As a homeowner, have you thought of “upgrading” your mortgage?

If you’ve had your current home loan for years, chances are your needs may have changed, your loan may not have the flexible features or add-ons, or even discounted rates that are now available to new borrowers.

“Upgrading” your home loan can be done through refinancing, and in this article, we’ll answer the one thing that could be running through your head at this point – What does it cost to refinance a mortgage?

Jump straight to…

The Costs of Refinancing

When you refinance your home loan, you pay off your current loan with your existing lender with a new loan either with the same lender or a different financial institution.

- You can choose between internal refinance and external refinance.

When you do an internal refinance, you change your mortgage but keep the same lender.

On the other hand, when you do external refinance, you switch to a new lender to get a new mortgage.

| Two Types of Refinancing | |

| Internal Refinance | External Refinance |

| Same lender different home loan | New lender with a new mortgage |

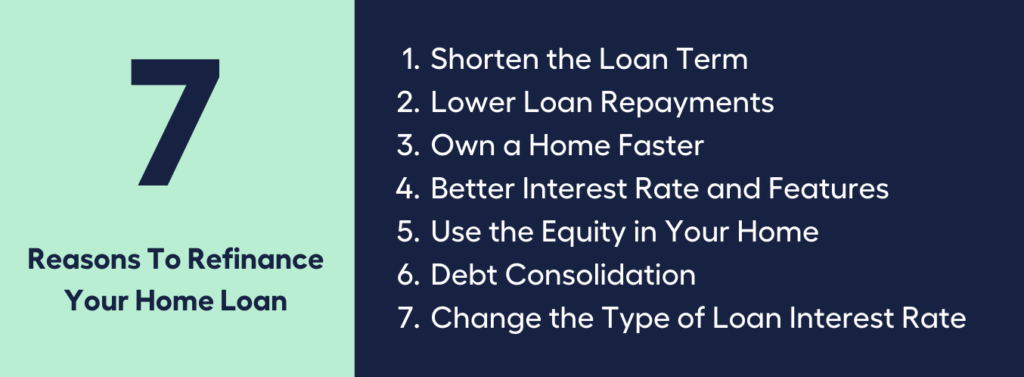

Whether you choose internal or external refinance, refinancing can help shorten the length of your loan term and lower your loan repayments, so you could pay more off your mortgage and own your home faster.

Refinancing your existing home loan may also allow you to:

- Get a lower interest rate or new features like flexible payments, redraw facilities, or an offset account

- Use the equity in your home to make repairs, invest, or fund a holiday

- Secure a loan with a better interest rate, lower monthly repayments, or a more flexible home loan if your existing fixed-rate term is coming to an end

- Consolidate various debts and loans like a personal loan, car loan, or credit card into your mortgage, which makes it easier to keep track of your money. Also known as debt consolidation

- Change the type of loan rate from a variable-rate home loan to a competitive fixed-rate home loan, or get a split loan.

Do remember when you compare home loans with the goal of refinancing your home loan, you need to consider any ongoing and upfront costs that come with paying off your existing loan and starting a new one.

What Fees Do I Have to Pay When Refinancing?

Refinancing your home loan comes with various home loan fees and refinancing costs. What you pay will depend on your financial situation, although there are common fees that you need to inquire about.

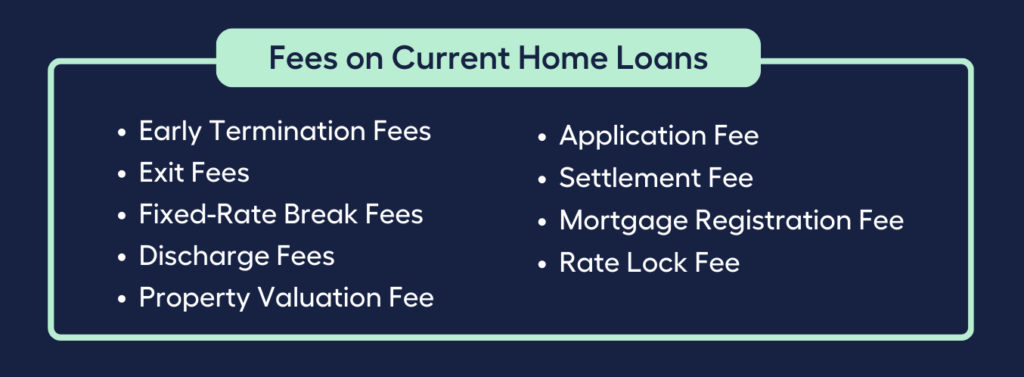

To identify these refinancing fees more easily, let’s split them in two:

- Fees on Current Loans and Fees on New Home Loans.

