Falling interest rates that helped fuel Australia’s real estate market boom have prompted home buyers to consider if variable home loan rates are the better deal when taking on a mortgage.

But with the recent cash rate hikes and further increases expected to happen, you might find yourself asking:

Is a variable rate home loan still a good deal or not?

This article will provide the essential concepts you need to know about variable home loan rates:

- advantages and disadvantages of a variable home loan

- formulas used for variable rate home loans

- sample calculations to see the effect of changing interest rates on interest repayments

Jump straight to…

Let’s start!

So, what is a variable rate home loan?

A variable rate home loan is a mortgage with an interest that can go up or down over time based on an underlying benchmark or index that is updated on a regular basis.

Benchmarks are financial yardsticks used by investors to evaluate how well or poorly assets perform in the market. The benchmark used by lenders is based on the Reserve Bank of Australia’s (RBA) official cash rate.

The cost of borrowing money typically increases as the official cash rate does. When this happens, lenders follow suit and may change the interest rate on home loans. In effect, the principal and interest repayments will change if your loan has a variable interest rate.

Is it a good idea to get a variable-rate mortgage?

A variable-rate mortgage is a good idea when interest rates are on the decline so that you can pay less on your existing home loan.

Typically, borrowers opt for variable rate home loans if they anticipate these conditions to happen before an interest rate rise:

- Borrower plans to sell the house

- Borrower’s wage will rise

- Borrower has the option to refinance an existing home loan

If these conditions are aligned with your situation, dig in further by learning how to calculate for interest repayments of variable rate home loans in the next part of this article.

Variable Home Loan Rate Example

You can calculate the interest repayments of your variable home loan in three steps:

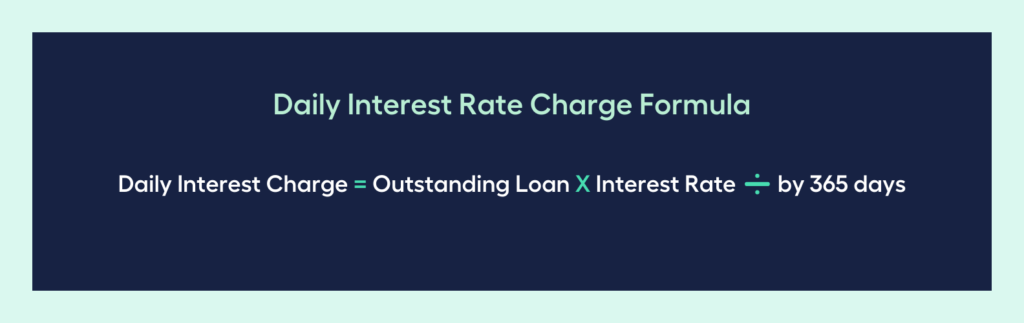

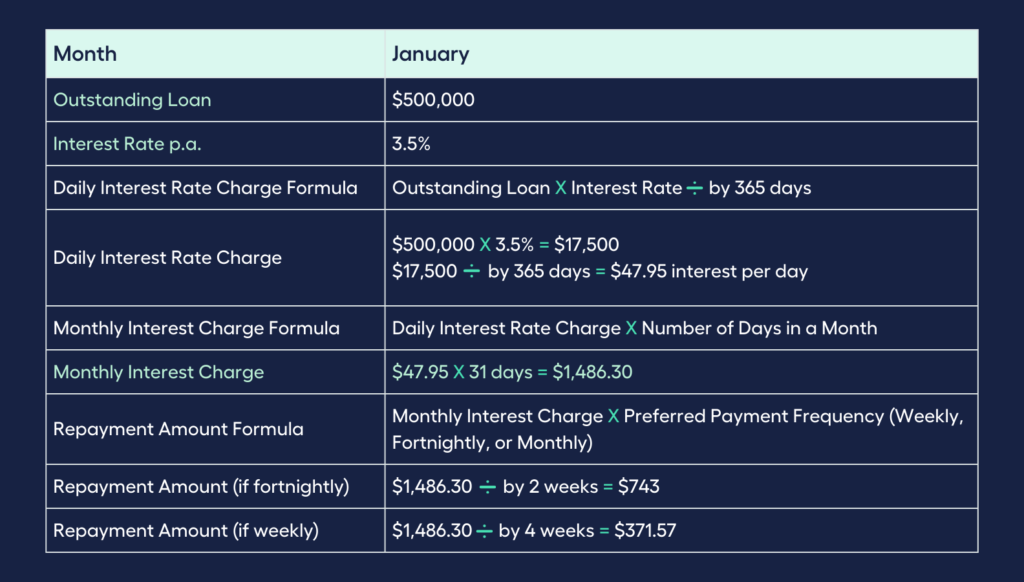

Step 1: Calculate the Daily Interest Rate Charges

Multiply the balance on your existing home loan by your interest rate and divide by 365 days in a year.

