Did your parents expect you to ace secondary school so that you would be eligible to get into university and graduate with a degree?

If you answered YES, you are not alone.

According to research released by the Australian Institute of Family Studies, Australian mothers have high educational expectations for their children, with more than half of mothers expecting their child to graduate from university.

Their aspirations are well founded. Australian university graduates have a wide variety of employment options and the education system in Australia generally ranks higher than that of other countries, the study stated.

The same research also revealed that children’s expectations for their own educational achievements were closely related to their mothers’ expectations.

However, education costs now aren’t what they used to be when we were students. And who knows what affordability challenges will arise when our children finish high school and go to university.

The unpredictability of educational expenses, at all levels of schooling, is a reason to begin saving early for an education fund.

While you may not have much to save right now, starting small and making regular contributions builds your savings over time and can help you meet both anticipated and unexpected education expenses.

But how?

There is one underrated investment option you can use to build a secondary or tertiary education fund for your child:

Education bonds.

If you haven’t heard of education bonds before, here’s a quick explainer for you.

Jump straight to…

What is an Education Bond?

Education bonds are a type of long term investment vehicle that cover the expenses for primary, secondary, and post secondary education, including training programmes provided by colleges, universities, TAFE, and other recognised domestic and international institutions.

An education bond is a type of investment bond that provides investors with versatility, options, tax efficiency, and intergenerational estate planning features.

An investment bond is also known as an insurance bond because it is a combination of an investment portfolio and a life insurance policy that allows you to list a policy owner and a life insured.

Offered by financial organisations and insurance companies, an investment bond pools investors’ funds and are invested based on the investment option you select.

It’s generally a 5-10 year investment wherein you can access the funds anytime, but it is usually most tax effective as a 10+ year investment.