Fees on Current Home Loans

Aside from paying fees for costs incurred on your current home loan, your new loan and new lender will charge fees on costs incurred as well.

Early Termination Fees

An early termination fee, which is also called a mortgage settlement fee, is a one-time fee that you incur if you pay off your home loan before the term is up.

This usually only happens in the first five years or so, which is why it happens more often when people refinance:

- The termination fee is meant to cover the lender’s legal fees and any other costs related to this early cancellation of the home loan contract.

Not all lenders charge an early termination fee, but those who do charge do so depending on the type of loan, and various other factors like the length of time left in the loan term.

Exit Fees

Some lenders impose an exit fee on home loans taken out before 01 July 2011. Although some lenders no longer charge an exit fee. To be sure, check with your lender if you have an older loan.

Lenders typically charge this fee to cover the cost of ending the current loan and to discourage people from switching home loans often.

Exit fees (aka early exit, termination, or deferred establishment fees) were banned on 01 July 2011 following government reforms.

Fixed-Rate Break Fees

If you have a fixed-rate home loan and want to refinance before the end of the fixed rate period, you’ll likely have to pay break fees.

- These fees cover financial losses that your current lender might incur as a result of the loan agreement not lasting the length of the agreed term.

Lenders usually borrow money from the wholesale money markets through the Bank Bill Swap Rate (BBSR), which is locked in at the same time as your fixed rate home loan. When you sign a fixed-rate agreement with your lender, they also sign a fixed-rate agreement with a third party to lock in their funding costs.

If you break a fixed rate term, your lender will have to break a contract with a third party, which means they will lose money, a loss they will pass on to you.

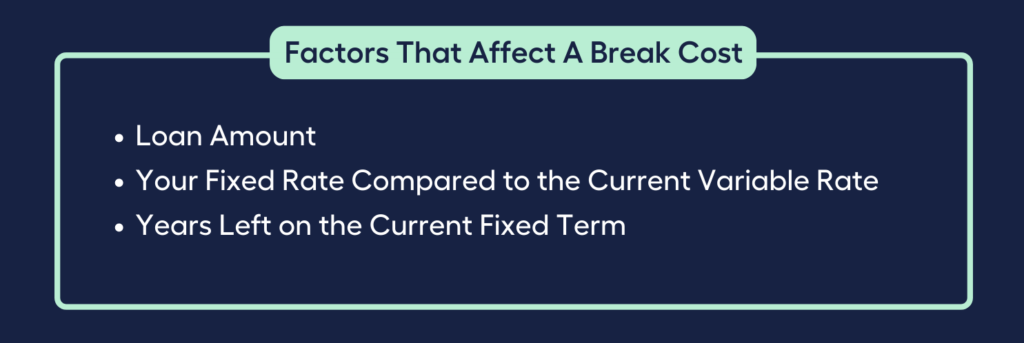

Break costs can be difficult to calculate, but they are usually based on:

- the amount of the loan

- how the fixed interest rate compares to the current variable interest rate market

- Length of time left on the fixed term

Typically, if interest rates have gone down since the beginning of the fixed term, break fees will be higher.

The cost to break a mortgage can be several thousand dollars or more, which is why it would be wise to ask your lender for a clear answer about how much it will be.

Discharge Fees

On top of any fixed loan break costs, your lender may add a discharge fee when your existing home loan is paid out in full.

- A discharge fee, also called a termination fee, covers part of the cost of ending your loan.

Loan completion necessitates paperwork and labour from the lender — administrative costs which they need to recoup from the borrower. The cost of the fee varies depending on the lender.

Fees on New Home Loans

Aside from paying fees for costs incurred on your previous home loan, your new loan and new lender will charge fees on costs incurred as well.

Property Valuation Fee

When you refinance or apply for a home loan, one of the various upfront fees that new lenders may charge is a valuation fee.

The valuation fee covers the expense of the lender valuing your property before choosing whether or not to approve your application.

A valuation assists the lender in determining whether the amount you’re borrowing is appropriate in relation to the market value of the property.

To accomplish this, the lender will normally send an impartial valuer out to view the property and determine whether the genuine value differs from what you’ve agreed to pay.

- The valuation fee is frequently determined by the lender and the property’s location. Valuation fees for rural properties are typically higher than urban homes, mostly due to travel time required to get to the property.

In some cases, lenders will not charge a valuation fee but may see fit to charge an application fee.

Application Fees

You may be required to pay an application fee if you refinance with another lender.

