Ever felt like you know your way around a place like the back of your hand, only to later realise the roads have changed?

Isn’t it frustrating?

Fortunately, finding your way around just about any place is no longer difficult with navigation apps.

That’s pretty much what having a financial plan is:

The purpose of a financial plan is to get you to your destination as planned or ahead of schedule, with updates of alternate routes when unexpected things happen.

The benefits of financial planning are numerous, and you can take full advantage of a financial plan with the help of a financial planner.

Jump straight to…

The Role of Financial Planners: Why Use a Financial Planner?

The best thing about navigation apps these days is that they’re up to date with current events, like what’s happening with traffic, the weather and even hazards to look out for.

Just like a dedicated financial planner.

Dedicated financial planners are up to speed when it comes to information about changes in the law, interest rates, the share market, property markets, and tax revisions, among other things. Armed with this information, they can ensure that your financial plan adjusts accordingly to your financial situation and that your financial goals do not get sidetracked.

A financial planner can create a plan for your:

- Budget and Savings

- Tax Management

- Diversified Portfolio

- Retirement

- Asset Management (including properties)

- Estate

Wouldn’t it be nice to have a financial planner working with you on your financial goals?

The Importance of a Financial Plan

A financial plan, with the help of a financial advisor, can assist you in better managing your finances, ensuring that you’re saving enough to live comfortably today and after retirement, be able to cover any unforeseen expenses, and be on the right track to reach your longer-term financial goals.

A financial plan ensures that your expenses don’t affect your funds for savings, and that you are able to take out loans you need without affecting your cash flow or getting you into unmanageable debt.

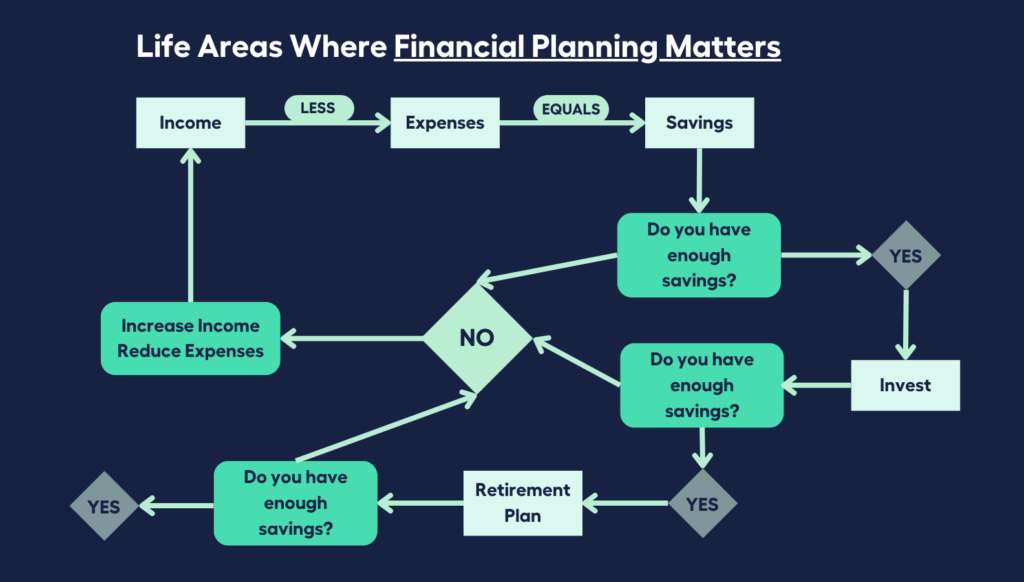

A Financial Plan for Different Areas of Financial Life

Financial security is possible if different areas of your financial life are considered. Invest the time to grow in these areas for a better financial future.

Areas of Financial Life Where a Financial Plan is Needed:

- Income

- Expenses

- Savings

- Investments

- Taxes and Tax Benefits

- Retirement

- Estate Planning

- Life Changes

1. Income

Having a financial plan makes you aware of your income sources such as salary, interest, and dividends, and helps determine if your income is sufficient or if you need a new job, career, or increase in salary in order to reach a financial goal.

