Have you ever found yourself flicking through channels and streaming videos, and declaring

“There’s nothing to watch!”

Isn’t it amazing that even with all the shows available out there, we sometimes can’t find anything to watch?

And as decision fatigue starts to set in and you find yourself settling for whatever is randomly recommended or popular.

Imagine that happening with your home loan:

With hundreds of lenders and home loan deals to review and shortlist, the same decision fatigue starts to set in.

Jump straight to…

Only this time, we’re talking about a long term debt here that amounts to hundreds of thousands of dollars. Something so costly it should not be left to random selection.

Good thing this needn’t be the case, because there’s an option available to help you avoid this situation:

Which is to engage the services of a mortgage broker.

Read on and find out for yourself if mortgage brokers are worth it.

What Does a Mortgage Broker Do?

A mortgage broker is a person or organisation that acts as a go between home buyers and lenders, helping borrowers obtain home loans and helping lending institutions to attract clients.

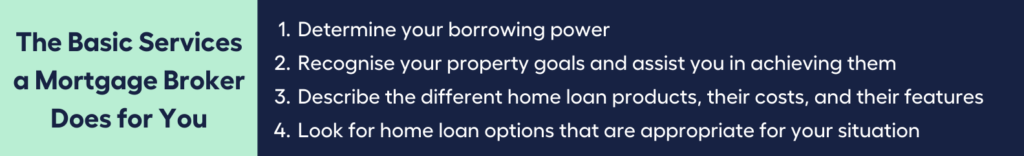

Let’s have a quick rundown of the basic services a mortgage broker does for you.

Determine Your Borrowing Power

Determining your borrowing power is simply put, knowing how much money you can afford to borrow.

Borrowing power is determined by your financial situation, and having a higher borrowing power indicates that you have a greater ability to pay back a larger home loan.

Factors that influence borrowing power:

- Earnings

- Daily living expenses

- Existing debts

- Loan type

- Dependents

- Assets

- Your current employment situation

Use our free borrowing power calculator to see how much you may be able to borrow.

Recognise Your Property Goals and Assist You in Achieving Them

A mortgage broker’s task is to clarify your property goals and help you achieve them.

- Do you have a clear property goal?

