Imagine your dream home. Imagine standing in front of it.

A sun-drenched house with a sprawling deck surrounded by a picture-perfect garden. It’s the perfect place for your children to grow up. The local school, just a short walk away, boasted excellent academic standards and a vibrant community of parents and children.

As you stroll through the neighbourhood, you’re warmly welcomed by future neighbours, who share stories of neighbourhood barbecues and festive celebrations that would soon become part of your lives.

But your bank won’t lend you enough money to purchase the property.

Why?

They say your Loan to Valuation Ratio (LVR) isn’t good enough.

Should you have a higher LVR? A lower LVR? What is it?

In this article, we’ll explain what loan to value ratio means, how it relates to investing, and why it matters.

Jump straight to…

Overview: What is LVR in Finance?

In finance, the loan-to-valuation ratio (LVR) is a financial measure used to evaluate loan risk. It is especially used in real estate or securities lending, by comparing the loan amount to the collateral value or property price.

The loan-to-value ratio (LVR) represents the ratio of the loan amount to the appraised value or market value of the property being used as collateral for the loan.

For example, if you wish to buy a house with a property price of $800,000 and borrow $600,000 from a bank, your LVR is 75% because you’re borrowing 75% of the house’s value.

LVR is a key factor in deciding if a borrower is eligible for a loan. A high LVR means that you’re borrowing a lot of money compared to the value of your home, which could lead to higher fees or stricter requirements.

A low LVR means that the owner has put in a lot of money, which could mean lower risks and better loan terms. Thus the bigger your deposit amount on a home or investment property, the lower your LVR.

The LVR that banks will let you borrow relies on the home loan amount, where your property is, your credit history, how much money you make, your employment status, and the type of loan you want.

One more thing, people often think that the LVR is a fixed number. Not at all. Your LVR will change if the value or price of your property increases (or decreases) or if you decide to borrow more money on your current mortgage.

So, in a nutshell, LVR is a means to determine how much you’re borrowing compared to the value of something, and it helps banks decide whether or not to lend you money and on what terms.

Does LVR include closing costs?

Upfront costs are not included in the loan amount for LVR calculations.

Upfront costs are the fees and expenses associated with finalising a real estate transaction. This includes conveyancing, stamp duty, appraisal fees, title insurance, and legal fees, among others.

While upfront costs are not included in the LVR calculation, they are important to consider when budgeting for a real estate purchase because they are additional expenses that the buyer needs to pay in addition to the deposit amount and the loan amount.

Buyers should be aware of both the deposit amount and the closing costs when planning for the total amount of funds needed to complete a real estate transaction.

Let’s use an example to show this:

Let’s say you want to buy a $500,000 house and are looking for a home loan to pay for it. You have saved $50,000 for a deposit, and you think that closing costs will cost you another $5,000.

Deposit Amount: You’ll contribute $50,000 as your deposit toward the purchase of the house.

Home Loan Amount: To calculate the loan amount, subtract the deposit from the property’s value:

![Calculating for Loan Amount]](https://mymoneysorted.com.au/wp-content/uploads/2023/09/1-4-1024x576.png)

Home Loan Amount = Property Value – Deposit

Loan Amount = $500,000 – $50,000

Home Loan Amount = $450,000

In this case, your home loan value is $450,000. But it’s important to remember that the $5,000 in closing costs are neither part of your deposit nor your loan amount.

Considering that your deposit of $50,000 is 10% of the property value, your lender will probably require you to pay lenders’ mortgage insurance (LMI). Home loan lenders often require borrowers to pay LMI if they lend more than 80% of the value of a property.

Note then that lenders’ mortgage insurance as well as upfront costs are neither part of your home loan nor your deposit.

Your home loan only looks at the home loan amount and the property value.

