If you’re in your final year before retirement, it’s crucial to take some important money steps to ensure a successful transition. You definitely don’t want to be caught off guard by unexpected expenses or find yourself in a tight financial spot.

But don’t worry!

With careful planning, you can create a solid financial plan that will provide a comfortable retirement.

In this article, we’ll cover the key money steps you should take during the year leading up to retirement. These steps could help you organise your financial plan and investment strategy, ensuring a smooth and worry-free transition into retirement.

So let’s dive in and get your retirement plan on track!

Jump straight to…

- Making a Clean Break From Working Life? Here’s Some Tips on Using the Last Year Before Retirement To Prepare

- Get a Health Check and Review Your Health Insurance

- Ensure Your Estate Plan is in Order

- Check Your Pension Eligibility and When You Can Apply

- Need Financial Advice to Get Ready for Retirement?

- Book a FREE 15 min Call or Send Us Your Questions!

Making a Clean Break From Working Life? Here’s Some Tips on Using the Last Year Before Retirement To Prepare

If you’ve recently considered your retirement goals, you’ve probably realised that it’s critical that they fit with your individual circumstances and needs.

To ensure that you’re financially ready for retirement you’ll need to check if your retirement plan is up to date, see how you can manage outstanding debts, know your health status, prepare your estate plan, and check what government retirement plans are available to you.

Tip #1

Review Your Retirement Plan

Financial planning for retirement involves a review of your retirement plan to ensure that your financial goals are updated to meet your current needs and circumstances. In particular, it’s essential to review your superannuation account and life insurance policies to ensure that your retirement income is secure. It may also be necessary for a trial living on your retirement budget to determine if it’s sustainable.

Are Your Retirement Goals the Same?

In the world of retirement planning, it’s natural for our goals to evolve over time. Life happens, circumstances change, and our dreams for retirement may take different shapes. Maybe you had a specific retirement age and income in mind, but as you approach that milestone, you realise you want to retire earlier or later. Or perhaps you’re itching to explore the world or start a new adventure in your golden years.

On top of personal factors, economic changes and the financial climate can also impact our retirement goals. Interest rates, inflation, and market conditions have the power to influence our retirement savings, investment returns, and overall income streams.

So, what should you do if your retirement goals shift?

Here are some practical suggestions to help you adjust your retirement plan accordingly:

1. Re-evaluate your retirement expenses

If your retirement goals have changed, it’s likely that your retirement expenses have also changed. Take the time to re-evaluate your retirement expenses based on your new goals and adjust your retirement budget accordingly.

2. Review your retirement savings

Review your retirement savings to ensure you have enough funds to support your new goals.

3. Adjust your investment strategy

If your retirement goals have changed, it’s possible that your investment strategy may need to change as well.

For example, if you need to save more money, you may need to adjust your investment mix to take on more risk.

Alternatively, if you’re planning to retire sooner than expected, you may want to adjust your investment mix to reduce risk and preserve capital.

4. Consider delaying retirement

If your new retirement goals require more money than you currently have, you may want to consider delaying your retirement. It can give you more time to save enough money and reduce the risk of running out of funds in retirement.

You can also employ a transition to retirement (TTR) strategy to get a feel of retirement while still working.

Review Superannuation and Life Insurance – Is Your Retirement Income Secure?

Taking a good look at your superannuation and life insurance policies is key to securing a comfy retirement income and protecting yourself and your loved ones. Let’s break it down.

When it comes to superannuation, you’ll want to assess your current savings, explore different investment options available to you, and keep an eye on those pesky fees. It’s all about maximising your potential returns and minimising unnecessary costs.

Now, let’s talk life insurance. It’s not the most exciting topic, but it’s incredibly important. Life insurance provides much-needed financial stability in case you face unexpected health issues, disabilities, or the unfortunate event of passing away. So, it’s crucial to review your life insurance coverage and ensure it’s enough to provide for your loved ones if anything were to happen.

By giving these accounts and policies a thorough review, you can make any necessary adjustments to achieve your desired retirement income and have the peace of mind that comes with knowing you’re fully covered.

Super Health Check

The first step in reviewing your superannuation is to do a super health check. The super health check is a simple 5-step process to help you manage your super, know what you’re entitled to, and make better choices when you retire.

The best way to perform these checks is either on Australian Taxation Office (ATO) online services through myGov or by contacting your super fund directly.

Here’s how:

Step 1: Double-check your contact information.