Step 2: Calculate the Monthly Interest Charge

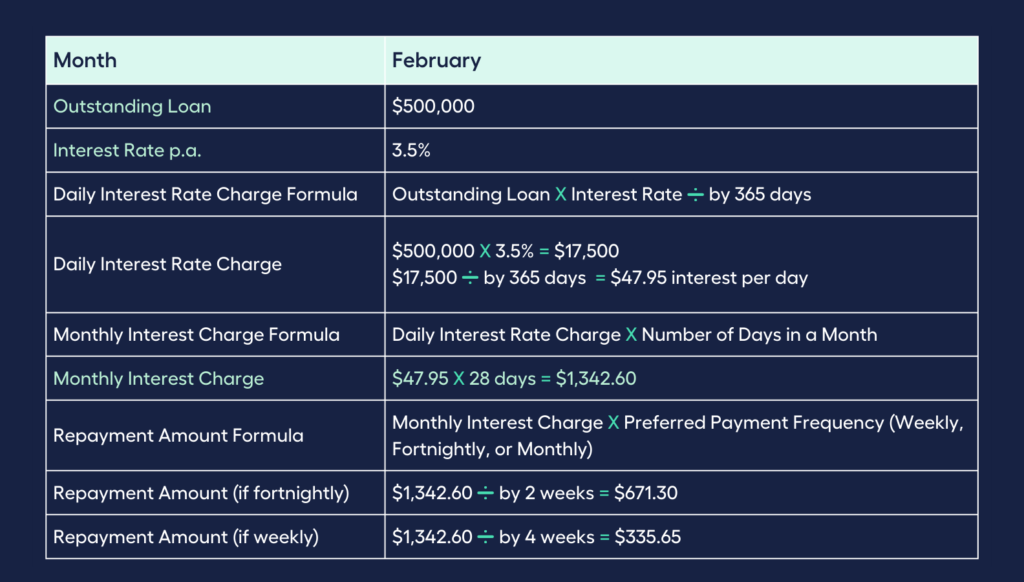

Add the daily interest rate charge for every day in each month to come up with the monthly interest charge that is shown on your variable home loan statement. Take note that the interest repayments may vary from month-to-month since there are months with fewer days like February (28 or 29 days), and other months with 30 or 31 days.

Step 3: Calculate the Repayment Amount

Divide the monthly interest charge by your preferred frequency of home loan repayments (weekly, fortnightly or monthly) to come up with the repayment amount.

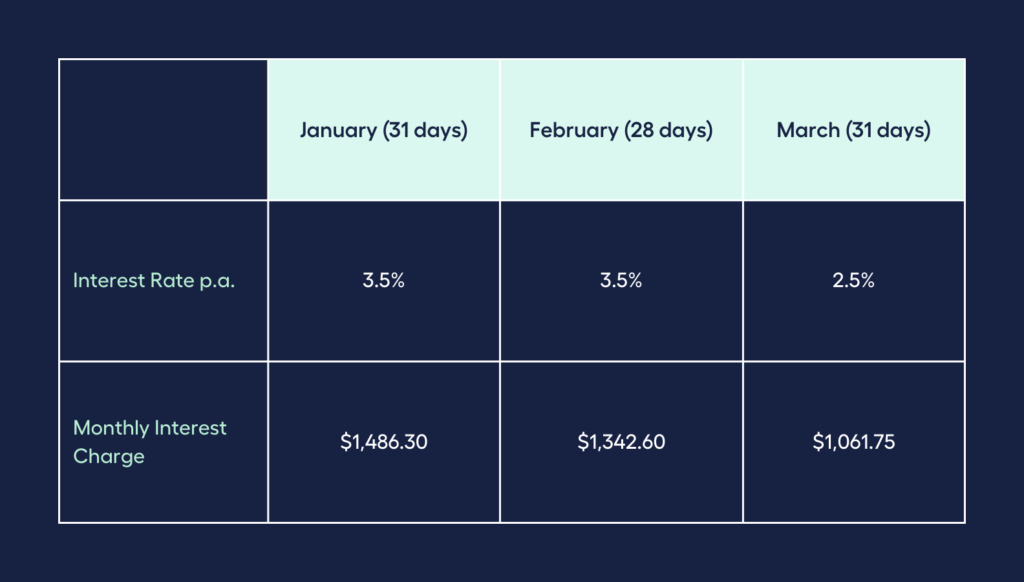

Sample Calculation:

Now, let’s try calculating for interest repayments using a month with the least number of days: February.

