Given that you are already familiar with the process of purchasing and owning a home, you’re may be considering investing in a second home to break into the real estate market. One way to expand your property portfolio is to access your property’s equity. Although not considered a liquid asset, many investors see equity as easy access to cash when buying investment properties.

Let’s explore how equity works when buying an investment property or a second home.

Jump straight to…

Everything You Need to Know About the Role of Equity in Buying a Second Home

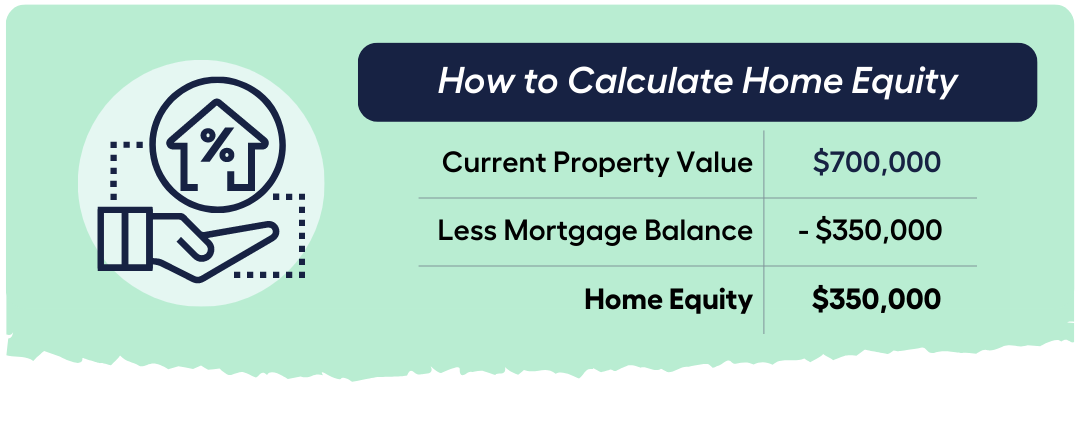

Your equity in a property is the current value of your home, less your current home loan balance.

- For example, if your property is valued at $700,000 and the current debt on your home loan is $350,000, your home equity would be $350,000.

It’s important to calculate how much equity you have in your current property and understand the various ways you can increase the equity in your property over time.

From our formula for calculating home equity, one way to increase your home equity is to reduce the balance on your current home loan.

You may be able to reduce the balance on your home loan sooner by choosing to get a principal and interest loan instead of an interest only loan.

The funds you borrow when you first take out your mortgage is the principal (aka loan amount), and you pay interest to your lender in return for them extending you a loan.

- With a principal and interest loan, you are paying down your home loan balance regularly (through weekly, fortnightly or monthly repayments). Additionally, some lenders can offer lower home loan interest rates on principal and interest repayments.

Whereas with an interest only loan, you’ll still have the full loan amount (principal) to pay off when the interest only period ends.

- Adding to your repayments is another way to help you pay off your home loan sooner.

- Raising the amount of your loan repayments by making additional repayments or increasing the frequency of repayments has the potential to substantially reduce your outstanding debt and improve your home equity. However, you need to ensure that your home loan product allows you to do this, otherwise you may incur penalties.

- An interest offset account is another means you may consider for building equity.

- A transaction account that is connected to your mortgage is referred to as an offset account. The amount in the offset account is applied to the principal balance of the home loan when interest is calculated by your lender; as a result, the total amount of interest that is due is decreased, and you can pay off the loan more quickly.

Your home equity also increases when the value of your home increases.

The value of your home may increase when you keep the property for a longer period, as property values can experience growth. Coupled with a reduced home loan balance, you have a one-two punch that could likely improve your home equity.

Making improvements to your property to make it more desirable to potential buyers helps improve the market value of your property. You can update the kitchen, upgrade the bathroom, or maintain and update the fixtures and fittings.

The value of a property can go up because of capital growth or consistent mortgage repayments. So by simply taking care of your home while holding on to it and not missing any home loan repayments, you should increase its equity.

Can I Use All My Equity to Buy Another House?

It’s a common misconception that you can access all your equity to purchase a home. In most instances, you can borrow up to 80% of the value of your home.

Why?