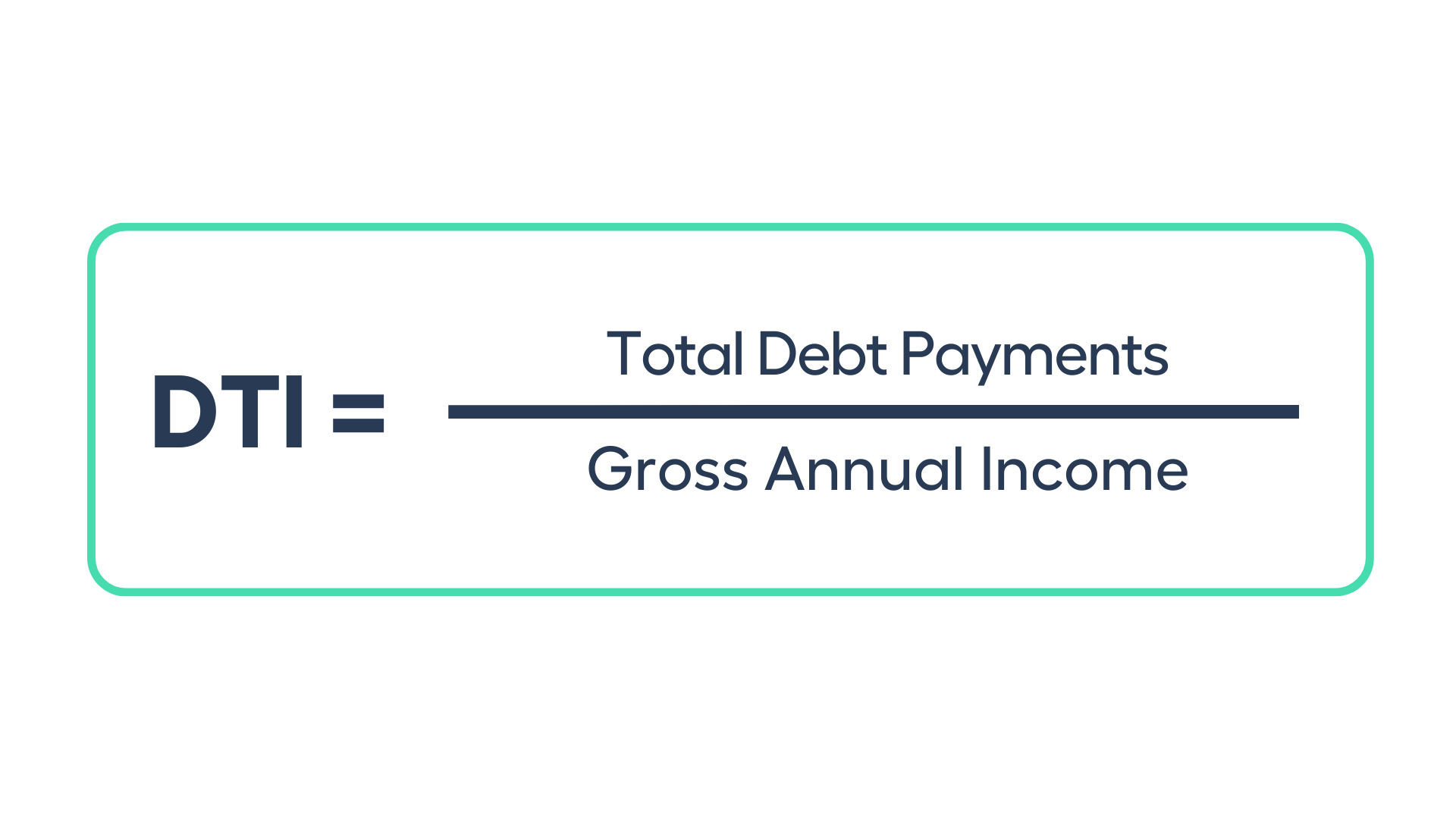

What is DTI for mortgage?

The debt-to-income ratio (DTI) is a financial indicator used by lenders, notably mortgage or home loan lenders, to assess a person’s ability to meet their home loan repayments.

DTI is one of the most important things that home loan lenders look at when deciding whether or not to give a client a home loan.

Most of the time, a lower DTI ratio is better because it means that you spend a smaller part of your income on debt payments. Most lenders have maximum DTI ratios they will allow, and borrowers with lower DTI ratios may be more likely to qualify for a home loan with better terms and interest rates.

In short, the Debt-to-Income (DTI) ratio for a mortgage is a way to compare how much you owe each month to how much you make each month.

