Are you looking for a safe and steady way to invest your money?

Bonds could be a smart choice for you. Bonds are essentially loans that you make to a company or government, which they pay back with interest over time.

But not all bonds are created equal. There are different types of bonds with different benefits and risks to consider.

In this investment guide, we will take a closer look at the various types of bonds. We’ll discuss the advantages and disadvantages of each and provide you with the information you need to make an informed decision about which type of bond is right for you.

So, if you’re ready to learn more about how to make your money work for you through bond investments, read on!

Jump straight to…

What are Bonds?

A bond is a loan of a certain amount given to a borrower by an investor for a set period in exchange for regular interest payments. The period from when the bond is issued to when the borrower agrees to repay the debt is referred to as the bond’s term to maturity.

The main difference between a bond and a regular loan is that once a bond is issued, it can be traded with other investors in a financial market. Thus, a bond has a market value.

When you buy bonds, you are lending money in return for receiving regular interest payments or coupon payments.

All bonds, when first issued, have a set value known as the face value. You receive the face value (or principal) back if you keep the bond until maturity.

On the other hand, if you sell a bond before it matures, you’ll get the market value of the bond. And sometimes you can end up with a market value that’s less than the face value.

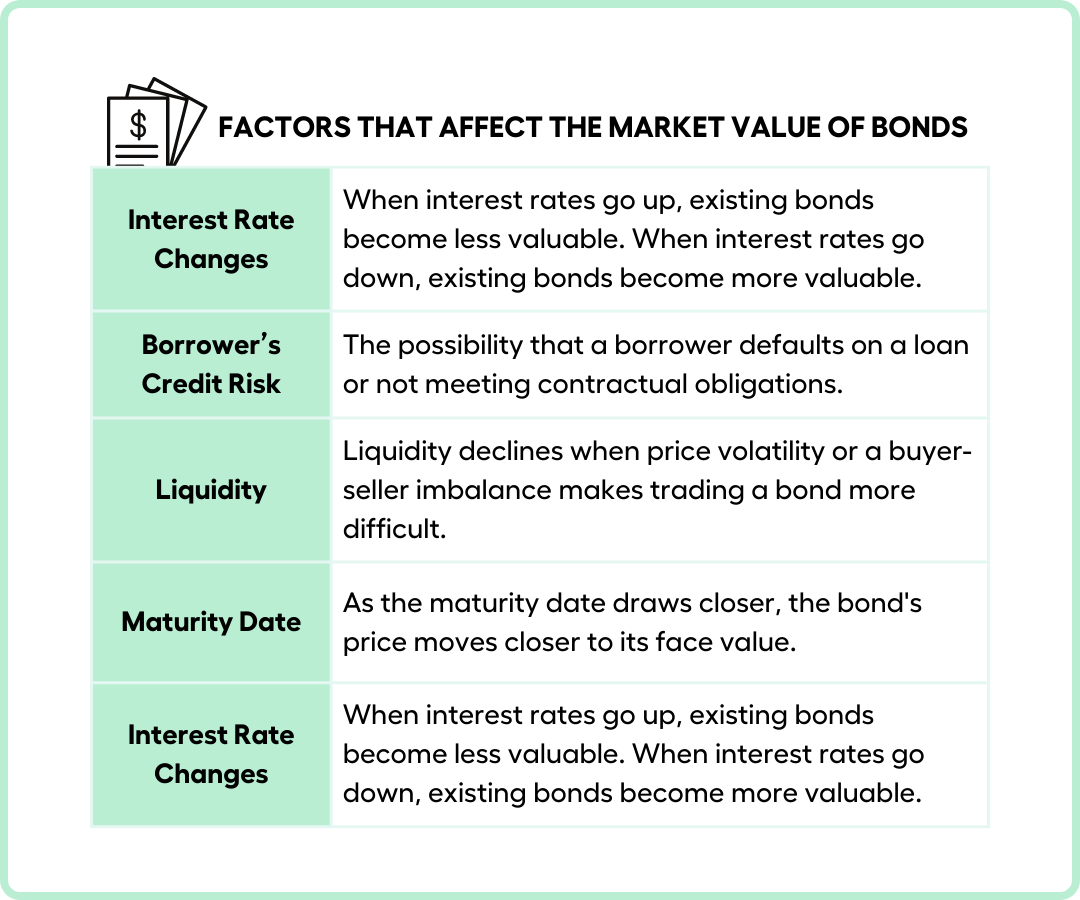

Market value is affected by interest rate changes, the borrower’s credit risk, the level of liquidity, and the time a bond matures.

