Thinking of securing a home loan for your next purchase?

Or perhaps you’re looking to secure a better deal on an existing loan?

Ensure you’re getting a fair go and are securing the best deal by comparing the real cost of different home loan rates.

Read on to learn about the home loan process, how to compare home loans and find the home loan that’s right for your personal circumstances.

Jump straight to…

But first things first – what is a home loan?

A home loan, also referred to as mortgage, is a credit line provided by a bank or other financial institution to assist you with the purchase, construction, refinancing, or even renovation of residential real estate. It normally has a 25- or 30-year loan term that accrues interest which you can pay on a regular basis.

Based on the amount you can afford to borrow, you can start comparing home loans by looking at home loan interest rates, principal and interest repayments, costs, and other features of home loans offered by various lenders.

So, what is a comparison rate?

A comparison rate is a percentage rate that includes the interest rate and most other fees and charges associated with a mortgage.

The National Credit Code, which replaced the Uniform Consumer Credit Code (UCCC), requires lenders to publish the comparison rate next to the advertised interest rate to give borrowers a better picture of the total cost of a home loan after most fees and charges have been included.

Why pay attention to comparison rates?

Because the cheapest home loan won’t always be the one with the lowest interest rate.

The interest rate impacts the total cost of any loan and can differ considerably among home loan lenders. Home loans are typically long-term debts so slight variations in the home loan interest rate can make a notable difference on the overall amount that you have to pay.

But don’t just take out the mortgage with the cheapest interest rate you can find.

Why not?

The money you think you would save on interest may be offset by up-front and recurring costs which may increase the loan’s total cost.

Bottomline:

What may initially appear as cost savings due to a lower interest rate may be erroded by add-on costs and fees.

Here’s a hypothetical example:

Emily was looking for the lowest home loan interest rate. Since this was her first time buying a house, didn’t have a mortgage broker, and was not aware of helpful tools like home loan calculators, she opted for a lender offering an interest rate of 3.5% over a bank with a 3.6% comparison interest rate.

It turns out, however, that the lender offering a lower home loan rate of 3.5% charges a $1,000 annual fee. Once these costs are taken into account, Emily’s loan may end up costing more than the one from the bank that was charging 3.6% but with no fees.

A home loan with a slightly higher interest rate that permits you to make extra mortgage repayments and offset interest may better suit your needs and speed up your progress repaying the loan.

You can easily compare home loans from different lenders by looking at the comparison rate.

Remember to consider the interest rate as well as these factors:

- Any costs or fees attached to the home loan as establishment fees, or ongoing annual fees

- Features offered, such as:

- redraw facility – which enables a borrower to make repayments on their loan and to redraw this money if they need the funds again, or

- offset account -your offset account’s balance lowers the outstanding loan balance and helps you save on interest

With a comparison rate, you can find the combination of the best mortgage rate with low fees and essential features. It can also give you an idea whether the loan is good value for money or not because any large fees that may not be immediately obvious are indicated.

How is a comparison rate calculated?

Wondering how a home loan comparison rate is determined?

Actually, it employs a method that considers both interest payments and any additional fees or costs. And since it accounts for additional expenses, the comparison rate will be slightly higher than the headline interest rate.

Under Australian law, lenders must determine the comparison rate based on a loan of $150,000 for a 25-year term, which includes the principal and the interest.

The calculation is a bit complicated since it considers different variables. You can simplify the process by using home loan calculators such as the MMS loan comparison calculator which allows you to compare different home loans. Simply input the loan comparison rate within the interest rate field and the calculator will show you the difference in repayments across both home loans.

Aside from your preferred loan amount, loan term, repayment frequency, you will also need to consider other fees and charges before you start calculating.

Here are the 3 main categories of fees that are typically used to calculate a comparison rate:

- Upfront fees

- Application fee

- Pre-approval fee

- Valuation fee

- Document preparation fee

- Legal fee

- Ongoing fees

- Monthly account fee

- Annual package fee

- Periodical admin fee

- Discharge fees when the loan is paid off

- Discharge admin fee

- Documentation preparation fee

- Settlement fee

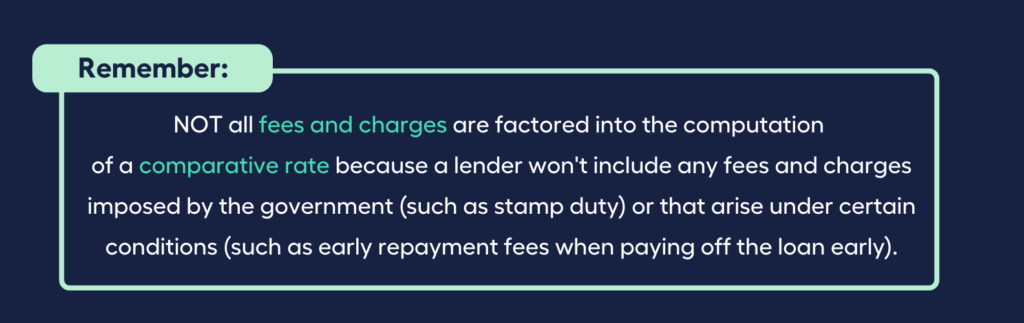

It is important to note that not all fees and charges are factored into the calculation of a comparison rate because a lender won’t include any fees and charges imposed by the government (such as stamp duty) or that arise under certain conditions (such as early repayment fees when paying off the loan early).

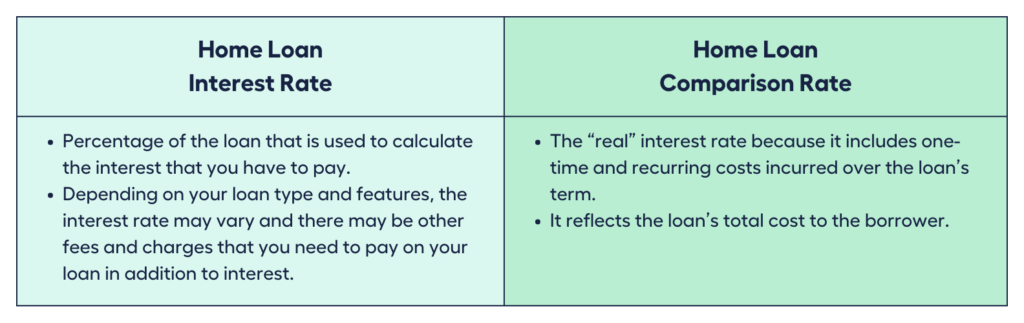

What’s the difference between a home loan’s interest rate and comparison rate?

It’s easier for you to evaluate different home loan products offered by various lenders if you use a comparison rate.

So take note of this:

What is the rate on a home loan after the fixed rate ends?

Fixed rate home loans give you more security because the interest rate and home loan repayments are fixed for a duration, although fixed rate loans are less flexible when it comes to making additional loan home repayments, paying off the loan sooner and refinancing before the term is over.

But here’s the thing:

What happens to the per annum interest rate if your fixed rate loan ends today?

When the fixed period ends, loan terms will change and the loan converts to the Standard Variable Rate (SVR) relevant to your loan purpose and repayment type at that time, or a new fixed rate period may be chosen.

The SVR, an interest rate set by the lender, is the default interest rate that mortgage borrowers are moved onto when the initial deal ends.

Comparison rate warning

Without a doubt, a comparison rate for home loans is important in determining whether or not a loan you are considering is the right fit for your financial situation.

In spite of this, there are some advantages and disadvantages when you utilise it.

The Pros & Cons of Comparison Rate Home Loans

You can be assured that as mandated by the Australian law, all comparison rates for home loans are based on a $150,000 loan for a term of 25 years.

However, different comparison rates may result if other terms, charges, or loan amounts are to be used.

Here are the advantages of using a comparison rate when assessing your home loan options:

- Assists you in calculating the total cost of your mortgage by factoring known expenses, such as up-front and ongoing fees, into that rate

- Helps you compare costs of several home loans with similar features

- Provides you with a clearer picture of the actual cost of the loan rather than assessing this based on the advertised interest rate

- All Australian financial institutions and mortgage providers use the same comparison rate calculation formula, which is regulated by the Australian Securities and Investments Commission (ASIC)

However, a comparison rate will show cost comparisons but it will not include:

- Fees and charges related to loan options or events that the borrower may or may not take advantage of, including early repayment or redraw fees

- Cost-saving measures such as fee exemptions or the availability of interest offset plans which can influence the cost of a loan

- Fees and costs that are not available at the time the comparison rate is given

- Additional benefits provided by lenders, such as flexible payment plans, the use of offset accounts, or fee-free accounts

- Government taxes or charges (stamp duty or mortgage registration costs)

Now that you know all about home loan comparison rates, are you ready to compare different home loan rates offered by different lenders?

Check Your Borrowing Power with MMS Mortgage Calculator

Knowing your borrowing power is just the first step. A mortgage is a big investment of both time and money, which is why It’s often best to receive guidance from a financial expert like a mortgage broker.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by an experienced Mortgage Broker.

It’s that easy!

Get Ahead Of Your Home Loan by Speaking with My Money Sorted Today