Congratulations on securing a home loan! Your dream of owning a house will soon be a reality!

As you dutifully make your monthly mortgage repayments, you may find yourself wondering, “When will this debt be repaid?”

How Long to Pay Off a Mortgage?

In this post, we’ll discuss how to get ahead on the road towards home ownership while taking the mortgage into account. Let’s get going and find out how long it will take to fulfil your dream!

Jump straight to…

How Long Does It Take the Average Australian To Pay Off Their Mortgage?

A home loan, also known as a mortgage, is a type of financial contract that enables people to buy real estate.

It entails borrowing money from a lending institution with the promise to pay it back over a predetermined loan term with interest in order to purchase real estate. The borrowed principal and interest charges are then repaid at regular intervals in the form of home loan repayments.

Typically, you would choose principal and interest repayments (P&I) over interest-only repayments (IO) if you want to pay off your home loan sooner.

The length of time it takes the typical Australian to pay off their mortgage can differ greatly and is influenced by a number of factors.

These variables include the mortgage’s size, the loan’s interest rate, the borrower’s financial situation, and their repayment plan.

A typical mortgage could last between 25 and 30 years, on average. Some mortgages can extend up to 40 years. To cut down on overall interest costs, many homeowners aim to pay off their mortgages earlier.

It’s important to take into account various repayment options, such as fixed interest or variable interest rates, as you investigate your mortgage options. Your financial security may be significantly impacted by these decisions.

While fixed interest rates have predictable loan offers with set repayments, variable interest rates have the potential to change your monthly payments – for better or for worse. Choose a repayment option that best suits your needs by considering your financial objectives and need for cash flow stability.

There are many ways to speed up the mortgage repayment process, such as making additional payments or choosing loans with shorter terms.

A shorter timeline for paying off your mortgage may result from these proactive measures. The duration of your mortgage repayments is also greatly influenced by economic factors, such as changes in interest rates and housing purchase prices.

Understanding Your Loan Terms

Knowing the specifics of your loan is crucial before we can determine when your mortgage will be paid off. These conditions affect the total length of the loan as well as your monthly payments.

Monthly Payments and Interest

The principal and interest components determine your regular repayment amount. A portion of each payment goes towards principal reduction and the interest charges will change over the course of the loan. Initially, a larger percentage of your payment is applied to interest; however, over time, more will be put towards the principal. Understanding how your current loan develops requires an understanding of this dynamic.

Repayment Frequency and Types

It is crucial to select the right repayment frequency and type. You can choose from weekly, fortnightly, or monthly repayment schedules. The interest you pay over the life of the loan may be impacted by this decision. In addition, there are various repayment types, including principal and interest and interest-only. Each has an effect on the total repayments and the life of your loan.

Variable and Fixed Interest Rates

Increases in interest rates may significantly affect your loan. Fixed-rate home loans will have the same interest rate for the entirety of the fixed-rate period. In Australia, the majority of fixed-rate mortgages have short- to medium-term terms, with fixed-rate periods ranging from one to five years.

If you have a variable-rate home loan, your interest rate could change depending on the state of the market. Planning for potential rate changes can be made easier if you comprehend these concepts.

The Role of Extra Repayments

The term of your mortgage can be accelerated by making extra repayments. More money is put towards lowering the principal when you contribute over and above your regular repayments. This can shorten the length of your loan by years and help you save on interest costs.

Rate Lock Feature

With the rate lock feature offered by some loans, your interest rate will stay fixed even if market rates rise. Your loan management may become more predictable and worry-free as a result.

To find the best mortgage repayment rate, use the MMS mortgage repayment calculator. Simply input your current loan details, and it will provide you with valuable insights to help you make informed decisions.

Is It Better to Pay Off Your Mortgage Sooner?

For many homeowners, paying off their mortgage more quickly is a worthwhile goal. It increases financial security and brings about peace of mind. The decision of whether it is a good idea to accelerate your mortgage payment is generally a good thing, but it is also dependent on a number of factors.

The loan amount is one of the most important things to think about. How quickly you can pay off your loan depends critically on how big it is. Smaller loans might be easier to manage in the long run than larger loans, which might take more time and effort to repay.

The interest rates on your home loan are another important factor to take into account. The total cost of your property may be significantly impacted by the interest you pay over the loan’s term.

A fixed-rate provides stability by guaranteeing that your interest rate won’t change during the specified fixed term. A variable rate, on the other hand, indicates that your interest rate is subject to change depending on changes in the market. Either way, you would want to secure the lowest interest rate possible on your mortgage.

You might think about making extra repayments to hasten your mortgage repayment. These extra payments may aid in lowering the principal balance and, as a result, the interest you pay. It’s a wise move for borrowers who want to reduce the loan term and interest costs, however, you may have to forego a fixed-rate loan to do so.

In this process, a home loan repayment calculator can be a very helpful tool. It enables you to calculate the impact of various factors on your loan, such as repayment frequency and additional repayments. You can choose a repayment type that fits your financial objectives by adjusting these variables.