Although bonds are usually seen as a defensive asset and a lower-risk investment, they still carry credit risk and interest rate risk.

Credit risk is the possibility that the borrower will not pay back the debt or go bankrupt.

Interest rate risk is the chance that a change in interest rates could make the bond worth less on the market. If interest rates rise, issued bonds with smaller coupon payment rates become less attractive investments. A good indication of interest rate changes is when the Reserve Bank of Australia (RBA) sets a target cash rate in order to control inflation, consumption, growth and liquidity.

Bonds are also regarded as debt securities because they may be bought or sold between two parties and have specified basic terms, such as the amount borrowed, the interest rate, and the maturity date.

Bonds are also considered fixed income securities because the lender receives a fixed income from coupon payments.

What is a Bond Issuer?

We mentioned earlier that a bond is a loan given to a borrower by an investor. Whereby the borrower is the bond issuer, and the investor or lender is the bondholder or purchaser.

In Australia, the primary issuers of bonds are corporates, where a company or bank is the borrower, and the government, wherein the government is the borrower.

Government Bond Issuer

Government bonds are among the safest investments available in Australia since they are guaranteed by the full taxing power of the government. Investing in government bonds virtually eliminates your exposure to default.

Government securities are an attractive investment option because your initial investment is guaranteed to remain intact regardless of what happens to interest rates in the market.

Because of their low risk and predictable income flow, most default superannuation plans will have a portion of their members’ money invested in government bonds.

Bonds issued by the federal and state governments are classified as government bonds.

1

Federal Government Bonds

Federal government bonds are issued in the primary (wholesale) market through competitive tender and are denominated in Australian dollars. Syndications (appointment of a group of banks) are sometimes used to establish new bond maturities or to use current bond lines.

Federal government bonds are also traded on the secondary market, both domestically and overseas, in several trading platforms where their price and yield may change with market conditions.

The Commonwealth of Australia, acting through the Australian Office of Financial Management (AOFM), issues federal government bonds aka Australian Government Securities (AGS).

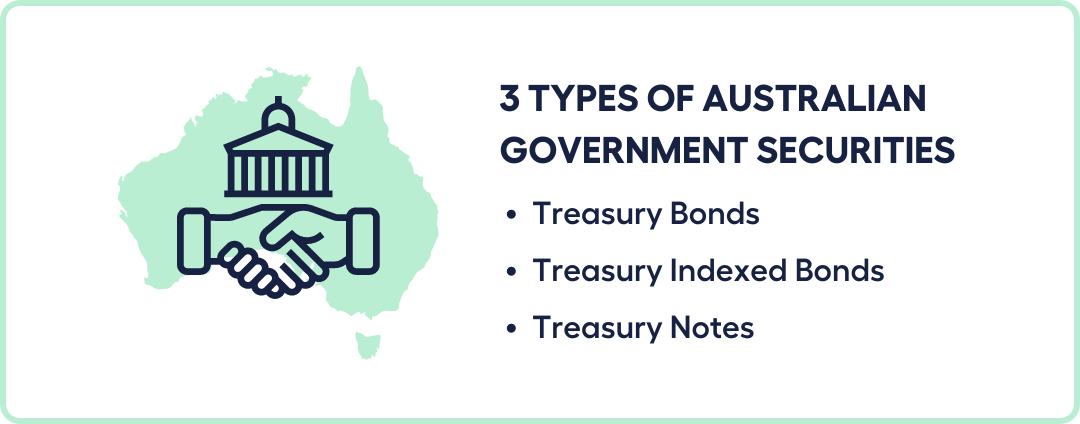

The AOFM issues three types of securities: Treasury Bonds, Treasury Indexed Bonds, and Treasury Notes.

