You want to safeguard wealth against inflation and maximise returns.

And you’ve heard of capital growth in an investment property as a strategy to enhance returns and protect wealth from inflation.

However, you’re concerned about the long-term commitment and liquidity issues related to this investment approach. Additionally, you’re unsure about the potential risks and benefits associated with a capital growth strategy in the real property market.

In this article, we present a comprehensive guide to understanding capital growth and how to calculate capital growth. It’s tailored for both seasoned and new investors alike to help them make an informed decision about investment properties.

Jump straight to…

What is Capital Growth?

Capital growth, also known as capital appreciation or return on investment, is the increase in value of a property or investment over time.

Property capital growth should not be confused with income and rental yield. Income and rental yield are the gains in holding a rental property that generate income. Rental income and rental yield are steady sources of regular income.

How do investors gain in holding an asset?

Capital growth occurs when an asset appreciates in value over time while being subjected to economic changes such as market growth and inflation. However, capital growth can only be realised once a sale of the asset or the property has been made.

Simply put, capital growth is what an investor gains in selling their asset or property.

What is capital growth percentage?

The capital growth percentage denotes the percentage increase in the value of an asset or investment over time.

The calculation involves determining the difference between the current market value of the asset and its purchase price, expressed as a percentage of the initial purchase price.

The capital growth percentage is the actual increase in the value of the asset over a specific period, which can be annual or for a different time frame.

Capital vs Equity: Are They The Same?

Equity and capital refer to the financial stake that owners or shareholders have in a company, which might include finances, assets, or shares. While these phrases have some similarities, they also have substantial differences, and understanding the differences is critical for business success.

Explaining Equity

Equity in property refers to the portion of the property that the owner actually owns outright. Equity can be built over time through mortgage payments and property appreciation.

Homeowners can use their equity to access cash through home equity loans or lines of credit, pay off debts, make home improvements, or plan for retirement.

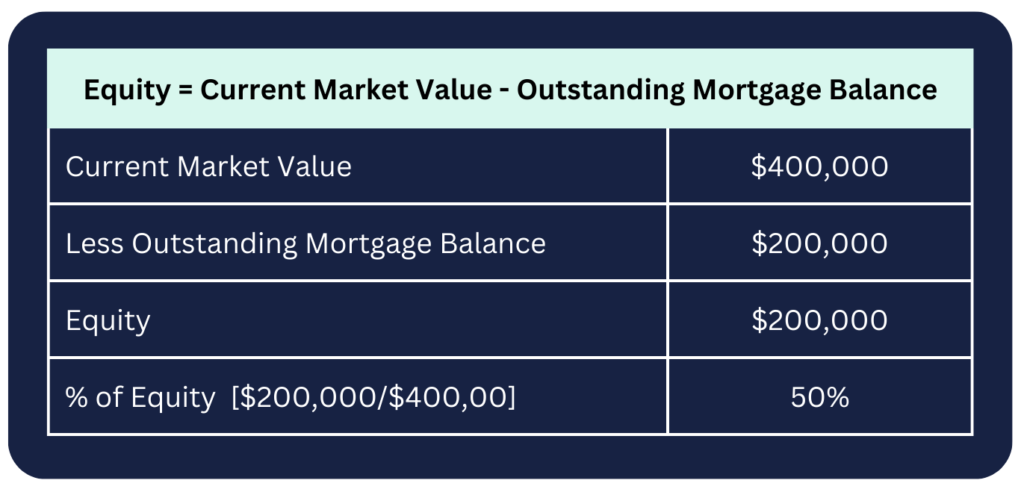

The formula for calculating equity in a property is quite simple. It is the difference between the current market value of the property and the outstanding balance of any mortgage or loan secured against it. Here’s the formula:

Equity = Current Market Value – Outstanding Mortgage Balance

For example, if your investment property is worth $400,000 and you have a mortgage balance of $200,000, your equity would be $200,000. This means you have a 50% equity stake in your investment property.

Understanding Capital

In the context of property investment, capital refers to the money used to fund a given property investment deal. It includes the costs of acquiring a property, initial renovations, and upfront costs.

Capital is the financial resource utilised to purchase and improve the property. Capital can be raised through various means, such as personal savings, loans, partnerships, or other forms of financing.

Additionally, the term “capital” in the context of property investment is distinct from “capital assets”.

Capital assets are significant pieces of property, including investment properties, and are not intended for sale in the regular course of business operations. Capital assets are recorded as assets on the balance sheet and are often used to generate revenue over the course of more than one year.

