Homeownership is considered a significant milestone and a major goal for many Australians.

However, according to the Australian Bureau of Statistics, as of 2021, 31% or 2.9 million households were renters.

Jump straight to…

What prevents Aussies from owning a home?

A variety of factors prevent Australians from owning a home. It can be one or a combination of any of these: High property prices, lack of savings, limited availability of affordable housing, limited access to credit, strict lending criteria, and low income or underemployment.

To help more Australians own a home, the Australian government offers a variety of home loan programs to help first-time home buyers and low-income earners enter the housing market.

This guide will explore the different government home loan programs available in Australia, including eligibility criteria, the application process, and how to find the right program for you.

What are Government Home Loans?

Government home loans (aka social or affordable housing loans), provide financial assistance to folks who don’t have the deposit amount required by lenders or may not be eligible for a standard bank home loan.

Eligible homebuyers can benefit from the following government help:

- federal government home loan assistance

- state government home loan support

- indigenous home loans

Regardless of which scheme a homebuyer takes, it is almost certain that they can do two things:

Pay a minimum deposit amount and NOT pay lenders mortgage insurance (LMI).

This would mean that if you were to take advantage of a government home loan program on a $700,000 residential property and pay only a 5% deposit and have the LMI waived, you get to defer $105,000 on a deposit and save from $25,591 to $29,495 on LMI.

That’s more than $130,000 you get to defer/avoid and put towards your home loan repayments if you meet government home loan assistance requirements.