Lenders look at it to see if you can pay your mortgage and other fees on time. It is an important part of the process when getting a mortgage.

The DTI ratio is expressed as a percentage and is calculated using the following formula:

Let’s use the same example above to illustrate the debt-to-income ratio for home loans.

Let’s say you have a loan amount of $450,000, you have no other debts, and have a gross annual income of $120,000.

What would your debt-to-income ratio (DTI) be?

That’s $450,000 divided by $120,000, which is equal to 3.75.

| Calculating Debt-to-Income Ratio | |

| Total Debts | $450,000 |

| Divided by Annual Income | $120,000 |

| Debt-to-Income Ratio | 3.75 |

Is this debt-to-income ratio good?

Home loan lenders usually look kindly on borrowers whose debt-to-income ratio is under 3.6.

Having a low debt-to-income ratio shows that you can handle your debt well. If a consumer has a low debt-to-income ratio, lenders may be more likely to offer them lower fees and rates and give them more loan choices.

A high debt-to-income relationship makes it harder for a person to get a loan. Generally speaking, a debt-to-income ratio of around 6 is considered high. Different institutions have different rules about what they look at, but if your debt-to-income ratio is 9 or higher, the big institutions probably won’t consider you for a loan.

All the big four banks have distinct debt-to-income ratios that they offer and accept based on their own processes:

- ANZ won’t approve your home loan application if you have a debt-to-income level of more than 9.

- Your home loan application must be manually approved by CommBank’s credit department if it comes with a debt-to-income ratio of more than 7.

- All home loan applications to National Australia Bank are limited to a debt-to-income level of 9.

- Westpac has a rule that if your debt-to-income ratio is 7 or higher, your home loan application will be sent to its credit staff for further review.

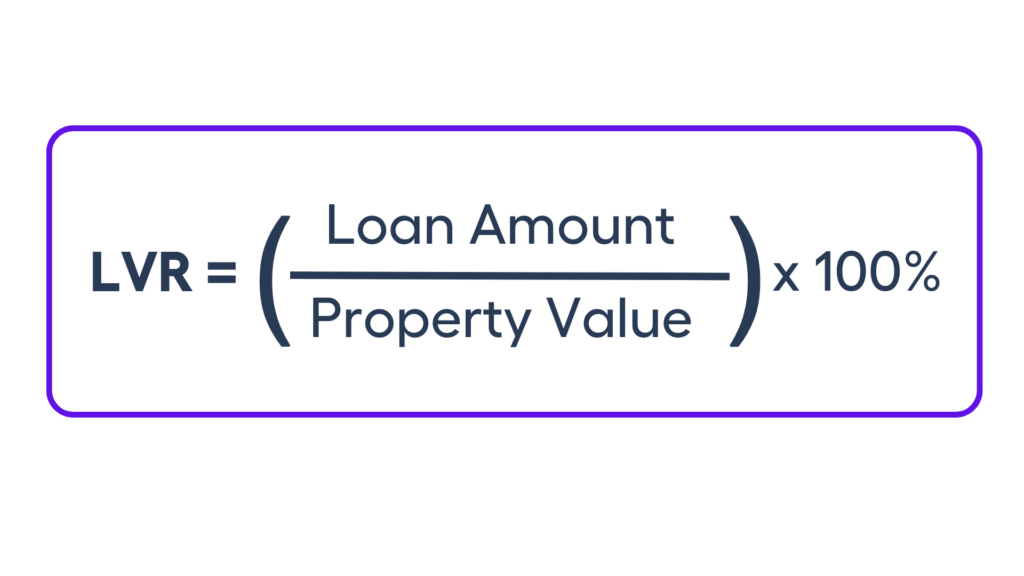

How Is Loan-to-Value Ratio Calculated?

The Loan-to-Value Ratio (LVR) is calculated by dividing the amount of the loan by the appraised value or the purchase price of the property, depending on which is lower.

The formula for calculating the LVR is as follows:

Here’s how it works step by step:

Loan Amount: This is the total amount of money you are borrowing from a lender to purchase a property.

Property Value: The value of your property is determined by either the appraised value or the purchase price, whichever is lower. If the property has been appraised by a professional appraiser, you would use the appraised value. If you’re in a situation where the purchase price is lower than the appraised value (common in competitive real estate markets), you would use the purchase price.