A helpful hack is to separate your wages account from your other bank accounts. This makes it easier to manage and direct the flow of your after-tax income, and even allocate a set amount of your income towards savings and expenses.

2. Expenses

Financial planning includes budgeting for living expenses. Keeping track of monthly expenses allows budget flexibility in different life stages, spending habits, and earning capacity.

One way of monitoring your expenses is by funnelling them all through a transaction account that’s separate from thel account you receive your wages in.

3. Savings

Keeping track of your earnings and spending makes you aware of your savings or if you save money at all. It gives a clear picture of how close (or far) you are from your savings objective or goal of financial independence.

To do this with ease, it would be wise to have a separate savings account from your wages account and transaction account.

4. Investments

Sound financial advice allows you to create investment strategies and set realistic goals according to your income and risk appetite. This helps you create a balanced investment portfolio that minimises investment risk and worry.

5. Taxes and Tax Benefits

A financial plan can help you assess your tax position at the start of the year. You can create strategies so that you legally pay the least amount of tax possible and direct more of your earned income into your savings accounts.

6. Retirement

A comfortable retirement is possible if you have a retirement plan that sets up your finances for your preferred lifestyle, and includes funds to cover unexpected expenses through your retirement years.

Retirement planning involves listing your financial goals, expenses, and investment details to help determine the steps to achieve your retirement goals and have a secure financial future.

7. Estate Planning

Estate planning is the process of making decisions about how your assets will be distributed after your death.

The specifics of how assets and liabilities are to be handled are more important than the amount of money in this situation.

The financial plan will include a reference to your estate plan, or in certain cases, a general summary of what needs to be done so that your family or the people handling your finances are aware of the actions necessary to manage your estate.

8. Life Changes

Our lives undergo many changes. You can get married, lose your job, win the lottery, or have a loved one become critically ill.

Such lifestyle changes can have an impact on your financial situation, either positively or negatively. Personal financial planning makes it possible to anticipate financial needs in various situations and maintain financial security at all times.

Now that we know the importance of a financial plan, let’s talk about the benefits of financial planning.

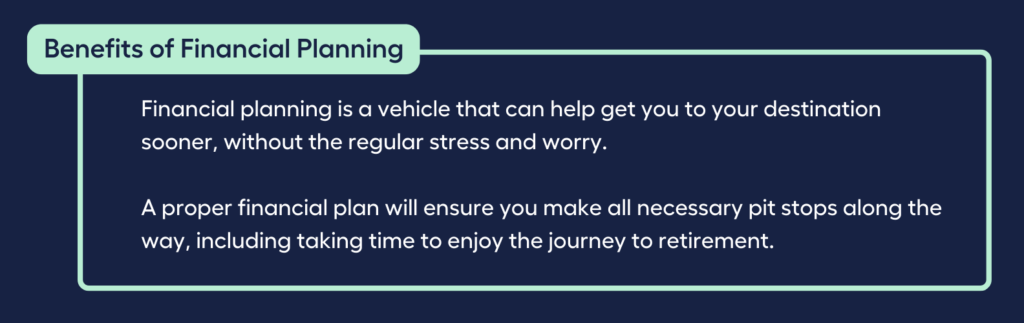

Benefits of Financial Planning

If we consider our financial situation as a journey from beginning to end with pit stops and ‘time to smell the roses’, then consider this:

Financial planning is a vehicle that can help get you to your destination sooner,

without the regular stress and worry. A proper financial plan will ensure you make all necessary pit stops along the way, including taking time to enjoy the journey to retirement.

To simplify things, we identified the 7 Main Benefits of Financial Planning:

1. Helps Define Personal and Financial Goals

2. Keeps You On Track

3. Efficiently Manage Your Personal Finances

4. Provide a Guide for Financial Decisions to Improve Results

5. Achieve the Main Goal of Financial Planning

6. Keep Calm When Faced With Financial Risks

7. Improves Your Financial Security & Financial Position

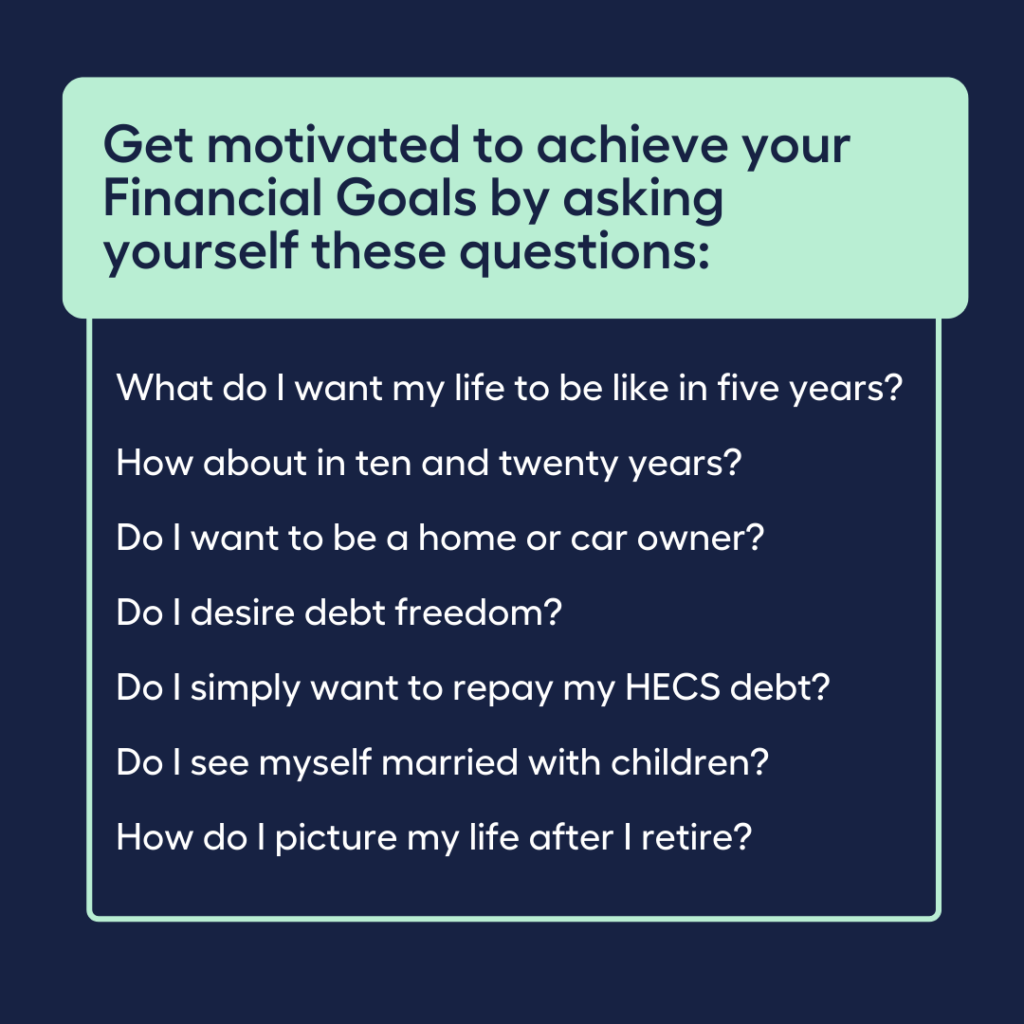

Helps Define Personal and Financial Goals

Your financial goals serve as a guide for a sound financial plan.

Saving will feel more deliberate if you approach financial planning from the perspective of what money can achieve for you, whether that’s helping you buy a house or retire early.

Make your financial goals a source of motivation by asking these questions:

What do I want my life to be like in five years?

How about in ten and twenty years?

Do I want to be a home or car owner?

Do I desire to be free of debt?

Do I simply want to repay my HECS debt?

Do I see myself married with children?

How do I picture my life after I retire?

Your goals also serve as a focal point to work towards.

Having specific goals will help your financial advisor create a plan that provides you with the specific steps you need to take to reach them.

Having a Written Financial Plan to Keep You On Track

Have you ever tried going to the supermarket without a grocery list?

You’ll end up pushing your trolley from aisle to aisle, like a lost traveller, as you try to remember the items you need to buy. Grocery shopping without a list will take up more of your time and you may even forget to buy some items, or even go over budget buying things you don’t really need.