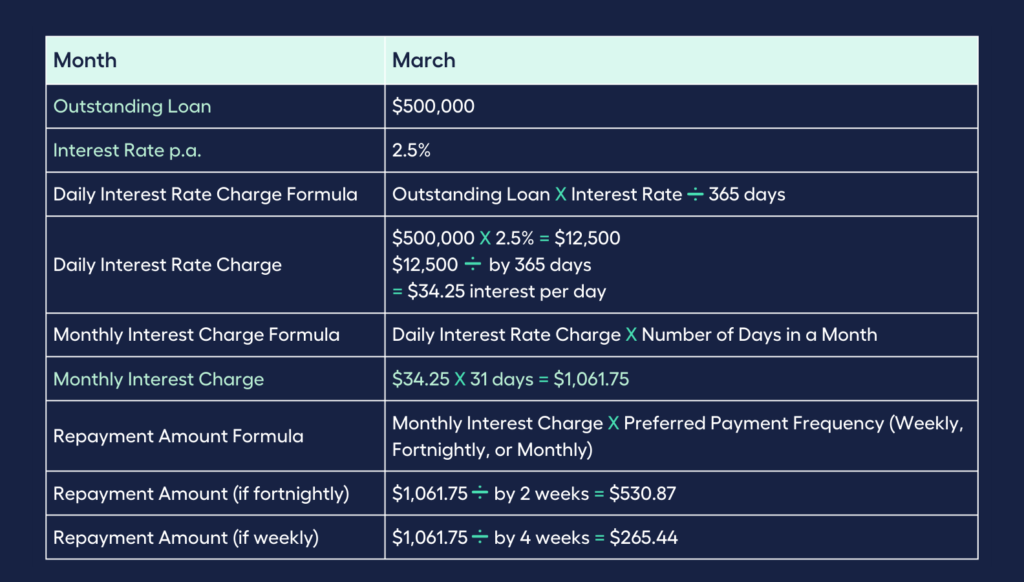

Since the number of days decreased, the home loan interest repayment amount using the same interest rate also decreased. Now, since this article is about variable rate home loans, what will happen if the variable home interest rate fell on a month with the same number of days as January?

Let’s try it out!

See how the monthly interest charge changed when the home loan interest rate and number of days in a month changed?

The monthly interest rate charge and your mortgage repayments could also change when home loan interest rates rise.

Check your home loan repayments and interest charges over the course of a loan using the MMS mortgage repayment calculator. The calculator can also be used to check the effect of extra repayments on your mortgage.

Is it better to choose variable or fixed rate?

Different people will have different answers to this question depending on where they are coming from. There is no right or wrong answer because both variable rate home loans and fixed rate home loans have advantages and disadvantages.

The best home loan deal for you will depend on the status of your personal finance, financial goals, risk tolerance, and economic situation.

You can compare home loans with fixed and variable interest rates of different lenders and study their eligibility criteria, and which loan terms are best for your credit history, income, debts, down payment, and monthly budget.

You can start by using home loan calculators like the MMS Loan Comparison Calculator to find a financial institution with the most competitive interest rate and the best variable home loan product with a lending criteria that fits your needs. You may use the sample calculations of monthly repayments above to guide you in the process.

I Want to See All My Options with the Help of a Finance Expert

Book a FREE Call TodayAdvantages & Disadvantages of Choosing a Variable Rate Home Loan

What is the advantage of a variable interest loan?

1. Affordability

It is easier for a borrower to qualify for a variable interest loan due to its affordability compared to a fixed interest loan.

This is because a variable interest loan is typically designed to look lower when compared to a fixed interest rate when a borrower is applying for a mortgage.

2. Save Interest

a. Benefit from cash rate drops which usually snowballs to loan interest rate drops. In effect, this may lower repayments as well. Also, your lender may give you the option to pay the same repayment amount or increase your principal repayment.