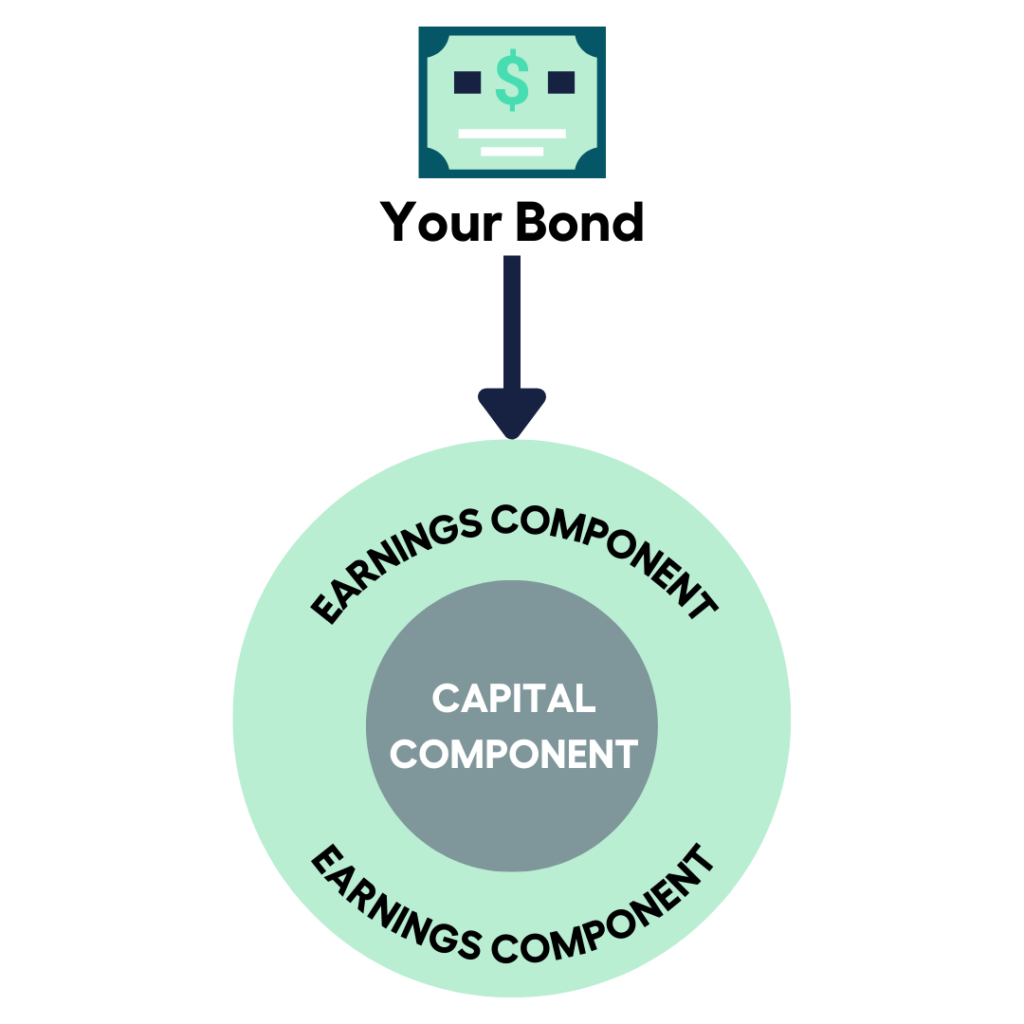

It’s important to remember that while an education bond is a type of investment bond, only education bonds have two parts:

A bond earnings component and a bond capital component.

Your initial investment to create the bond plus additional contributions or investments make up the bond capital component, and the income earned by your bond as investment income makes up the bond earnings component.

Your bond balance is the total of these two components at any given time.

Education bond expenses are not limited to paying the cost of tuition fees in schools, any expenses related to your child’s education are considered education expenses and can be funded by your education bond.

How Does an Education Bond Work?

Education bonds include all the features and tax advantages of conventional investment bonds plus additional educational tax advantages, estate planning features, and the freedom to designate numerous beneficiaries.

Let’s go through the 10 Features of Education Bonds.

| 10 Features of Education Bonds | |

| Common with Investment Bonds | 1. Will-like Estate Planning 2. Savings Plan and Lump Sum Contribution 3. Future Activated Transfer 4. Avenues for Tax Free Access 5. Asset Protection with Creditors 6. Tax Paid Investing |

| Unique to Education Bonds | 7. Education Benefit Claims Have Valuable Education Tax Benefits 8. Add to Capital or Make Capital Only Withdrawals 9. Individual or Multiple Discretionary Beneficiary 10. Bond Guardian Feature |

Will-like Estate Planning

Education bonds have a feature that allows you to nominate one or more beneficiaries in case of death. The education bond’s proceeds are then distributed tax-free to the beneficiaries according to your specified allocations.

Your education bond benefits pass directly and discretely to your beneficiaries. These agreements also avoid any delays and expenses related to obtaining probate or administering your estate because the transfer occurs outside of your Will and legal estate.

You can also cancel or amend your bond nominees any time.

Savings Plan and Lump Sum Contribution

An education bond can be funded in two ways:

Through a lump sum contribution or a savings plan.

- Lump Sum Contribution: By investing a single “once-off” lump sum contribution, you can establish your education bond. You can also make add-on contributions to it if you wish. Those who want to establish their education bond with a greater capital component associated with long-term educational funding goals may benefit from lump sum arrangements.

- Savings Plan: Savings plans are the best way to create a dedicated education fund for elementary and secondary school tuition. You can invest and increase your money up to a specific point, after which you can start taking withdrawals to pay for your education. It also has a feature that allows you to set a percentage (up to 25%) to automatically increase your annual regular contributions. Your savings plan amount will increase every year on the anniversary of your education bond. You can also change your rate of escalation at any time.

Future Activated Transfer

The ownership of your bond can be set up to automatically change from you, as its initial owner, to other people, including your education beneficiaries, without affecting the bond’s benefits and tax-advantaged status.

Your bond can be instantly turned over to other people in the following ways:

- on a specific date in the future that you designate; or

- upon the occurrence of specific events, such as your death as the bond owner, or when a predetermined amount of time (for example, three years) has passed since your death.

You can utilise this feature to designate specific inheritances for kids and grandkids to conduct tax-effective intergenerational wealth transfers outside of your will.

Avenues for Tax-Free Access

There are several ways to get access to your bond and receive payments from it, and you, your education beneficiaries, and the people who will receive your bond upon your death will all receive tax-free treatment for doing so.

The capital component of your bond is always available for withdrawal at any time, under any circumstance, and the receipts are always tax free.

