This year’s International Women’s Day 2023 (IWD 2023) #EmbraceEquity campaign aims to spark conversations around the world about the importance of understanding the difference between equity and equality and how they impact our lives, especially when it comes to money matters.

Before sharing the importance of equity playing a crucial role in money matters, it’s important to understand the difference between equality and equity. These two terms may sound similar, but they have different meanings.

Jump straight to…

Equality vs Equity: An Explanation

Defining Equality

Equality means treating everyone the same, regardless of their unique circumstances. It’s also common to connect equality with fairness and sameness under the premise that everyone will benefit from a one-size-fits-all solution.

But think about this:

Treating everyone exactly the same in the hopes of achieving equality assumes that everyone started at the same point.

However, people come from different backgrounds and have different life experiences that shape who they are and what they need to succeed. In other words, simply giving everyone the same thing doesn’t always guarantee that we’ll all end up on an equal playing field.

Defining Equity

Equity means recognising individual differences and addressing them to ensure everyone has access to the same opportunities and resources. In other words, equity means not giving everyone exactly the same thing, but rather providing what is required for success.

How Money Matters Impact Equity

Now, let’s talk about how equality and equity matters when it comes to finances. Unfortunately, women may face many challenges that can make it difficult for them to achieve financial stability and success.

Some of these challenges include:

- gender pay gap

- unequal access to credit, and

- discrimination in the workplace

- For example, Australian women earn just 87 cents for every dollar earned by men.

What does pay inequality mean when it comes to equity in money matters?

The Organisation for Economic Co-operation (OECD) has reported that:

- This results in women earning significantly less over their lifetime

- Women are more likely to work in low-paying industries

- Women are more likely to take time off work to care for children and elderly relatives

- This leads to lower superannuation balances and reduced financial security in retirement

By embracing equity in money matters, we can create a more just and equitable society where everyone has the opportunities and resources they need to succeed, regardless of their gender or other individual differences.

The Motherhood Penalty

What is Meant by the Motherhood Penalty?

The Motherhood Penalty refers to the reduction in wages and career advancement opportunities that mothers may face after having a child. This penalty is unique to women and does not affect men in the same way.

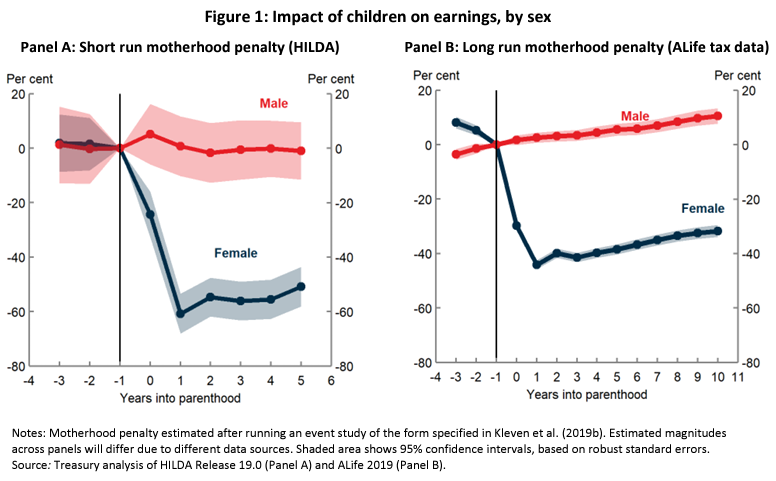

A report from the Australian Treasury in October 2022 on Children and the gender earnings gap has revealed that the arrival of children reduces women’s earnings by an average of 55% across the first five years of parenthood (check out Figure 1 Panel A). In comparison, most men’s earnings remain unaffected by entry into parenthood.

Unfortunately, this penalty may persist for at least a decade into parenthood, with only a slight recovery in later years (see Figure 1 Panel B). Ten years after the birth of their first child, women’s earnings are down more than 40% compared to their previous income.

For women who only have one child – the penalty is smaller than for those with multiple children. However, for women with one child, statistics have revealed that there is still no significant earnings recovery at year 5 when kids typically start school.

- This significant gap between men’s and women’s earnings in Australia can hold back our entire economy.

Understanding Domestic Labour

Domestic labour refers to the unpaid work performed in households such as cooking, cleaning, and childcare.

