Buying a house is a life-changing event for most people. It’s a commitment that lasts decades, and it’s more complicated than most financial transactions you’ll ever make.

With rising interest rates and properties in demand, navigating the process of obtaining a mortgage from lending institutions is increasingly becoming more difficult. Add with the variety of home loan products offered by various financial institutions – it’s a labyrinth of paperwork too daunting for most people to tackle head on.

But you don’t have to live with the hassle and complexity of talking to different lenders, getting a pre-approval, submitting your application, obtaining a property valuation, paying for a lender’s mortgage insurance (LMI), and getting a loan approval on your own if you employ a mortgage broker.

Jump straight to…

What is a Mortgage Broker?

A mortgage broker acts as a liaison between a financial institution that offers loans guaranteed by real estate and individuals who require a loan to buy real estate, and works in the best interest of the borrower.

Mortgage Brokers vs Lenders vs Loan Officers – Who Does What?

Mortgage Broker

The mortgage broker works with both the borrower (you) and the lender to get the loan approved. They also collect and verify all the paperwork required by the lender to complete the home purchase.

A mortgage broker typically works with various lenders and provides the borrower with a variety of loan options.

As a borrower, you are not required to work with a mortgage broker. If you prefer, you can work directly with a lender.

Lender

Potential home buyers can obtain a loan from any lender, even individuals.

A lender is commonly a bank, a credit union, or another type of financial institution that can provide financing for a real estate transaction. In exchange, the borrower repays the funds plus an agreed-upon amount of interest over a set time frame.

If you choose to approach a lender on your own, you’ll be dealing with a loan officer employed by the lender.

Loan Officer

A loan officer can assist you in understanding and selecting from among the loans they offer.

The loan officer will answer all your questions, assist with loan pre-qualification, and assist with the application process. They can act as your representative as you work to secure the loan.

While a mortgage broker isn’t required to complete the transaction, some lenders will only work with mortgage brokers. If your preferred lender is one of those, then you’ll need to work with a mortgage broker.

And this can be to your advantage too if you dig into the services a mortgage broker offers.

Mortgage Broker Services

Mortgage brokers arrange the necessary financing on the borrower’s behalf so that they can buy a home while providing advice and direction at every step of the way

In order to get the best possible loan for their customer, the broker will gather information from the individual and contact many lenders.

To determine the kind of loan they may arrange on your behalf, they will verify your credit.

The broker also acts as the loan officer, gathering the necessary loan documents and coordinating with both parties to close the deal.

The main information your broker needs to have:

- Proof of identification, which can be verified with:

- Birth certificate

- Current passport

- Driver’s licence

- Medicare card

- Proof of Income can be shown by providing:

- Recent pay slips

- PAYG (Pay As You Go) statement containing Year to Date (YTD) income

- Accounting reports and statements if you are self employed

- Any rental income you earn

- Expenses in any of the following categories needs to be declared:

Make a thorough note of all of your monthly expenses to make sure your spending is transparent.

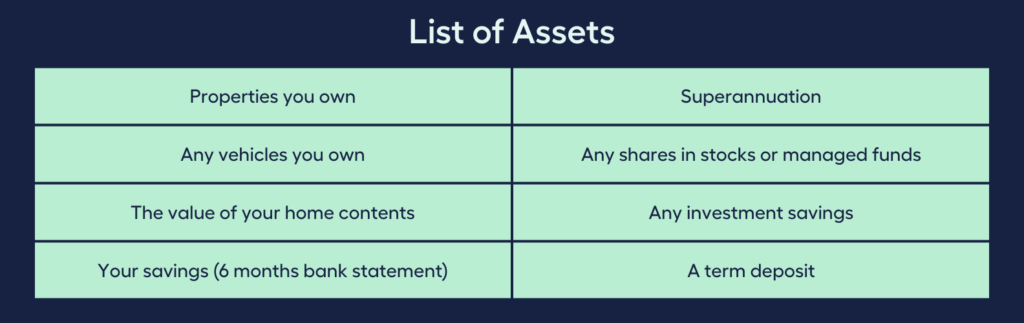

- A declaration of Assets including:

- Statements of Liabilities include:

By providing all the information on your assets, liabilities, income, and expenses, you give your mortgage broker the information they need to ensure that they get you a home loan you are comfortable repaying.

A qualified broker will help you consolidate all these as well as guide you through the entire application process.

A competent broker will:

- Determine your needs and goals.

If your broker knows your needs and goals, it will be easier for them to provide the suitable home loan options.