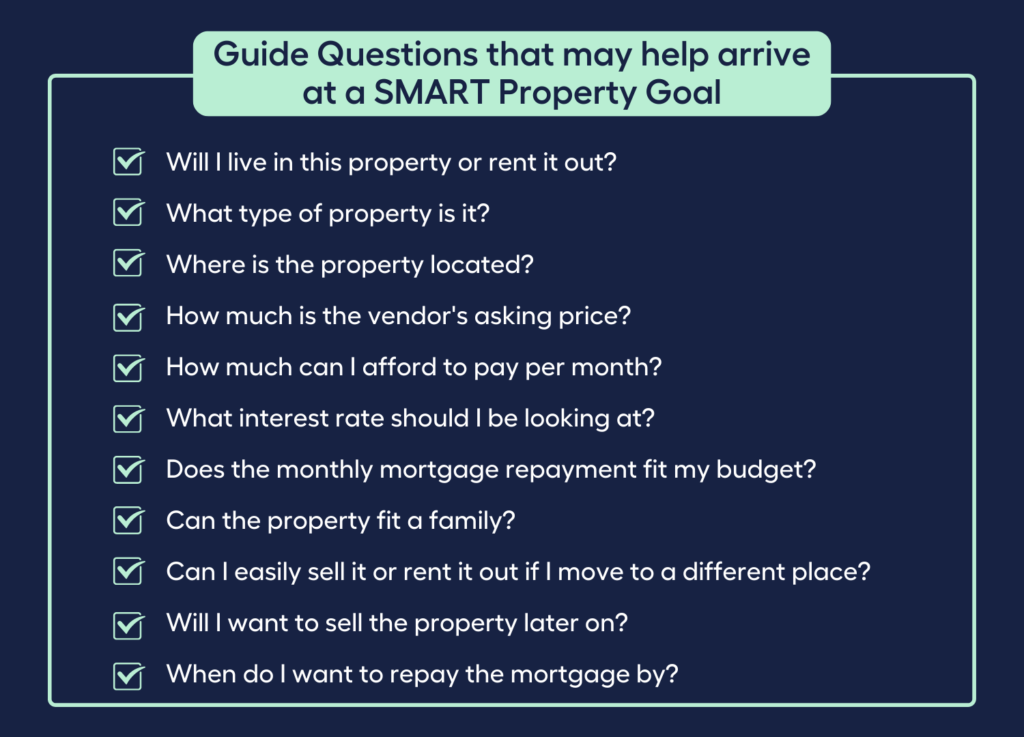

One way to clarify your property goal is to set SMART goals. SMART stands for Specific, Measurable, Attainable, Relevant, and Time-Bound.

Here’s how it can be applied in your search for a property:

Specific: Identify the property, its location, and the vendor’s asking price.

Measurable: Calculate the amount you would need to pay in mortgage repayments per month.

Attainable: Factor in the monthly repayment to see if it fits your budget.

Relevant: Determine whether the property will still suit you if your circumstances change – ie. if you get married, have kids, or choose to step back from work.

Time-Bound: Determine how long you will hold on to the property.

Describe the Different Home Loan Products

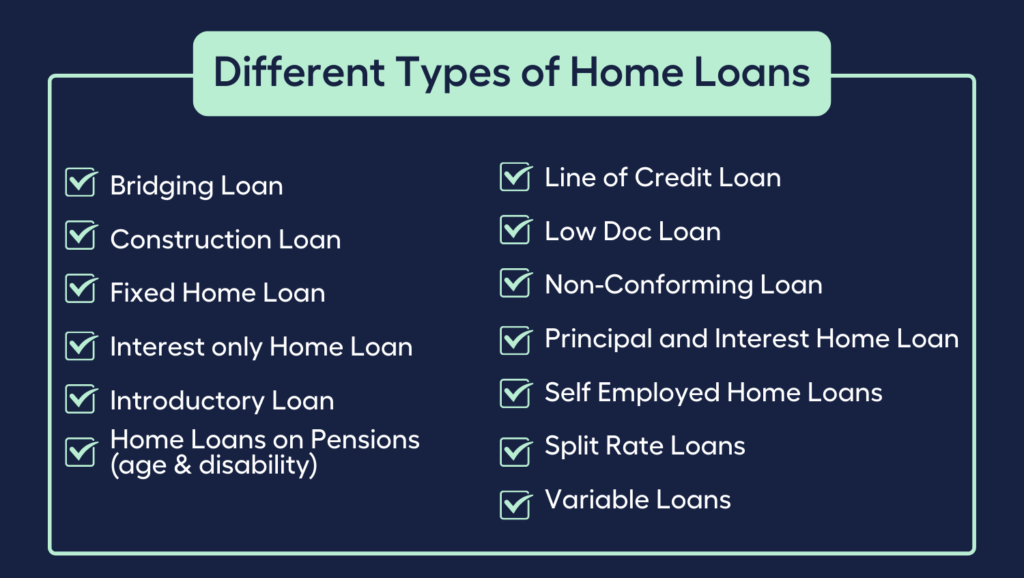

There are many different home loan products to choose from, and each of them can be suitable for different borrowers.

Different Types of Home Loans

- Bridging Loan: If you’re buying a new property while still selling your old one, consider a bridging loan. A bridging loan gives you up to 6 months to sell your current home, helping you transition to your new one.

- Construction Loan: A construction loan helps with ongoing payments during construction by allowing you to draw on the loan balance, while a regular home loan is given in one lump sum.