Calculate the LVR: Divide the loan amount by the property value (either appraised or purchase price) and multiply the result by 100% to express the LVR as a percentage.

For example, let’s say you’re purchasing a home for $500,000, and you’re borrowing $400,000 from a lender. If the appraised value of the property is also $500,000, the LVR calculation would be:

LVR = ($400,000 / $500,000) x 100% = 80%

| Calculating Loan-to-Value Ratio | |

| Loan Amount | $400,000 |

| Divided by Property Value ($500,000) | $400,000 / $500,000 |

| Equivalent multiplied by 100% | 0.80 x 100% |

| Loan-to-Value Ratio (LVR) | 80% |

In this case, the LVR is 80%, which means you are borrowing 80% of the property’s value.

It’s important to note that LVR is a critical factor for lenders when evaluating your home loan application.

Lenders often have specific LVR limits or guidelines they follow to manage risk, and a high LVR can result in higher interest rates, the requirement for lenders’ mortgage insurance (LMI), or even loan denial in some cases.

Therefore, understanding your LVR and how it impacts your mortgage application is crucial when buying a home.

Banks also look at your LVR to figure out how much equity you have in your home, or how much of it you actually own. The more equity you have in your home, the more likely it is that your home loan lender will be able to get their money back if you don’t pay back your loan.

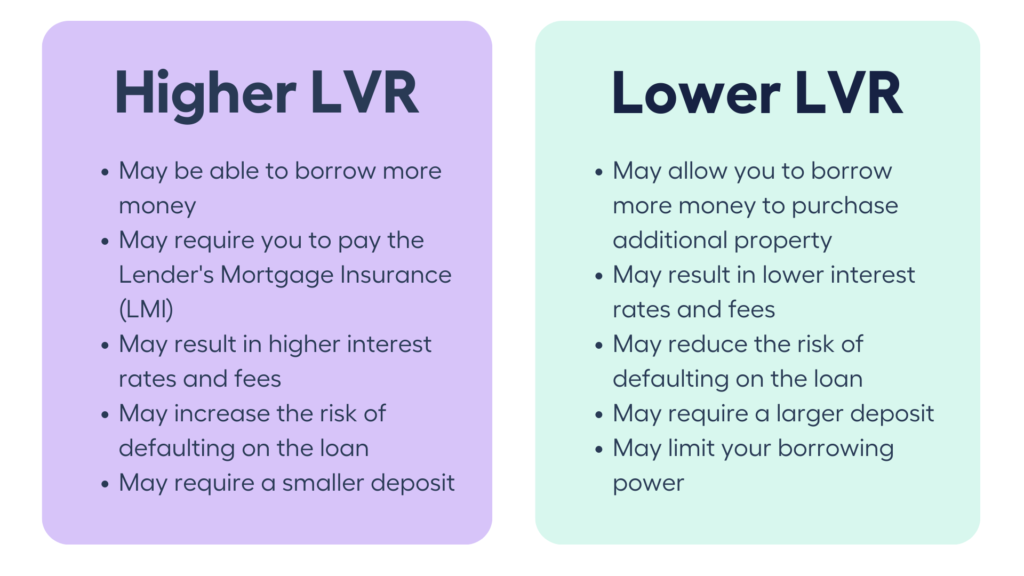

Higher Loan-to-Value Ratio or Lower Loan-to-Value Ratio?

In the housing market, LVR is important because they can affect the terms of your mortgage. For instance:

- Lending Criteria: Banks and lenders often have specific LVR limits. If your LVR is high (like 90% or more), it may be harder to qualify for a loan, or you might have to pay for Lenders Mortgage Insurance (LMI) to protect the lender, which adds to your costs.

- Interest Rates: Lenders generally see a lower LVR as less risky. Therefore, borrowers with lower LVRs may be offered lower mortgage interest rates.

- Equity Building: Your LVR changes as you pay down your mortgage. Over time, as you make mortgage payments, your LVR decreases, which means you’re building more equity in your home. Alternatively, if you experience capital growth on the property, your LVR will also decrease.