- Calculate what you can afford to borrow.

A competent broker will be able to determine what you can afford to pay over a 30-year period even if you go through life changes.

- Find options that fit your circumstances.

A capable broker is aware of your situation and gets you the best deals based on it.

- Describe the benefits and costs of each loan (such as interest rate, features, and fees).

A seasoned broker is able to break down proposals and explain each part to you including the fine print.

- Make a loan application and follow it through to completion.

A truly dedicated mortgage broker will be with you through every step of your journey until you sign a contract or loan agreement with the lender.

Furthermore, brokers must act in your best interests or face fines of more than $1 million based on the Best Interests Duty for mortgage brokers, which officially came into effect on 1 January 2021.

This makes mortgage broker services a great way to secure the best outcome for your situation, typically with no upfront cost.

Weighing in if you need a mortgage broker?

Speak with a Finance Expert to help you make an informed decision!

I want to see all my options with the help of a Finance Expert

Book a FREE Call TodayMortgage Broker Costs

The majority of brokers don’t cost borrowers anything upfront.

Normally, a mortgage broker is only compensated when a loan settles and money is disbursed.

How much does a broker cost?

A mortgage broker may be paid by a combination of fees from clients and commissions from lenders that originate loans.

A mortgage broker typically makes between a small percentage of the overall loan amount, though charges might vary substantially.

Depending on the type of loan, the broker employed, and the commission the broker receives from the lending institution, the borrower’s overall payment will change.

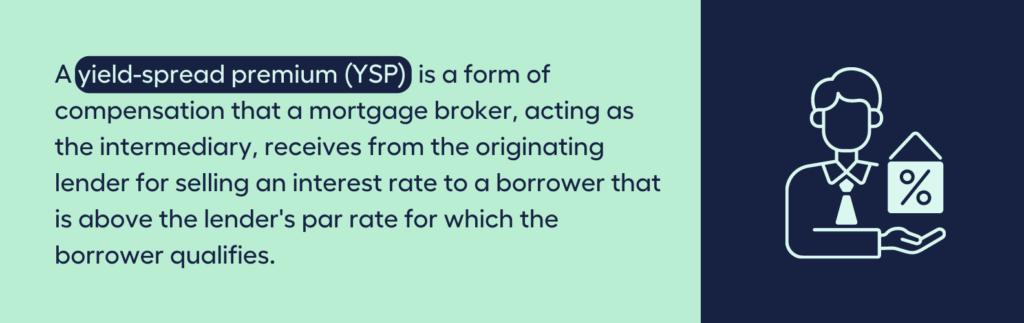

Your closing costs sheet may include a mortgage broker’s compensation in several different ways.

They could impose broker commissions, yield-spread premiums, upfront costs, loan administration fees, or loan origination fees.

In order to avoid any surprises on closing day, you should ask mortgage brokers early in the process about their fee structure.

Transparency is the key to a good borrower-broker relationship. It can even lead to you getting a higher home loan amount.

Can a mortgage broker get you more money?

Mortgage brokers can assist with loan application details that may lead to improved borrowing capacity because they know a variety of financial products available on the market.

Mortgage brokers typically have access to many different financial institutions for mortgage loans.

Most people don’t have the time to compare the various home loan products available from Australia’s numerous lenders (not just the big four). A mortgage broker, on the other hand, is well-versed in these products.

This is why more than half of all Australian borrowers find mortgage brokers to be a useful resource.

Benefits of Using a Mortgage Broker

Advantages

- Save Yourself the Legwork

Mortgage brokers maintain regular contact with a wide range of lenders, some of whom you may be unaware of. They can also steer you away from lenders who have onerous payment terms hidden in their home loan contracts.

However, before meeting with a broker, you should conduct your own research.

Search home loan rates online and use an online mortgage calculator to calculate loan details.

This type of tool allows you to easily compare rates and provides you with additional information when evaluating the credibility of mortgage brokers.

- A Broker Has Keys to More Lenders

Some lenders may not allow you to contact them directly and prefer to only work with mortgage brokers and rely on them to bring qualified clients.

Because of the volume of business they generate for lenders, brokers may be able to obtain rates from lenders that are lower than what you can get on your own.

- A Broker Has a Better Chance of Handling Your Fees

Taking out a new mortgage or working with a new lender can involve various fees.

Origination fees, application fees, and appraisal fees are examples of these.

Mortgage brokers may be able to convince lenders to waive some or all of these fees in some cases, saving you hundreds or potentially thousands of dollars.