Education benefit claims made from the earnings component of your bond are tax-free for adults and minors with taxable income within their respective tax free thresholds.

| Resident Minors Tax Rates | |

| Eligible income | Resident tax rate |

| $0 to $416* | Nil |

| $417 to $1,307 | 66% of excess over $416 |

| Over $1,307 | 45% of the entire amount of eligible income |

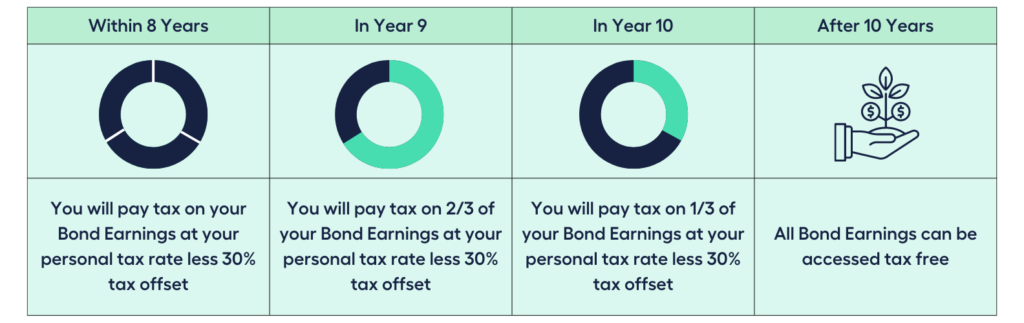

Where the education bond’s 10-year advantage is applicable, withdrawals from the bond’s earnings component made at any time and in any amount after 10 years are tax-free receipts.

If your education bond matures due to the death of its life insured, the full bond benefits are transferred to your bond estate beneficiaries tax-free.

If your bond expires owing to the end of its bond term, all proceeds distributed to you are tax-free where the Investment Bond 10-Year Advantage applies.

Asset Protection with Creditors

There may be circumstances where your financial situation changes, such as those brought on by significant debt, legal liability actions, or even bankruptcy proceedings. Under Australian bankruptcy laws, education bonds are given particular protection from creditors because they are types of life insurance investment contracts.

Tax Paid Investing

The bond provider (rather than you) pays the fund tax on the continuous investment earnings from your bond for the duration of the entire bond term.

This means you don’t have to concern yourself with tax reporting and paying tax on ongoing fund earnings.

Also, bond owners with middle- to high-marginal tax rates (MTR) may gain significantly from tax-paid investments since the effective fund tax rates on the bond’s investment options are typically lower than their higher ongoing personal income tax rates.

Additionally, the value of education bonds is not included in your annual personal taxable income. The effects of automatically reinvested investment earnings and compounding in an investment structure with tax advantages can result in substantial additional performance advantages.

| Australian Resident Tax Rates 2022–23 | |

| Taxable income | Tax on this income |

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000* | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000* | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over* | $51,667 plus 45 cents for each $1 over $180,000 |

*Income with marginal tax rate above 30%

**The above rates do not include the Medicare levy of 2%.

Education Benefit Claims Have Valuable Education Tax Benefits

Education bonds are eligible for favourable “scholarship plans” taxation treatment when they are created with the sole intention of providing for education costs and educational expenses of beneficiaries.

When this happens, the bond providers claim tax deductions for education benefit claims paid and completely pass the financial benefits to the receiving education beneficiaries.

The benefit essentially amounts to a reimbursement of the fund tax that the bond providers had paid on the bond’s investment gains.

The benefit amounts to an additional $30 for every $70 withdrawn from your investment returns as education benefits.

Instead of being considered as taxable income to the bond owner, student benefit claim amounts are tax assessable in the hands of the student beneficiary at the marginal tax rate for adults and minors.

Add to Capital or Make Capital-Only Withdrawals

Education bonds give you the flexibility to make additional contributions or investments to your capital at any time.

You can also withdraw from your capital anytime for any purpose and you don’t have to pay tax.

Individual or Multiple Discretionary Beneficiary

You have the option to have one education bond with multiple beneficiaries, instead of investing in multiple education bonds for each of your beneficiaries.

This way you can avoid paying multiple fees on multiple bonds, and optimise the investment income earned in one bond.

Bond Guardian Feature

In the case of your death, legal, physical, or mental incapacity, you can nominate one or more (up to three) bond guardians to act in your capacity as bond owner. This is especially critical since you can set your bond’s term between 1 and 99 years.