Step 2: Review your superannuation balance and employer contributions.

Step 3: Look for missing or unclaimed superannuation.

Step 4: Determine if you have many super accounts and consider consolidating them.

Step 5: Confirm your nominated beneficiary.

Know When You Can Access Your Super

Let’s now discuss retirement age.

It’s important to understand the difference between two key numbers:

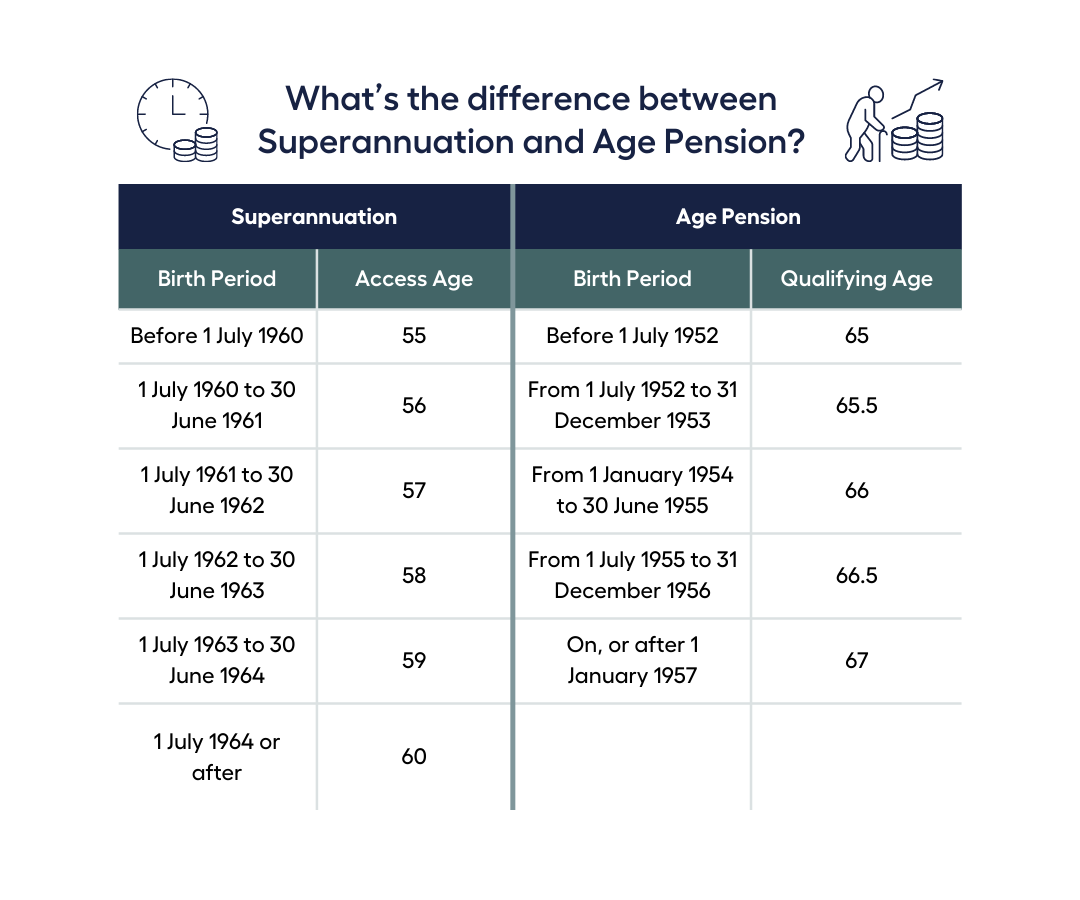

Your Preservation Age and your Qualifying Age.

Your preservation age determines when you can access your super, while your qualifying age determines when you can apply for the Government Age Pension.

It’s worth noting that even if you’ve reached the age where you can access your super, you might not be eligible for the Age Pension. This would have a big impact on your retirement income for at least 7 years.

Consider How Much You’ll Need for Retirement

When it comes to retirement, your age isn’t the only factor to consider. It’s crucial to think about your current and future financial needs before making any decisions.

Start by envisioning the kind of lifestyle you want during retirement. This will help you determine how much money you’ll likely need. Also, whether you’re single or in a relationship can impact your plans. The Association of Superannuation Funds of Australia (ASFA) publishes a helpful breakdown of retirement budgets each quarter. It can give you a good idea of how different factors might affect your retirement plans.