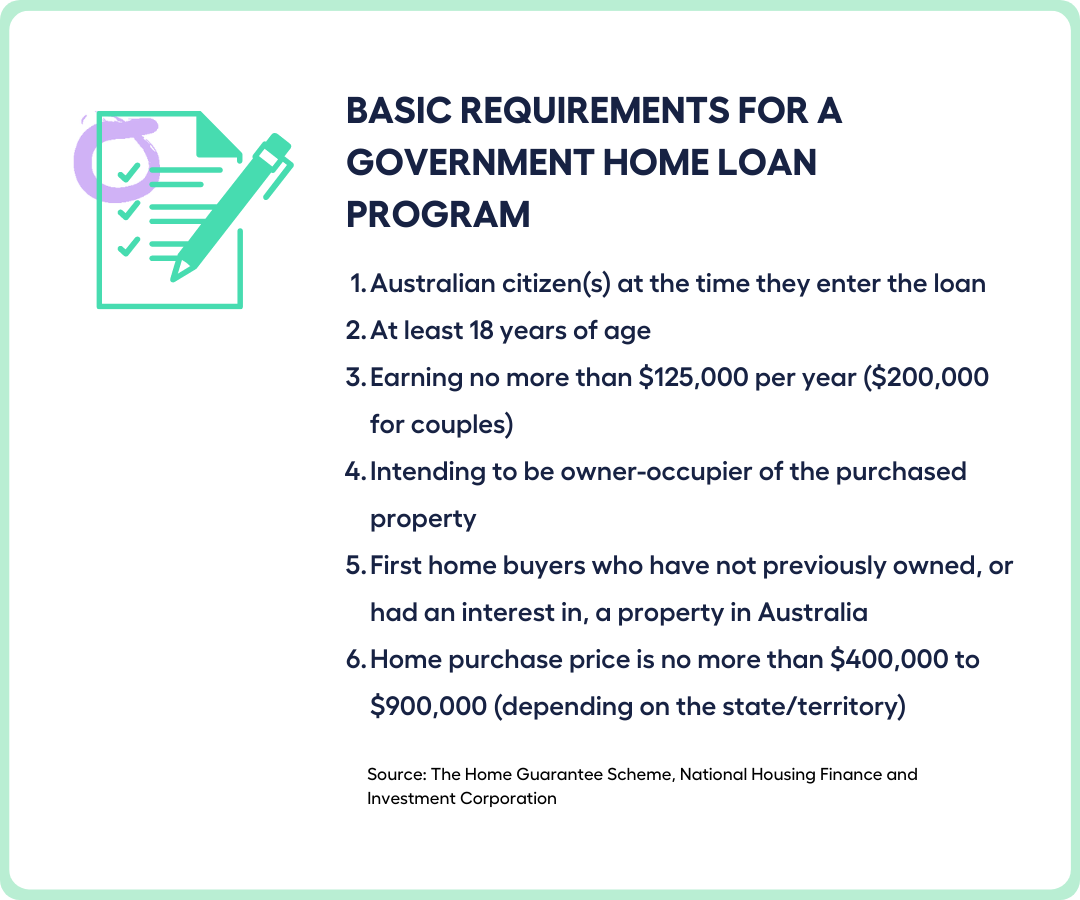

Government Home Loan Assistance Requirements

The various government home loan programs each have specific requirements depending on the type of product and the state offering it, but they share some common requirements.

To qualify for these programs, borrowers typically need to meet certain requirements, such as citizenship, first-time homebuyers, meeting income and asset limits, and purchasing a residential property within certain price limits.

Additionally, borrowers will typically need to demonstrate their ability to repay the loan by providing proof of income, employment, and credit history.

It’s important to note that the requirements and conditions for these programs may change over time and vary depending on the specific program and location.

So, check with your mortgage broker, the Australian government website or a Participating Lender for the most up-to-date information and specific details on the program you are interested in.

If you’re looking for a stress-free way of going through this process, you can book a free call with My Money Sorted and you’ll be matched with an experienced Mortgage Broker.

Types of Government Home Loan Assistance

There are many government home loan programs offered by the Australian government and each state. Most of these, but not all, are created to help eligible first home buyers purchase a home with minimum deposits and avoid paying lenders mortgage insurance (LMI).

Federal Government Home Loan Assistance

The Home Guarantee Scheme (HGS) is an Australian federal government initiative that assists qualified homebuyers in purchasing a home faster. It is managed by the National Housing Finance and Investment Corporation (NHFIC) for the Australian Government.

First Home Guarantee/First Home Loan Deposit Scheme

Under the First Home Guarantee Program (FHBG), which was previously known as the First Home Loan Deposit Scheme (FHLDS), the NHFIC will guarantee a portion of a home loan given by a Participating Lender to a qualified first-time buyer.

The maximum amount that the NHFIC will guarantee for a home loan is 15% of the residential property’s value as assessed by the lender.

- The eligible home buyer can purchase a home with as little as a 5% deposit and avoid paying LMI thanks to this guarantee.