- According to the Organisation for Economic Co-operation and Development (OECD), women spend an average of 4.5 hours per day on unpaid care work, compared to men’s 1.5 hours per day.

This means that women are doing three times more unpaid work than men, which has a significant impact on their ability to advance their careers.

Financial Impact of the ‘Motherhood Penalty’

The financial impact for mothers who take time off work to care for their children may face reduced superannuation, lower wages, and fewer opportunities for career advancement. This penalty results in reduced financial stability, lower retirement savings, and increased risk of poverty as women get older.

How To Embrace Equity in These Money Matters?

Personal Solutions

Raising a family may come with a hefty financial burden, and unfortunately, as statistics have shown women tend to feel the impact the most. That’s why having a solid financial plan in place is crucial for ensuring you and your family are well-prepared for any challenges that may come your way.

So, where do you start?

Create a Financial Plan with a Women’s Financial Planning Specialist

Well, the first step you can take would be to speak with a financial planner who specialises in women’s financial planning. These experts may have a better understanding of the unique challenges women face and can help you create a family financial plan that supports your family’s needs while allowing you to maintain financial independence throughout motherhood.

Consider Spouse Super Contributions

- Women in Australia are at risk of experiencing financial hardship in their later years.

So, what can be done to prevent financial hardship in retirement for women?

If you’re a couple, you may want to consider contributing to your spouse’s superannuation (a non-concessional contribution). This could be an effective way to help balance the impact of these factors and ensure your partner has a sufficient superannuation balance in retirement.

- An alternative to making spouse super contributions is Contribution splitting, whereby you can share up to 85% of your before-tax super contributions made in the previous financial year.

The definition of a spouse for this application includes a person you are legally married to, in a registered relationship under certain state or territory laws, or who lives with you on a genuine domestic basis in a relationship as a couple (known as a ‘de facto spouse’).

Another alternative you may want to consider as part of your retirement plan is the Low Income Super Tax Offset (LISTO). It’s a payment that eligible individuals with an adjusted taxable income up to $37,000 receive in their super fund effective 1 July 2017. It replaces the Low Income Super Contribution (LISC) that was repealed from 1 July 2017.

The amount you receive is calculated on 15% of the concessional (before tax) super contributions that you or your employer pays into your super fund. The maximum payment you can receive for a financial year is $500, and the minimum is $10. If you’re eligible for less than $10, the amount will be rounded up to $10.

The best part?

If you’ve reached your ‘preservation age’ and are retired, you can apply to have your LISTO paid directly to you. This is especially helpful for women who may have lower super balances and need extra income during retirement.

Additionally, women may want to take an active role in their own retirement planning. This means understanding their superannuation balance, choosing an investment strategy suitable for their situation and goals, and seeking financial advice when necessary.

Women may be vulnerable to financial hardship in their later years, but there are steps you may take to help prevent this. By considering strategies such as spouse superannuation contributions, contribution splitting, super co-contribution and taking an active role in retirement planning, women can work to provide themselves with a financially secure retirement.

Creating a Household Budget

Household budgeting relates to how you distribute income, and how you value each person’s contribution to the household can be important to discuss with your partner to ensure you are both on the same page. It may not be an easy conversation to have, especially if you’re in a situation where some people may be earning more than others.

Creating a household budget is all about figuring out how to allocate your income to cover expenses, and it’s important to have a clear understanding of each person’s contribution to the household. This can be a sensitive topic, especially if there are income disparities between you and your partner.