Bond guardians act in the best interests of your student beneficiaries first. So, it is critical to pick someone who can be trusted and is skilled.

Bond guardians are authorised to perform basic activities for ordinary bond operations, such as receiving reports and statements.

Have Questions on the 10 Features of Education Bonds?

Get the Answers from Finance Experts – Book a Complimentary Call with our Team Today.

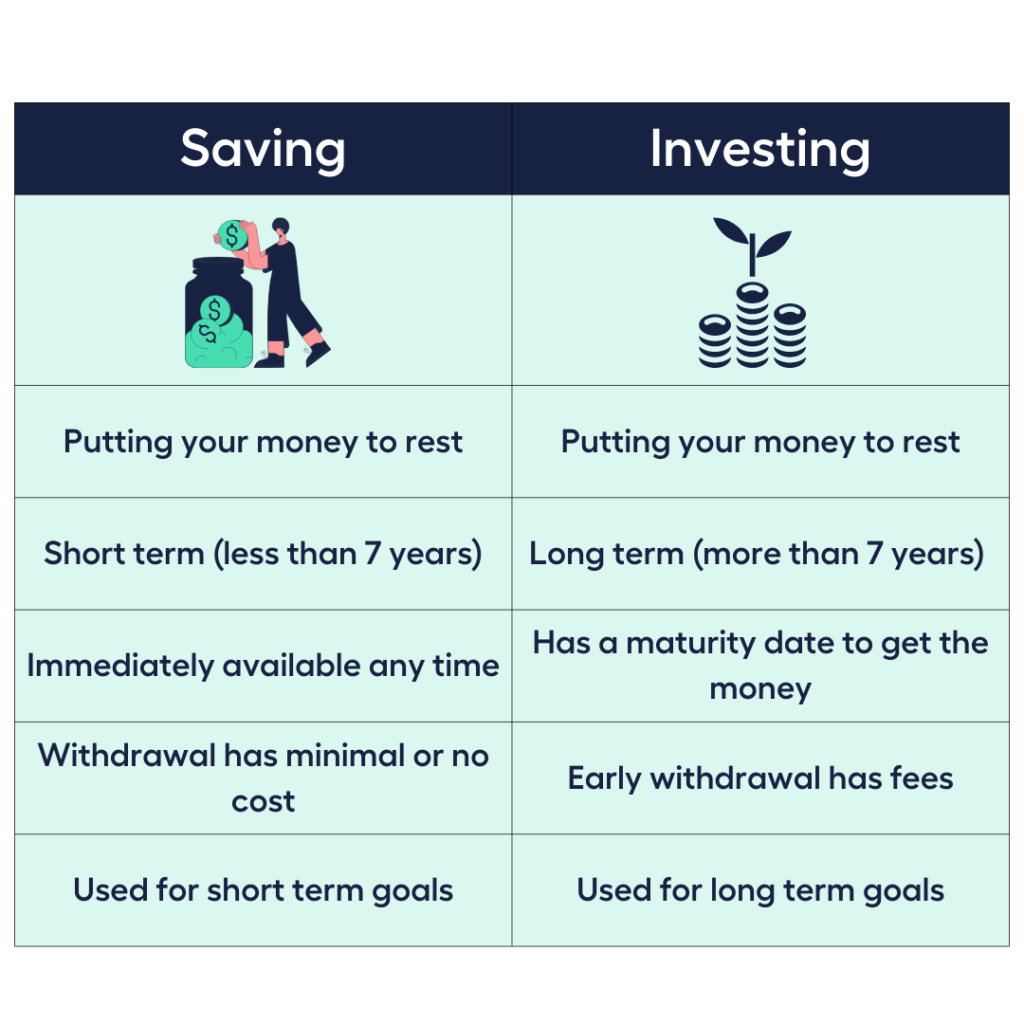

Is a Bond an Investment or a Savings?

