Before getting into a relationship, have you ever thought of this important factor that could make or break your future as a couple?

Money.

Couples Financial Planning is a topic that only a few people are comfortable discussing even if it has long been known that it is one of the main sources of stress in relationships.

Experts say the success of a relationship will be greatly influenced by the couple’s financial compatibility.

Financial compatibility does not imply that you should look for a partner who is in the same financial situation as you. Rather, financial compatibility is based on your respective attitudes towards saving and spending money.

As newlyweds and new couples, any decisions you make or don’t make will be influenced by money.

Will you purchase a home, have children, or retire early?

Each of those things necessitates considerable financial planning, and if you are not on the same page or share the same money values, it may lead to problems down the road. For this article, I’ve prepared some practical financial planning tips for newlyweds and new couples, which are also relevant for couples who have been together much longer.

Jump straight to…

How Do New Couples Manage Their Finances?

The subject of money, like everything else in your relationship, boils down to communication skills.

A conversation is the only way to determine your financial compatibility.

It’s never too late to start talking about money, no matter where you are in your relationship. To begin, learn about each other’s financial histories.

Ensure You Know Each Others Financial History

Every person has a financial background. Our family history and life experiences have an impact on how we view money now.

Therefore, when we start a relationship and start to combine our finances with our partner, we are also combining years of ingrained spending and saving habits, financial messages from our families, and a connection that has been built around money. According to The Center for Growth, there are eight important areas for you to consider when discussing your financial histories.

8 Key Areas That Influence an Individual’s Financial History

1. Financial Decisions: How did your parents manage their money? Who took care of transactions, and who made the significant financial decisions?

2. Financial Education: How did you feel about money growing up? Did your parents borrow money? Did they teach you to save or take risks?

3. Financial Literacy: Did your parents have a joint bank account? Did they ever discuss assets, investments, or saving in front of you and your siblings?

4. Financial Literacy Skills: What are your memories of learning about various financial processes? At what age did you start saving? Were you taught about investing?

5. Financial Advice: Do you remember any common practices, like negotiating a purchase, or expressions such as “money doesn’t grow on trees”, that your parents had?

6. Financial Management: Did your parents ever make any important financial decisions that had a long-term effect on you?

7. Sense of Trust: How much do you trust others with your money? How much access to your savings will you give your spouse?

8. Financial Values: What financial values do you think you and your spouse may share? Do any of these make managing your finances as a couple difficult or easy?

These are just a few of the many questions about money and your financial history. It could help connect some dots and gain understanding of your partner’s financial habits as well as your own.

Understanding your past gives you the chance to reflect on and possibly alter your financial habits and presumptions so that you are better prepared to meet your current and future financial obligations.

Discuss Debts & Make a Plan to Reduce Debt

By developing a shared understanding of your financial histories, you and your partner can create a financial plan to ultimately succeed at whatever issue or difficulty you face, including coming up with a strategy for dealing with debt.

Although neither of you need to be perfect, you must be on the same page and willing to work through any money issues that may arise in the future.

Once on the same page, you can move along to the next stage: debt reduction.

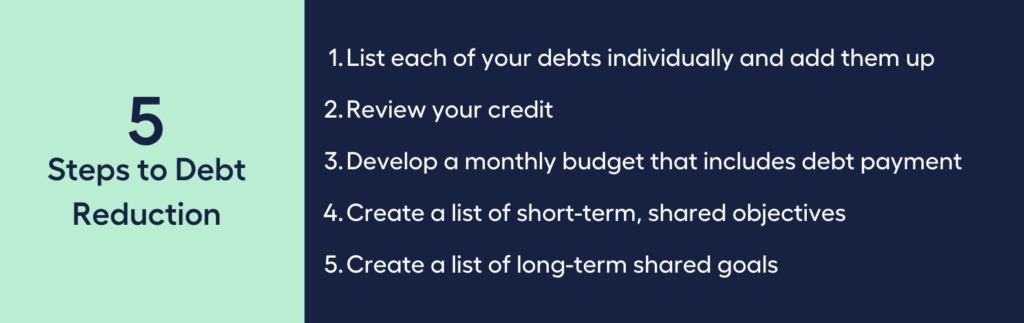

5 Steps to Debt Reduction

- List each of your debts individually and add them up

- Review your credit

- Develop a monthly budget that includes debt payment

- Create a list of short-term, shared objectives

- Create a list of long-term shared goals

Step 1:

List each person’s debts individually and add them up

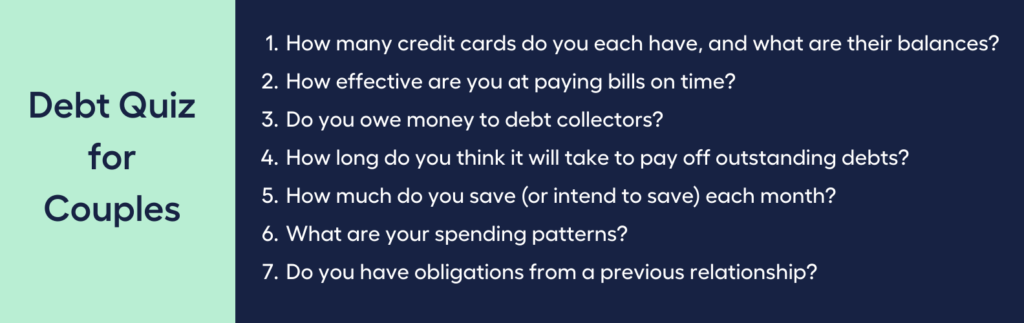

Once more, it’s crucial to be sincere and make the dialogue a “no-punishment” discussion. The debt quiz for couples below could be helpful in your conversation.