According to the ASFA standard:

- a couple will need around $690,000 in savings to enjoy a comfortable retirement,

- individuals should aim for about $595,000.

These figures assume that retirees will withdraw all their savings and receive a partial Age Pension. They also assume that retirees will own their own home instead of renting.

Based on normal life expectancies, a couple with this lump sum can expect annual living expenses of around $69,691, while a single person can expect expenses of around $49,462. Keep in mind that living costs are constantly rising, so it’s important to stay updated on the ASFA standard.

Understanding the average retirement needs and expenses empowers you to plan your finances more effectively. So stay informed and make the most of your retirement!

You can use this superannuation calculator to work out how much super you’ll have when you retire and how fees affect your final super balance.

Do you want to get an estimate of your retirement income from super and the age pension?

Use this retirement planner calculator and get an instant result when you input required information, such as account contributions, investment options, fees, retirement age, and working part-time or taking a break from work.

Check Your Insurance Cover

While most super funds offer automatic insurance, it’s crucial to make sure that your coverage aligns with your needs. As you age, those needs can change, which means your current insurance amount might be too much or too little.

Life has a way of throwing curveballs at us, right?

Changes like your adult children moving out or a shift in your relationship status could mean it’s time to reassess your insurance coverage. It’s all about making sure you’re adequately protected.

Depending on where you are in life, there are a few types of insurance you might want to explore.

First up, we have Income Protection, which helps you out if you’re unable to work due to illness or injury. Then we have Total and Permanent Disability (TPD) insurance, which kicks in if you become permanently disabled and can’t work anymore. Lastly, there’s Death Insurance (aka life insurance), which provides financial support for your loved ones if you were to pass away.

Take a moment to review your insurance needs and make sure you’re covered in the right areas. It’s all about finding that sweet spot of protection for your unique situation.

Know Your Retirement Income Options

Understanding your retirement income options is critical for financial security in retirement. There are various sources of earning income from superannuation and personal investments, and it is critical to assess which ones correspond to your wealth management plan and retirement needs.

- Superannuation

You can keep your super working for you even after you reach your preservation age. You may be able to profit from alternatives such as annuity, account-based pension, or super lump sum.

a. Annuity

You can purchase an annuity from a super fund or life insurance business using your savings or super. When you purchase an annuity, you can specify whether you want the payments to continue for a set number of years (e.g. 15 years), your life expectancy (e.g. until age 70), or the rest of your life (until death).

b. Account-Based Pension

An account-based pension provides regular, flexible, and tax-efficient income from your superannuation. You can avail of one when you reach preservation age.

Your super fund is still invested when you choose an account-based pension. This opens the door to further growth and investment performance. Although it lasts just as long as your super money does, so it does not guarantee a lifetime income.

c. Super lump sum

When you retire, you might be able to receive your superannuation as a lump amount. Typically, this is tax-free after age 60.

You could be able to take a lump sum withdrawal of all or a portion of your superannuation depending on the restrictions of your fund. If so, you can either receive all of your super in one lump sum payment or multiple payments.

- Age Pension

Australians over 65 may receive a government Age Pension, either in full or in part. The Age Pension might supplement your retirement income when you reach pension age. Currently, the Age Pension pays a maximum amount of $1604 per fortnight. We’ll discuss the Age Pension in detail later on.

- Assets

Retirement income can also be supplemented by personal savings and assets like shares and real estate. It’s beneficial to comprehend how your assets fit within your retirement strategy.

For instance, downsizing is a choice available to Australian homeowners. You might be able to put money from the sale of your primary residence into your super if your current residence is too large for your requirements in retirement and you downsize.

- Transition to Retirement (TTR)

You can use a transition to retirement (TTR) strategy to access some of your super while continuing to work. It can also be a gradual process for you to cut your working hours and still maintain your cash flow.

If you’ve reached your preservation age and are still working, a TTR approach can improve your super and save tax while you work full-time or supplement your income if you cut your hours.

You can start a TTR pension by shifting some super to an account-based pension. You need to keep some money in your super account so you can keep getting employer contributions and make voluntary contributions of your own.

Trial Living on Your Retirement Budget

Ready to give your retirement budget a trial run?

It’s a practical way to ensure you’re financially prepared for this new phase of your life.

Here’s a step-by-step guide to help you test your retirement budget:

1. Establish a retirement budget

Identify your sources of income and determine your expected income in retirement. Then, make an estimate of all of your anticipated retirement costs, including housing, utilities, healthcare, transportation, food, entertainment, and any other costs you anticipate.

