Selling real estate seems like a pretty straightforward transaction. You sell the property and keep the profit.

But what happens to the profit from a house sale?

It depends on your personal circumstances.

Not to worry, many of the scenarios laid out by the Australian Taxation Office (ATO) ensure that sellers keep most of the profits they make from selling their homes regardless of their personal tax rates.

Does the Seller Keep the Profit From a House Sale?

It goes without saying that the income from selling a property typically belongs to the seller or property owner. However, the date when the seller gets the income and how much of it they keep can be confusing.

Let’s take a look at the after sale journey to have a better picture of when you get a hold of your money and how much of it you may keep.

To help shed light on the unknown side of a financial meeting, we curated 10 questions to ask a financial advisor on your first meeting.

These 10 questions can become your very own cheat sheet and will help get all the information you need before making a decision and selecting an adviser to work with. Questions that could make that first meeting less daunting.

Jump straight to…

What happens after the sale of a home?

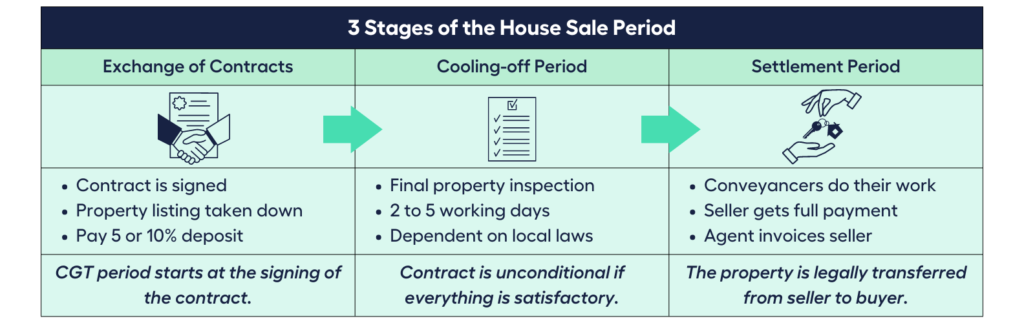

There are 3 General Stages following the sale of a home:

- The Exchange of Contracts

- The Cooling-off Period

- The Settlement Period

Keep in mind that there may be variations depending on the state or territory where the property is located.

Stage 1

Exchange of Contracts

Once an offer has been accepted or an auction has ended successfully, the buyer and the seller sign the contract and the property is then removed from the market.

Following that, the buyer will need to pay a deposit, which is typically 10% of the purchase price, though in some circumstances this can be negotiated. But for an auction, a deposit is typically paid in whole.

It is also at this period that the capital gains tax (CGT) date is established.

Do note that CGT applies only to assets acquired after 20 September 1985, the date the tax was introduced.

Once the deposit is paid, the sales process can move on to the following phase.

Stage 2

Cooling-off Period

The cooling off period is usually two to five working days long and is the period of time during which the buyer may withdraw from the sale and avoid legal or financial consequences.

Do note that properties sold at auction are unconditional, and bidders are usually not granted a cooling-off period.

The rules of the state or territory where the property is located will determine the duration of the cooling-off period, whether it applies to both parties or just the buyer, if it can be negotiated between the parties, and the consequences of cancelling the agreement during the cooling-off period.

The contract is deemed unconditional, meaning it’s locked-in, once the cooling-off time has expired without protest from any party, at which point the entire settlement period starts.

Stage 3

Settlement Period

Both parties must complete the property purchase during the settlement period.

The majority of the work is now being done by the solicitors or conveyancers representing both sides, who make sure the buyers are purchasing precisely what they have been promised, as well as reviewing boundaries, zoning, planning, and other factors.

Six weeks is the typical settlement term, though this can change. This is the time to start packing up your belongings ready to move into your new home.

On settlement day, the buyer receives the keys to the property, the seller is paid the amount due, and the property is legally transferred from seller to buyer.

When the deal is done, the agent will send the seller an invoice for costs, with the calculation of fees dependent on the final sale price. The seller should always check that any fees included on the invoice are in accordance with the terms of the contract.