Disadvantages

- A Broker’s Interests may Differ from Yours

The ultimate goal of home loans shopping is to find one with a low interest rate and few fees.

Mortgage brokers are frequently compensated by lenders for bringing in new business. This fee may be based on the loan amount and will differ between lenders.

As a result, a broker’s goal may be to get you into a home loan that maximises their compensation.

However, brokers operating in Australia today must act in your best interests or face fines of more than $1 million based on the Best Interests Duty for mortgage brokers.

To determine whether your broker is genuinely giving you a great bargain, it never hurts to do some independent research. As was previously noted, using a mortgage calculator is a simple way to compare loan options and repayments across various loan products.

- You May Be Paying a Broker Fee

Mortgage brokers are compensated by the lender, or by you, or by both the lender and you.

If the lender pays the fee, you should always do your research to ensure you are not being directed to a more expensive loan because the broker’s commission is higher.

If you pay the fee, add it to your mortgage costs before determining how good of a deal you’re getting.

Also, before you begin working with a broker or sign anything, make sure you have resolved all fee issues.

- Estimates are Not Guarantee by Brokers

When a mortgage broker first presents you with offers from lenders, the term “good faith estimate” is frequently used.

This indicates that the broker believes the offer will include the final terms of the transaction.

This, however, is not always the case. In some cases, the lender may change the terms based on your application, and you may end up paying a higher interest rate or additional fees as a result.

Keep this in mind, and keep a copy of the estimate in case you wish to dispute the revised terms.

- Some Lenders Refuse to Work With Mortgage Brokers

Working through a broker may limit your access to these lenders, some of whom may be able to offer you better home loan terms than the broker. Shop around before contracting a mortgage broker.

To put your mind at ease, ask the mortgage broker a lot of questions before engaging their service.

Questions to Ask Before Engaging Mortgage Brokers

- Are you licensed?

Brokers in the mortgage broking industry in Australia are required to meet Australian Securities and Investments Commission (ASIC) licensing standards. And they’re usually members of a finance brokers association.

- Do you provide loans from a variety of lenders? Which lenders do you deal with?

Knowing the network of lenders a broker has will help you foresee the pool of options you have to choose from.

- What types of lenders are you unable to access?

Determine if the broker’s lack of access limits your options to get a good deal.

- How do you get paid for the advice you give me? Does this vary depending on the lender?

Is the broker influenced by a higher commission if the lender pays the fee? If you pay the fee, factor it into your mortgage costs before determining how good of a deal you’re getting.

Questions to Ask Your Mortgage Broker During the Process

- Why did you suggest I take out this loan? Why is this loan beneficial to me?

Take suggestions with a grain of salt to determine the best proposal you can get.

- What fees will I be responsible for when I take out this loan?

Transactions involving services always involve fees. It is advisable to know which are included in your loan and to determine which can be omitted or anticipated while making loan payments.

- What choices (features) are included with this loan? Can you explain to me how they operate?

A mortgage in Australia is typically set up for 30 years. That’s nearing on a lifelong commitment. Understand what you’re getting yourself into before you fully commit.

- How will the costs and features of this loan impact my ability to repay it?

The worst thing you don’t want to happen is defaulting on your loan and the lender repossessing your home. Make sure that you have the capacity to repay the home loan before signing on the dotted line.

- Can you provide me with a few additional choices, one of which should be the most affordable?

Always ask for more choices. Look out for yourself and your future.

- How can I avoid lenders’ mortgage insurance (LMI) and what is the threshold?

Your broker should be able to make some recommendations. Saving up the required deposit for a home is one way to avoid paying LMI. Alternatively, if you have a guarantor for the property loan and your deposit is less than 20%, you may be able to avoid paying LMI.

Is it worth getting a mortgage broker?

The advantage of using mortgage brokers over dealing directly with banks and lenders is that the broker handles all of the paperwork. Instead of wasting time shopping around for a deal that meets your needs by comparing all of the different offers available, a broker handles all of the negotiation and paperwork for you.

When you work with an experienced broker, they have access to all of the information and will negotiate on your behalf. A good broker will also make an effort to understand your specific situation and the factors that are important to you, such as term flexibility.

Leave nothing to chance.

Check Your Borrowing Power with the MMS Mortgage Calculator

Knowing your borrowing power is just the first step. A mortgage is a big investment of both time and money, which is why It’s often best to receive guidance from a financial expert like a mortgage broker.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by an experienced Mortgage Broker.

It’s that easy!