2. Reduce expenses

Try to reduce your present spending to meet your anticipated retirement costs in order to replicate your retirement budget. This can entail cutting back on dining out or reducing your entertainment spending.

3. Spend a few months on a retirement budget

For a few months, try to maintain your projected retirement budget to observe how it functions in practice. You can use this to find areas where you might need to make further changes.

4. Track your spending

During the trial period, keep track of your spending to compare it to your anticipated retirement costs. You can use this to determine where you might need to make changes or cut back.

5. Make necessary changes to your retirement budget

Make any necessary adjustments to your retirement budget in light of your trial living experience. Your projected retirement spending or income sources may need to be adjusted.

By taking these steps, you can improve your understanding of how your retirement budget will function in reality and make required adjustments before retiring. This could make your retirement more stress-free and financially secure.

Tip #2

Review Any Outstanding Debts

Adulting often pushes us to dance with debt like buying a house, getting a new set of wheels, or pursuing higher education, all of which often lead us down the path of taking out loans and getting into debt.

Now, debt isn’t always a bad thing. Sometimes, it’s necessary to help us reach our goals. But as you approach your golden years, it’s crucial to have a solid plan in place for managing and reducing that debt.

Picture this:

A future where you’re free from the burdens of debt, where you can truly enjoy the fruits of your labour and live life on your own terms. That’s what we’re aiming for here.

So, take a moment to assess your debt situation. Understand which debts are helping you move forward and which ones might be holding you back. Then, craft a clear and actionable plan to manage and reduce your debt as you approach retirement.

Refinancing Mortgages

While you can technically refinance at any age, it’s important to understand that as you near retirement or have already reached it, your options may become limited.

Why?

Well, lenders might consider you a “high-risk” borrower due to factors like reduced income or uncertain repayment ability.

Here’s the trick:

If you’re looking to refinance, doing so before the age of 55 generally increases your chances of approval. It gives lenders more confidence in your ability to meet repayment obligations.

When you refinance prior to retirement, lenders will want to know your exit strategy. They’ll dig into your plans for repaying the loan once you retire. After all, your regular income from a job won’t be there anymore, and you may need to rely on your superannuation and the age pension to meet your mortgage payments.

It’s crucial to take your time and carefully consider how you can comfortably make those payments. Take a close look at your financial situation and assess if the loan term, which might be set for 10 or 20 years, will extend into your retirement years. You want to ensure that your mortgage won’t become a burden when you’re enjoying your well-deserved retirement.

Refinance to Extend Your Loan Term

Consider refinancing to a longer loan term if your monthly payback amount is too high. Your loan’s payoff period would be extended as a result, which would result in lower monthly payments. However, as mentioned above, it may eat into your retirement income.

Refinance for a Lower Interest Rate

Refinancing for a loan with a lower interest rate and/or fewer fees is another option. A small reduction in interest rates might have a significant impact on your repayments. Ask your lender to lower your interest rate, or think about looking for a different lender.

Downsizing

Selling your home and downsizing to a smaller one is an option if you want to avoid retiring with a mortgage. Retirees typically move to coastal areas from large cities to save money and have a fresh start for a major life transition.

It could offer you the extra money you need to pay off your home loan or reduce it. The best-case scenario is that you sell for a profit and have some money left over after paying off your mortgage.

Consolidate Other Debts

Debt consolidation is combining your credit card, personal, car, or other loans into one loan with a lower interest rate.

Because of its reduced interest rate, some people use their home loan to consolidate debt, but this puts their home at risk if they can’t pay.

Rolling debts into a personal loan or credit card balance transfer is another option.

Do your homework first because different choices have benefits and drawbacks depending on your situation.

Advantages of Debt Consolidation

Depending on how much you owe, you might be able to save money by consolidating into a loan with a lower interest rate and fees.

As you might just have to handle one monthly instalment rather than having to juggle numerous ones, a combined loan can be simpler to manage.

The quantity of paperwork will be reduced because you’ll just receive statements from one lender, which might make monthly budgeting much simpler.

Disadvantages of Debt Consolidation

Consolidating debt doesn’t prevent debt. If you have a habit of living beyond your means, you might do so again once debt-free.

Debt consolidation loans may charge fees such as annual fees, balance transfer fees, closing costs, and loan origination fees. These fees may be worth it, but you should factor them into your debt consolidation decision.

