When planning to make a purchase, do you grab the first item you see or do you search for the best deal?

If you’re like most Aussies, you want a bang for your buck whether you are a bargain hunter or a high end shopper. It’s but natural to be prudent with our hard earned money.

The same holds true when it comes to investing:

We want the most out of our money because we are laying the groundwork for future life goals, be it going on a holiday, buying a house, or saving for retirement.

And this is why many Aussies who are keen on stepping on the investment ladder start by asking:

How much does a Financial Planner cost?

In this article, we’ll tackle how much you’ll pay a financial planner in exchange for the value of the personal advice they bring to the table.

Jump straight to…

Financial Planning – Costs, Benefits and Who Needs It

Are you thinking of DIY financial planning or would you rather engage the services of a financial adviser?

No matter which option you choose, having a financial plan will have a positive impact on your life.

Financial plans help people keep track of their cash flow, create a feasible budget, boost their bank account, create an emergency fund, and invest for the future.

However, there is value in having someone providing advice on debt management, risk management along with investment advice, particularly when they are up to date with interest rates, and are able to point out that crucial step you might have missed in making a financial decision.

Whether financial advisers give comprehensive advice or general advice, their input adds wealth to your knowledge as well as your pocket.

Financial Planning Benefits – Financial Planner vs Advisor

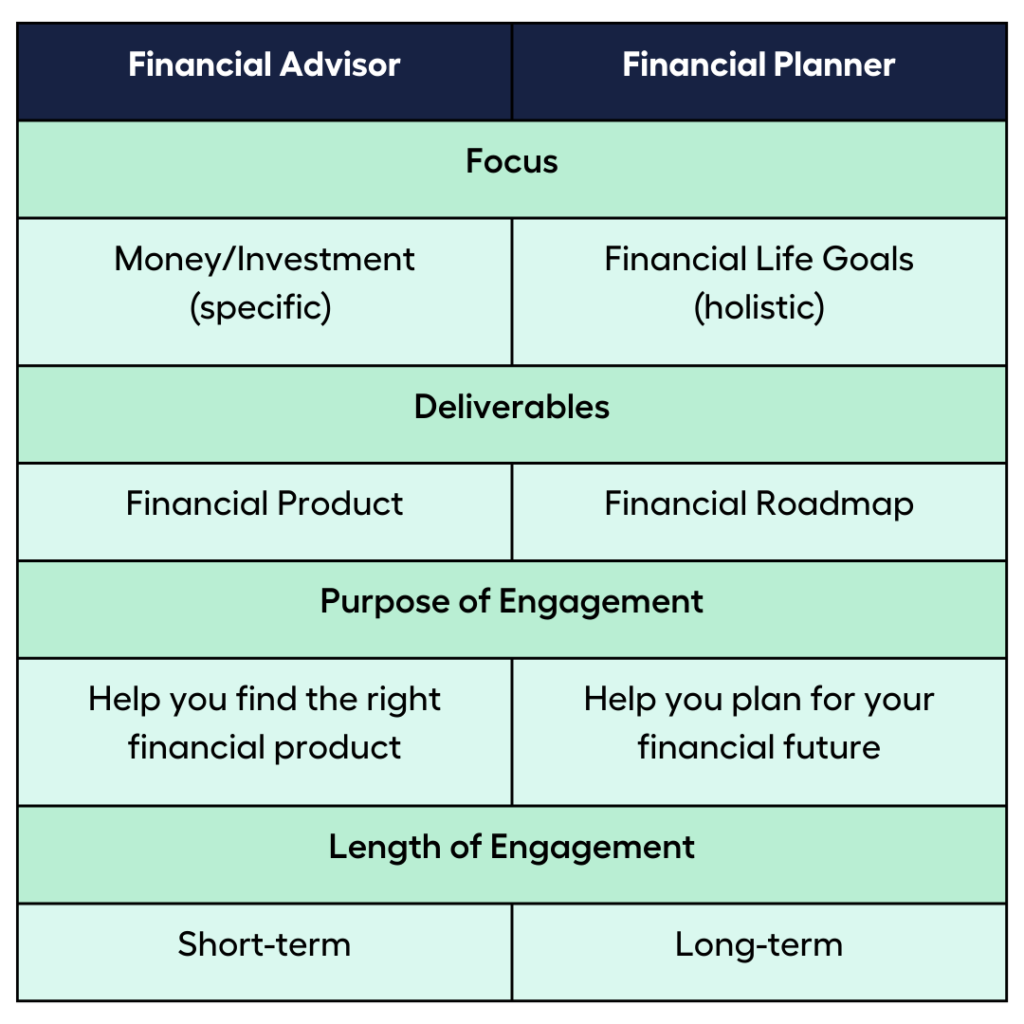

The terms “financial planner” and “financial advisor” are frequently used interchangeably, but these two categories of professionals differ significantly.