Treasury Bonds are medium to long-term bonds that offer a stable and reliable investment opportunity with fixed interest payments annually that remains consistent throughout the bond’s life. Additionally, interest payments are made twice a year, thus providing a steady income stream for investors.

Treasury Indexed Bonds are investment options for medium to long-term investors looking for protection against inflation risk because the security is adjusted for movements in the Consumer Price Index (CPI). You’ll receive payment quarterly at a fixed interest rate based on the adjusted capital value. At maturity, investors will receive the adjusted capital value of the security, which accounts for any movement in the CPI over the bond’s term.

Treasury Notes, aka Treasury Bills, are short-term discount security that can be redeemed at face value once they reach maturity. Terms are up to twelve months or less. Treasury Notes are a helpful tool for the Australian government to meet its short-term funding requirements.

2

State Government Bonds

Queensland Treasury Corporation

You can invest in QTC Queensland Bonds with a minimum of $5,000 and then in multiples of $100 if you reside in Australia (for tax purposes).

Investors have a selection of QTC Queensland Bonds with various maturities and interest rates. On maturity, the principal investment and interest earned can be paid directly to a bank account. Interest can be paid quarterly or semi-annually.

Queensland Bonds are completely fee-free, with no brokerage, “front-end,” management, or record-keeping fees.

TCorp offers access to bonds and other financial instruments issued on behalf of the state of New South Wales to domestic and foreign investors. The NSW Government fully guarantees each and every debt instrument, and both the Australian dollar and foreign currency issues have good credit ratings (Aaa/AA+). A panel of top banks and market intermediaries is offering the following TCorp bonds:

Benchmark Bonds are large, liquid, and frequently traded domestic bonds that are available on the financial markets.

Sustainability Bonds are sustainability, social, and green bonds offering a way for investors to contribute money to the realisation of environmental and social objectives.

You can also look into bonds from other states by contacting a fixed interest broker for further information.

Corporate Bond Issuer

Corporate bonds, along with government bonds, are two of the most common types of investments in the broader fixed income category.

Companies, even the big ones listed in the Australian Securities Exchange (ASX) issue corporate bonds. The minimum purchase price for corporate bonds is often large, up to $500,000.

Companies sell bonds to raise money for a range of objectives, such as:

- buying property or capital equipment

- research and development funding

- debt refinancing

- re-acquiring issued shares from shareholders to resell

- distributing dividends on current shares

- mergers and acquisitions financing

In contrast to typical financing channels like banks, the bond market may provide the issuing company with more advantageous terms.

Corporate bonds are typically issued and traded on the over-the-counter (OTC) market, outside of the Australian Securities Exchange (ASX). A dealer or broker facilitates OTC trading, which promotes financial instruments that would otherwise be unavailable to everyday investors.

Why invest in corporate bonds?

The case for investing in corporate bonds is based on how they are different from shares and government bonds. Let’s analyse some important differences.

1. Certainty of Principal Repayments

Corporate bonds, like government bonds, have a “maturity” date when the issuer must repay the principal, while a corporation that issues shares never needs to repay the capital. Maturity dates are from one to 30 years.

2. Predictable Interest Payments

Investors wanting predictable income streams and clarity regarding future cash flows can use corporate bonds, which offer a predetermined schedule.

Stock dividends are entirely discretionary and up to a company’s board, making income prediction difficult.

3. Bankruptcy Prioritises Corporate Bonds

Corporate bond investing is often much safer than share market investing since bonds are higher on the capital hierarchy. This means that if a corporation defaults, bond investors will be paid first, followed by share investors.

4. Higher Yields than Government Bonds

Corporate bonds yield more than debt securities issued by the government because they are riskier. Companies are more likely to default on bond payments than governments, which can raise taxes or print money to meet their financial obligations.

A word of caution.

Corporate bonds are rarely offered to the retail market (enabling sales of less than $500,000). Be alert if someone gives you a corporate bond, this could be a red flag.

