Managing your finances can make you feel like a circus performer – juggling bills while trying to decide which debts to pay first.

With various interest rates and repayment terms, are you able to balance your debt repayments and liquidity or do they end up flying everywhere like a newbie juggler’s balls getting tossed upwards but end up falling on a pile of more debts?

Whether your concern is about your credit card debt, mortgage, a personal loan or a car loan, consolidating your debts could be a good option in this situation.

On this page, we will discuss debt consolidation, including what it is, how it works, its advantages and disadvantages, and how to seek expert help with debt management.

Jump straight to…

What Does It Mean to Consolidate Debt?

Imagine your multiple debts as multiple pyres burning at the same time.

- How will you put out the flames?

By taking out a new loan (with a lower interest rate) to pay off your existing debts – you end up with just one loan and one repayment to manage.

With a debt consolidation loan, you can regain control over your money. The interest and fees you spend on several personal loans can be greatly reduced, and if you find it difficult to handle multiple debt repayments at once, consolidating your debt into a personal loan with a single regular payment can simplify your finances and make budgeting easier.

What happens when you consolidate debt?

Imagine, for instance, that your multiple pyres of debts are represented by the following:

$2000 and $4000 on two different credit cards

Plus $5000 on a personal loan

It will be difficult to remain on top of them all because each of these personal loans is likely to have a distinct interest rate, repayment amount, and due date.

You can combine all of these debts into a single personal loan to better organise your financial condition. You’ll need to submit an application for a new personal loan, and if it’s granted, you’ll use the money to settle your existing obligations.

As a result, you will only have to make one set of periodic payments over a specific time at one interest rate. You may be able to make greater progress towards lowering your overall debt if the interest rate on the new personal loan is lower than the interest rate on your current debts.

Here’s a heads-up:

- To make sure you comprehend the interest rate, fees, and payback plan, you must carefully study the terms and conditions of the new loan.

Is it a good idea to consolidate your debts?

If you’re having trouble managing several loans, want to lower your interest rates, and have a strategy for repaying the new loan, debt consolidation may be a good solution.

But let’s have a reality check:

It’s not a miracle solution.

If you don’t deal with the root cause of your money issues, your debt troubles won’t be resolved.

Take into account your financial goals, spending plan, and debt repayment strategy before consolidating your debt. To get an unbiased assessment of your circumstances, you might also wish to consult with a financial expert or credit counsellor.

Risks of Debt Consolidation

Consolidating debt can be advantageous, but there are hazards involved as well.

Before deciding to consolidate, consider the following factors:

1. Avoid credit providers with “get-out-of-debt” offers that are too good to be true.

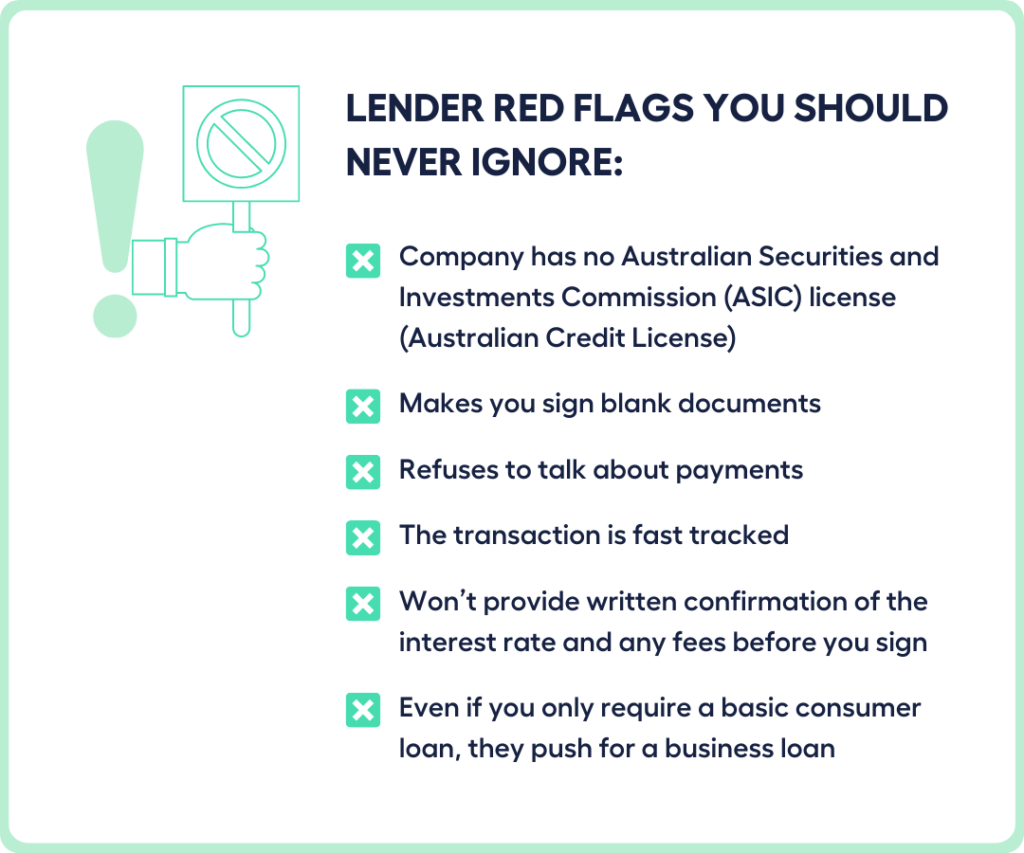

Lender red flags you should never ignore:

- Company has no Australian Securities and Investments Commission (ASIC) license – (Australian Credit License)

- Makes you sign blank documents

- Refuses to talk about payments

- The transaction is fast tracked

- Won’t provide written confirmation of the interest rate and any fees before you sign

Even if you only require a basic consumer loan, they push for a business loan

If you’re worried about rising costs of living, this money journal of UK-based Instagram sensation Money Mum aims to help you save thousands without even noticing.

2. Make certain that the interest on the new loan is lower than your current debts.

To make debt consolidation worth it, the new loan needs to be less expensive than your current ones.

As such, you need to compare the new loan’s interest rate, fees and other charges to your existing debts. You also have to make certain that you can afford the new payments.

Be sure to check other expenses, such as:

- Fees associated with early loan repayment

- Appraisal expenses, legal fees, and application fees

A longer-term loan needs careful consideration because although the interest rate may be cheaper, in the long term, you can end up paying more in interest and fees.

Compare personal loans using the MMS loan comparison calculator so you can find a better deal.

3. Keep the secured personal loan option at the bottom of your list.

You could be thinking about consolidating your unsecured debts (like credit cards or personal loans) into a single secured loan in order to obtain a reduced interest rate by offering an asset (like your house or car) as security for a secured debt.

This implies that the house or vehicle you pledged as security may be in jeopardy if you are unable to repay the new loan. To recoup the money you borrowed, the lender may sell it.

Before utilising your house or other assets as security, check all of your available options because you need to keep your house and other assets safe.

Does debt consolidation affect your credit score?

Your credit score may be impacted by debt consolidation, although not always in a bad way. The lender will run a credit check when you apply for a new loan, which could momentarily reduce your score.

However, if you pay your bills on time and avoid taking on additional debt, your credit rating should rise over time. On the opposite side of the coin, your credit score will suffer if you make late payments or default on the loan.

How long does debt consolidation stay on your record?

Your credit report will include data about your:

- credit cards

- current arrears

- credit applications

- debt agreements

- credit liability

- credit history

- defaults

- other credit issues

Unless you have defaulted on a sum of over $150 for more than 60 days, your credit report will not include information on utility bills like electricity.

