Are you looking for a low-risk investment that gives you peace of mind knowing how much money you will make?

If you’re planning to save or invest for big ticket items like buying a home, a car, or education, a term deposit could be helpful in achieving your money goal.

Term deposits (TD) are a type of investment vehicle where you deposit a one-time amount of money for a fixed period, and you can get your money back in exchange for a set interest rate. In this article, we’ll explain how term deposits work, what happens when they mature, and your options for maximising your money.

Jump straight to…

How do term deposits work?

Before you grab this low-risk investment option, there are things you need to make certain.

You must decide on your investment amount and term duration before opening a term deposit account. This is because your funds are secured for the fixed period (the term) you specify. You cannot make any more deposits once your account is open, and you cannot make any withdrawals until the account reaches maturity without incurring a penalty.

When it comes to term duration, the longer the term, the higher the interest you’ll typically earn. Thus, if you want your money to grow, you may opt for a longer term. Just take note that a TD typically requires a minimum deposit.

Furthermore, you have the option to set the interest payment schedule for term deposits. You may be able to select whether interest is paid monthly, semi-annually, annually, or at the end of the term when the term matures (when the term deposit ends and will stop accumulating interest). In general, you will be offered a lower interest rate if you opt for a more frequent interest payout.

How long do term deposits last?

A term deposit can range from as short as one month or as long as five years. Your investing objectives and the amount of time you are willing to keep your money locked up will determine the term length you select.

What happens when a term deposit matures?

You have several options when your TD reaches maturity. You have the option to withdraw the money, roll it over into another type of investment, or reinvest it in another term deposit for a new term length.

Financial service providers will typically reach out to you when your TD is about to mature. They’ll explain your options and the amount of interest you’ve earned.

What if you don’t take any action?

Your TD can automatically renew and become a new term deposit, and if you need to withdraw the money from the new TD, there may be a corresponding cost plus the interest rate can be lower than before.

Which is why it would be wise to review your term deposit account two weeks prior to the term deposit’s maturity. Make sure you’re getting the best deal by comparing its features to other term deposits.

How is term deposit interest calculated?

There are two ways to calculate the TD interest, both of which will likely generate the same result.

One way is by looking for the daily interest rate (based on the TD provider’s annual rate) to come up with the interest rate for your preferred term duration.

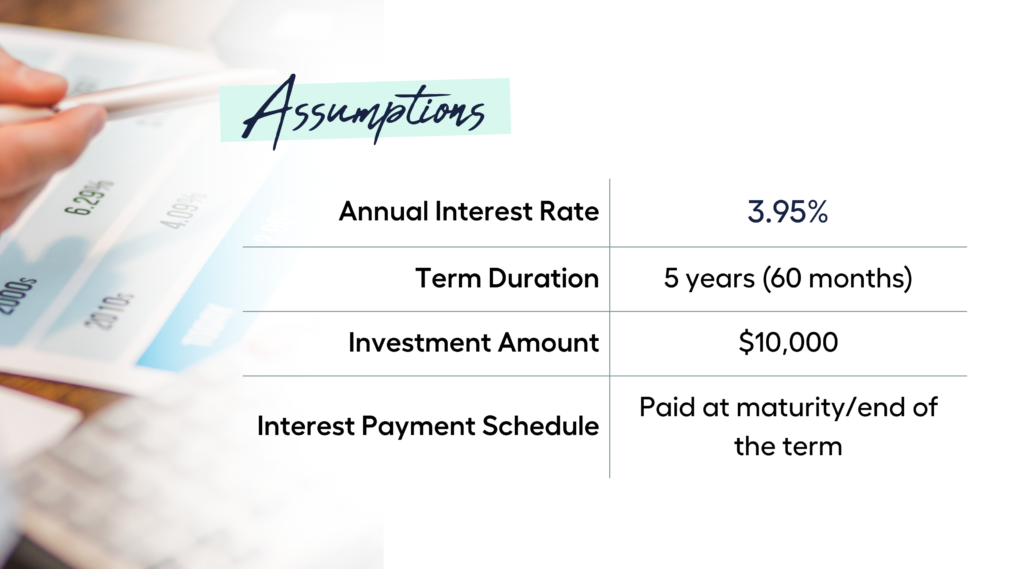

Let’s say your bank offers 3.95% p.a. for 5 years (60 months):

Assumptions:

To calculate for term deposit interest:

- 19.75% is the interest rate of the 5-year term and so, if you deposit $10,000 for 5 years then your money will earn $1,975 in 5 years.