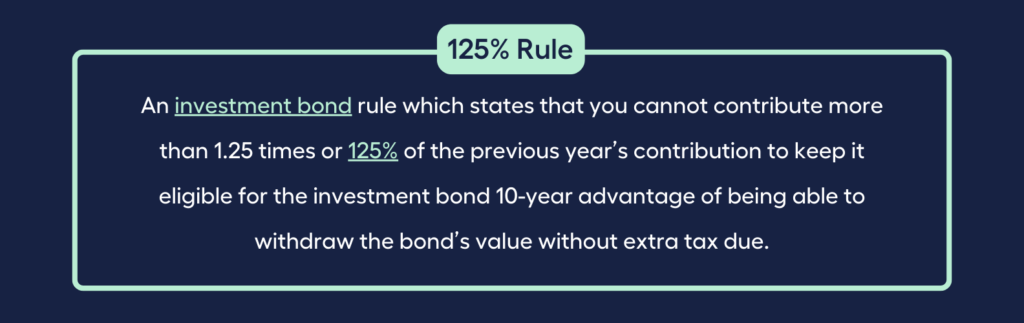

If we consider the 125% rule of an education bond, it’s easy to conclude that it functions more like a savings account.

One of the most important rules to remember with education bonds is the 125% rule, which states that you can contribute up to 1.25 times or 125% of the previous year’s contribution.

Maintaining compliance will keep it eligible for the education bond 10-year advantage where withdrawals made at any time and in any amount after 10 years from the earnings component of the education bond are tax-free.

It does sound like a term deposit with a lock-in period of 10 years considering that there are “penalties” for withdrawing your earnings early.

If you withdraw your earnings within 8 years for purposes other than education costs, you will pay tax on the earnings on the education bond at your personal tax rate, and a 30% tax offset applies to counteract the tax that was paid within the bond.

If you withdraw in the 9th year, you pay tax on two-thirds of the earnings.

If you withdraw in the 10th year, you pay tax on a third of the earnings.

However, one of the attractive features of an education bond is it allows you to be an investor.

Education bonds provide a diverse selection of investment products from prominent Australian and international fund managers.

Furthermore, unlike other child or school-related investing and savings products, education bonds provide unrivalled flexibility of switching across an extensive investment portfolio for free.

Education bonds are investments because you put your money to work in a long-term financial product to meet specific financial goals.

Are Education Bonds Worth It?

Clearly, an education bond, as a form of investment, isn’t designed to be accessed within 10 years. It’s a long-term investment and shouldn’t be treated as a savings vehicle.

That being said, it’s still worth looking into if you have the patience to have long-term investments outside of your super fund and value the risk/reward ratio of an investment that typically earns better returns than savings accounts and other bank deposits.

Pros and Cons of Education Bonds

Educational bonds offer you options, flexibility, intergenerational estate planning advantages, and tax effectiveness.

1. Options

Education bonds provide a diverse investment portfolio ranging from sector-specific or diversified funds for you to choose from. You can even switch or replace funds as you want.

2. Flexibility

Because education bonds are adaptable, they can meet your evolving demands. Its adaptability allows you to add, replace, and remove up to ten beneficiaries from your family and friends at any moment.

3. Intergenerational Estate Planning

Educational bonds provide estate planning features such as the ability to appoint numerous beneficiaries, the ability to establish will-like tax-effective inheritances so that bond revenues are dispersed to specified nominees, and the possibility of passing ownership through generations.

4. Tax-Effectiveness

Education bonds include all of the tax advantages of standard investment bonds, plus additional education tax advantages.

Investments in the education bond are not subject to taxes. When you make a withdrawal to cover educational expenses, you will receive a refund of the fund tax paid on your behalf. Nominees receive tax-free benefits.

These are the reasons why education bonds can outperform other investment kinds in terms of after-tax returns.

Primary Risks Associated with Education Bonds:

1. Investment Risk

The value of your Bond Benefits will rise or fall depending on the Investment Options you choose.

2. Market Risk

You may be susceptible to changing market conditions and volatility in the shares market, fixed interest markets, bond markets, and the property market.

3. Taxation Risk

This may include unanticipated or sub-optimal taxation benefit outcomes as a result of your selection of the kind and amount of education benefit claims and other withdrawals from your bond.

Is an Education Bond the Right Investment for You? One Way to Find Out is to Talk to the My Money Sorted Team.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Looking for the Right Solution, But Not Sure How to Find the Right Finance Expert for Your Unique Situation?

Get Some Peace of Mind and Start Living a Richer Life by Booking a Complimentary Call with our Team.

Curious about what happens during a call with our team?

Watch this video!

It’s that easy!

Looking to Invest in Your Future? Talk to our Experts to Learn More About Getting the Right Investment Advice.