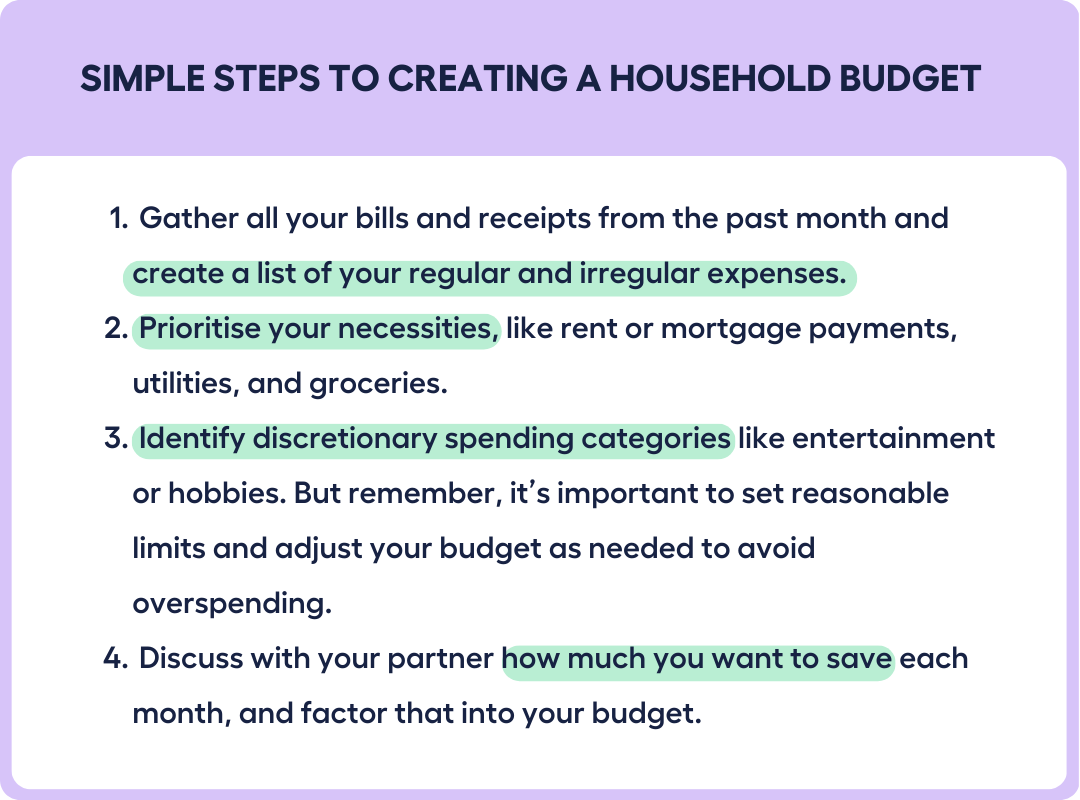

Here are the Simple Steps to Creating a Household Budget:

- Gather all your bills and receipts from the past month and create a list of your regular and irregular expenses.

- Prioritise your necessities, like rent or mortgage payments, utilities, and groceries.

- Identify discretionary spending categories like entertainment or hobbies. But remember, it’s important to set reasonable limits and adjust your budget as needed to avoid overspending.

- Discuss with your partner how much you want to save each month, and factor that into your budget.

Keep in mind that creating a budget can be an ongoing process, and it’s important to communicate with your partner regularly.

Discussing each person’s contribution to the household can be difficult, but it’s necessary to ensure that you’re both on the same page. By openly communicating about your finances, you’ll be better equipped to make informed decisions about your budget and work towards your financial goals.

Starting an Investment Portfolio

Have you thought of starting an investment portfolio to secure your financial future but don’t know how to begin?

You’re not alone.

According to Fidelity Investment’s 2021 Women in Investing Study, more women are making investments than ever before, with a forecast that by 2021,

67% of women would have invested outside of retirement plans, up from 44% in 2018.

Are you ready to take the plunge into the world of investing?

Here are 3 Tips to Help You Get You Started:

Build your financial confidence through micro-investing

If you’re a woman and not sure where to start when it comes to investing your money, micro-investing is one option to break into the investing world. If you’re on a tight budget or don’t have much experience in the investing game, micro-investing may help ease you in.

It involves investing small amounts of money on a regular basis, typically using a mobile app or online platform. By doing this, you can slowly build up your investment portfolio over time without breaking the bank. It may also slowly build your confidence when it comes to investing your money. Once you become familiar with micro-investing, you may decide to take the next step and begin investing in stocks, ETFs, property and bonds, which is a great way to build your wealth over time.

Figure out your Investment Goals

Setting investment goals is an essential part of any financial plan, and it’s important to have both short-term and long-term goals in mind.

Let’s start with short-term goals. These are the things you want to achieve in the next few years, such as buying a car, going on a wellness retreat, or saving for a deposit on a house. When setting your short-term investment goals, think about how much money you’ll need and how long you have to save.