A rate lock feature may be useful for those who want financial stability. By guaranteeing consistency in your interest rate, this feature provides predictability and peace of mind. Homeowners who want to avoid the ambiguity when interest rate rises find it particularly appealing.

Benefits of Paying A Mortgage Off Early

There are several reasons to consider paying your mortgage or home loan sooner, including the potential to save a significant amount of money on interest, reduce financial stress, build equity in your home, and even improve your credit score.

Here are the factors that help you decide whether to pay off your mortgage early, so you can make this important financial decision with confidence and clarity.

Saving Money on Interest

One of the most substantial advantages of paying off your mortgage sooner is the potential for substantial interest savings. Mortgages typically span over a long period, often 15 to 30 years, and a significant portion of your regular repayments initially goes toward paying off the interest.

By reducing the loan term or making extra repayments, you can pay down the principal loan amount faster, which, in turn, means less interest accrues over the life of your loan. This translates into thousands of dollars in interest savings over time, providing you with more financial freedom and security.

In some cases, borrowers make a lump sum payment to expedite the repayment process. This can be a great strategy if your financial situation allows for it. Understanding your loan type is vital, as certain loan types may have specific conditions and requirements for lump sum payments. Ensure you are familiar with your loan terms and conditions to make the most of this opportunity.

Reducing Financial Stress

Imagine the peace of mind that comes with being mortgage-free. Eliminating this substantial debt can significantly reduce financial stress, contributing to a more secure and relaxed lifestyle.

Without the burden of mortgage repayments and a regular repayment frequency, you’ll have extra funds to allocate to other financial goals, such as investments, lifestyle goals, or saving for retirement.

Additionally, should unexpected financial challenges arise, having a paid-off home can serve as a financial safety net.

Building Equity

Paying off your mortgage ahead of schedule is a powerful means of building equity in your home. Equity is the portion of your property’s value that you truly own, and it can be a valuable asset. This equity can be tapped into for various purposes, such as financing home renovations, investments, or even a child’s education. It’s a significant step towards securing your financial future.

Improving Your Credit Score

Paying off your mortgage early can also have a positive impact on your credit score. Your credit score reflects your creditworthiness, and demonstrating responsible financial behaviour, like paying off a substantial loan, can boost your score. This can be beneficial for future borrowing needs, as lenders are more likely to offer favourable terms and conditions to borrowers with higher credit scores.

Remember, the path to financial security and reduced debt stress begins with informed decision-making and the right strategies, and this resource can be a valuable asset on your home loan repayment journey.

Is There Any Downside of Paying A Mortgage Off Early?

There are three primary types of home loan fees: up-front, recurring, and loan-closing. Some charges to be aware of include:

application/establishment fee, valuation fee, legal fee, settlement fee, annual package fee, ongoing monthly fee and discharge fee.

Some people may need to think about Lenders’ mortgage insurance (LMI). Not a fee in the traditional sense, but a potentially significant cost incurred by some borrowers who have less than 20% deposit when taking out a home loan.

It’s critical to be aware of any potential fees and charges before starting the process of paying off your mortgage early.

Some lenders charge fines or fees if loans are repaid early. It’s a good idea to carefully review your loan agreement before making additional mortgage payments. You can decide whether the fees and charges outweigh the advantages of early repayment by understanding these conditions.