- Fixed Rate Home Loan: Fixed rate home loans lock in the interest rate at settlement. This means the lender can’t raise or lower the interest rate. You may want to fix a rate for up to 5 years for loan terms that may be 25 or 30 years. This type of loan is for people who like the certainty of knowing exactly how much their repayments will be, even if it may mean missing out on falling interest rates during the lock-in period.

- Interest Only Home Loan: You can choose to pay just the interest when getting a home loan by using this loan type. If you pay only the interest, your loan repayments will be lower, freeing up cash for renovations and other expenses. As interest-only loans typically only have a 5-year life span, a lender or bank will always assess your ability to pay back both interest and principal.

- Introductory Loan: Typical of a honeymoon phase where partners are at an exciting stage of their relationship, lenders also offer a honeymoon rate through low rates to attract borrowers. The honeymoon rate lasts about a year before rising. Rates can be set or capped. After the introductory period, most interest rates return to standard rates.

- Home Loans on Pensions (age & disability): Although pensioners are considered risky by lenders, it is possible to get a mortgage despite the challenges. If you’re on a pension or applying for a home loan at an older age, lenders may limit the amount you can borrow due to a higher risk profile but you may still be able to apply for reverse mortgages, line-of-credit, and investment loans.

- Line of Credit Loan: After owning a property for a while and building up equity, you can apply for a line of credit, a loan that gives you instant access to funds. This product is a creative way to manage your cash because it can be typically used for anything and repaid on your terms. These accounts are useful if you’re looking for improved cash flow. It’s worth noting, however, that if the line of credit balance isn’t regularly replenished, you will be charged interest on the amount you have used and it will also reduce your home’s equity.

- Low Doc Loan: Low-doc loans are for borrowers who can’t provide the paperwork for a traditional mortgage. This type of loan appeals to investors and self-employed people because lenders will consider other sources of documentation to accommodate them.

- Non-Conforming Loan: People with poor credit may find it difficult to get a traditional home loan because the lender sees them as a risk. With non-conforming loans, lenders will often accept other evidence of repayment ability. A larger deposit is often needed, and the loan will typically attract a higher interest rate which offsets the lender’s risk.

- Principal and Interest Home Loan: You can choose to pay both the interest and the principal (the actual amount borrowed) when getting a home loan, thereby allowing you to pay off your home loan sooner.

- Self-Employed Home Loans: Getting a home loan as a self-employed person is possible but may involve extra steps.

Common home loan requirements for self-employed borrowers include:

- Two-year ABN registration proof

- Tax returns and assessment notices from the last two years

- Two-year balance sheet and profit and loss statements

- External debts: Leases, overdrafts, company loans, and guarantees

- Last month’s bank statements

- Split Rate Loans: A split rate loan lets you fix a portion of the mortgage and keep the remainder of the mortgage variable. You can choose how much to allocate to both, giving you the best of both worlds. You’ll get the peace of mind a fixed rate provides while also being able to capitalise on rate drops.

- Variable Loans: Your mortgage interest rate in a variable loan can be affected by the Reserve Bank of Australia’s (RBA) interest rate changes. If the RBA changes the rate, your lender may pass on the change to you.

Look for Home Loan Options that are Appropriate for Your Situation

As you can see, there’s a wide variety of loans out in the market, and not all of them are available or presented to a borrower.

However, a licenced mortgage broker has access to most if not all of these and can use them to present a list of home loans appropriate for you.

Additionally, if you’re low on cash and can’t come up with a 20% deposit, your mortgage broker can help you search for a lender or product that can accommodate your needs.

In which case, you need to get a Lenders Mortgage Insurance (LMI). LMI protects the lender and is a one off cost paid by the borrower at loan settlement.