Final payments received at settlement do not constitute your final income. Aside from the costs associated with selling a property, you also have to consider if the income generated by the sale is considered assessable income and thus subject to income tax.

Pay Tax on Selling a House

Whether you pay income tax from the sale of a property or not depends if the income is considered taxable income or not.

Your net capital gains, or your earnings after deducting costs and other expenses, from the sale of an asset are included in your taxable income. And your capital gains tax is payable as part of your income tax assessment.

Since most of us consider our family home to be our most valuable asset, you might be wondering:

Will I pay capital gains tax when I sell my home?

Thankfully, in most cases you don’t have to. The sale of your main residence which results in a capital gain (or loss) is automatically exempt under the tax code.

This is not, however, a general exclusion. There are still some circumstances when part or all of the gain from selling your main residence may be subject to CGT.

How does my home qualify for main residence exemption?

The ATO has a clear definition of what property qualifies for main residence exemption.

If you live in Australia and the following conditions apply to your home, it is exempt from CGT:

- has served as the residence for you, your spouse, and any other dependents during the whole time you have owned it

- has not been utilised to generate income, meaning you have not used it to run a business, rent it out, or “flip” it (bought it to renovate and sell at a profit)

- has no more than 2 hectares of land

If you satisfy ALL these requirements, you are exempt from paying taxes on capital gains and losses when you sell your main residence.

If you don’t satisfy all of these requirements, you can still be eligible for a partial exemption, and we’ll discuss those scenarios later. For now, let’s identify what makes a property a main residence.

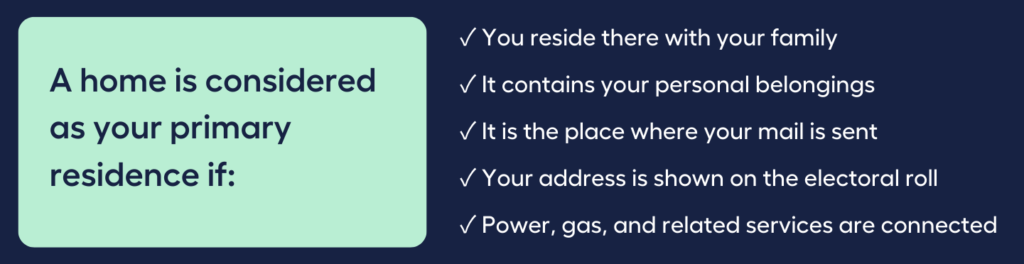

What is a main residence?

Typically, a home qualifies as your primary residence if:

- You reside there with your family.

- It contains your personal belongings.

- It is the place where your mail is sent.

- Your address is shown on the electoral roll.

- Power, gas, and related services are connected.

A home may be regarded as your primary residence regardless of the length of time you have lived there. If you check all the above boxes, a property will be your primary residence even if you just own it for a brief time—say, six months.

The CGT exemption typically only covers the home and up to a maximum of two hectares of the land on which the home sits.

Your real estate must have a dwelling on it, and you must have lived there, for it to qualify as your primary residence.

What is a dwelling?

Anything used exclusively or mostly for residential housing is considered a dwelling, such as:

- a house or cottage

- an apartment or flat

- a strata title unit

- a unit in a retirement village

- a caravan, houseboat or other mobile home.

An empty block of land typically does not qualify you for the CGT exemption.

However, in some situations, you may decide to treat land as your primary residence for up to four years before constructing a home.

If you opt to have this exemption apply after purchasing land, make sure that you:

- build a house on the land

- repair or renovate an existing home on the property, or

- complete a house that is partially built on the property

Before you qualify for the exemption, you must meet a number of requirements. You must complete the dwelling’s construction, maintenance, or renovation and then:

- move into the home as soon as possible when construction is complete, and

- stay in the home as your primary residence for at least three months after moving to it.

Furthermore, under the ‘six-year rule,’ if you use your old house to generate revenue (for example, by renting it out), you can choose to classify it as your primary residence for up to six years after you cease living there.