Check the following for any corporate bond offer:

Is the prospectus posted on the ASIC offer notice board?

If it does not, it is most likely a hoax.

Is the offer or prospectus coming from a reliable source?

If you’re unsure, visit the issuer’s website and get the prospectus and application form (complete with bank account information).

Regardless, any time you are investing money, you should complete your due diligence and ensure you are dealing with a reputable, trustworthy and reliable company.

What is a Bond Issuer Credit Rating?

One way to minimise risk when investing in bonds is to check the credit rating of the bond issuer. Just like people have their own credit scores, businesses and governments also have credit ratings.

A credit rating is an evaluation of a borrower’s creditworthiness, capacity to repay a debt or susceptibility to default. To determine a borrower’s credit rating, independent organisations called credit rating agencies evaluate them.

Credit ratings can help investors understand the relative risk of buying bonds or hybrid securities.

- A lower credit rating indicates a higher risk to the investor.

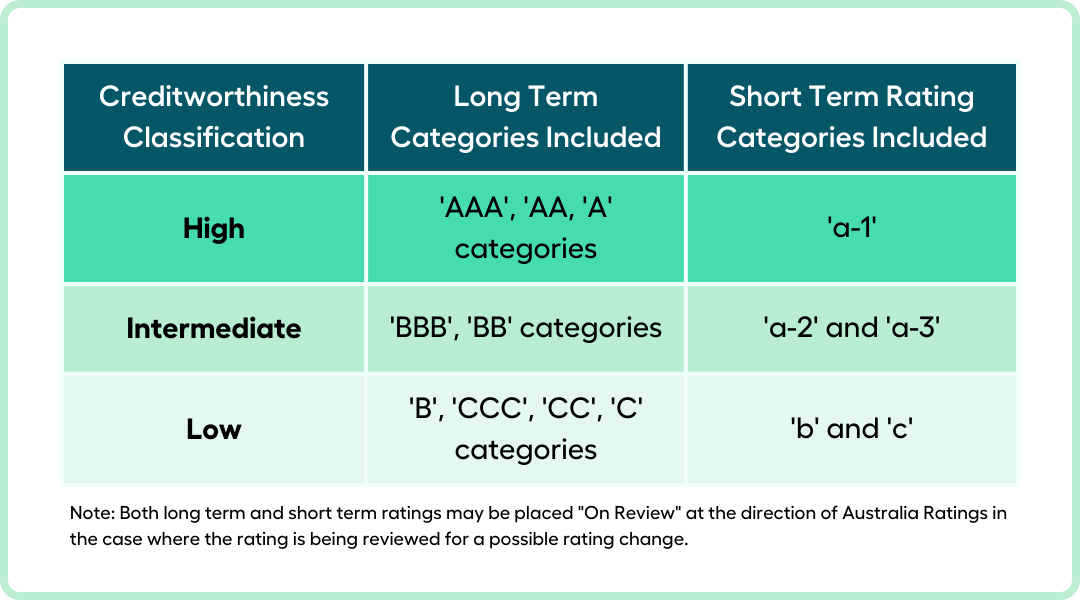

Australia Ratings‘ credit ratings on selected securities represent its assessment of the issuer’s creditworthiness. It is based on an alphabetical indicator of ‘AAA’, ‘AA’, ‘A’, ‘BBB’, and so on, with ‘AAA’ being the highest possible rating.

As for the Australian government, it is one of only nine countries to be rated AAA by all three major credit rating agencies.

A bond rating is a significant process since it notifies investors of the bond’s quality and stability. That is, the rating has a significant impact on interest rates, investment appetite, and bond prices. Furthermore, ratings are assigned by independent rating agencies based on future projections and outlooks.

- Higher-rated bonds, also known as investment-grade bonds, are considered safer and more reliable investments since they are linked to firms or government bodies with a favourable outlook. Investment-grade bonds have AAA to BB ratings (or high and moderate creditworthiness). Australian government bonds account for the majority of the most common AAA bond securities.