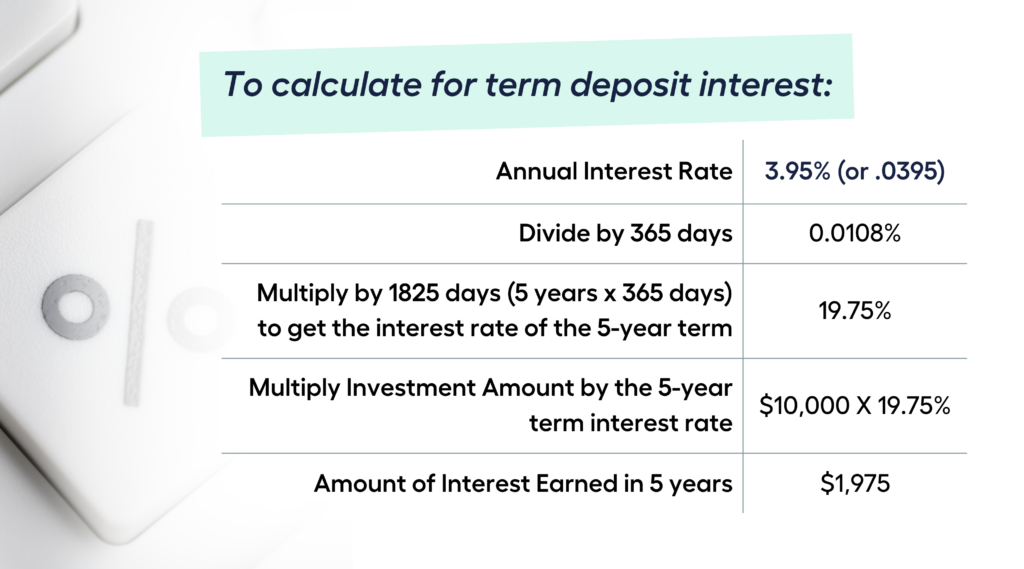

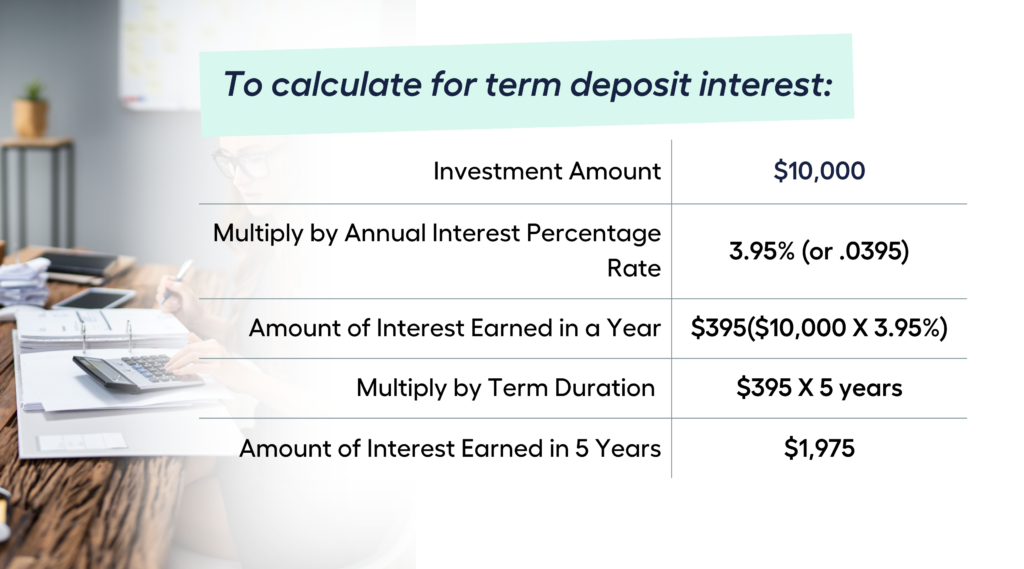

Another way to calculate the interest in a TD is by using the annual interest rate as a percentage of the amount deposited per year.

To determine the annual interest earned, multiply the deposit amount (for example, $10,000) by the annual interest percentage rate (for example, 3.95% or 0.0395). The entire amount of interest earned is then multiplied by the term duration.

Assumptions:

To calculate for term deposit interest:

Keep in mind that these are hypothetical examples. The particular term deposit you select will determine how much interest you can really earn.

Can you lose money in a term deposit?

Yes and No.

Before you panic, keep on reading to learn how to avoid losing money in a TD.

A term deposit CANNOT cause you to lose money if your deposit does not exceed $250,000. Deposits are protected by the Financial Claims Scheme (FCS) up to $250,000 per account holder and per authorised deposit-taking institution (ADI).