Capital Gains Tax (CGT) Discount

The ATO affords you a CGT discount if you owned the residence for at least a year before selling it and are an Australian resident. You will generally be entitled to a 50% capital gain discount. The 50% CGT discount is also available to trusts but not to companies.

However, you will not be eligible for the discount if you used your property to generate rental income or used it for a business and held the property for less than 12 months prior to selling or disposing of it.

Additionally, foreign residents or non-residents for tax purposes will no longer be able to claim the main residence exemption beginning July 1, 2020.

However, if certain “life events” occurred, the principal residence exemption may still be available to a taxpayer who has been a foreign resident or non-resident for tax purposes for a continuous period of six years or less when the property is sold.

No partial exemptions exist for a taxpayer who has long lived in their home as their primary residence but who thereafter becomes a foreign resident or non-resident before selling their home. They would not be eligible for any main residence exemption at all.

However, the main residence exemption is still available to people who leave Australia and come back to resume their Australian tax residency before signing a contract of sale. The time they spent living abroad as a non-resident is simply ignored.

Other strategies to reduce CGT might exist. Consider if it’s in your best interest to hire professionals like a lawyer and an accountant to manage your taxes to avoid submitting the incorrect income tax return or being lumped with a hefty tax bill.

Can you buy another house to avoid capital gains?

Contrary to what others may suggest, you cannot buy another house and avoid paying CGT.

The practice of selling a rental property or investment property and quickly buying a similar type investment within 180 days to avoid paying CGT is not legal in Australia.

“There is no general rollover or exemption for a capital gain you make when you sell an asset and:

- put the proceeds into a superannuation fund

- use the proceeds to purchase an identical or similar asset, or

- transfer an asset into a superannuation fund.

For example, if you sell a rental property and put the proceeds into a superannuation fund, or use the proceeds to purchase another rental property, a rollover is not available.”

The Australian government is generous enough no to charge CGT on the sale of a dwelling and offer a 50% discount on CGT in certain situations.

In the next section, we’ll be covering the different scenarios where you can access CGT exemptions for homes which are classified as rental properties.

So, How Much of the Profit Do You Get When You Sell Your House?

One of the biggest financial transactions of your life may be the sale of your primary residence or an investment property that earns rental income or is flipped for profit.

However, how much of the profit truly ends up in your bank account?

As we learned earlier, the answer depends on many variables as making money from real estate transactions is not a one-size-fits-all proposition.

The amount of money you keep after selling your home is largely dependent upon your specific situation and the costs and other expenses attached to the selling of investment properties or primary residences.

Let’s first discuss the costs attached to selling real estate whether it’s an investment property or a primary residence as these are billed to you on the date of settlement.

Selling Costs to Consider

Whether you use an agent to sell your property at auction or via private treaty, you will incur commission and marketing costs, accounting and legal fees, and other expenses. Let’s take a closer look at them.

1. Commission and Marketing Costs

If you decide to use an agent’s services, you should be prepared to pay a commission since the Australian real estate market is still largely based on a commission model.

How much commission an agent charges you depends on the location of the property. Sydney has the lowest commission rate in Australia at 1.86%, while Hobart has the highest at 2.70% on the final sale price. However, commission rates can be negotiated for the benefit of both parties.

Let’s say your agent charges 2% commission on your property’s sale price of $600,000.

Your agent’s commission will cost about $12,000, which leaves you with $588,000.

Fortunately, goods and services tax (GST) does not apply to the sales of an existing property. So, as the seller, you need not worry about GST eating 10% off your sale price.

However, the buyer will need to pay stamp duty, the calculation and amount being dependent on the location of your property. It’s best to be aware of how much this is as it may affect the costs of selling your home.

There are also marketing costs involved to pay for:

- Photography

- Signage

- Videos

- Listing on property websites

- Styling and staging a home

Depending on your property’s location and the type of marketing package you get, marketing costs can amount to roughly 1% of your sale price.