- Non-investment grade bonds, sometimes known as junk bonds, are typically rated B to C or not rated at all. Bonds with these ratings are viewed as higher risk assets that can draw investor interest due to their high yields. However, investors in junk bonds should be aware of the implications and risks associated with investing in a bond issued by a corporation with liquidity risk.

Different Types of Bonds

Bonds are classified into three classes based on their coupon rate.

These are:

- fixed rate bonds,

- floating rate bonds,

- and indexed bonds.

Let’s discuss each of them briefly!

Fixed Rate Bonds

The interest rate of a fixed rate bond is set when the bond is issued and stays the same until maturity. You get scheduled fixed coupon payments and the face value back if you hold the bond to maturity.

- A fixed rate bond could provide a stable regular income stream that may be used to diversify your investment portfolio.

Bonds with fixed interest rates carry both credit quality risk and interest rate risk because their interest rates are fixed. If market interest rates rise higher than current interest rates or the issuer’s financial health weakens, buyers may want a higher yield and the bond’s price will generally go down.

Floating Rate Bonds

The interest rate on a floating rate bond may rise or fall over the life of the bond. The coupon rate is calculated by adding a predetermined percentage or margin to an underlying interest rate.

Your coupon payments increase as interest rates rise but decrease as interest rates fall. If you hold it to maturity, you receive the face value back.

- A floating rate bond offers a steady income and protected returns in the event that interest rates increase because the coupon payment rate adjusts.

Indexed Bonds

- An index rate bond offers protection against rising inflation by indexing interest rate returns against the consumer price index (CPI).

The face value and coupon payments rise in step with fluctuations in the CPI.

An indexed bond protects your earnings against inflation risk and helps diversify your investment portfolio.

How Do Bonds Work?

Now that you know the basic principles of bonds, let’s discuss the two ways you can make money from owning bonds: holding onto them and trading them.

Holding Bonds

When you buy and hold onto a bond, you simply receive interest payments until the bond matures and have the issuer repay the bond’s face value.

After bonds are issued, their value fluctuates in the same way that shares do. If you hold the bond until maturity, the fluctuations will have no effect on your interest payments and face value.

- Like any other type of loan, changes in overall interest rates will have a greater impact on bonds with longer maturities.

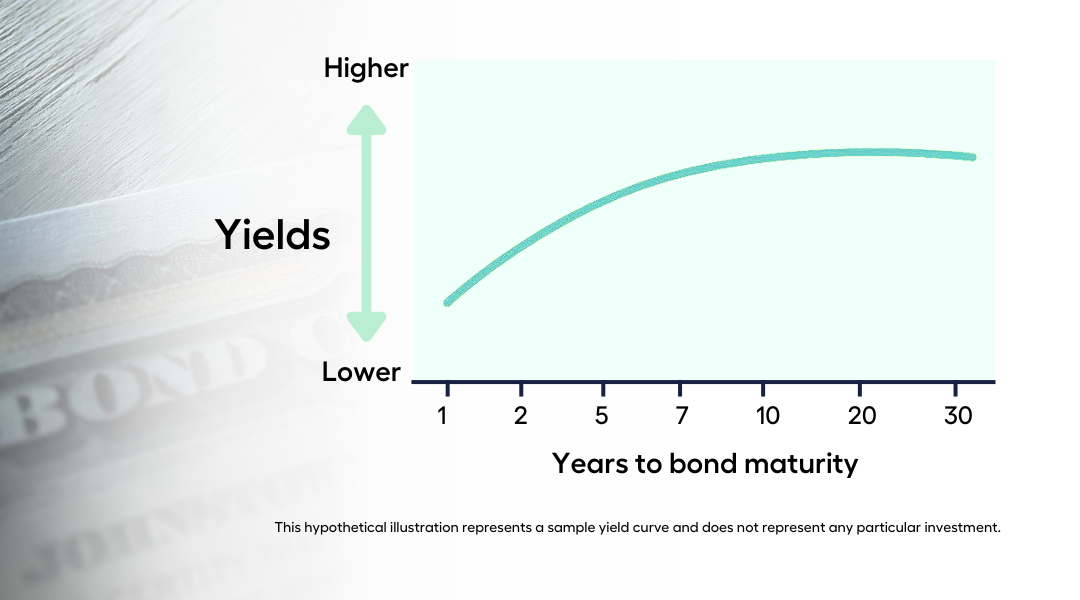

Bonds with longer maturities have a higher amount of risk owing to interest rate changes, hence their bond yield offer is normally higher to make them more appealing to potential buyers. The yield curve represents the relationship between maturity and yields.