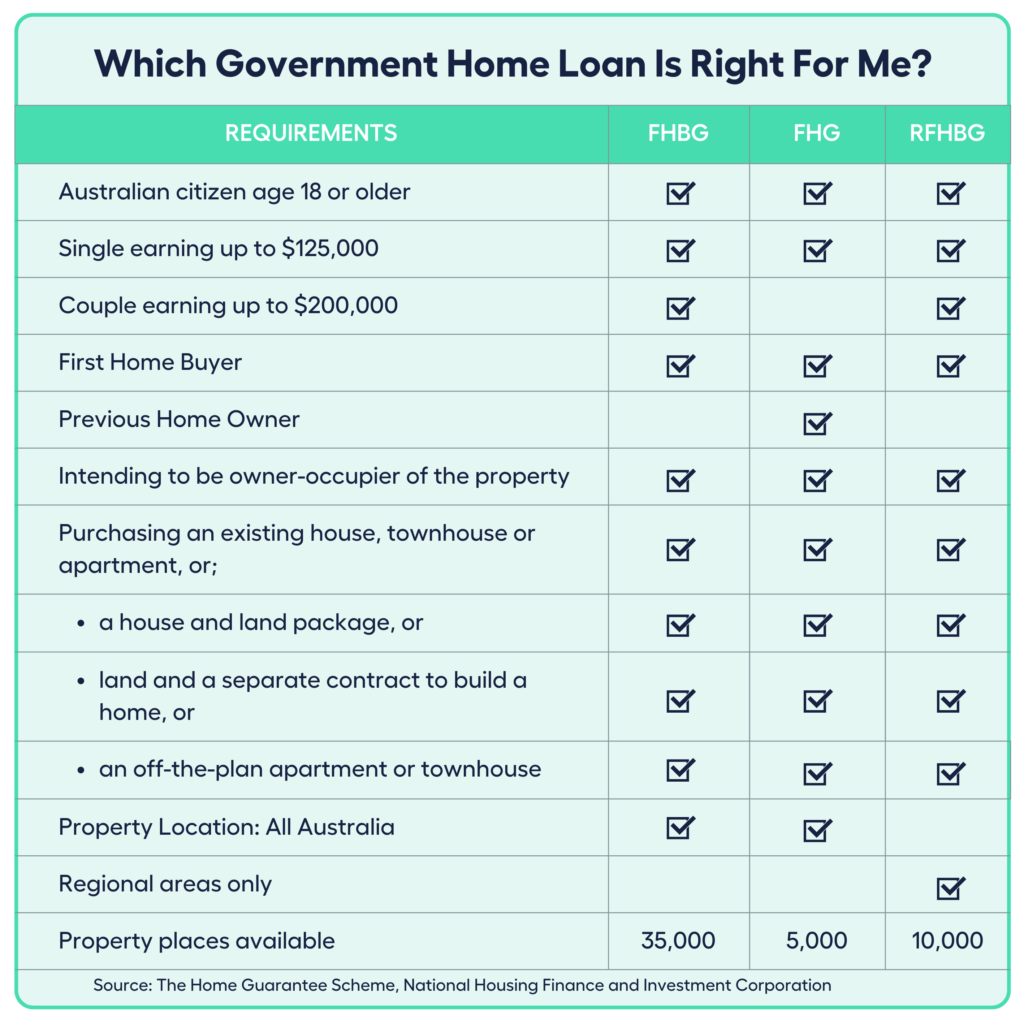

From 1 July 2022 to 30 June 2023, eligible first-time buyers can apply for one of 35,000 FHBG places.

Family Home Guarantee

- The Family Home Guarantee allows eligible single-parent borrowers to purchase a home with only a 2% minimum deposit and avoid LMI.

There are 5,000 FHG places open to eligible single parents with at least one dependent child for the period of 1 July 2022 to 30 June 2023.

The family home loan guarantee is limited to a maximum of 18% of the residential property’s value as assessed by the Participating Lender.

Regional First Home Buyer Guarantee

To support eligible regional first-time home buyers, the NHFIC guarantees a portion of their home loan from a Participating Lender under the Regional First Home Buyer Guarantee (RFHBG).

- This allows an eligible home buyer to buy a home with as little as a 5% deposit and avoid paying LMI.

Any home loan guarantee is limited to a maximum of 15% of the residential property’s value as assessed by the Participating Lender.

There are 10,000 RFHBG places available to eligible regional first home buyers from 1 October 2022 to 30 June 2023.

State Government Home Loan Assistance

Several state governments have home loan assistance programs. These are usually, but not always, shared equity schemes.

In a shared equity scheme, the buyer and the government split the costs of putting down a deposit. The catch is that the government receives a portion of the residential property’s value.

Keystart in Western Australia

Keystart was founded in 1989 by the Government of Western Australia in order to assist Western Australians who are unable to meet the deposit requirements of traditional lenders.

Keystart offers Low Deposit Home Loans to residents of WA who make less than a certain amount of money.

- In metropolitan areas, a 2% deposit is required, while a 10% deposit is required in rural areas.

Additionally, first-time homebuyers can use the state’s first-home-owner grant program to subsidise their deposit.

Because they do not require LMI, Keystart loans are different from the low-deposit home loans that traditional lenders might offer.