If you skip a monthly loan payment, you may have to pay a late charge. Some lenders charge a returned payment fee for insufficient money. These fees can dramatically increase borrowing expenses.

Tip #3

Get a Health Check and Review Your Health Insurance

Getting a health check and reviewing your health insurance before retirement helps ensure that you are prepared for the health issues and healthcare costs that may occur as you age.

A health check can help you figure out if you have any health problems or risks, so you can take steps to treat or control them before they get worse.

It’s also important to know what Medicare can and cannot cover and what private health insurance can deliver.

Here are some of the basics:

Medicare helps pay for some of the costs of health care in both public and private hospitals.

If you are a patient in a public hospital, Medicare helps pay for things like emergency care, most surgeries and procedures, hospital-provided medicines, and follow-up care.

Medicare pays for some of the doctor’s fees for private patients, but it doesn’t pay for hospital costs like accommodation and theatre fees.

Medicare covers a wide range of medical services through the Medicare Benefits Schedule (MBS), including:

- consultations with health practitioners

- mental health services

- health checks

- magnetic resonance imaging (MRI)

- nuclear medicine scans like positron emission tomography (PET)

- ultrasounds

- computed tomography (CT) scans

- x‑rays

- pathology tests

- eye tests

Medicare does not cover the following costs:

- ambulance services

- most dental services

- glasses and contact lenses

- hearing devices

- elective and cosmetic surgery

- services not on the MBS

- services provided through the private health system

If you have private health insurance, it might cover some of the costs that Medicare doesn’t cover, depending on your policy.

It’s best to understand what your private health insurance coverage covers and when to file a claim.

A private health information statement must be sent to you by your health insurer at least once a year. The information statement is similar to a product disclosure statement for financial services.

This statement summarises what your policy covers. There are various types of statements for hospital policies, extras policies, and combined policies for both hospitals and extras.

You can file a claim with your health insurer if you:

- are treated as a private patient in a hospital, if you have hospital cover,

- get additional medical treatment that is not covered by Medicare, and if your supplemental policy covers the service

Healthcare costs can be a big bill in retirement. Reviewing your health insurance before you leave can help you make sure you have the coverage you need to handle these costs and avoid any surprises that could hurt your retirement savings.

Tip #4

Ensure Your Estate Plan is in Order

A sound estate plan will ensure that your final wishes are carried out; and if you find yourself unable to make your own decisions, it may also be helpful.

What you want done with your assets after you pass away is documented in an estate plan. It may consist of records like these:

- your will

- a testamentary trust (as part of your will)

- superannuation binding nominations

Your Will

Your estate plan includes a will, which is a formal document that outlines your intentions for your assets after death.

Your will can specify how you want your assets distributed, who will care for your children if they are still young, any trusts you want to establish, how much money you want to donate to charities, and funeral arrangements.

Testamentary Trusts

A trust that is written in your will is called a testamentary trust, which takes effect when you die. You usually name a trustee in your will to administer it.

The trustee takes care of your assets until they can be given to your heirs. This is written down in your will and happens when:

- when a child turns a certain age or

- when a beneficiary meets a certain goal, like graduating or getting married.

You might want to set up a trust for your beneficiaries if they are under 18, cannot live independently, or may not be able to manage their wealth well.

A trust is also a good idea if you want to keep family assets as part of a divorce agreement or as part of a bankruptcy case.

Superannuation and Your Will

With a binding nomination, you tell the trustee of your super fund who should get your super benefit when you die. If you don’t name someone, the trustee of your super fund will decide who gets your money.

An estate plan also addresses how you wish to be looked after financially and medically in the event that you lose the ability to make decisions for yourself. Your estate plan may include the following documents:

- any powers of attorney

- a power of guardianship (which appoints someone to choose your residence and medical care)

- an advance healthcare directive (your needs, values and preferences for your future care)

Depending on your situation and what you feel comfortable trusting others with, you will select a particular set of documents. It’s best to obtain legal counsel if you’re unsure.

Powers of attorney

A power of attorney is a formal document that lets someone else handle your affairs on your behalf. It’s important to choose someone you can trust, who is good with money, and who will probably be around when you need them.

There are 3 types of powers of attorney:

1. General power of attorney

This lets someone handle your finances and legal matters. It’s generally temporary, as when you’re abroad and can’t manage your affairs.