Shorter maturities correspond to lower yields in a typical yield curve.

Due to their promise of returns on investment in addition to yearly interest income, bonds are a popular choice among investors for long-term investments.

Even if your plan is to hold your bonds until maturity, be on the lookout for one key indicator that it may be time to sell – the issuer appears unstable.

If the bond issuer becomes financially unstable, experiences a big loss that threatens its future profitability, or gets into legal trouble, it’s worth considering liquidating your bond holdings.

Check your bond issuer’s financials regularly (or have your financial adviser do so) and consider selling if they appear to be falling.

In the event of a bond issuer’s default, liquidating your holdings and reallocating to a more secure investment option may be a more convenient and prudent course of action.

Trading Bonds

When a bond is issued, an investor has made the first purchase of the bond in the primary market. After that, the investor can exchange the bond with other investors in the secondary market, where the price and yield of the bond may fluctuate depending on market conditions.

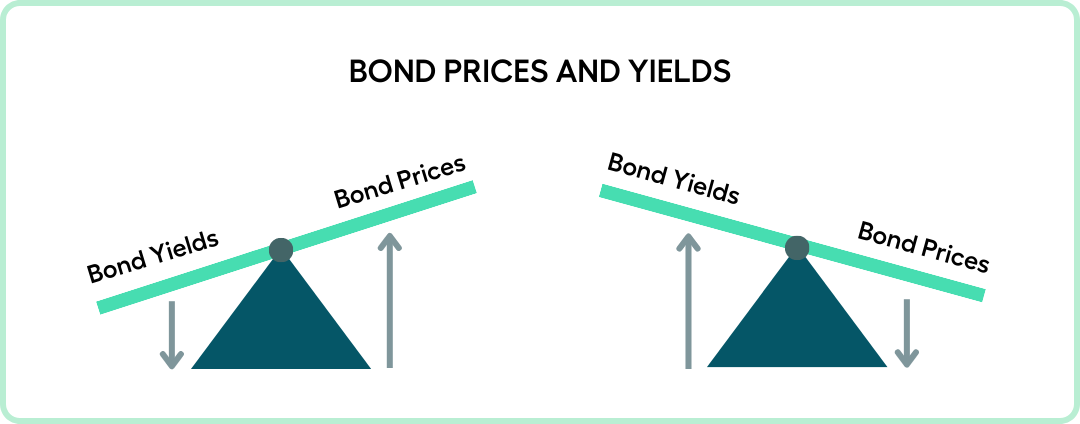

The secondary market prices at which investors trade bonds fluctuate in the opposite direction from the yields they anticipate.

Interest rates fluctuate constantly in financial markets, and as a result, new bonds issued will pay different interest rates to investors than existing bonds.

For example:

If interest rates drop, lower interest rates will be offered on newly issued bonds. Existing bonds would become more attractive to investors due to their higher interest rates compared to newly issued bonds.

As a result, the price of existing bonds will go up. However, if the cost of a bond rises, it becomes more expensive for a prospective new investor to purchase. The yield on the bond will therefore decrease as a result of the decreased return that an investor anticipates from buying this bond.

Investors buy and sell bonds for many reasons. If you’re a bond trader, it’s important to understand these reasons so you can find good opportunities to make money in the bond markets.

Let’s examine some of the most common reasons why investors trade bonds:

1. Yield Pickup

Increasing the yield on investors’ portfolios is the primary motivation for bond trading. Many investors aim to maximise the yield, which is the total return you may anticipate getting if you hold a bond until it matures.

What would you do, for instance, if you owned investment-grade BBB bonds from Company X with a yield of 5% but you noticed that bonds with a comparable rating from Company Y were trading at 5.5%?