Another product Keystart offers is referred to as a Shared Ownership Home Loan. This loan aids in financing homes that the Housing Authority offers.

Through the Keystart Home Loan program, loan recipients are able to finance a portion of the cost of a home while also receiving a share of ownership from the Housing Authority.

A complete list of products and eligibility checks is available on Keystart’s website.

HomeStart Finance in South Australia

In an effort to speed up the home ownership process for South Australians, the Government of South Australia established HomeStart in 1989.

- South Australians can increase their borrowing capacity and decrease the amount they need to save for a deposit through HomeStart.

HomeStart home loans enable borrowers to pay a much less expensive loan provision charge in place of LMI. Additionally, it provides loans to specific customer groups at a 97% LVR.

A Shared Equity Option is also offered by HomeStart. Between 5% and 25% of the value of your home may be covered by HomeStart.

Queensland Housing Finance Loan

With the Queensland Housing Finance Loan, eligible Queenslanders can purchase or build a home with a low deposit.

- The loan only needs a 2% deposit and has no LMI requirements. It also has variable or fixed rate options.

The loan is set up to make it easier for borrowers to make their payments. The Queensland Housing Finance Loan includes borrowers’ income in its calculation of repayment amounts in addition to loan size, term, and interest rates.

The borrower’s initial monthly payments begin at 30% of their income and are limited to 35% of that amount.

Victorian Homebuyer Fund

The Victorian Homebuyer Fund is a shared equity scheme in which the Victorian Government contributes money to the purchase of a home in exchange for an equity stake in the property that participants can buy back over time.

The Victorian Government contributes up to 25% of the purchase price of a home to eligible participants under the scheme. Participants must contribute at least 5% of the purchase price and cover any acquisition costs, such as stamp duty and conveyancing fees. The remainder will be secured by a home loan from a partner lender.

Here’s an example:

- Your home costs $500,000.

- Your deposit is 5%, or $25,000.

- The Homebuyer Fund contributes 25%, or $125,000.

- You take out a loan from a Participating Lender for the remaining 70%.

- You sell the house for $600,000 after 4 years. A quarter of the sale, or $175,000, goes to the Victorian Homebuyer Fund.

Indigenous Business Australia Home Loans

If you are an Aboriginal or Torres Strait Islander home buyer, you may be eligible for home loan assistance from Indigenous Business Australia (IBA). The Indigenous Home Ownership Program allows eligible borrowers to qualify for loans with low deposits.

How Do Government Home Loan Programs Work?