Furthermore, a capital growth strategy in property investment seeks to maximise long-term capital appreciation of a portfolio via an allocation geared to assets with high expected returns, such as real estate.

A capital growth strategy focuses on the increase in the value of the investment over time, which is a driving factor behind significant wealth creation.

How to Calculate Capital Growth

While there is no certainty that a property will increase in value at any given time, real estate has historically had consistent growth over the long term.

Capital growth can be determined by subtracting the current market value of the property from the initial purchase price. To calculate capital growth in a property investment, follow these steps:

1. Determine the initial purchase price of the property, including any taxes, fees, and commissions incurred during the purchase. Let’s call this value V1.

2. Estimate the current market value of the property. This can be done by researching recent sales of similar properties in the area or by using a property valuation tool.

3. Calculate the capital growth by finding the difference between the current market value and the initial purchase price. Divide this difference by the initial purchase price and multiply by 100 to get the capital growth percentage. The formula is:

Capital Growth (%) = [(Current Market Value – Initial Purchase Price) / Initial Purchase Price] x 100

For example, if you purchased a property for $400,000 and its current market value is $450,000, your capital growth would be:

Capital Growth (%) = [(450,000 – 400,000) / 400,000] x 100 = 12.5%

Initial Investment

The initial investment is the sum of money you put into a property. This is normally 5% to 20% of the property’s value. However, if you wish to avoid paying lenders’ mortgage insurance (LMI), most lenders prefer that you have at least 20% down.

The deposit is the initial payment made towards the purchase of the property. In addition to the deposit, there are other initial costs involved in owning an investment property, such as legal fees, stamp duty, and mortgage insurance.

It’s important to consider ongoing costs as well, such as rates, insurance, repairs and maintenance, and mortgage pay.

The capital growth rate is usually expressed as an annual percentage. The capital growth rate is frequently used for forecasting and analysing investment opportunities, whereas the capital growth percentage represents the particular rise in value over a specified time period.

The capital growth rate is computed by subtracting the asset’s current market price from its original acquisition price, including all associated expenses. It’s usually expressed as a yearly percentage and can be used to calculate the prospective return on investment.

Keep in mind that investments can fluctuate, and past performance does not guarantee future results.

How to Calculate Growth Rate?

To calculate capital growth rate in investment property, you need to find the difference between the current market value of your investment and the price you initially purchased it for.

Then, divide the difference by the initial purchase price and multiply by 100 to get the percentage increase in value.

The formula for calculating capital growth is: Capital Growth = (Current Market Value – Initial Purchase Price) / Initial Purchase Price x 100.

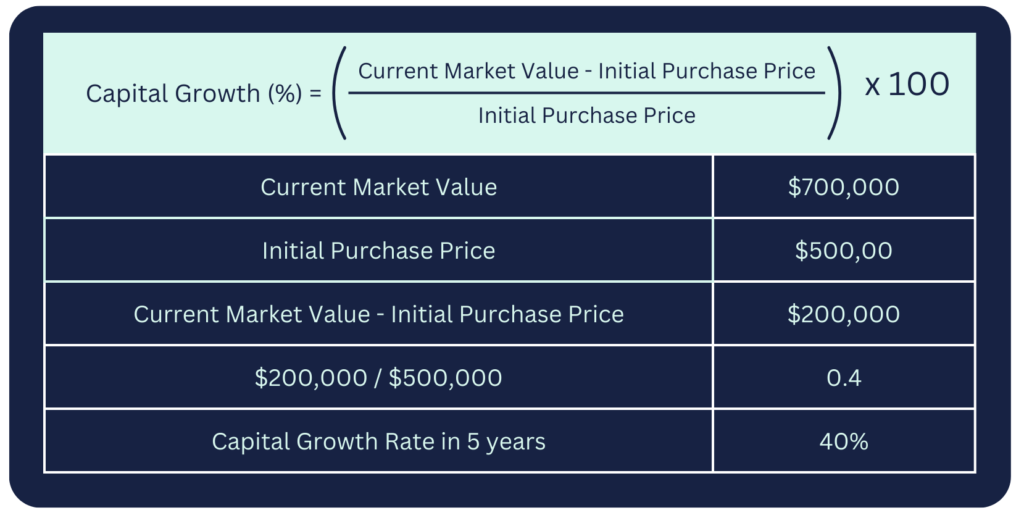

An example of calculating capitalization rate for an investment property can be as follows:

Assume you purchased an investment apartment for $500,000 and the current market value is $700,000. The investment period is 5 years.