b. Save interest with an Offset Account

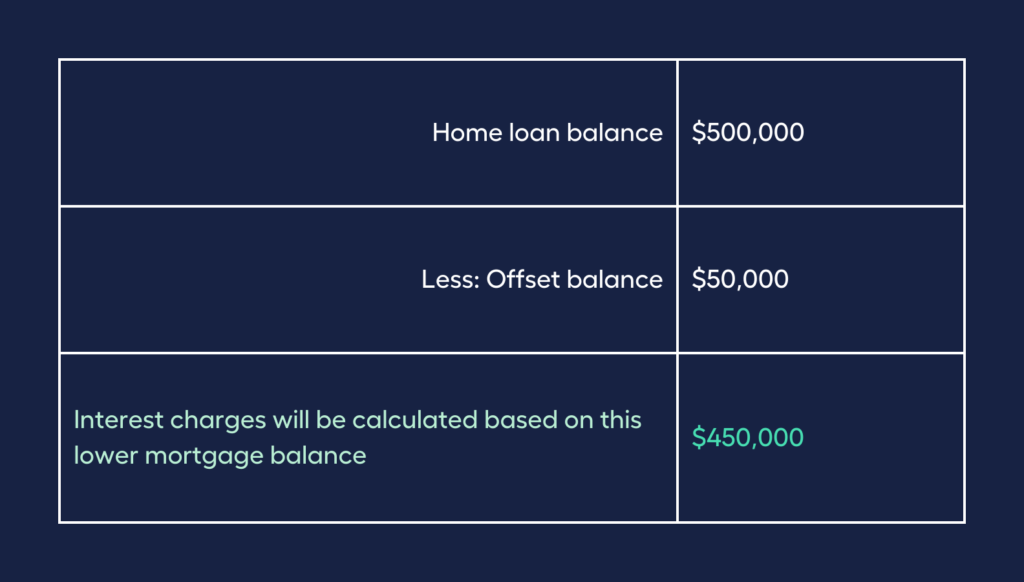

To lower the amount of interest you pay on your loan debt and pay off your home loan sooner, some lenders give borrowers an option to keep money in an offset account.

An offset account is a regular bank account that’s linked to your variable home loan. Every dollar in your account lowers or cancels off (thus, an “offset”) the interest on your mortgage.

But how?

You only pay interest on your loan balance less the funds in your offset account.

For example:

Remember:

Every dollar you deposit in your offset account lowers your daily home loan interest because, as illustrated in the variable home loan rates sample calculations above, the interest on home loans is calculated daily. Thus, the more money you have in your offset account, the more interest you’ll save.

Here are some Tips to Make an Offset Account Work Best for You:

- Regularly deposit your salary into an offset account to make every dollar you earn work for you.

- Put your extra funds towards an offset especially if your home loan attracts a higher interest rate than you are able to earn on a savings account or a term deposit

Having second thoughts if an offset account is right for you?

Here are some considerations to make:

- Offset home loans typically include higher interest rates and fees.

- Your offset balance will not generate interest, but you will reduce the interest on your mortgage.

- It might not be worthwhile to pay for this option if your offset balance is consistently low.

3. Flexibility of Loan Features: Reduce interest and pay off your mortgage sooner with extra repayments using a redraw facility.

A redraw facility is a home loan feature that allows borrowers to make additional payments to reduce a mortgage balance and pay less interest. It can also be accessed at a later date if you need money.

Variable home loans also typically waive redraw fees and early repayment fees which could translate to more savings.

Offset Account and Redraw Facility – What’s the difference?

While both home loan features let you access extra cash at a later date and use it to lower the interest on your mortgage, their difference lies in how you are able to access the funds.

An offset account’s funds can easily be accessed like other linked transaction accounts, such as ATMs, online and phone banking, debit card, and at bank branches.

On the other hand, funds from a redraw facility have some restrictions when it comes to accessibility. A borrower needs to transfer the funds to a transaction or other account through online or phone banking or in-person at a branch in order to access the funds.

What is the disadvantage of a variable rate loan?

A variable rate loan’s flexibility is both a boon and a bane.

The drawback is that your minimum repayment amount will increase if your variable rate rises.

While its flexible features give you the freedom to make changes in your loan contract and benefit from lower interest rates when market rates fall, do keep in mind that your borrowed money may come with complicated conditions.

Before committing to a variable rate loan, it’s best to be prudent by:

- Understanding the terms and conditions of the loan contract

- Avoiding a variable interest rate if your financial situation is uncertain

- Consulting a finance expert to help guide you in making decisions best suited for your situation

Now that you know the pros and cons of a variable home loan rate, do you think this home loan type might work for your financial circumstances?

You can take the first step:

Check Your Borrowing Power with MMS Mortgage Calculator

Knowing your borrowing power is just the first step. A mortgage is a big investment of both time and money, which is why It’s often best to receive guidance from a financial expert like a mortgage broker.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan. Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by an experienced Mortgage Broker.

It’s that easy!

Get Ahead Of Your Home Loan by Speaking with My Money Sorted Today