- Equity is how much of your home you own.

Equity is the sum of your deposit and the money you paid towards your mortgage. If the value of your home has increased, your equity will include the difference between its current value and the purchase price.

If you use up all your equity, you will no longer own a part of your property. In the beginning, most people typically owned at least 20% of their property, which is the least amount you need to pay for a deposit to avoid paying Lenders Mortgage Insurance (LMI).

But don’t be discouraged. The way equity works when buying a second property involves using the available equity in your home as security instead of a usual cash deposit.

So how do we calculate available equity?

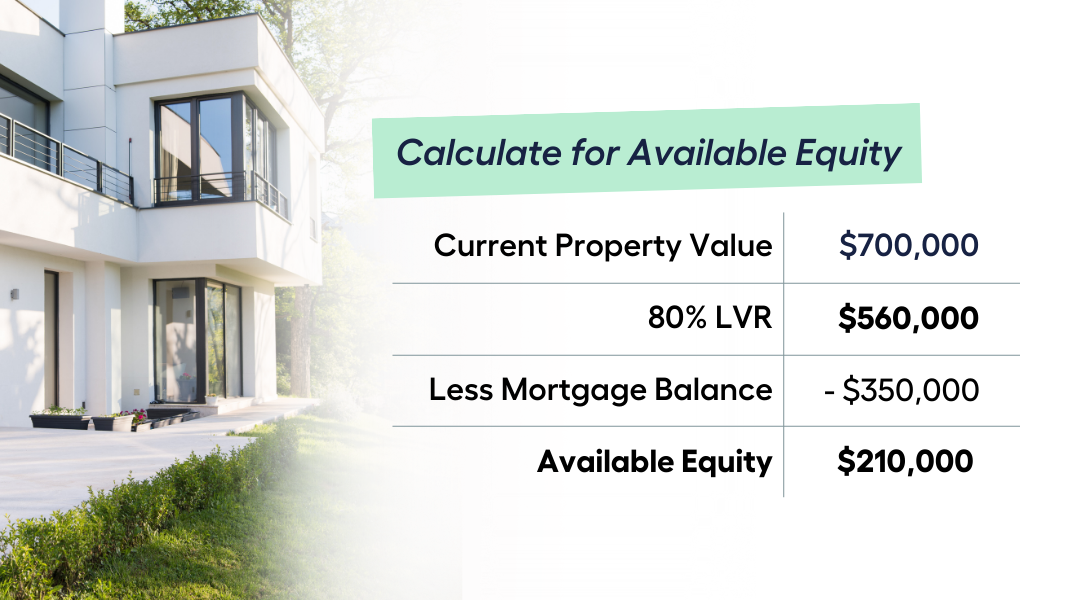

Usually, a bank will lend up to 80% loan to value ratio (LVR) of your property value minus the mortgage balance, as long as it thinks you can meet the repayments. However, this can differ depending on the lender.

You take 80% LVR of the current value of your home and deduct the amount you owe your bank.

Let’s use our previous example where the property value is $700,00 and your mortgage balance is $350,000. Where 80% LVR of $700,000 is $560,000, minus the mortgage balance of $350,000, we get $210,000 as the available equity or usable equity.

You may be able to then access the usable equity to buy a second property such as a holiday home or an investment property that earns you a rental income.

Buying an investment property is one way to generate wealth over the long run and help to create financial security for one’s retirement.

And the Australian Taxation Office (ATO) allows you to claim as a deduction on all or a portion of the interest paid on that loan if you take out a loan to invest in a rental property.

Can I Use Equity as a Deposit for a Second Home?

Even though you might not have enough usable equity to buy a new property, you may be able to still use some of it as a deposit.

To do this, you may need to refinance your existing home loan or borrow more money against your home’s value.

Your equity from your existing home can be used as a deposit on a new property, while your existing home becomes a security on the new mortgage. Using home equity allows you to buy a new property with no cash deposit. With mortgage refinance, you could be steps closer to buying a second home and entering the property market.

Factors that influence your bank’s decision to grant access to your usable equity:

- your income

- debts

- value of the property

- your ability to service any extra loans arising from accessing the usable equity as the deposit

Considering all these factors, you might be wondering:

What price range should I be looking at when buying an investment property or second home?

