This results in a negative cash flow of $5,000 ($18,000 – $23,000).

The negative cash flow of $3,000 can be used to reduce your taxable income. As a property investor, you can claim tax deductions for the expenses associated with your investment property, including the interest on your loan, maintenance costs, property management fees, and more. These deductions can help lower your taxable income, which may result in a reduction in the amount of tax you need to pay.

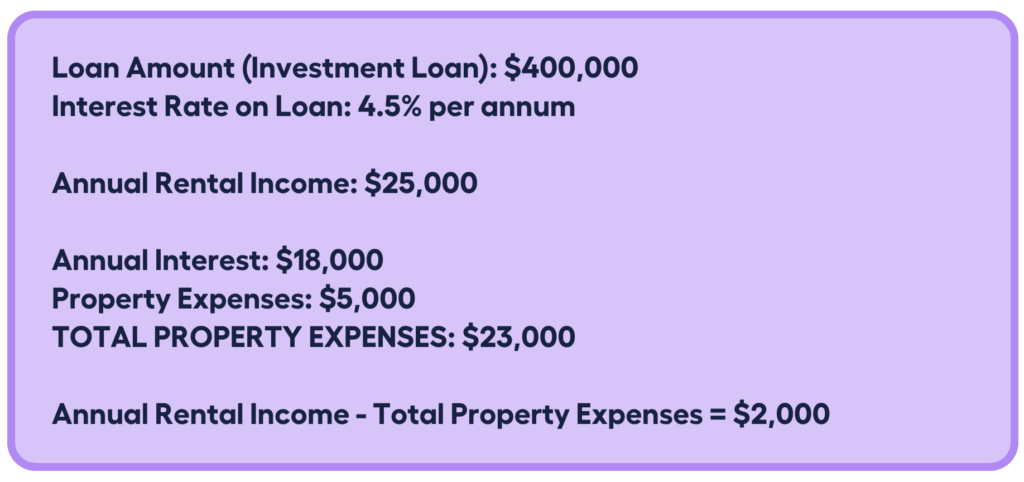

Positive Gearing

Buying properties can include an alternative financial approach called positive gearing. It involves taking out a loan to buy an asset that generates income, such as a rental property. The primary characteristic of positive gearing is that the rental revenue from the property exceeds all expenses related to owning and maintaining the investment. These expenses include loan interest, repairs, upkeep, management fees, inspection fees, and other ongoing charges.

Positive gearing is based on two main principles. First and foremost, the investor wants to profit right away from the total rental income. Second, the long-term goal is to sell the property for more money, taking advantage of its rising market value and making a profit.

Let’s illustrate positive gearing using the same scenario as above. But this time, your property attracts an expected rental income of $25,000 per year, while the annual expenses, including loan repayments, property management fees, maintenance, and other costs, total $23,000. With positive gearing, your net income from the investment would be calculated as follows:

In this scenario, your investment property generates a positive cash flow of $2,000 per year. This means you are making a profit from your property investment from day one, as the rental income exceeds all associated costs.

Capital Gains Tax

Capital Gains Tax (CGT) is a significant consideration for property investors. It’s a tax imposed on the profit generated from selling assets, including investment properties, shares, or managed funds. Understanding capital gains tax is vital for beginners in property investment, as it can significantly impact your financial outcomes.

Here is an illustration of how the Australian capital gains tax functions. Let’s say you spent $500,000 on a rental property in 2010 and sold it for $800,000 in 2023. The property’s capital gain is $300,000 ($800,000 – $500,000).

Any costs associated with purchasing, holding, and selling the property, such as legal fees, real estate agency commissions, and advertising charges, can be deducted from your capital gain. Let’s say you spent $20,000 on costs. Then, $280,000 is the net capital gain ($300,000 – $20,000).