A home loan application fee is a one-time fee levied by your new lender at the start of your home loan application to cover the costs of loan processing and documentation. They are also known as an establishment, start-up, or set-up fee.

Application fees are based on the amount you intend to borrow from the lender. They are usually non-refundable but also the most commonly waived fees in loan products to attract customers.

Settlement Fee

Settlement fees encompass paying off your current lender and switching to your new mortgage.

They cover the cost of the lender’s legal representation to conduct the loan settlement with you and your conveyancer or solicitor.

Mortgage Registration Fee

The State Government of the state in which the property is located will charge a mortgage registration/deregistration fee to cover the admin costs of switching your mortgage registration between lenders.

- It prevents the homeowner from selling the property without paying the lender.

Registration fees vary by state and territory.

You have to pay this fee when you register the property as the security for a home loan. This is important because it lets buyers check to see if there are any claims on the existing property.

You typically pay the mortgage registration fee during settlement. This is when your new mortgage starts and the old one ends.

Even though mortgage registration fees are small when compared to some of the other costs of a home loan, they still need to be taken into account at settlement.

Rate Lock Fee

Your new lender will give you the choice to lock in the interest rate that is quoted at the time your loan is authorised if you apply for a fixed rate home loan.

This is provided as protection against any rate increases that your lender may implement between the time of approval and settlement.

Just be cautious:

Fees for a rate lock can be costly, so be sure you know where mortgage rates are headed and whether one is really essential. Furthermore, you can be stuck paying a higher rate if you choose a rate lock and interest rates fall in the interim.

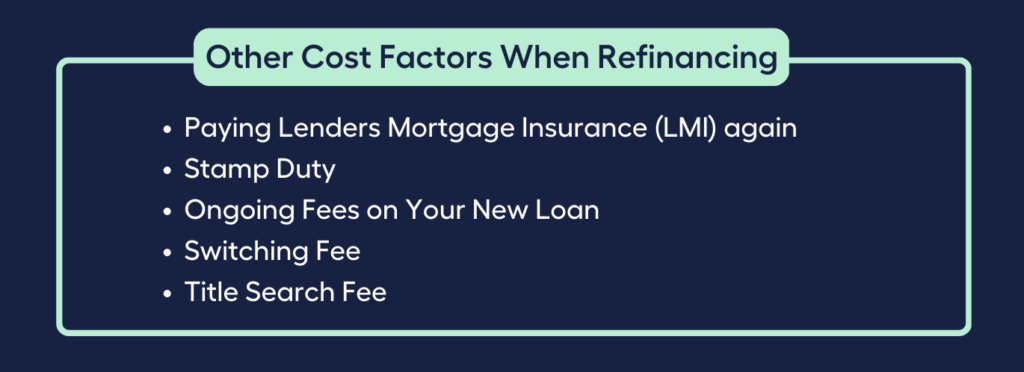

What Other Cost Factors Should I Keep in Mind When Refinancing?

Aside from the fees paid to each lender, there are other costs related to a home loan refinance which you may have to pay.

Paying LMI Again

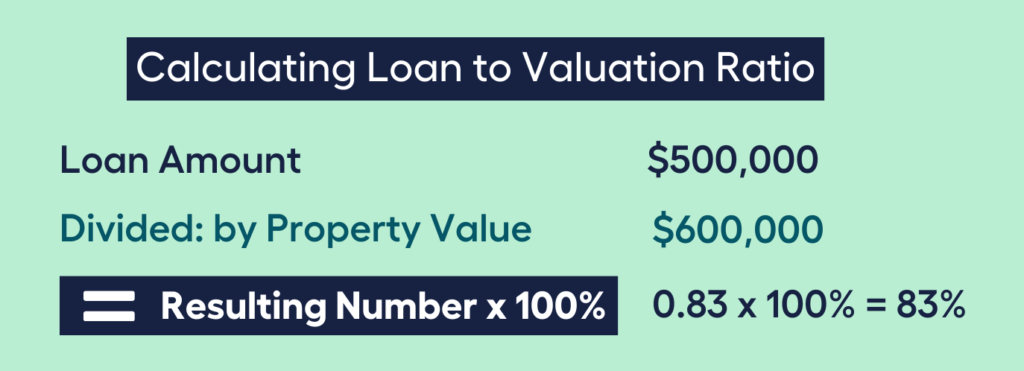

- Lenders mortgage insurance (LMI) is typically required for borrowers with a loan-to-value ratio (LVR) of less than 80%.

LVR is determined by dividing your loan amount by the property value, then multiplying that number by 100.

For example, if you borrowed $500,000 to buy a $600,000 house, your LVR would be $500,000 divided by $600,000, or 83%.