First, calculate the annual capital growth rate:

Capital Growth Rate = ((Current Market Value – Initial Purchase Price) / Initial Purchase Price) x 100

Capital Growth Rate = ($700,000 – $500,000) / $500,000 x 100 = $200,000 / $500,000 x 100 = 40%.

This means that the capital growth rate for your investment apartment is 40% in 5 years.

However, keep in mind that this is a simplified example and does not account for factors such as expenses, taxes, and market fluctuations. It’s essential to consider these factors when evaluating the actual performance of your investment property.

It is important to note that capital growth is driven by demand and supply forces, such as the demand of people wanting to live within the area and the supply of houses available.

Other factors that influence capital growth include location characteristics, demographic changes, and established capital benchmark. There are also capital growth calculators available online that can estimate the return on your investment property

Investment Term

The investment term for an investment property apartment refers to the duration of time you plan to hold the property in your portfolio.

Terms can vary depending on your investment strategy, financial goals, and market conditions. The investment term can be for short-term capital gain (1-2 years) or long-term capital gain (5-10 years or more). It’s essential to consider the investment term when purchasing an investment property, as it can impact your overall return on investment and the potential implications on your income tax rate.

Factors to consider when determining the investment term for your investment property apartment include:

Your financial goals: Determine your investment objectives and the expected rate of return.

Market conditions: Assess the current market conditions and potential future trends in the property market.

Property characteristics: Evaluate the property’s location, size, age, and condition, as well as its potential for capital growth and rental income.

Legal and tax implications: Understand the legal aspects of property ownership in Australia, such as land title restrictions and zoning regulations, as well as the implications on your income tax rate, including capital gains tax rate and depreciation.

Property management: Consider the costs associated with managing the property, such as maintenance, repairs, and property management fees.

Understanding Factors That Impact Capital Growth & Return on Investment

There are several strategies for achieving capital growth in investment properties, ranging from passive to active and strategic approaches. However, capital growth without active work may seem appealing, and there are several factors to consider:

Risk: There is no guarantee that property values will consistently rise, and markets may fall or remain stagnant. Capital growth is a long-term endeavour, and prior growth does not guarantee future outcomes.

Tax Implications: You have to pay Capital Gains Tax (CGT) on the profit made from selling an asset, including rental properties. The Australian Tax Office (ATO) provides tools to help you calculate your individual capital gains tax, and it is advisable to consult with a tax professional or accountant to understand the complexities of CGT and taxation for investment properties.

State Tax Regulations: Tax rules for investment properties can vary between states in Australia, so it is crucial to be aware of the specific tax regulations in your area.

By understanding these factors and consulting with professionals, investors can make informed financial decisions and potentially reduce their tax liability.

What Factors Influence Capital Growth Over Time?

It is critical to consider local factors and demographic changes such as average income, median age, percentage of owner-occupiers vs. investors, and whether there is a nearby precedent for higher housing values (known as ‘established capital benchmark’).

Market Increases

Market uptrends offer a simple way to increase your capital growth by aligning with the rise in real estate values. As the property value rises, corresponding increases in your capital gains become apparent.

Experiencing a market rise is arguably one of the simplest ways to achieve capital growth. A surge in demand or a decrease in supply can cause a property boom, increasing the value of your property.

Thorough study is required before purchasing an investment property. Determine growth corridors that are characterised by ongoing development. Keep in mind that investing in places that have a high probability of experiencing such a boom is essential, as capital growth is not guaranteed. Investigate regions where land is scarce but there is substantial demand for homeownership.

Home Improvements

When done correctly and within budget, investing in home upgrades can maximise capital growth. Renovations, whether simple paint jobs or more extensive alterations like additions or bathroom upgrades, have the potential to increase the value of your property. However, it is critical to be judicious and prevent overcapitalisation – make sure that the money spent on renovations is proportionate to the additional value they offer.

Strategic modifications on investment properties, such as adding a bathroom or a study, can increase their appeal to potential purchasers, resulting in a gradual increase in its value. Improving curb appeal with a professional paint job and renovating essential sections such as the kitchen and bathroom can also have positive results.

Avoid overspending on renovations, especially if selling is the intent. The goal is to make capital gains rather than losses. Furthermore, keep in mind the type of renovations you do, as not all modifications are marketable. Consult a real estate professional to evaluate the renovations that yield the highest returns in the property market.

Purchasing Below Market Value

Buying below market value entails paying less than the specified market price for a property, which is usually determined by comparing it to similar properties in the region.

While this strategy might provide a quick increase in capital growth, finding and acquiring properties below market value can be difficult, especially in a market that is gaining traction.