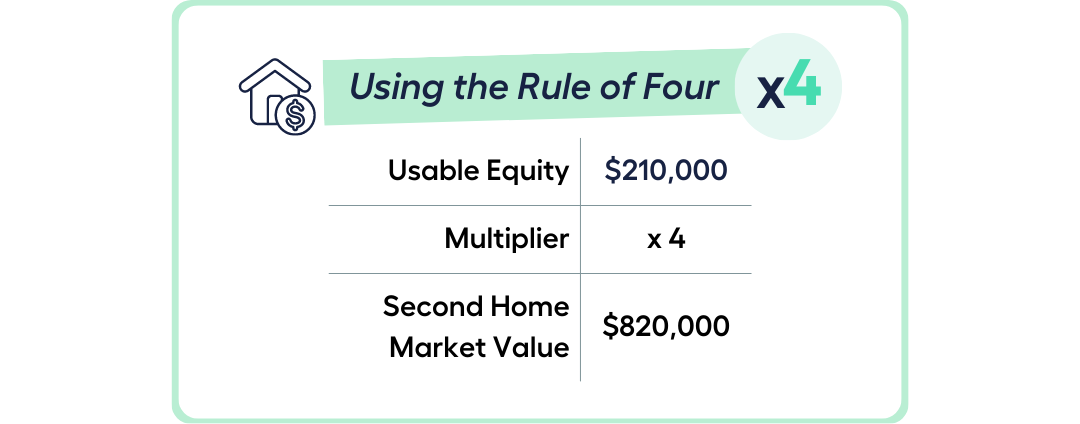

The ‘rule of four’ is a calculation used by some property investment advisers. To get the answer, multiply your usable equity by four.

Using our previous example, where the available equity is $210,000, you may be able to buy an investment property or second home with a market value of $840,000 or less.

But why four?

The ‘rule of four’ allows you a 20% deposit, so you can avoid paying LMI. It also provides a buffer for other charges, such as stamp duty and legal fees.

This calculation may be useful in determining whether you have a sufficient deposit and can afford the upfront cost of purchasing another property.

Deposit Needed to Purchase a Second Home

The process of buying your second property will be similar to that of purchasing your first property. Banks will analyse your financial situation, which includes your current home loan repayments, to calculate how much you can borrow.

To avoid paying LMI, the deposit for your second house will need to be at least 20%. If you can’t save for a 20% deposit, you may still be able to secure a mortgage for your second house by paying LMI or, if possible, leveraging the equity in your current property.

From our previous example using the ‘rule of four,’ if you have a usable equity of $210,000, you may be able to get a property worth as much as $840,000 and possibly not worry about forking out any funds.

If you have sufficient equity in your property, you can access it as additional security for your second home loan rather than a cash deposit.

How Much Money Should You Have Before Buying If You’re Planning to Use Your Home Equity Line of Credit (HELOC)?

A major perk of owning a property is building equity and taking out loans against it. When you have enough equity in your property, you can access it with a home equity loan or a home equity line of credit (HELOC).

What’s the difference?

A home equity loan enables you to borrow a lump sum amount against the equity in your property. While a HELOC similarly uses the equity of a home as leverage, homeowners can apply for an open line of credit and borrow up to a predetermined amount as needed.

HELOCs often feature lower interest rates and more flexible payment options, but a home equity loan is preferable if you need all the funds at once.

Either way, when buying a property using equity, your lender will usually require you to make at least a 20% deposit on the property you wish to buy. Additionally, you can only access your usable equity, not the entire equity.

Using the “rule of four” from our last example, if you have $210,000 in usable equity, you may be able to buy a property worth up to $840,000 without having to utilise your cash funds for purchase costs such as stamp duty and legal fees.

However, you may have to save money for repairs on your investment property.

Can I Get Equity Out of My Home Without Refinancing?

You can access equity without refinancing with a home loan increase, home equity loans, HELOC, and reverse mortgages.

When you refinance your current mortgage, you pay off the old one and get a new one in its place. Refinancing could be easy to manage because you only have to repay one loan. After all, if you get a loan with both principal and interest and keep making repayments, the goal is that you’ll eventually pay back the whole amount.