So, what if you plan to invest more than $250,000 in a term deposit?

To make sure that your money is protected by the FCS in case your financial institution fails, it’s worth considering only depositing a maximum of $250,000 in individual TD accounts of different institutions. However, practise due diligence by researching if there are set-up fees and other related fees for each account in each institution.

On the other hand, a term deposit CAN cause you to lose money if you fall victim to a TD scam.

There are scammers marketing bogus investments that are marketed as being “like a term deposit” and assert that they are a “new breed of investment”.

Red flags to watch out for:

Offers making inflation-beating claims.

Higher interest rates than other available options

A promise of too-good-to-be-true high returns

Having a stranger approach you with an investment proposition.

To avoid these scammers, make sure you only transact with authorised deposit-taking institutions regulated by the Australian Prudential Regulation Authority (APRA).

It can also be worth considering getting financial guidance from a certified financial advisor if you are considering term deposits as part of your retirement plans.

Need help looking for a certified financial advisor?

Your MMS Money Mentor can help connect you to a finance expert that’s right for your needs.

Withdrawing a Term Deposit

You’ve made the decision to lock away your money for a fixed length of time in order to earn interest on your TD.

What if your circumstances change and you find yourself in need of accessing your funds before the end of the term?

You might think about taking an early or partial withdrawal from your TD in such a circumstance.

Early Withdrawal

Majority of term deposits have stringent restrictions on withdrawing your money early. Depending on the bank and the particular product you have selected, these conditions may change.

An early withdrawal will typically incur a penalty fee or withdrawal fee, which can drastically lower the interest you would have otherwise earned on your investment. The penalty could be a fixed amount or a percentage of the money you’re taking out; in some situations, it might even be greater than the interest accrued.

Other limitations on early withdrawals, such as a waiting period or a cap on the number of times you can withdraw money before the end of term, may also apply in addition to penalties.

Partial Withdrawal

Making a partial withdrawal has the benefit of allowing you to access some of your money without having to pay the whole early withdrawal penalty. However, because you will have less money invested in the account, the amount of interest you earn on the remaining balance will be lower.

Most of the time, banks will impose a fee or penalty for making a partial withdrawal from a term deposit. This cost can still be substantial even though it is typically lower than the penalty for a full early withdrawal. The fee may vary depending on the bank and the TD you select.

Furthermore, there might be limitations on the number of partial withdrawals you can make from some accounts, or a waiting period (like 31 days) before you can make a partial withdrawal.

You could also be eligible to receive a prepayment adjustment and/or have the prepayment administration fee waived if your situation is particularly difficult or due to hardship. It’s also important to keep in mind that some TD accounts do not allow partial withdrawals.

To commence with the process of early or partial withdrawal due to difficult financial circumstance, your financial institution may ask you to provide documentation, such as invoices, and a Statutory Declaration (a legal document that contains a written statement about something that is true), that demonstrates your need to withdraw your funds immediately or before the end of the waiting period to evaluate your prepayment request due to hardship.

Be sure to carefully read the terms and conditions of a TD and to take into account any potential penalties and fees before making an early withdrawal.

How do you close a term deposit?

When your term deposit reaches the maturity date and you’ve provided withdrawal instructions when you opened your account, the amount you invested plus interest will be sent to your designated bank account.

If no instructions have been given before the maturity period, some TD providers give a grace period for you to inform them of your preferences in closing a TD. If you still take no action, financial institutions typically automatically roll over your TD for the same term at the applicable interest rate given on that maturity date.

What To Do Next? Options for Maximising Your Funds From a Matured Term Deposit Account

You have a number of alternatives for maximising your money once your term deposit matures:

1. Take a portion of the money out, then invest the balance

Make a partial withdrawal of the total term deposit maturity amount for personal use or placed in another investment, and then reinvest the balance in a new TD for the duration of your choice.

2. Renew the deposit for another term

Here, you have two options:

Renew the deposit with the present bank OR make a full withdrawal and search for a different bank that might provide a competitive interest rate. Generally, the interest rate rises as the term lengthens. But this might not always be true and so prior to renewing the deposit, it is worthwhile to shop around for a higher interest rate.

3. Renew the term deposit and increase the deposit amount

If you have extra savings, you have the option to increase the deposit amount when you renew the TD which could result in a lift in interest rate.

Are you interested in exploring other investment options?

If you’re not sure what to do next, it’s a good idea to speak with a financial advisor who can help you make the best decision for your financial situation. They can provide guidance on how to maximise your returns and minimise your risks.

Get a jump-start on Ways to Start Investing by booking a free 15 minute call!