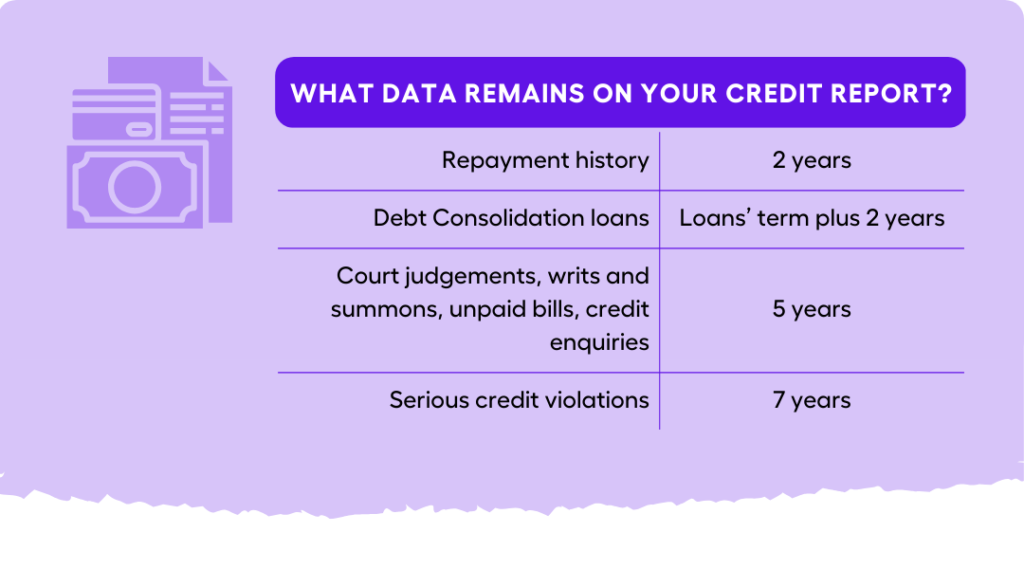

Various information remains on your credit report for different lengths of time, such as:

- Repayment history is kept on file for two years.

- Credit obligations, like debt consolidation loans, will continue to be on your record for the loan’s term plus two additional years (after the loan is terminated or ceases to exist).

- Court judgements, writs and summons, unpaid bills, and credit enquiries all remain on your record for five years.

- Serious credit violations, including a clearout (where a lender has attempted to reach you but has been unable to do so), will stay on your credit record for seven years.

All in all, consolidating debt can be an effective strategy for those struggling to keep up with multiple debts and high-interest rates.

It entails rolling over several loans with higher interest rates into one with a reduced interest rate, which can lead to cheaper monthly payments and a quicker route to debt freedom.

However, it’s crucial to approach debt consolidation with prudence. It’s not everyone’s best option, even though it can be a beneficial tool for some. Before making a decision, consider all the possibilities and balance the pros and cons.

If you ultimately decide that debt consolidation is the best course of action for you, it’s essential to conduct adequate research and select a reputable lender with a great track record. Debt consolidation can be a successful strategy for getting control of your debt and achieving financial independence if you use the appropriate strategy and prudent money management.

Want to Get Out of Debt But Not Sure Where to Start?

Book a FREE 15 min Call or Send Us Your Questions!

I want to see all my options with the help of a Finance Expert

Call Our Team TodaySOURCES:

https://www.target.com/p/the-100-day-financial-goal-journal-by-alyssa-davies-hardcover/-/A-79651636

https://www.bookdepository.com/Real-Life-Money-Journal-Clare-Seal/9781472279033

https://www.refinery29.com/en-us/kakeibo-japanese-money-saving-method-breaking

Kakeibo: The Japanese Art of Budgeting Saving Money by Fumiko Chiba | Goodreads

Disclosure: Links on this page are affiliate links, which means that if you click on the link or make a purchase using the link, the owner of this website may earn a commission. When you make a purchase, the price you pay will be the same whether you use the affiliate link or go directly to the vendor’s website using a non-affiliate link. By using the affiliate links, you are helping support this website, and your support is genuinely appreciated. Please note that any product or service recommendations on this website are based on personal experience or research.