Impact of Local Development

Local area developments might help you achieve capital growth on your property as well. Examine for improvements such as commercial centre renovation, and the creation of new parks and playgrounds. The inclusion of amenities such as improved transportation, shopping centres, or schools can increase the appeal and demand in a suburb, resulting in higher property prices.

Essentially, if the neighbourhood is being improved, the value of your house will rise, making it more desirable to live there.

Factors Impacting Return: Yield, Expenses & Taxes

It’s important to understand the factors that impact your return on investment. Yield, expenses, and taxes are three key factors to consider when evaluating the performance of your investment property. Understanding these factors is crucial for maximising your return on investment and avoiding unexpected costs.

Yield

If you’ve already calculated your investment’s capital growth and find yourself smiling, here’s more good news – you haven’t yet factored in your annual yield.

Yield, commonly referred to as the annual cash return on your investment, constitutes passive income or cash flow.

The yield for apartment property investment in Australia varies depending on the location. The Commonwealth Bank considers a good rental yield to be 5.5% or above, while some experts advise aiming for yields of at least 7.5%.

To determine your total investor return, combine the anticipated annual yield over the investment’s lifespan with the calculated capital growth.

It’s important to note that rental yields are influenced by various factors, with location being a significant one. Thus, it’s essential to conduct thorough research and consider the specific market conditions when evaluating the potential yield for an apartment property investment in Australia.

Capital Expenses

Capital expenses for apartment property investment in Australia refer to the costs of improving a rental property or adding value to it. These expenses include renovations, upgrades, and improvements that increase the property’s value or extend its useful life.

It’s important to note that capital expenses are not immediately deductible and are instead used to calculate the capital gain or loss when the property is sold. Some common capital expenses are:

Renovations: Updating kitchens, bathrooms, or adding new rooms can increase the property’s value and attract more tenants.

Upgrades: Installing new windows, roofing, or HVAC systems can improve the property’s energy efficiency and attractiveness to tenants.

Maintenance costs: Regular maintenance, such as painting, repairs, and landscaping, can help keep the property in good condition and attract tenants.

Strata fees: If the property is part of a strata complex, the annual strata fees can be a capital expense.

Council rates: The annual council rates can be a significant capital expense for property owners.

Insurance: Property insurance, which covers the property against damage and liability claims, is another capital expense.

Property management fees: If you use a property manager to manage the property, their fees can be a capital expense.

Legal and conveyancing fees: Solicitor’s fees for the purchase of the property and the preparation of loan documents can be capital expenses.

Stamp duty: The stamp duty paid on the property purchase can be a capital expense.

Keep in mind that not all expenses may be claimable as tax deductions, and it’s crucial to consult with a tax professional or financial advisor to ensure you’re aware of the tax implications of these expenses.

Taxes

When selling an investment property, it is critical to recognise the capital gains tax rate (CGT) liability on the profit made. While CGT may appear to be distinct, it is a necessary component of your income tax assessment for the year in which the asset was sold.

The amount of tax payable is determined by the length of asset ownership and your classification as a person or corporation. Subtract the original price and any associated charges, such as legal fees and stamp duty, from the selling price to calculate capital gains tax. The final sum indicates your capital gain or, in some cases, loss.

Maintaining a meticulous record of all deductible expenses related to your investment is crucial for understanding your asset’s total cost base. This amount is utilised in calculating the overall capital gain, achieved by subtracting it from the total sale proceeds of your asset. A higher cost base translates to a lower capital gain.

Since tax is not automatically withheld on a capital gain from your investment, unlike an employee’s PAYG salary, it’s prudent to determine the amount you’ll owe to the taxman. Seasoned investors ensure they set aside adequate funds to cover the potential tax liability.

These experienced investors are also adept at implementing strategies to reduce this tax liability.

Conclusion

Investing in property can be a lucrative long-term investment strategy, but it requires careful consideration of various factors that can impact capital growth and return on investment.

These factors include market conditions, property characteristics, legal and tax implications, and property management costs. Additionally, investors should be aware of the risks involved and consult with professionals to make informed financial decisions.

If you are considering investing in property, it is essential to do your research and seek professional advice to ensure you make informed decisions.

Consult with a real estate agent, tax professional, or accountant to understand the legal and tax implications of property ownership in your area.

By taking a strategic approach and understanding the factors that impact capital growth and return on investment, you can potentially reduce your tax liability and achieve long-term financial success.

Want to Learn More About Investing in Property? Book a FREE 15 min Call or Send Us Your Questions!