Financial planners and financial advisors are both professionals who assist clients in managing their financial life for better financial health.

But not all financial advisors are financial planners because a financial planner is one type of financial advisor. We can differentiate them based on the benefits of what they deliver.

What is a Financial Planner?

A financial planner is a specialist who assists and gives advice to people and organisations in developing a plan to achieve their long-term financial goals.

A financial planner will typically assist and give advice in creating a strategy for retirement planning, saving money, investing, and budgeting.

Although a lot of financial planners work with private clients in their own practise, they may also be employed by a bank, wealth management company, or nonprofit. Because of this, every individual in the business of giving financial advice can claim to be a financial planner.

However, there is only one professional body for financial planners in Australia—the Financial Planning Association of Australia (FPA). The FPA certifies financial planners and promotes professionalism, compliance, and ethical standards for Certified Financial Planner (CFP) professionals.

It’s always best to ask financial planners if they are certified by the FPA before you seek advice from them.

What is a Financial Advisor?

Financial advisor (aka financial adviser) is a general term that includes many types of professionals who give financial advice and services.

For example, an investment advisor is a type of financial advisor who specialises in choosing and managing investments for clients.

You also have accountants for tax planning, and real estate and mortgage brokers who specialise in properties.

There are also other finance professionals who specialise in different financial products such as insurance agents and stockbrokers, as well as money managers, estate planners, bankers, etc. who can claim to be and are considered financial advisers if they perform their duty on your behalf.

What’s the Difference?

Simplistically a financial planner gives holistic advice for retirement planning, insurance needs, estate planning and family wealth.

A financial planner focuses on your long term life goals to come up with a comprehensive financial plan using an investment strategy that allocates assets to ensure that your expected returns and risk tolerances are balanced. The strategy is often reviewed every year to check if it still aligns with your goals and personal circumstances, and as plans are revised, client investments or strategies are updated.

In contrast, a financial advisor is a broader word for someone who may be involved in money management or financial products. They may, for example, offer life insurance, real estate, or accounting services, as well as assist in the placement of short-term trades and banking services.

Who Needs a Financial Planner?

There’s a wealth of information out there on personal finance management, such as in books, videos, and websites. There are also people who can manage their finances on their own, and you could be one of them.

But as the Greek philosopher Heraclitus said, “The only constant in life is change.”

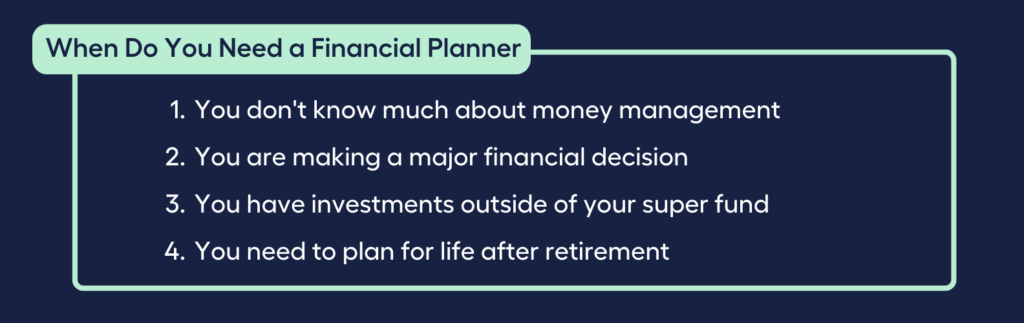

Should your personal circumstances change and you find yourself in a financial situation such as these, you may need the services of a financial planner:

- You don’t know much about money management

- You are making a major financial decision

- You have investments outside of your super fund

- You need to plan for life after retirement

1

You don’t know much about money management

Maybe you can manage your finances quite well, but life changing events such as starting a busines of your own or having a family can make managing your finances complicated.