A top-up or home loan increase allows you to borrow against the equity you’ve established in your current home without refinancing. You can use the funds for a deposit on a second home, renovate your home, or consolidate debt, among other things.

On the other hand, a home equity loan is usually a separate loan you can get on top of your mortgage when you have enough equity.

A home equity loan may offer more options than when you refinance with a traditional home loan. However, you may have to pay a higher interest rate on any money you take out.

But because you’re using your home as security for the loan, your interest rate is likely much lower than if you had used other forms of credit such as personal loans, credit cards, or other unsecured debt.

If you take a home equity line of credit (HELOC), you’ll need more financial discipline to handle your debt, as a line of credit works like a credit card. If you pay only the minimum amount, you might owe more than you thought or need to pay off all of your debt immediately.

A reverse mortgage, a home loan for Australians aged 60 and up, is another way of using equity without refinancing.

With a reverse mortgage, you can borrow money against your home’s equity. Depending on your age and the lender’s rules, you may be able to borrow 15–25% of your home equity. The interest you pay on loan adds up over time, making the total amount you owe go up.

The loan is paid in full, including interest and fees, when you move out or sell the property.

Negative equity protection was added to reverse mortgages on September 18, 2012. It means you can only owe the lender as much as your home is worth.

The Benefits & Risks of Using Equity

There are many reasons why investors and homeowners tap into their equity. Equity offers you the possibility of obtaining more financial resources and, if spent wisely, helps build your property portfolio.

Even while there are many potential benefits, it helps to also be mindful of the potential dangers.

Benefits of Using Equity to Buy a Second Home

Tapping your home equity might make purchasing a second property less expensive and provide you with more liquidity. There are several significant advantages to leveraging home equity to purchase an investment property.

Make a Bigger Deposit

Home equity provides you with additional funds to put toward your next home. You can cut your monthly repayments and interest rates by putting more money into your deposit.

Overcome Strict Loan Requirements

Due to stricter loan requirements, second homes are often more difficult to finance, making a home equity loan or mortgage refinance typically a more practical choice for most borrowers wishing to buy investment properties.

Lower Interest Rates

Leveraging equity offers lower interest rates since they are secured by real estate as collateral. Additionally, you may get lower fees as lenders spend less time originating home equity loans.

Risks of Using Equity to Buy a Second Home

Using home equity to purchase an investment property has advantages, but there are also some possible drawbacks.

Swapping Asset for Debt

You are essentially taking the part of your home that you own and putting it up as collateral for another loan.

Even though this may be worth it because you won’t have to take money out of existing alternative investments, you may want to think about the effects of taking on more debt.

Fluctuating Property Market

If you own two homes, changes in the housing market affect you twice as much. If the value of either of your homes goes down, you may end up owing more on your mortgage and home equity loans. Plus if you default on the loan, you could lose both your main home and your second home since both are used as collateral.

Not Necessarily Tax Deductible

When you file your income tax return, you can deduct the interest you paid on your home loan if you rent it out to make money. Otherwise, you can’t get a tax break if you only use the property as a place to live.

Example of How Equity Works When Buying a Second Home

Let’s have an example to review what we discussed.