Let’s say your agent gives you receipts amounting to $5,000 for marketing.

Deducting $5,000 from the $588,000 balance after your agent’s commission, you keep $583,000 from your $600,000 sale price if you go with an agent.

You probably need to budget around the same amount if you choose to sell via auction. You may be charged less in commission if you sell via auction but spend more on marketing to ensure a large pool of bidders.

In any case, your expenses don’t end here as you have legal fees to take care of.

2. Legal Fees

It is entirely legal to sell your house without the assistance of a licenced conveyancer, but you run the risk of making errors throughout the settlement process.

These errors could end up costing you a lot of money.

Depending on the type of transaction and the state where the home is located, a typical conveyancer may cost between $800 and $2,000.

These fees cover expenses like:

- Title search: $20 to $100

- Transfer of Certificate of Title: $300

- Building certificate from the local council: $53 to $133

Thus, from the $583,000 you keep after agent commission and marketing costs, you need to deduct $2,000 and end up with $581,000 after legal fees.

Of course, you cannot transfer ownership to your buyer without settling your mortgage first.

3. Settling Your Mortgage

If you don’t own your home outright, you’ll probably need to use the sale profits to settle any remaining mortgage.

In some circumstances, paying off your mortgage early might also require you to pay a break fee.

How much money will you be out of pocket?

This expense is particular to your situation, but let’s use a simple example and say settling your mortgage costs you $200,000.

| How Much is Left After Selling Your House | |

| Property’s Sale Price | $600,000 |

| Less 2% Agent’s Commission | -12,000 |

| Less Marketing Costs | -5,000 |

| Less Legal Fees | -2,000 |

| Less Mortgage Balance and charges | -200,000 |

| Amount Remaining | $381,000 |

You now have a tidy profit of $381,000.

Or do you?

It all depends on your situation if you need to pay tax. Let’s look at some scenarios to determine if CGT is applicable, and if so, how it is calculated.

4. Capital Gains Tax Scenarios

You don’t have to pay tax when selling your property if it is not an investment property, you never used it or a part of it for business, or you’ve always resided in it.

Here are some scenarios presented by the ATO where one may need to pay CGT as it is viewed either as an investment property, rental property, or used for business purposes.

Scenario 1

Part of Home Used for Income Throughout Ownership Period

In this ATO scenario, “Thomas bought a house on 1 July 2000 for $300,000. He sold it on 30 June 2022 for $700,000. The house was his main residence for the entire time.

Throughout the period Thomas owned the house a tenant rented one bedroom, which represented 20% of the house. Both Thomas and the tenant used the living room, bathroom, laundry and kitchen, which represented 30% of the house. Only Thomas used the remainder of the house. Therefore, Thomas would be entitled to a 35% deduction (20% + (30% ÷ 2 people) for home loan interest (if he incurred it).

Using the steps provided by the ATO, Thomas works out his assessable capital gain as follows.

Thomas used his home to produce income from the time he acquired it. Therefore he uses its initial value to work out his capital gain:

$700,000 − $300,000 = $400,000.

The proportion of the floor area set aside for rental is 35%.

Thomas’ assessable capital gain is $400,000 × 35% = $140,000. As he used his home for income right up to when he sold it, he does not need to apportion the time it was used to produce income.

As Thomas owned his house for at least 12 months he can use the CGT discount (50% for individuals) to reduce his capital gain. Therefore, Thomas’s assessable capital gain would be $70,000.”

Note that tax payable on taxable income is the same as the sellers income tax rates.

| Taxable Income on Sale of Property with a Room Rented Out During the Entire Ownership Period | |

| Property’s Sale Price (30 June 2022) | $700,000 |

| Less Property’s Acquisition Value | – 300,000 |

| Capital Gain | $400,000 |

| Multiplied by Percentage of Floor Area Used for Rental (35%) | x 35% |

| Assessable Capital Gain | $140,000 |

| Multiplied by CGT Discount (50%) | x 50% |

| Taxable Income | $70,000 |

Scenario 2

Part of Home Used for Income for Part of Ownership Period

In this ATO scenario, “Fatima bought a house in December 1995 for $200,000. It was her main residence.