If you owned the property for more than 12 months, you are eligible for a 50% capital gains tax discount. Therefore, the taxable capital gain is $140,000 ($280,000 x 50%). Suppose your marginal tax rate is 37%, so you will pay $51,800 in capital gains tax ($140,000 x 37%).

The actual computation can be more complicated based on the unique conditions of the asset and the taxpayer, therefore it is recommended to consult a taxation professional before making any choices related to capital gains tax.

To gain a better understanding of capital gains tax and learn how to calculate it, check out this useful resource.

Tax Deductions for Investment Properties

Property investing can be profitable, but it also comes with a lot of financial responsibility. One area that savvy investors should be familiar with is tax deductions. By taking advantage of these deductions, you can significantly reduce your tax bill and boost your investment profits.

Loan Interest and Fees

When it comes to financing your investment property, the interest paid on the loan used for purchasing or maintaining the property is a deductible expense. This includes not only the loan interest but also loan establishment fees, mortgage broker fees, and refinancing costs. It’s essential to keep detailed records of these expenses, as they can substantially impact your overall tax position.

Council Rates and Land Tax

Council rates and land tax are another set of deductions that property investors can claim. However, it’s important to note that these levies can vary significantly between states, and the timing of when you can claim the cost also varies. Make sure to check the specific rules and rates applicable to your location.

Depreciation

Property depreciation can be a significant source of tax deductions for investors. There are two main types of depreciation deductions to consider: capital works deduction and plant and equipment deduction.

Capital works deduction covers the depreciation of the building structure itself. It’s essential to obtain a depreciation schedule from a qualified quantity surveyor to maximise this deduction.

Plant and equipment deduction pertains to the depreciation of assets within the property, such as fixtures and fittings (e.g., carpets, cupboards, air conditioning, and ovens). Keep in mind that the eligibility of these deductions may vary depending on the date of the property purchase.

Repairs and Maintenance

Expenses incurred for repairs and maintenance of your investment property are also deductible. These could include plumbing repairs, electrical work, or any other maintenance costs required to keep the property in a rentable condition. Keeping thorough records of these expenses is crucial for tax purposes.

Advertising Costs

Finding suitable tenants for your investment property often involves advertising expenses. Fortunately, these costs can be claimed as deductions, reducing your taxable income. Be sure to keep receipts and records of your advertising expenditures.

When it comes to claiming deductions for your investment property, there are a few key considerations to keep in mind. First and foremost, deductions can only be claimed for periods when your property was either rented out or available for rent. If there were times when your property was not available for rent, you may not be eligible to claim certain expenses for those periods.

Additionally, it’s important to remember that you can only claim the portion of an expense that directly relates to the business use of your investment property. This means you must be able to demonstrate that the expenses you’re claiming are directly connected to your property investment activities.

Lastly, maintaining meticulous records is critical when it comes to tax deductions. It’s essential to keep all your receipts, invoices, and documentation to substantiate your claims, especially in case of an audit. You may check out these tax-smart tips to help you accurately report your deductions and ensure compliance with tax regulations.

Managing an Investment Property

The right management is key to enjoying the benefits of investing in property. Managing an investment property demands careful preparation and smart decision-making.

Here are some valuable tips and steps to help you navigate the dynamic landscape of property investment.

Recalibrate Your Investment Strategy

Start by carefully examining your investing plan and checking out other investments. It’s essential to regularly evaluate and modify your approach to fit your investment objectives and the current conditions of the market. Numerous variables, such as interest rates, market trends, and shifts in property prices, can have an impact. Success requires flexibility.

Evaluate Properties Diligently

A comprehensive analysis is essential when considering new investing opportunities. Consider aspects including the location of the property, local economic development, demand for rental properties, property valuations, vacancy rates, and possible hazards and benefits. You may make wise financial selections that withstand the test of time by conducting a thorough study.

Engage with Experts

Professionals with specialised knowledge can help you understand the local market. Buyer’s agents, real estate agents, and property managers with experience in your target area can provide valuable insights and property investment advice. Their expertise can help you make well-informed decisions and navigate any challenges that may arise.