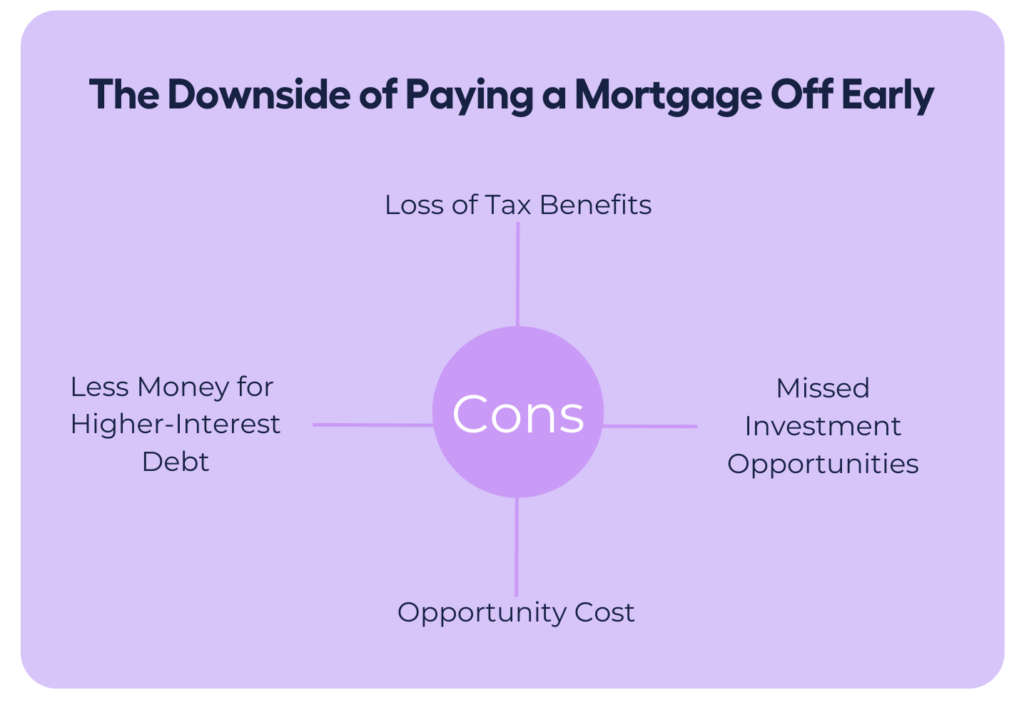

Less Money for Higher-Interest Debt

One significant drawback of focusing on paying off your mortgage early is that it might divert your financial resources away from higher-interest debts. Loans, such as credit card debt or student loans, often come with higher interest rates than home loans. By prioritising your mortgage, you may inadvertently end up paying more in interest on these other debts, which could prove costly in the long term.

Missed Investment Opportunities

Another potential downside is missing out on the chance to earn higher returns through investments. If you can invest your money in avenues that offer significantly higher returns than your mortgage interest rate, it may be wiser to allocate your funds there.

For instance, if your mortgage carries a 3.5% interest rate and your investment portfolio has a historical average annual return of 6%, focusing on your mortgage early could mean forgoing the opportunity to earn a more significant return on your investments.

Loss of Tax Benefits

Paying off your mortgage early might lead to the loss of certain tax benefits in Australia. If you prioritise mortgage payments over maximising contributions to tax-advantaged superannuation strategies, you might miss out on valuable tax savings.

Additionally, you could lose the ability to claim tax deductions for mortgage interest payments if your property is an investment property and not owner-occupied.

Opportunity Cost

Every extra dollar you channel towards paying down your mortgage sooner is a dollar you can’t use for other financial goals. This trade-off, known as opportunity cost, could mean sacrificing contributions to your retirement savings, your emergency fund, or other investments with higher potential returns.

It’s crucial to carefully weigh the pros and cons of paying off your mortgage early before making a decision. Ultimately, whether or not to pay off your home loan ahead of schedule is a personal choice that hinges on your unique financial circumstances. Consider consulting a financial advisor or using mortgage calculators to assess the potential impact on your specific situation.

What Happens After You Pay Off Your House?

The mortgage discharge process is the next step in your home-buying process after you have paid off your mortgage in full. This crucial step gives you full ownership of your property by formally removing your lender from your Certificate of Title. It’s crucial to comprehend the complexities of this procedure, which could involve a variety of costs and paperwork.

Charges and Mortgage Discharge

As you begin this phase, you might have to pay some charges related to the mortgage discharge procedure. Typically, you must pay these fees to wrap up the legal processes and formally close your home loan account. The precise sum of these fees may change based on your lender and the type of loan you are taking out. In order to fully understand any potential costs involved, it is advised to review the terms and conditions of your mortgage agreement.

Loan Balance and Interest

Examining your loan balance and interest is essential before moving forward with the discharge. It’s critical to confirm that this amount matches your records because it represents the total amount you have borrowed. Also keep in mind that you may still owe interest, which is typically calculated up to the date of full repayment, even after you have paid off your mortgage. A crucial step in the mortgage discharge procedure is making sure that all interest obligations are fulfilled.

Ownership and Property Value

You become the sole owner of your property once your mortgage is paid off. This is an important accomplishment, and your mortgage will be removed from your Certificate of Title to reflect it. It’s possible that your property’s value has increased more than its purchase price. This could improve your financial situation by enabling you to use your property as leverage for other investments or financial choices.

Financial Freedom and Investment Opportunities

Your regular home loan payments won’t be an issue anymore, giving you more financial freedom. This creates a wide range of possibilities, including travel, investing in home improvements, or purchasing long-desired items. Additionally, you can investigate various options for increasing your wealth, such as making investments in a diversified portfolio with various risk profiles.

Paying off your mortgage is a major accomplishment that results in financial freedom and new opportunities. It’s a good time to evaluate your financial situation, look into investment options, and make choices that fit your objectives. To make the most of this exciting period in your investment property and home-buying journey, consider speaking with a financial advisor.

Need Mortgage Advice? Talk to a Money Buddy Today About Finding the Right Lender for Your Needs.

Our team works hard to provide a variety of resources to help you build the financial future you deserve:

✓ Our Property Wealth Investment Plan is perfect for would-be property investors!

✓ Our Australian Property Show Podcast is FREE to listen to and share a wealth of knowledge every episode!

✓ Sign up to our Newsletter to receive FREE resources, tips and finance updates direct to your inbox each month!

My Money Sorted is your stress-free pathway to getting ahead sooner – if you’re unsure of what you need you can book a FREE call to find out more.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a financial advisor or broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense.

It’s that easy!

Get Your Money Sorted Today by Speaking with a My Money Sorted Team Member