Debt Quiz for Couples

- How many credit cards do you each have, and what are their balances?

- How effective are you at paying bills on time?

- Do you owe money to debt collectors?

- How long do you think it will take to pay off outstanding debts?

- How much do you save (or intend to save) each month?

- What are your spending patterns?

- Do you have obligations from a previous relationship?

Step 2:

Review Your Credit

This is especially important if you are unsure about all of your debts. You can access your credit report from the following credit reporting agencies:

Because credit reporting bodies may have different information about you, you may need to request a copy of your credit report from each one.

Step 3:

Develop a monthly budget that includes debt payment

Each may now share how much they earn (gross and net income) and spend in a month, which could greatly help in creating a budget and keeping track of monthly expenses.

Determine areas where you and your partner can cut costs after tallying a month’s worth of expenses. This will make it easier for you to keep track of debt repayment.

You can simplify the process and have a better understanding of your income and expenses by using the MMS Budget Planner calculator.

Step 4:

Create a List of Short-term, Shared Objectives

Start with small and manageable immediate goals:

✓ Create an emergency fund by saving at least 5% of your earnings per pay period or month.

✓ Pay off any loans with high interest rates.

✓ Contact debt collection agencies and, depending on what is most reasonable for you, negotiate out a monthly repayment schedule or a settlement amount.

Step 5:

Create a List of Long-term, Shared Goals

Once you’ve determined your short-term goals, it’s important to build towards financial stability.

Setting long-term objectives can reduce your risk of re-entering the debt trap, help you maintain manageable spending levels, and get into the habit of saving.

Discuss Spending Habits & Personal Finances

If you and your spouse don’t know what your respective financial situations are, it will be nearly impossible to plan for your financial future.

The first thing you may want to do is reveal your respective financial situations.

![Money Matters Your Spouse Should Know About You]](https://mymoneysorted.com.au/wp-content/uploads/2022/09/Money-Matters-Your-Spouse-Should-Know-About-You-1024x323.png)

This is where you go over the fundamentals to help set the foundation for your personal financial plans as a couple.

Money Matters Your Spouse Should Know About You

- How much is your personal income?

- Do you have a savings account?

- What assets do you have?

- How much is your debt?

- Do you have an investment?

- Do you have insurance?

- How do you ensure proper management of your accounts?

- How are your bills paid?

- How much do you spend and save in a month?

- How passionate are you with budgeting? (or if you budget at all)

It’s not about exhibiting your financial literacy but, rather, how you make financial decisions.

Create a Household Budget Together

One of the less spoken about aspects of marriage is making a budget with your partner. Creating a household budget will serve as a framework for preventing financial arguments.

Step 1: Establish S.M.A.R.T. Goals

To make sure you are making plans for both the present and the future, divide your financial goals into short-, medium-, and long-range categories.

Your budget’s general structure will be significantly influenced by your short-, medium-, and long-term financial objectives.

Step 2: Calculate Your Total Net Income

Once your financial objectives have been determined, assess your monthly earnings. Use your net monthly income, or take-home pay, to create a budget. This is the sum you are given before you start spending.

You can simplify the process and have a better understanding of your income and expenses by using the MMS Budget Planner calculator.

Step 3: List and Add Up Mandatory Expenses

You’ll have some things you pay for each each month as part of your mandatory expenses. Examples include housing rent or mortgage, as well as payments for cars, gas, parking, utilities, school loans, other loans, insurance, credit card bills, and groceries.

Deduct mandatory expenses from your net income.

Step 4: Calculate How Much You Need to Save

To calculate how much you need to save in order to achieve your financial goals, refer to your goals in Step 1.

Deduct the amount you need to save in Step 1 from the money left over in Step 3. That is the amount available for the next category—discretionary spending.

Step 5: Divide Discretionary Spending

Discretionary spending is spending money on your wants, not your needs.

This exercise should be fun!

All potential discretionary spending should be listed and divided into “shared” and “individual” categories.

Spending that is not required but is nonetheless within a monthly budget is known as discretionary spending.

Generate Passive Income.

| A Simple Household Budget | ||

| Total Monthly Net Income | $8,000.00 | see Step 2 |

| Less Mandatory Expenses | -$4,000.00 | see Step 3 |

| Balance | $4,000.00 | see Step 3 |

| Less Savings for SMART Goals | -$3,000.00 | see Step 4 |

| Discretionary Income | $1,000.00 |

Creating a budget can keep money conflicts to a minimum and help you and your partner achieve the goals you have set for yourselves.