Likewise, a written financial plan serves as a roadmap, a direction, and a reminder of your objectives—what you hope to accomplish both in the short and long term. It outlines the potential costs you can incur and explores ways to control them.

Having a written financial plan enables you to maximise your assets, ensures that you achieve your objectives, and gives you the assurance you need to handle any hiccups along the way.

Manage Your Personal Finances More Efficiently

According to a University of Melbourne study, the majority of Australians (77%) have financial regrets.

The top three regrets are behavioural in nature:

- not saving,

- investing,

- or budgeting.

The fourth being the lack of financial education.

In fact, 20% of Australians surveyed had savings totalling less than $1,000, and 50% had $10,000 in savings.

A financial planner’s advice can help address these behavioural regrets and educate their clients at the same time.

Financial planning leads to the creation of an efficient and strategic plan incorporating things like investing and saving for retirement, starting a new business, and protecting and preserving wealth.

Provides Guidance for Decision-Making To Improve Financial Outcomes

The top 4 financial regrets mentioned in benefit #3 could serve as clues to deeper reasons why Aussies feel this way.

Let’s take a closer look at some of the reasons why making financial decisions can sometimes seem difficult:

- There is a lot of stress and guilt associated with money.

- People feel uncomfortable discussing money.

- Personal finances frequently include terms that many people are unfamiliar with.

- Financial decisions are often big decisions with long-term consequences, either negatively or positively affecting your financial future.

- Financial decisions can be difficult when there are so many options available.

Which of these reasons resonate with you?

While all these reasons are valid, there is a way to avoid turning financial decision-making into a guessing game:

Create a financial plan.

A financial plan can assist you in identifying specific actions to take to put you and your family in the best financial position possible. It is much easier to act confidently when a financial adviser explains what needs to be done instead of using the hit-and-hope approach.

Main Goal of Financial Planning

A person’s clearly defined goals are at the heart of a financial plan.

These may include:

- paying for a child’s education,

- purchasing a larger home for a growing family,

- starting a business,

- retiring early,

- or leaving a legacy.

Building Blocks of a Financial Plan:

- Retirement Plan

- Loan and Risk Management Strategy

- Long-term Investment Strategy

- Tax Reduction Strategy

- Estate Plan

It may be confusing to determine how to prioritise these building blocks, but a professional financial planner may be able to guide you in choosing a detailed plan that will allow you to nail your financial building blocks one by one.

Financial Risks – Like Investing – Are Less Scary with a Professional to Guide You

Imagine attempting to climb Mt. Everest without an experienced Sherpa and a map.

Even if you are physically fit and trained to climb to such high altitude, the emotional and mental pressure of traversing an extremely difficult terrain without an ascent plan and guide could most likely result in a failed attempt to reach the summit.

Similarly, hitting your financial goals on your own could give you the heebie-jeebies.

An experienced financial planner is like a Sherpa who can hike with you towards your financial goals using a sound blueprint and by providing guidance to make your journey less scary.

Think about it:

Having a comprehensive financial plan has emotional and mental health benefits. Individuals who have a plan are less stressed and more optimistic about their future than those who do not have a financial plan.

You are more likely to overcome setbacks if you have a plan in place.

More importantly, when people improve their lives in one area, it naturally spills over into other areas of their lives. This means that having a written financial plan can benefit not only your finances but also your overall health and well-being.

Improves Your Financial Security & Financial Position

Just like the goal of reaching the summit of Mt. Everest motivates climbers to attempt their ascent, having a financial plan enables you to start with the end goal in mind.

A financial plan could provide you with the necessary perspective to balance current goals and needs with financial future goals and needs.

A plan gives you the opportunity to focus on both your financial present and financial future.

People who have a written financial plan are two and a half times more likely to save enough money for retirement than those who do not.

What will your financial future look like if you have a financial plan in place that can help improve your financial security and financial position?

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Financial Planner for you with the help of My Money Sorted

When you book a call with My Money Sorted , you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with the right financial planner who can help simplify your family’s journey to financial wellness

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick property investment alternatives session with My Money Sorted

Step 2: Get matched with a licensed Finance Planner that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Financial Planner.

It’s that easy!

Want to get your money sorted? Speak with My Money Sorted about your financial planning needs today!