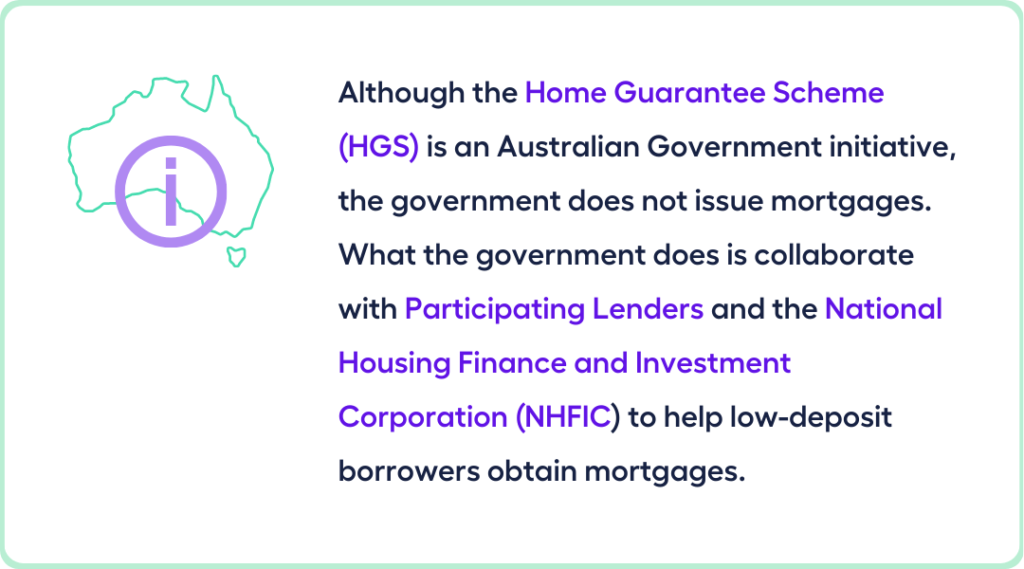

We mentioned earlier that the HGS is an Australian Government initiative created to assist eligible home buyers in purchasing a home sooner, and is managed by the NHFIC.

Although the HGS is a government initiative, it’s important to note that the Australian government does not issue mortgages. What the government does is collaborate with Participating Lenders and the NHFIC to help low-deposit borrowers obtain mortgages.

As we mentioned earlier, two things normally happen when you access a government home loan program:

- You pay a lesser deposit, around 5% of the property value

- You don’t have to pay lenders mortgage insurance (LMI)

- Normally, a bank or a lender will require you to pay LMI if your deposit is less than 20% of the property value. This is to protect the lender in case you default on the loan and leave them with a property in their inventory.

However, since government home loan assistance guarantees the mortgage, you can pay a deposit between 2% and 5%, depending on which Guarantee you get and have the LMI waived.

NHFIC does not accept HGS applications. Government home loan program applications are to be processed with a Participating Lender or their authorised mortgage broker.

There are 32 Participating Lenders authorised by the NHFIC to offer the HGS to home buyers.

The buyer and their advisors need to speak with a Participating Lender and seek independent financial and legal advice in order to determine whether a particular home loan or residential property, and the terms of the HGS, are appropriate for the buyer’s circumstances and goals.

If you’re looking for a stress-free way of going through this process, you can book a free call with My Money Sorted and you’ll be matched with an experienced Mortgage Broker.

Can I Access Government Loan Assistance to Buy a House?

Any Australian citizen who meets the eligibility requirements for government home loan assistance can benefit as long as they meet the lender’s requirements and there are property places available.

You might be wondering now:

Which government home loan program is right for me?

Let’s have a look at the table below to check which Home Guarantee Scheme is suitable for you:

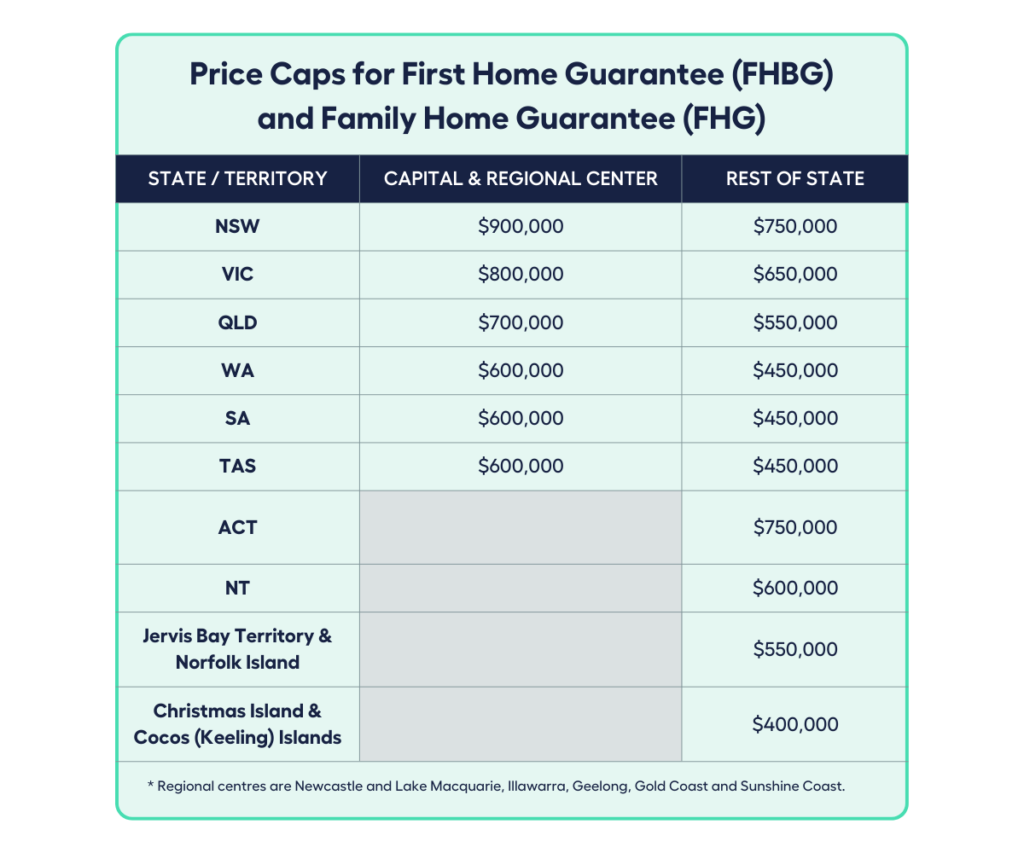

In addition, properties eligible for purchase under the HGS are subject to property price caps established by government legislation.

Price caps on real estate vary from one fiscal year to the next and from one location to another (in a capital city, large regional centre, or regional area).

Below are property price cap tools that can assist home buyers in determining the appropriate property price caps:

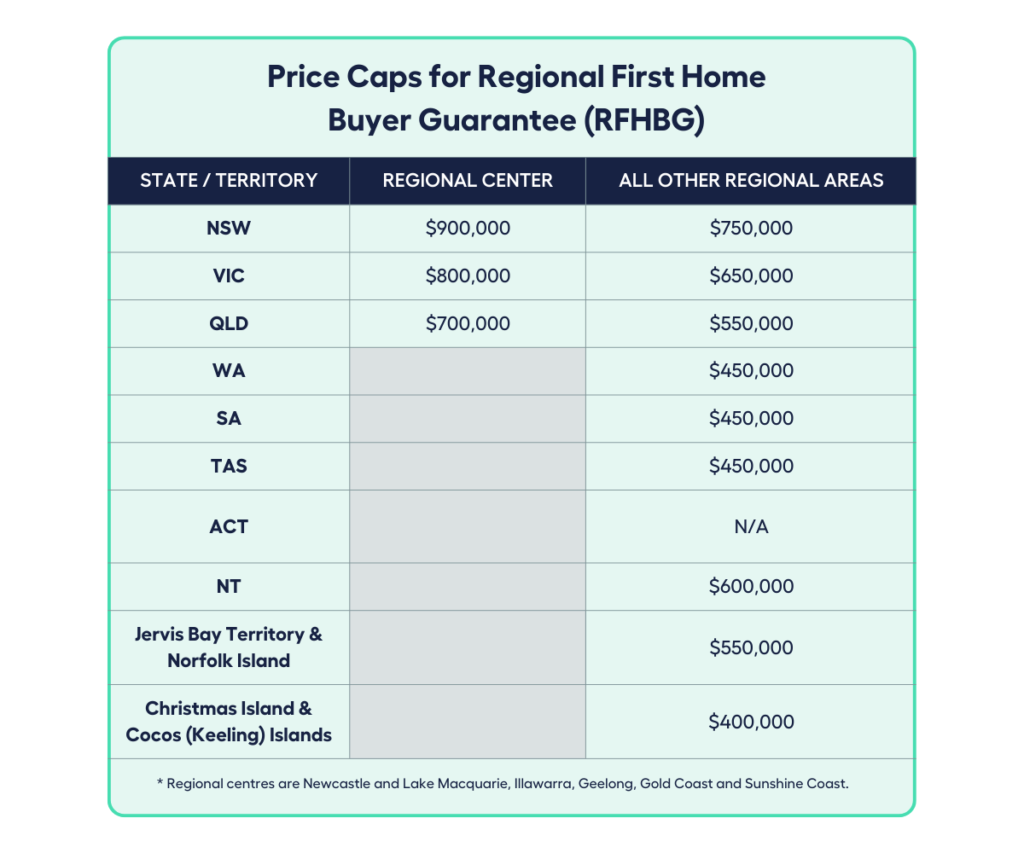

Here are the price caps for the Regional First Home Buyer Guarantee (RFHBG):