It’s especially tempting to buy your wants when you set out on your own until debts pile up. You can seek personal financial advice from a financial planner to help create a budget plan for things like better cash flow and credit card debt management.

As for starting a family, money is frequently a touchy topic among couples, especially when your spending and saving habits differ. Financial planning helps you decide which accounts to combine and which to keep separate—a cohesive financial plan satisfies both of your needs.

2

You are making a major financial decision

Whether you’re looking to buy a house, sell a business, or send your children to uni, having a financial planner on your side can be quite beneficial. A financial planner can assist you in considering the different consequences of a given decision and planning for contingencies.

Having a strategy in place after receiving a substantial inheritance or windfall can help to guarantee that the money is not wasted. A financial planner can create a financial plan to invest and grow your newfound wealth, as well as help with tax planning to protect your assets over time.

3

You have investments outside of your super fund

Investments outside of your super account is a great way to grow your money. However, if you don’t have time to spend studying options and managing your investments, hiring a financial planner can be an excellent alternative.

Time may not be an issue, but knowledge is. Consider working with a financial planner, particularly one who is willing to educate you on the foundations of investing.

4

You need to plan for life after retirement

Retirement entails far more than simply ceasing to work. A successful retirement for the majority of people necessitates extensive financial planning. You’ll need to figure out how much money you’ll need to live the lifestyle you want, and design a strategy for withdrawing your life savings in a tax effective manner that follows the law.

Not everyone is capable of making these financial decisions on their own. A financial planner, particularly one who specialises in financial planning, can assist you in developing a comprehensive financial plan that covers all of these issues.

Is It Worth Seeing a Financial Planner?

There’s nothing to lose when you meet a financial planner. After all, an initial meeting is almost always free and you can always walk away if you feel that the financial planner’s investment philosophies don’t align with yours.

But if you value your money and your future, it’s worth getting a financial plan done.

A financial plan, with the assistance of a financial planner, ensures that your expenses do not deplete your savings and that you can obtain necessary loans without jeopardising your cash flow or putting you in unmanageable debt.

A recent Financial Services Council (FSC) report evaluated the value of various levels of advice, and noted that:

Financial advice is not only beneficial to the wealthy; in fact, those with less economic wealth may benefit more from it.

Financial advice will most likely add value to an individual’s personal wealth by the time they retire, regardless of age or financial status.

How Much Money Do You Need for Financial Planning?

Financial planners are money management professionals. They can help you go a step closer to your financial goals while avoiding costly mistakes.

And this brings us to the question:

How much does it cost to hire a financial planner?

According to the 2020 FPA Member Research, setting up a financial plan typically costs $3,300 initially, and then $4,300 a year afterwards for ongoing financial advice, while the 2022 Australian Financial Adviser Landscape notes that the median ongoing fee is at $3,529.

| How Much Money Do You Need for Financial Planning? | |

| 2022 Financial Planning Association of Australia (FPA) Member Research | 2022 Australian Financial Adviser Landscape Report |

| Financial Plan Set Up: around $3,300Ongoing Financial Advice: $4,300 annually | Median Ongoing Fee: $3,529 |

The cost varies depending on the scope and complexity of financial advice required, where you live in Australia, and service delivery, to name a few factors.

Let’s try to break down how a financial planner charges fees whether giving you general financial advice, investment advice, or comprehensive advice.

What is the Normal Fee to Consult a Financial Planner

1. Initial Consultation

First off, your initial consultation with a financial planner is typically free of charge.

Your initial consultation will last around 30 minutes to 1 hour. Its purpose is to identify the type of advice you need and to see if it is beneficial for you to obtain financial advice.

If working together seems advantageous, the financial adviser will give you an estimate of the cost of their advice based on the extent of the advice that will be given to you.

Initial Consultation Fee: $0

2. Initial Advice

Before providing you personal financial advice, the financial planner will need to invest time in learning about your present financial situation and your short, medium, and long-term goals.

The financial planner will then prepare a Statement of Advice (SOA), a legal document that contains all product and strategy suggestions made to help you reach your financial goals.