Now, let’s talk about long-term goals. These are the things you want to achieve in the next 10, 20, or even 30 years, such as retiring comfortably or buying an investment property. When setting your long-term investment goals, it’s important to consider factors such as inflation, market fluctuations, and your risk tolerance.

Questions to help you identify your investment goals:

- What do I want to achieve with my investments?

- Am I looking at generating income, building wealth, or both?

- Is there a place I’ve been wanting to travel to?

- Do I want to retire early? Or what does my dream retirement look like?

Choose your Investment Strategy

There are many investment strategies to choose from, including growth investing, value investing, and income investing. Each strategy has its own unique risks and benefits, so it’s important to choose one that’s aligned with your goals and risk tolerance. You’ll want to do your due diligence on any investment opportunity before putting your money into it. If you’re not confident in your ability to choose your own investments, consider working with a financial advisor.

According to a 2020 Investor Study by the Australian Securities Exchange,

men make up 58% of direct sharemarket investors in Australia while women make up 42%.

Even if the percentage of female investors has risen significantly in the decade to 2020—up 45% compared to 31% in the decade to 2010—the quantity invested by women is still far lower than that of men.

But a more recent study conducted by Fidelity has revealed that the investment landscape is slowly changing.

In the 2021 Women in Investing Study, data shows that since the onset of the pandemic,

50% of women say they are more interested in investing, and 42% of women think they have more money to invest.

Starting an investment portfolio can seem daunting, but with the right strategy, mindset, and support, it’s possible to build a solid foundation for your financial future tailored to your risk tolerance.

To help you get started, you can check out our guides on superannuation, investments, and financial planning. If you’re ready to make the first step, you can have a chat with the My Money Sorted team to help you build an investment portfolio tailored for your specific needs and circumstances.

Tools & Resources to Help Women Get Their Money Sorted

But where do you start?

The most significant and impactful steps women can take is to:

- Look for ways to become financially savvy – this can look like taking financial courses, engaging in money coaching or even speaking with your financial advisor about your individual finances.

- You may want to think about money in the long-term, not the short-term – this looks like getting your superannuation sorted and getting comfortable with investing.

- Superannuation is a cornerstone of your retirement funds and yet, women have an average of 52.8% less superannuation at retirement than men. Taking the time to find the right super fund and making the switch as soon as possible can have a significant long-term impact on your retirement outcomes.

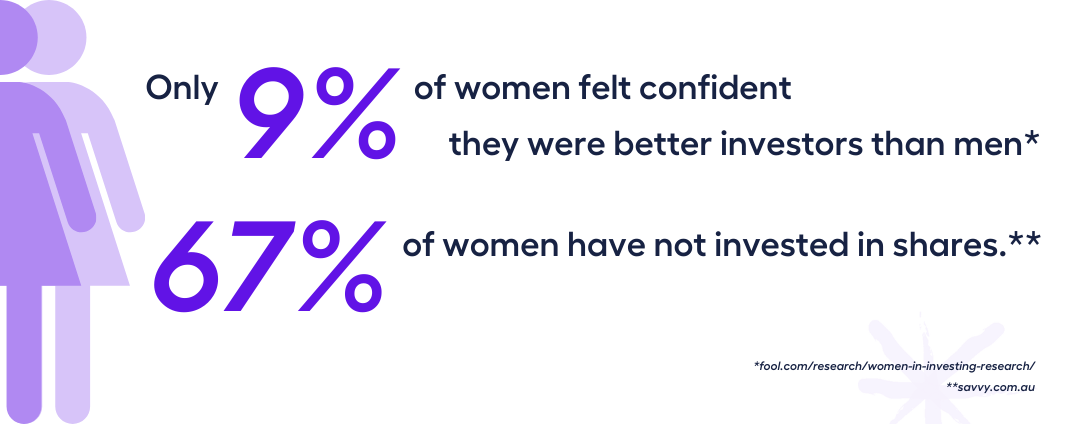

- Investments can be an incredible means of wealth generation, even when you aren’t able to invest large amounts of money. There are a lot of misconceptions and mysteries around investing, and women disproportionately lack the confidence and resources they think they need to invest, which is why 67% of Australian women have not invested in shares, compared to 53% of men.

At My Money Sorted, our goal is to help as many Australians as we can to improve their present financial situation and set themselves up for long-term money success.

Here are some tools, resources and guides that may help to set you on the path to long-term financial security.