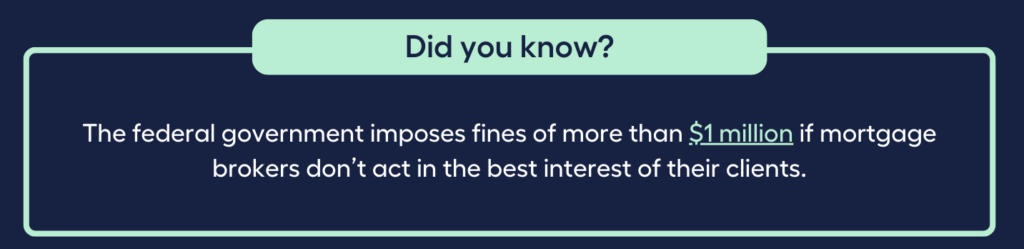

Rest assured, mortgage brokers are legally required to act in your best interests.

In fact, the federal government imposes fines of more than $1 million if mortgage brokers don’t act in the best interest of their clients.

Best of all, you don’t have to fork out any of your hard earned money to pay for a mortgage broker’s services.

Mortgage brokers are compensated by the lender, through a commission, for bringing them business.

Knowing all that, you also have to ensure that you’ll be dealing with a registered mortgage broker.

Check they have an Australian Business Number (ABN) and Australian Credit Licence. If you’re still unclear, you can check with the Australian Securities & Investments Commission (ASIC), the Australian Business Register (ABR) or the Mortgage and Finance Association of Australia (MFAA).

It’s always better to be safe than sorry when it comes to real estate, home loans, and refinancing.

Why Do People Go to Mortgage Brokers?

More Australian home buyers are engaging the services of experienced mortgage brokers ever since the best interest duty came into effect.

According to the most recent MFAA data, more than 2 out of 3 current Aussies home loan borrowers are serviced by mortgage brokers.

Knowing that you’re protected by law can very well help boost your confidence that your mortgage broker will act in your best interest.

And that brings us to the next question:

Do I still need a mortgage broker when there are numerous comparison sites available?

Here are some reasons why people seek the help of a mortgage broker:

1. Market Expertise

Finding the most affordable home loan is one thing, but that only tells half the story.

A mortgage broker is aware of the home loans you’ll qualify for and the lenders who are likely to reject your application.

They assist you in making the appropriate decision the first time, which might make or break your real estate purchase.

Mortgage brokers also are aware of which lenders can process home loan applications swiftly and which are currently having issues processing loan applications.

2. Comprehensive Market Advice

A mortgage broker provides “whole market service”, which means a licenced mortgage broker explores the market for the best home loan for your specific situation.

If you go to a lender directly for a home loan, you will be limited to its own offerings, which may or may not result in the best outcome for your situation.

A mortgage broker provides personalised advice geared to your personal and financial needs and is not limited to the one particular lender.

3. Exclusive Product Access

Mortgage brokers have access to home loans that you may not have access to directly.

Some lenders exclusively offer their services through mortgage brokers and do not interact with the general public directly.

These products may be more suitable for your circumstances, and you can only learn about them by working with a mortgage broker.

4. Specialist Requirements

If you are self-employed, have seasonal income, or have a history of weak credit, it may be tough to obtain a home loan on your own.

A mortgage broker has access to a broader range of specialised lenders as well as experience with clients who have had challenges obtaining a loan from the mainstream market.

Specialist lenders recognise that life happens and that you may have a home loan application rejected by a conventional lender through no fault of your own.

If your circumstances are peculiar, specialist lender underwriters will evaluate each application individually and look at the overall picture.

5. Hassle-free

Obtaining a home loan and purchasing a property can be hard, with numerous documents to fill out and various parties to deal with.

A mortgage broker handles the labour for you, relieving stress by assisting you in filling out documents and preparing your application so that it has a greater chance of going through successfully the first time.

They then stay on top of things throughout the process, communicating with the lender and coordinating with solicitors as needed.

6. Loyalty

If your financial situation changes, your mortgage broker will assist you in reviewing your alternatives, and they will usually contact you well before your loan term expires to see if they can offer you a better home loan.

A mortgage broker wants to keep your business for the long term, and they want you to recommend them to your friends and family. As a result, they are motivated to act in your best interests and are devoted to you as a client.