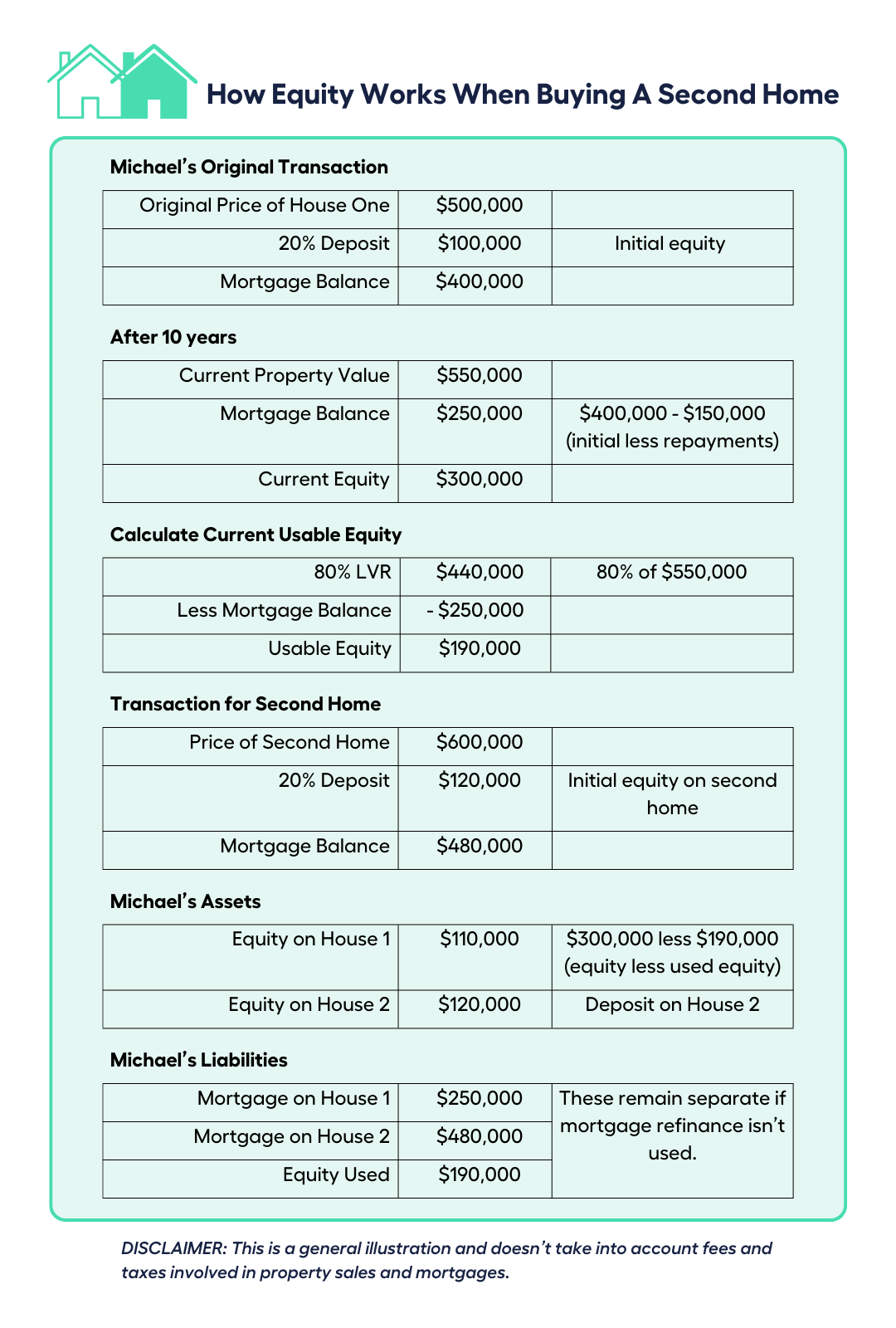

Michael purchases a $500,000 home with a 20% deposit ($100,000) and a $400,000 home loan. His equity in the property is at $100,000.

In ten years, he pays off $150,000 of the principal on the home loan (leaving $250,000 outstanding) while the property’s value rises to $550,000. Michael’s home now has a $300,000 equity.

He wants to use some of the $300,000 home equity as a deposit on a future home. He’ll need to put a 20% deposit on the new home, leaving him with an 80% LVR. In this case, 80% of the property’s value ($550,000) is $440,000. Take away the $250,000 in outstanding debt, and he’s left with a possible usable equity of $190,000.

While his equity is $300,000, his available equity is $190,000.

He then decides to use the usable equity as a deposit on a $600,000 property, with $120,000 as a deposit and the remainder for other fees and house repairs and remodelling. He takes a $480,000 loan on the second home.

Using equity as a deposit on a second property tacks on additional debt while potentially decreasing your equity. Having a clear picture of your financial situation before accessing your equity is important; otherwise, you could be biting off more than you can chew.

If you’re looking to buy a second home by using your equity, looking for other ways to do it, or wish to know more about property buying, consider talking to a financial adviser and mortgage broker.

Looking to Buy a Second Home?

Get Your Money Sorted & Discover Your Financial Advice Options by Booking a Free 15 minute call With Our Team Today!