2. Enduring power of attorney

An enduring power of attorney (EPA) lets someone handle your finances and legal matters. If you become incapacitated, an enduring power of attorney will still be valid.

3. Medical power of attorney

This enables someone to make medical decisions on your behalf in the event that you are ever unable to do so on your own. A medical power of attorney is limited to medical decisions.

Tip #5

Check Your Pension Eligibility and When You Can Apply

The Australian Government’s Age Pension is a regular fortnightly income that assists qualified older Australians with essential costs of living.

The Age Pension is intended to serve as a safety net for retirees, providing a basic standard of living for Australians who are most in need and unable to adequately or fully fund their retirement.

Approximately 62% of Australians over 65 receive either a partial or full Government Age Pension.

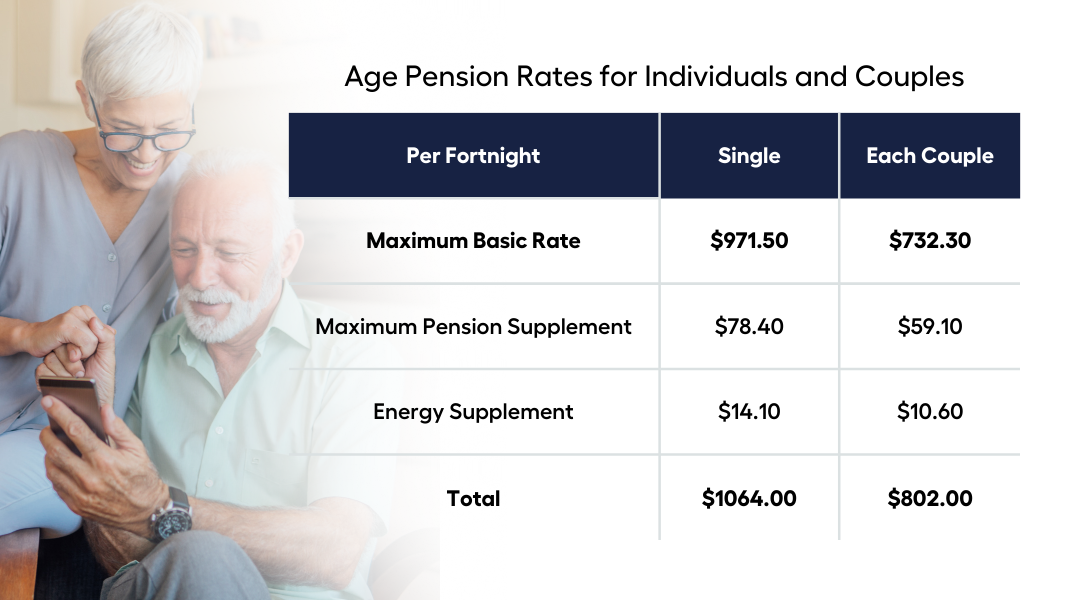

Age Pension benefits vary in amount depending on whether a person is single or in a relationship. If you live with a partner, you must disclose to Services Australia both your income and asset details.

In order to account for changes in the Consumer Price Index, the Department of Social Services examines Age Pension rates regularly. The figures listed below represent the highest rates per fortnight.

Note that when you reach the superannuation preservation age and stop working, you do not automatically qualify for the Age Pension.

Before you can start receiving your first pension payment, you must complete the eligibility standards outlined by the Australian government. These consist of your residence status, your assets and/or your income, as well as your eligibility age for the Age Pension (aka “pension age“).

Eligibility Standards for Age Pension

Age Pension Age

To be eligible for Age Pension you must be Age Pension age. Age Pension age is:

- 65 years and 6 months, if you were born between 1 July 1952 and 31 December 1953

- 66 years, if you were born between 1 January 1954 and 30 June 1955

- 66 years and 6 months, if you were born between 1 July 1955 and 31 December 1956.

From 1 July 2023, Age Pension age will be 67 years, if you were born on or after 1 January 1957.

Residence Status

To be eligible for the Age Pension, you must meet the residency requirements.

Generally, in order to qualify for an age pension, a person must have lived in Australia for a minimum of ten years. There must not be a pause in your residency for at least five of those years.