When reviewing a mortgage application, lenders evaluate both DTI and LVR. DTI assesses a borrower’s ability to manage debt payments based on income, assisting lenders in determining whether or not the borrower can afford the mortgage. LVR evaluates the mortgage’s risk from the lender’s perspective, calculating the borrower’s equity in relation to the property’s value. In practice, DTI and LVR are taken into account simultaneously to guarantee that borrowers also have an appropriate DTI to handle their loans.

Whether a higher or lower Loan-to-Value Ratio (LVR) is more favourable depends on your perspective and financial goals.

A higher loan-to-value ratio (LVR) means that you are borrowing a larger amount of money compared to the value of the property, while a lower LVR means that you are borrowing a smaller amount of money compared to the value of the property.

Here are some factors to consider when deciding whether to opt for a higher or lower LVR.

Higher LVR:

- May be able to borrow more money

- May require you to pay the Lender’s Mortgage Insurance (LMI)

- May result in higher interest rates and fees

- May increase the risk of defaulting on the loan

- May require a smaller deposit

Lower LVR:

- May allow you to borrow more money to purchase additional property

- May result in lower interest rates and fees

- May reduce the risk of defaulting on the loan

- May require a larger deposit

- May limit your borrowing power

Does Your LVR Affect Your Interest Rate?

Your Loan-to-Value Ratio (LVR) can affect your interest rate when you apply for a mortgage or other types of loan. Here’s how it works:

Lower LVR (for example, 80% or less):

Advantages

- Lower interest rates: Because borrowers with a low LVR are regarded as less risky, lenders often give lower interest rates to them.

- Lower risk of default: A low LVR indicates that you have a higher equity investment in your home, lowering the danger of default.

- Borrow more money: If you have a low LVR through smart investing or paying a large deposit, you may be able to access the equity in your original property to fund the purchase of another property.

Disadvantages

- Higher upfront costs: A low LVR necessitates a greater deposit, which might be significant.

- Limited borrowing power: If your lender requires a lower LVR it implies you can only borrow a smaller amount of money, which may limit your capacity to buy a more costly property.

A lower LVR means you’re paying more money upfront, which often leads to a cheaper interest rate. Lenders prefer this because it makes them feel more secure, which makes them more likely to grant you a loan with a lower interest rate. If your LVR is low, you can probably get a loan with a lower interest rate, which means you’ll save money over time.

Higher LVR (for example, above 80%):

Advantages

- Increased borrowing power: If your lender permits a higher LVR, this can enable you to borrow more money, which may allow you to purchase a more costly house.

- Lower upfront expenses: A high LVR necessitates a smaller down payment, which can result in a lower initial cost.

Disadvantages

- Higher interest rates: Lenders often charge higher interest rates to customers with a high LVR since they are regarded as more risky.

- Increased default risk: A high LVR indicates that you have a lesser equity share in your home, which increases the chance of default.

A higher LVR indicates that more money is being borrowed than is really being put towards the purchase. Lenders can get nervous because of this. If your LVR is high, you might have to pay a higher interest rate. Sometimes, you’ll also have to buy insurance to protect the lender, and that adds to the overall cost of your loan.

In short, having a lower LVR is usually better if you’re entering the property market because it can get you a cheaper loan, while a higher LVR might mean a more expensive loan with extra costs. But if you can make a big down payment, you might get the best deal.

It’s important to remember that interest rates can change a lot between borrowers and lenders. Your credit score, income, and the length of your loan can all affect your interest rate. So, it’s important to compare several lenders and loan deals to find the best interest rate and terms for your specific financial situation and goals.

Check Your Borrowing Power with MMS Mortgage Calculator

Your dream home may be closer than you think, and it’s essential to assess your borrowing power before embarking on the home-buying journey.

With the MMS Mortgage Calculator, you can effortlessly check your borrowing power and gain insights into your potential loan eligibility.

Speak with a Money Guru Today

Your future home may be waiting just around the corner. Our team of financial experts is ready to assist you in navigating the complex world of mortgages, interest rates, and borrowing power. Don’t hesitate to reach out and schedule a consultation with one of our Money Gurus today. Together, we can create a tailored financial plan to help you achieve your homeownership goals. Your dream home is within reach, and we’re here to guide you every step of the way.