Common Questions About Using Mortgage Brokers

It’s always worthwhile to do your homework before deciding to use a mortgage broker.

We’ve compiled a few questions to help you get started on your research beyond the usual “what’s the best deal you can give me” or “how much interest can we save” type of questions.

Does using a mortgage broker affect credit score?

Your credit score is an important factor in obtaining a home loan. When you apply for a loan directly with a lender, the lender performs a credit check, which is recorded as an enquiry in the borrower’s credit file.

Multiple inquiries may have a negative influence on your credit score.

Unfortunately, while enquiries are recorded, not all banks record approval or pre-approval on enquiries, which can make multiple enquiries appear as rejections to other lenders.

On the other hand, enquiries made with a mortgage broker are typically not recorded and thus, leave no trace.

So, if you’re doing some research and considering your alternatives, hiring a broker can help ensure that your credit score is unaffected.

Should I speak to multiple mortgage brokers?

Before enlisting the help of a mortgage broker, it’s ideal to talk to at least three licenced mortgage brokers.

Although a licenced mortgage broker provides “whole market service”, there’s still a chance some mortgage brokers don’t cover your specific needs, or are simply not a good fit for you.

So, shop around and choose the best mortgage broker for you before you start your home loan journey.

How about using more than one mortgage broker?

This may seem like a good idea in theory because it might provide you with a greater range of loans to pick from, but in practice, it can complicate matters.

Using several mortgage brokers is possible, but it is not recommended, especially if they are both submitting applications on your behalf and both applications are approved.

At this point you’ll be looking at terminating the services of a mortgage broker and a financial institution. One or both of them may choose never to deal with you again in the future.

The consequence can be tough in an ever changing property market where borrowers are always in search for a better deal.

Are you more likely to get a mortgage with a broker?

Banks are a viable option for obtaining a home loan, but keep in mind that they do not have access to the breadth of options that mortgage brokers have.

And should you be self-employed or have an unstable income, banks may be less likely to offer a favourable interest rate to you.

These two factors make it difficult to find the best home loan deal with a bank.

With an experienced licenced mortgage broker, you may have a better chance of getting a home loan approved at a good or comparable interest rate even if you…

- do not have a high credit score

- are self-employed

- have a variable income

- had been declined before

- are seeking a big loan

Which is why you should do your homework and shop around for the best mortgage broker that suits you.

Is a broker better than a bank?

Now that we’ve identified the advantages of using a mortgage broker, you can ask yourself:

Will I use the services of a mortgage broker or not in my search for a home loan?

The decision is likely to be influenced by your personal circumstances rather than the specific benefits of using a mortgage broker vs. doing the work yourself and going directly to a bank.

Mortgage brokers not only give you convenience and control, but they also provide you with a point of contact even after you’ve decided on your new loan and home.

If you decide in the future to refinance with a new lending company to get a better deal, the broker may be able to assist you with this process as well.

Alternatively, if you’re looking for a home loan, you could do it all yourself by dealing directly with your chosen lender.

Whether you prefer to directly deal with a lender or use a mortgage broker, asking yourself these two questions can help narrow down and provide clarity to your decision:

- How much time do I have to compare home loans, check comparison rates, upfront and ongoing fees, engage with banks, fill out paperwork, etc.?

- How confident am I with my financial and negotiation skills considering that I’m taking on a long term debt?

Some borrowers who are short on time but still sceptical about using a mortgage broker go to a comparison site and pick the best deals they can find. Then they present these best deals to a mortgage broker to see if the broker can beat these deals.

This way, the borrowers know that they are getting a good product and interest rate, and that the process is being managed properly by a good broker.

Likewise, if you need help finding the right mortgage broker for you, talk to My Money Sorted for free!

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your home loan options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Curious what happens during a call with My Money Sorted?

Watch this video!

It’s that easy!

In the Market for a Mortgage? Chat with My Money Sorted Today.