Prioritise Preventive Maintenance

Regular maintenance is a preventative measure that can help you avoid costly future repairs. Plan regular property inspections and take prompt action to resolve any problems. This not only keeps your property in top shape but also makes it more appealing to potential tenants.

Decide on Property Management

Take into account whether you want to manage the property yourself or hire a property management company. If you choose self-management, be ready to take on tasks like tenant vetting, rent collection, and property upkeep. Instead, employing a property management company can reduce your workload and time dedicated to managing the property.

Emphasise Capital Growth

Focusing on capital growth when investing in property can be a smart move. This includes searching for homes in regions with significant room for economic expansion and a high probability of sustained appreciation. Such investments can be valuable assets in your portfolio because they typically offer better returns over time.

Efficiently Manage Ongoing Costs for Renting Out a Property

Regular expenses associated with managing an investment property include interest rates, legal fees, management costs, and landlord insurance. Here are some of the ongoing costs involved in renting out a property.

Investigate ways to cut these ongoing costs without sacrificing the level of service. You can more effectively manage your rental property and make sure it stays profitable by taking these recurring expenses into account. For instance, renegotiating your loan to get a lower interest rate can result in significant long-term savings.

Check the deductions you are eligible to make in the tax year that your rental property expenses are incurred.

How to invest in real estate in Australia with little money?

There are several ways to invest in Australian real estate on a tight budget. Here are some strategies for making low-cost real estate investments.

REITs (Real Estate Investment Trusts)

In REITs, numerous investors pool their funds, and a fund manager then buys and sells real estate. Dividends are how the REIT company distributes its earnings to its investors.

Real Estate ETFs

Due to their high level of diversification, holdings of a variety of stocks, and low cost, ETFs could sometimes be regarded as lower-risk investments.

The indexes of publicly traded property owners are followed by REIT ETFs, which are passively managed. Many property investors can easily access the larger real estate market by tracking indexes without putting their money at higher risk with a single business.

Real Estate Managed Funds

Real estate managed funds invest primarily in REITs and property operating businesses using investment portfolio managers and professional research.

With a little capital, you can use them to get diversified exposure to real estate. The unit or share price is impacted by the asset value in which the fund invests.

Additional Tips for Fledgling Property Investors

In order to succeed in the Australian real estate market, you must adopt a multifaceted strategy. First and foremost, it’s crucial to keep meticulous records of all of your expenses, including everything from rent and mortgage payments to utility bills and maintenance fees. This level of detail not only helps with cash flow management but also maximises tax deductions, which lessens the financial burden.

Second, the state of one’s finances is crucial. Before starting a real estate investment venture, personal debt reduction is usually a priority. In addition to improving creditworthiness, reducing personal debt also increases borrowing capacity, making it simpler to obtain financing and pursue bigger investment opportunities.

Finally, it’s important to keep up with the most recent changes, laws, and market trends. To succeed over the long term in the real estate market, networking with other investors can be a valuable source of information.

Learn More About Property Investment with My Money Sorted!

Our team works hard to provide a variety of resources to help you build the financial future you deserve:

✓ Our Property Wealth Investment Plan is perfect for would-be property investors! [link: https://mymoneysorted.com.au/masterclass/]

✓ Our Australian Property Show Podcast is FREE to listen to and share a wealth of knowledge every episode! [link: https://podcasters.spotify.com/pod/show/tom-haigh]

✓ Sign up to our Newsletter to receive FREE resources, tips and finance updates direct to your inbox each month! [link: https://mymoneysorted.com.au/newsletter-sign-up/]

My Money Sorted is your stress-free pathway to getting ahead sooner – if you’re unsure of what you need you can book a FREE call to find out more.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a financial advisor or broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense.

It’s that easy!

Get Your Money Sorted Today by Speaking with a My Money Sorted Team Member