Superannuation Tips

Getting your superannuation sorted may be considered a top priority for anyone wanting to make an impact on their long-term financial security.

We have a number of tips and guides that can assist you with ensuring your super is up-to-date and working hard for your retirement.

- Compare Super Funds – choosing a super fund is an important decision and it’s one you should keep reviewing based on your fund performance. Read more here about comparing and choosing super funds.

- Find My Super – locate missing superannuation funds and consolidate them into your chosen super fund. Learn how you can find your super.

- Contributing to Your Super – find out what the difference is between Concessional Contributions and Non-Concessional Contributions, and how they can help build your superannuation faster.

To make getting your super sorted easier, the female-founded Super Fierce – a superannuation service made for women, by women – provides a FREE report on the lowest-fee funds that can maximise your super returns. This report shows you how much extra super you can have for retirement by switching from your existing super fund, including what this looks like as your weekly retirement income. Super Fierce also offers a one-off fee (which can be paid from a card or your super) to manage the switch for you.

The process includes:

- a quick video call to get you started;

- insurance-in-super health checkup to ensure you are getting the insurance (Death, TPD and/or Income) you want through your super;

- getting you set up in the right investment category;

- finding and consolidating any forgotten funds;

- taking care of all the paperwork for you along the way, plus so much more!

As a profit-for-purpose business, Super Fierce also donates 10% of this fee to Fierce Impact to fund social impact initiatives that help marginalised women across Australia. Cut out all the noise and let the experts do the research for you – get your free super switch report today.

Guides to Investing

Investing is still one of the primary financial activities in which the majority of women still lack confidence – even those who are financially educated and understand how investing works.

Investing is crucial to generating long-term wealth and securing a comfortable retirement. Our guides to investing can be a great place to start building the confidence needed to start building an investment portfolio as part of your financial plan.

- The Complete Guide to Investments – from distinguishing the different types of investments to investment strategies and how to get started, this guide can help you start the investment chapter of your financial plan.

- Best Investments for Retirement in Australia – our investment choices are part of a robust retirement plan and can have a significant impact on our retirement income. Learn more about the best investments for retirement.

- The Guide to Ethical Investing in Australia – if you’re ready to start investing but want to take an ethical approach with your investments, then our guide to ethical investing can help.

Money Courses to Get Your Money Sorted: Wealth Accelerator Program

There are a variety of in-person and online courses, webinars and money challenges that can help women to get their money sorted or make their money work harder for them – some free and some paid. You’ll find that free courses and challenges can be helpful and point you in the right direction, paid courses will often provide more value and guidance that results in long-term change.

In saying that, any education you can invest in for your financial future will be worth it!

For example, My Money Sorted’s Wealth Accelerator program was developed to help Australians make changes to secure their financial future and understand the value of financial advice.

Improving your finances doesn’t have to be confusing or complicated, in fact, our Wealth Accelerator Program makes it simple.

During the program, you’ll receive:

✓ 3 x 45 min Wealth Workshop Sessions

✓ Coaching & Guidance from an experienced financial expert

✓ Analysis of the 5 key areas of your finances

✓ Review of your biggest opportunities to save & make more money in 2023

✓ A customised Wealth Report

Our goal for this program is to help Aussies learn how they can eliminate the day-to-day money stress and start living a richer life sooner. If this sounds like something you’re looking for, contact our My Money Sorted team to learn more about the program and how to get started.

Money Calculators

Money calculators can be a great way to get started with sorting your finances and taking an in-depth look at your current money goals, ingoings and outgoings, refinancing any existing loans, and planning big money moves.

My Money Sorted’s finance calculators include a Budget Planner, Borrowing Power and Refinance calculators, Personal Loan and Loan Comparison calculators, Income Tax calculator, and Deposit and Expense Planners.

Not Sure What Steps You Need to Take to Ensure Your Financial Security? Contact the My Money Sorted Team!

We’re passionate about helping as many Aussies as we can to get their money sorted, because no one should have to live with financial stress.

If you’ve been inspired this International Women’s Day to prioritise your and your family’s financial future, but you’re unsure what the first steps should be, our team would love to speak with you. You can contact our team by booking a free call at a time that suits you or sending us an email with your questions and details – from here we can discover what your needs might be and can put you in touch with a range of financial experts.