In the event that the borrower is unable to make mortgage repayments, LMI shields the lender from losses.

The insurance cost for LMI is unfortunately non-transferable, so if you’re considering refinancing but haven’t been able to lower your loan-to-value ratio below 80%, you’ll probably end up paying it twice.

- Talk to your current lender about your choices because some lenders may be willing to give you a refund of some type.

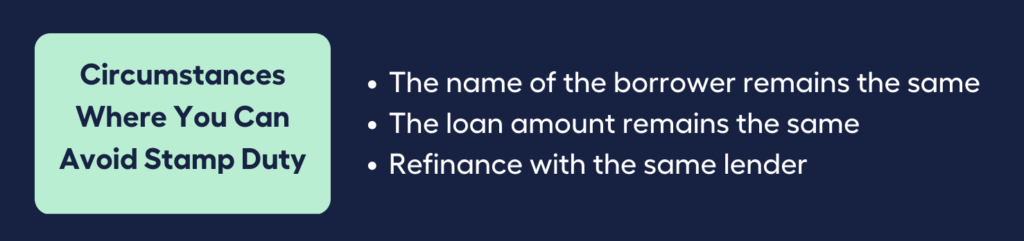

Stamp Duty

Stamp duty is a tax that the government puts on transactions involving real estate.

How much stamp duty you have to pay depends on:

- the property valuation

- where it is located

- whether it will be used as an owner occupier or investment property

In most refinancing situations, you will not have to pay stamp duty. For example, if you borrow under the same name, keep the size of the loan amount the same, and refinance internally, you might not have to pay stamp duty.

Since stamp duty is set by each state, it’s best to check with your state government to see if it applies to you. In some states and territories, stamp duty is called Transfer Duty, Conveyance Duty, or just Duty.

Ongoing Fees on Your New Loan

You’ll also need to know if your new lender will charge you any fees over the life of the loan.

Some of these fees could be:

- Monthly or annual servicing fees to cover the cost of managing your home loan.

- Extra repayment fees for making too many extra repayments in a year especially for a fixed rate loan.

- Redraw fee when you use a redraw facility.

- Late payment fee when you fail to make your loan repayments on time.

Switching Fee

If you’re refinancing internally with the same financial institution, they may charge you a switching fee to cover administration costs.

- Make sure to check if your lender charges a switching fee as these may be set to discourage switching to a lower interest rate.

Title Search Fee

When you refinance your loan, your lender may want to do another title search to establish ownership and to check if the property is free of encumbrances.

What’s the Average Cost to Refinance a Mortgage?

Refinancing can be relatively inexpensive, but for people in certain situations, it can be a very expensive exercise.

According to a Canstar calculation, you could pay an average of only $75 in refinancing fees at the low end of the scale, with the average cost amounting to $807. However, at the high end, you could pay fees up to an average of $2108. These figures don’t include deregistration fees, which vary from state to state.

| Fee Type | Minimum | Average | Maximum |

| Discharge Fee | $75 | $329 | $895 |

| Application Fee | $250 | $495 | $990 |

| Valuation Fee | $154 | $254 | $350 |

| Documentation Fee | $150 | $315 | $600 |

| Legal Fee | $200 | $334 | $440 |

| Settlement Fee | $99 | $232 | $995 |

| Total Fees | $75 | $807 | $2,108 |

Your current lender should be able to inform you about any early repayment fees that come with paying off a loan, or you can check important paperwork like the Key Facts Sheet (KFS). A KFS is an important tool for improving financial product transparency and disclosure.

The new lender you chose will be able to tell you how to apply for a loan and how much it will cost. Before you sign a loan agreement for a new home loan, you should read all of the important paperwork, like the Target Market Determination (TMD), Key Fact Sheets (KFS), and any other terms and conditions.

You can also try our Refinance Calculator to check how much you can save and how much quicker you can pay off your loan if you were to refinance.

Is Refinancing Your Home Worth It?

The 1% rule of thumb is a general rule of thumb for refinancing. It says that refinancing is a good idea if the new interest rate is at least 1% lower than your current rate.

Perhaps, another way to look at it is to calculate:

- how much your principal and interest repayments are reduced, or

- how much the term of your loan shortened

Keep in mind that a smart homeowner is always looking for ways to get out of debt, build equity, save money, and ultimately pay off their mortgage.

If you need help looking for the best refinancing deal for you, talk to My Money Sorted for free!

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your home loan options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Mortgage Broker

It’s that easy!

Looking to Refinance? Talk to My Money Sorted Today About Finding the Right Lender for Your Needs.