The SOA also safeguards your best interests as the financial adviser must disclose possible conflicts of interest in the SOA.

After the financial planner explains the Statement of Advice or financial plan to you, the decision to follow the recommendations is then yours.

At this point, you will likely have two one-off fees to consider.

Statement of Advice Fee: $3,500 (the one-off fee amount depends on the complexity of your plan)

Implementation Fee: $1,500 (the one-off fee amount depends on the complexity of your plan)

Working with a Financial Planner – Ongoing Fees

After the Statement of Advice has been delivered and put into action, you may decide to continue using the financial planner’s services.

This is necessary because unforeseen changes to your situation, goals, or the economy may modify your intended target goals, throw you off course, or offer an opportunity to further optimise your strategy.

A financial planner will assess your circumstances under an ongoing service agreement at least once a year to see if there have been any changes or if there is anything that can be done to help you financially.

Financial advice fees for consultations and services include newsletters, phone calls, reports, reviews, and emails.

Ongoing Advice Fee: Typically starts at $3,500 annually (the ongoing fee may also be charged as a percentage of funds under management – eg. 0.5% of $800,000 FUA = $4,000)

Funds Under Management Advice Fees

Financial planners may also charge you additional fees if you give them the authority to manage your investment funds.

Investment management fees are normally percentage-based fees calculated from the total value of assets in your portfolio, which you pay regardless of the performance of your investments.

You can also opt for an investment management fee as a percentage based on the performance of your investments. Here you can work with an agreed benchmark with your financial adviser.

Percentage-based Fee: eg. $5,000 annual fee (the investment management fee is a fixed fee calculated at 1% of a $500,000 FUA)

Commission from Insurance

If an insurance policy is part of your financial plan, which usually is either as part of estate planning or a retirement plan, you may need to budget for the cost of the adviser’s insurance services. Although the premium itself typically already includes the commission payable to the adviser some advisers also charge a fee for helping you secure the right cover.

As an FYI, the commission from the first year premium can be as high as 60%, and succeeding year commission on premiums taper off to 20%.

| Sample Calculation for a Fixed Fee Advice | |

| Type of Fees | Amount |

| Statement of Advice Fee | $3,500 |

| Implementation Fee | $1,500 |

| TOTAL ANNUAL | $5,000 |

| Amount as a Percentage of $500,000 ($50,000/$500,000) | 1.0% |

| Sample Calculation for a Fund Under Management Advice Fee | |

| Type of Fees | Amount |

| Statement of Advice Fee | $3,500 |

| Investment management fee (annual @ 1%) | $5,000 |

| TOTAL ANNUAL | $8,500 |

| Amount as a Percentage of $500,000 ($50,000/$500,000) | 1.7% |

How to Start a Financial Plan Before Seeing a Financial Planner

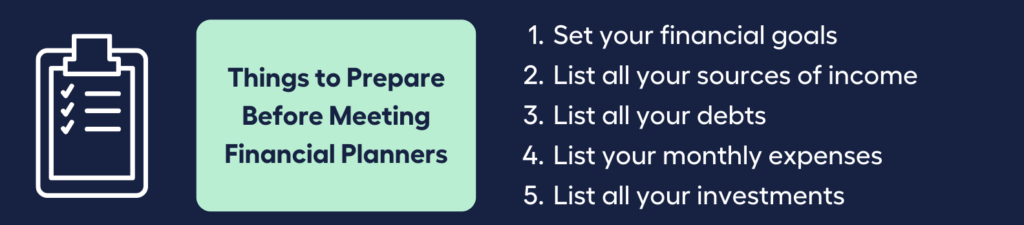

It’s always best to come prepared for your initial consultation with a financial planner. After all, you only have 30 minutes to an hour to get to know the adviser and explain your financial affairs and needs.

Have the following ready before your first meeting with financial planners:

- Set your financial goals

- List all your sources of income

- List all your debts

- List your monthly expenses

- List all your investments

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Financial Planner for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with the right financial advisor who can help simplify your family’s journey to financial wellness

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick financial assessment session with My Money Sorted

Step 2: Get matched with a licensed Finance Advisor that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Financial Advisor.

It’s that easy!

Want to know what to expect from a financial planner? Speak with My Money Sorted today to learn more!