- On 1 November 2015 she started to use 40% of the house for a consultancy business. At that time the market value of the house was $520,000.

- On 1 August 2019 she shifted her consultancy practice to separate business premises and once again used her home solely for private purposes.

- On 1 May 2022 she sold her house for $620,000.

Using the steps provided by the ATO, Fatima works out her assessable capital gain as follows.

- Her capital gain based on the value of her home when she first used it to produce income is $620,000 − $520,000 = $100,000.

- The proportion of her home’s floor area set aside for business was 40%.

- $100,000 × 40% = $40,000. As Fatima stopped using her home for business before she sold it, she continues to step 4.

- Fatima used her home to produce income from 1 November 2015 to 1 August 2019, a total of 1,370 days.

- The period from when she first used her home to produce income until she sold it is 2,374 days.

- Fatima’s assessable capital gain is $40,000 × 1,370 ÷ 2,374 = $23,083.

For CGT purposes, Fatima is taken to have acquired the house on 1 November 2015. This is more than 12 months before she sold it, so she can use the CGT discount (50% for individuals) to reduce her capital gain. Therefore, Fatima’s assessable capital gain would be $11,542.”

Note that tax payable on taxable income is the same as the sellers income tax rates.

| Taxable Income on Sale of a Property where a Room was Used for Business for Some Time | |

| Property’s Sale Price (1 May 2022) | $620,000 |

| Less Market Value of the House used for business (1 Nov 2015) | -$520,000 |

| Capital Gain | $100,000 |

| Multiplied by floor area used for business (40%) | x 40% |

| Capital Gain on floor use for business | $40,000 |

| Days home was used for business(1 November 2015 to 1 August 2019) | 1,370 days |

| Divided by Days from home was used for business to house being sold(1 November 2015 to 1 May 2022) | 2,374 days |

| Business Days Ratio 1370 / 2374 | 0.577 |

| Capital Gain on floor use for business | $40,000 |

| Multiplied by business days ratio (1370 / 2374) | x 0.577 |

| Assessable Capital Gain | $23,083 |

| Multiplied by CGT Discount (50%) | x 50% |

| Taxable Income | $11,542 |

Scenario 3

Temporarily Working Away from Home and Renting Out the Home

Ron has a house in Perth which he bought for $400,000 in 2007. He was hired in 2013 to work in the mines in a far-off region of Western Australia.

Since his employer provided him with a rented home near the mine, he rented out his entire Perth home while he was away. Eventually, he sold the Perth property for $900,000 in 2018, profiting $500,000 from the sale of the property.

Ron doesn’t need to pay taxes on the sale of his home as he is eligible to benefit from the six-year rule and obtain a complete exemption from CGT on the sale.

The six-year absence rule in tax law permits him to rent out his property while living elsewhere and earning assessable income without losing his primary residence exemption as long as he doesn’t buy another one during that time.

Scenario 4

Living Overseas

On 10 July 2010, Barry bought a house, moved in, and made it his primary residence. He left the house on 1 September 2018 and relocated to New York.

Barry enters into a contract to sell the house on 15 May 2021. He is ineligible for the principal residence exemption, since as of 15 May 2021 he is a foreign resident.

How to Use the Profit from a House Sale

Undoubtedly, you’re left with a great amount of cash after selling your house and settling your agent, lawyer, and accountant fees, and taxes if any.

You may decide to use part of this money for various things such as

- a deposit for a new home

- to boost your savings

- Pay down your debts

- invest it to grow wealth

Whatever you decide to do with the profits from the sale of a house, it’s best to always get good advice from the right people.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Financial Planner for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your investment options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with the right financial advisor who can help simplify your family’s journey to financial wellness

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick session with My Money Sorted

Step 2: Get matched with a licensed Finance Adviser that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Financial Adviser

It’s that easy!

Speak with My Money Sorted Today About Your Retirement Planning Needs and Get Your Money Sorted Today