Create Goals For Your Finances As A Couple

Here, you and your partner will discuss in depth not just how your finances currently stand but also how you currently plan to handle them, as well as whether or not your spending patterns and financial objectives mesh well together.

Imagine that you’ve always wanted to own a home and that you’d like to do it as soon as possible.

Is your spouse on board with the idea of forgoing major expenses like holidays or paying rent for a home in a desirable location until you have enough money for a deposit?

On the other hand, suppose your partner had extremely ambitious financial goals.

Would you be motivated to work towards and make sacrifices for them?

Once more, it’s acceptable if your financial objectives now don’t line up exactly. To reach a state where a couple is content and fulfilled, both financially and otherwise, you simply need to be willing to make concessions.

Decide How to Share Finances – Separate Accounts or Joint Account?

When a couple decides they are in it for the long haul, some decide to open a joint bank account, while others prefer to have separate bank accounts and maintain their financial independence for the rest of their life.

Even if you and your partner don’t combine your accounts anytime soon — or ever — their financial situation will affect yours.

In any case, whether to combine accounts or not ultimately comes down to personal preference. You might believe that being separate account holders is necessary for your protection.

However, some people might favour creating joint accounts in order to make things as simple as possible. The majority of the items you spend money on will likely be shared, so it’s still important to be on the same page when it comes to budgeting.

Open Accounts for Different Goals

It can be difficult to combine your savings with your partner’s. You’ll need to plan the logistics in addition to deciding how much to spend and save as a pair.

Some couples create joint bank accounts. Some favour maintaining separate accounts. Others choose to open a joint account and link it to each of their individual accounts.

This will allow you to pay for shared expenses while maintaining each of your own transaction and savings accounts.

You might also think about combining some of these options; for instance, opening joint transaction and savings accounts while being separate credit card account holders.

Maintaining a credit card in your own name will enable you to keep developing your personal credit.

High Interest Savings Account for Financial Goals

High interest savings accounts typically earn more than other accounts since they offer higher interest rates. These are often online and without a debit card, thus it is more difficult to withdraw cash from your bank account

The interest rate on a competitive savings account is around 1% or higher. An interest rate on a transaction account will typically range from 0% to 0.5%.

| What is a High Interest Savings Account good for? | |

| Purpose | Example |

| Short-term goals (1-2 years) | New carFamily holiday |

| Large purchase | Deposit for a home purchase |

High-yield savings accounts are an excellent way to save money for short-term goals or needs that will be met within a year or two, such as a family holiday or a new car.

A high-yield savings account can be extremely beneficial when saving for a large purchase, such as a deposit on a home. If you put your money in a high-yield savings account, you will earn more through compound interest.

Start a Separate Emergency Fund

An emergency fund is money set aside to cover unexpected or urgent expenses. This could include car repairs, unanticipated travel, or an unexpected medical bill.

It acts as a financial safety net, preventing you from having to borrow money if something bad happens to you or your family.

Even if you can only save a small amount, start now and keep saving. The more you can save on a regular basis, the better.

If you save $20 per week, you’ll have more than $1,040 by the end of the year. That’s the start of a substantial savings account to give you some financial breathing room.

Aim for having enough in your emergency fund to cover three months of expenses.

Accounts for Bills and Monthly Expenses

Having a separate bank account only for bills can protect you against overspending.

Maintaining a separate bank account for bills may assist you in ensuring that you have enough money to pay your bills each month. You could also easily set up automatic bill payments or direct debits to avoid missing payments.

Look for a bank that offers a low or zero transaction fees.

Discuss and Review Your Finances Regularly – Especially Important for Couples

Every month, set aside time for a “money date” to check in and reassess your objectives.

Regular financial discussions will keep you and your spouse on the same page and motivated to accomplish your objectives.

Considering that your budget will handle most of the work, the conversation doesn’t need to last for five hours.

A fun way to spend time with your partner while managing your finances is to talk about your budget over a glass of wine or while going for a walk.

Retirement and Estate Planning: Work with a Financial Advisor to Plan for the Future

Thinking about your retirement objectives and how long you have to achieve them is the first step in retirement planning.

Then you should consider super and different investment options that can assist you in creating the wealth necessary to finance your future. You must invest the money you save in order for it to grow.

The final aspect of preparing your financial plan is taxes:

While you are saving for the future, there are strategies to reduce the retirement tax hit—and ways to carry on the process when you actually stop working.

As it turns out, the management of various accounts—from a bank account to an investment account, a joint account to a mortgage account—can be confusing if you’re doing it on your own as a couple.

It shouldn’t be so challenging if you work with a financial advisor.

Find the right Financial Advisor for you with the help of My Money Sorted

When you book a call with My Money Sorted , you’ll:

✓ get a clear picture of your financial options

✓ have an idea of the experts you can call on to help you reach your financial goals

✓ be matched with the right financial advisor who can help create the best financial plan for your family

My Money Sorted is your stress-free pathway to getting ahead with your money goals. Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a Finance Advisor that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by a Financial Advisor

It’s that easy!

Need Financial Advice for Couples? Contact My Money Sorted Today to Find Out How You Can Get Your Money Sorted Sooner