The NHFIC also has an eligibility tool. It’s a short questionnaire to help home buyers determine eligibility for the First Home Guarantee, Family Home Guarantee or Regional First Home Buyer Guarantee.

Although the above tables and eligibility tool are useful in determining prices and your eligibility, it’s best that you and your mortgage broker consult with a Participating Lender and seek independent financial and legal advice about whether a specific home loan or residential property, as well as the terms of the HGS, are appropriate for your personal circumstances and objectives.

Get connected to an experienced Mortgage Broker to simplify the process by booking a free call today!

Government Home Loan Assistance Interest Rates

We mentioned earlier that the Australian government does not issue home loans. It collaborates with Participating Lenders and the NHFIC to help low-deposit borrowers obtain mortgages using a low deposit and having the LMI waived.

This means that your home loan interest rate will still be subject to several factors such as the cash rate set by the Reserve Bank of Australia (RBA), your loan to value ratio (LVR), employment status, and credit file.

Every borrower’s financial situation is unique, and while there is little you can do to influence the global financial market in your favour, there are numerous other factors that will influence your home loan interest rate.

It may be worth reassessing your loan every 12 months or so. This could lower your interest rate if you’ve paid off debt, gotten your income documentation in order, or can demonstrate financial discipline.

How to Get Government Home Loan Assistance?

To get government home loan assistance, you would need to apply for one with a Participating Lender or their authorised mortgage broker. It’s a simple four-step process for you if you have your papers in order.

1. Check Your Eligibility

Review the requirements and information mentioned earlier and check your eligibility by visiting the NHFIC website.

2. Submit Your Application

Call your mortgage broker or Participating Lender and complete your home loan application. The lender will evaluate your application to determine if you qualify for the loan.

Note that your Participating Lender must also approve you for an eligible home loan on an eligible residential property before your loan can be guaranteed under the Scheme.

3. Get Conditional Approval

Once you submit your application, your Participating Lender will collect your documents required for HGS eligibility and reserve your place in the Scheme.

Your Participating Lender will let you know if your application for a guaranteed loan under the applicable Guarantee has been accepted into the Home Guarantee Scheme.

4. Buy Your Home

After being accepted into the Scheme, you will have 90 days to find and purchase your first home. No extensions beyond the required timeframe are permitted.

In order to finalise your loan application, you should get in touch with your Participating Lender as soon as possible after signing a contract of sale.

NHFIC will be notified and your home loan application will be processed by your Participating Lender.

After that, all you have to do is move in after settlement!

While getting government home loan assistance looks simple after you’ve read this article, it always pays to ask for a second opinion by having a conversation with a mortgage broker.

A mortgage broker can help get your documents in order and save you time looking for the right Participating Lender.

Best of all, a licensed mortgage broker is mandated by law to work in your best interest, and you don’t have to pay them to do it.

If you need help looking for a mortgage broker that looks after your best interest, talk to My Money Sorted for free.

Knowing your borrowing power is just the first step. A mortgage is a big investment of both time and money, which is why it’s often best to receive guidance from a financial expert like a mortgage broker.

Many people may be unaware of this… but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with help from our MMS Team.

When you book a call with our team you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan. Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with the MMS team

Step 2: Get matched with a licenced Mortgage Broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by an experienced Mortgage Broker.

It’s that easy!

To Learn More About Government Home Loans & Which Lenders Can Assist You, Talk to My Money Sorted Today!