Income Test

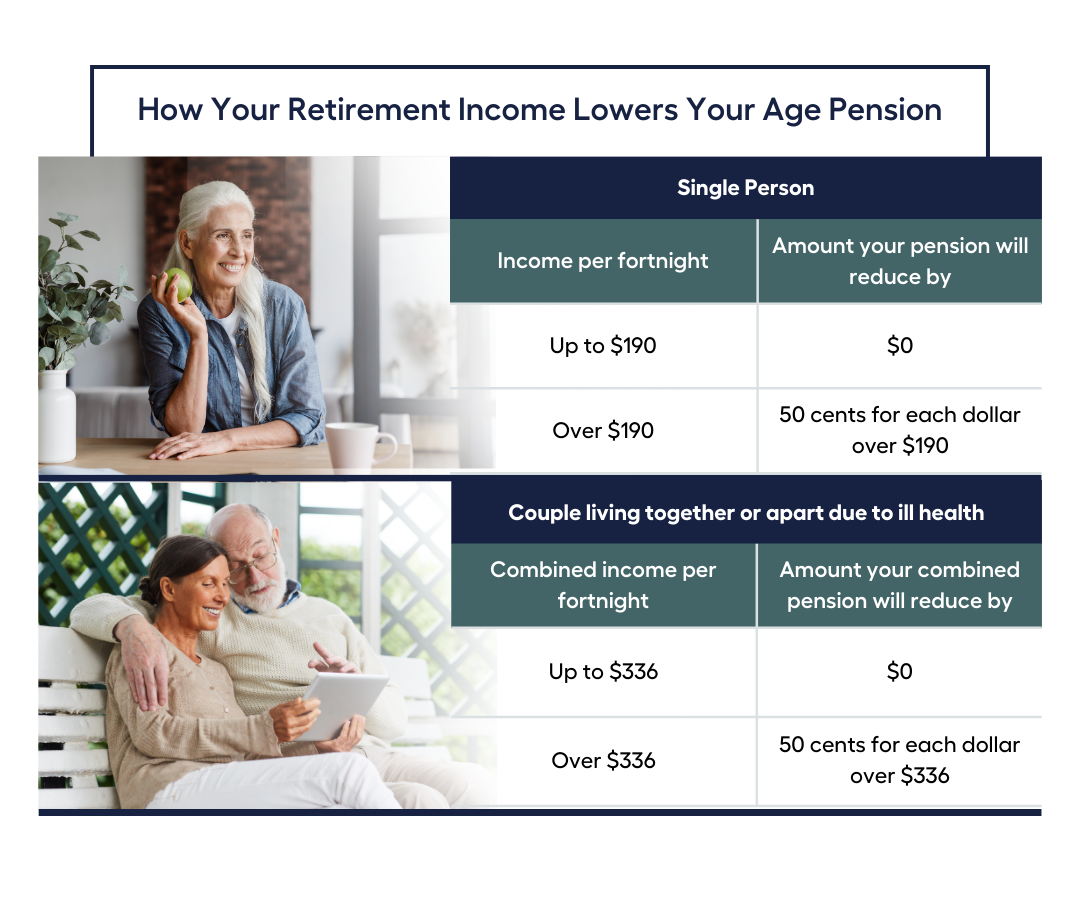

The pension income test determines Age Pension, Disability Support Pension, and Carer Payment.

Your income from all sources is evaluated by Services Australia for you and your partner, including superannuation. The deeming method is used to calculate the amount of income your financial assets generate. Deeming assumes these assets earn a certain rate of income, regardless of what they actually earn.

Your income may lower the amount you receive from Age Pension.

Asset Test

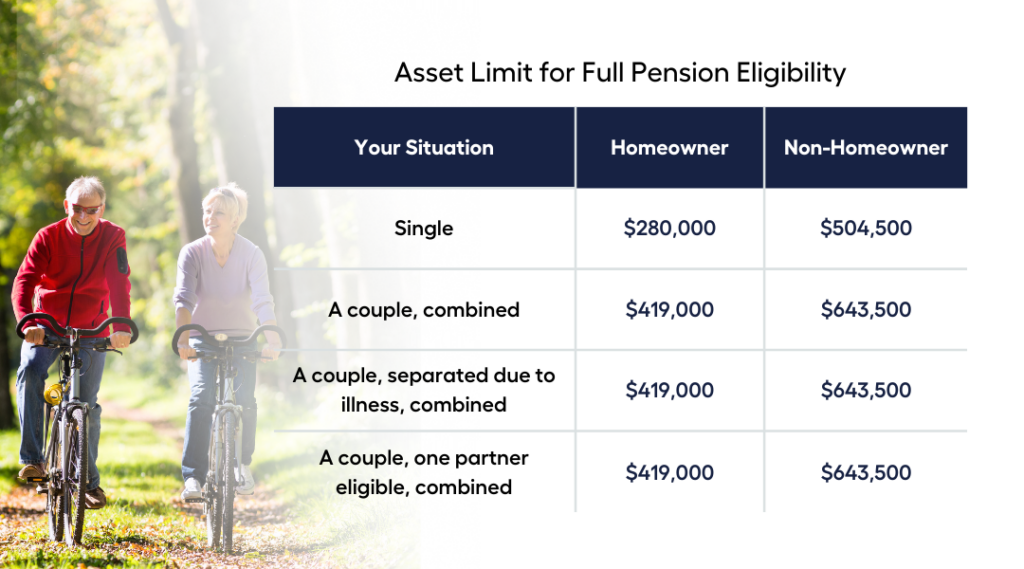

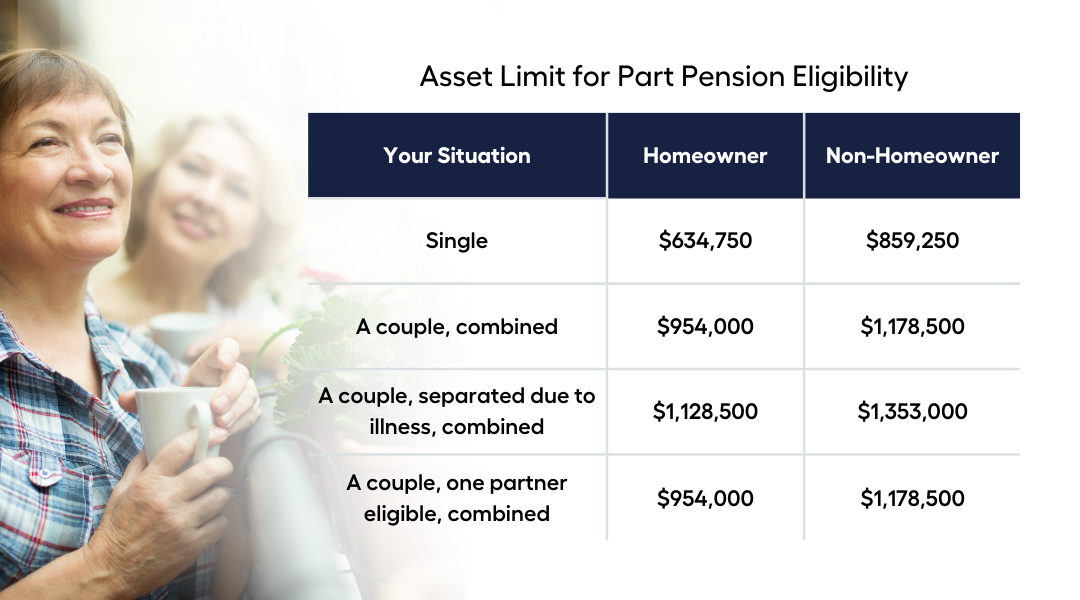

Your eligibility for the Age Pension, Carer Payment, or Disability Support Pension and the amount you receive is determined by the asset test.

The value of your assets and if you are in a relationship determine how much you are compensated. Each year, in January, March, July, and September, the Department of Social Services evaluates these caps and thresholds.

Any real estate or possessions that you fully own, partially own, or have an interest in constitute your assets, it also includes debts owed to you and assets located outside of Australia.

If you get a full pension

Your pension will be reduced if your assets exceed the threshold that applies to your situation. If you’re part of a couple, the cap applies to the joint assets of you and your spouse, not to each of you individually.

If you get a part pension

As of 20 March 2023, part pensions will be cancelled when your assets exceed the threshold that applies to your situation. If you’re part of a couple, the cap applies to the joint assets of you and your spouse, not to each of you individually.

When you’re thinking about retirement, it’s good to consider the Age Pension as one part of your plan. But it’s also important to look at all the money you’ll have coming in and how it all fits together. That means checking out all the different ways you can make money and how they might work together.

Getting advice from someone who knows about investing, like a licensed financial planner, can really help. They can give you guidance on how to make the most of your money and plan for a secure financial future. So it’s definitely worth considering meeting with one.

Need Financial Advice to Get Ready for Retirement?

Book a FREE 15 min Call or Send Us Your Questions!

I want to see all my options with the help of a Finance Expert

Call Our Team Today