If you believed the credit risk was small, selling the X bonds and buying the Y bonds would result in a 0.5% spread gain or yield pickup.

2. Credit-Upgrade Trade

If an investor believes that a specific debt issue will soon be upgraded, they can use the credit-upgrade trade. Generally, the price of the bond rises and the yield falls when a bond issuer’s credit rating is upgraded (let’s say from B to BB).

By purchasing the bond prior to the credit upgrade, the investor in the credit-upgrade trade is hoping to capitalise on this expected price increase. But in order to execute this transaction successfully, credit analysis skills are needed.

Additionally, trades of the credit-upgrade variety frequently take place around the boundary between investment-grade and below-investment-grade ratings. The trader can make large earnings if a bond’s status changes from junk to investment grade. The fact that many institutional investors are prohibited from purchasing debt with a rating below investment grade is a major factor in this.

3. Credit-Defence Trades

Certain industries are more likely than others to default on their financial obligations during periods of rising economic and market turmoil. As a result, the trader can take a more protective stance and withdraw funds from industries with a negative outlook or high levels of uncertainty.

4. Sector-Rotation Trades

Sector-rotation trades aim to redistribute capital to industries or sectors that are anticipated to do better than others, as opposed to credit-defence transactions that solely aim to safeguard the portfolio.

Depending on where you think the economy is going, one frequent sector-level approach is to switch bonds between cyclical (retail) and non-cyclical (consumer staples, e.g., foods and beverages) sectors.

5. Yield Curve Adjustments

The duration of a bond portfolio shows how much its price will change when interest rates change. If a bond portfolio has a high duration, it means its price will change more with interest rate changes. If it has a low duration, its price will change less.

When you think interest rates will go up or down, you can adjust your bond portfolio’s duration to make it more or less sensitive to interest rates.

Bond prices go up when interest rates go down, and bond prices go down when interest rates go up.

Where to Buy Bonds

Now that you have a better idea of how investors make money from bonds, it’s time to identify where you can buy bonds for your investment portfolio.

Buying Government Bonds

Retail investors previously had access to a Reserve Bank of Australia facility that allowed them to purchase Australian Government Securities directly from the Australian Government. This facility ceased operations on 21 May 2013.

As of May 21, 2013, retail investors can purchase and sell exchange-traded Australian government bonds (eAGBs) on the ASX.

EAGBs can be purchased or sold on the ASX in the same manner as ASX-listed shares. Exchange-traded Treasury Bonds (eTBs) and Exchange-traded Treasury Indexed Bonds (eTIBs) are the two forms of eAGBs that are offered.

eAGBs can only be purchased through authorised ASX brokers. Thus, in order to buy and sell eAGBs, you need a broker-sponsored Clearing House Electronic Sub register System (CHESS) account.

You should get in touch with a registered ASX broker to open an account if you don’t already have one for CHESS. Please be aware that there may be brokerage fees.

Each eTB or eTIB requires a minimum investment holding of one unit, which is equal to $100 in face value of the Treasury Bond or Treasury Indexed Bond over which it was issued.

Buying Corporate Bonds

Corporate bonds can be purchased in one of two ways:

- Through a public offering (primary market) or through a securities exchange (secondary market).

1

Primary market

(public offer)

Most small investors buy corporate bonds by applying for them through a public offering. To do this, they ask for a prospectus which tells them about the bonds being offered. Usually, investors find out about these opportunities through newspaper ads or banks.

When a company decides to issue bonds, it usually asks an investment bank to help sell them. The bank buys the bonds from the company at a set price and then sells them to other large investors.

The prospectus will specify the smallest amount of bonds called minimum investment parcels (or bundle of bonds) that can be purchased at once. It’s important to read the prospectus carefully if you plan on buying corporate bonds this way.

2

Secondary market

(securities exchange)

After being issued in the primary market, corporate bonds can be purchased (and sold) on the ASX, just like shares. You will pay the market price, which may be greater or lower than the bond’s face value if you purchase bonds on the ASX. Additionally, you will pay transaction costs to your broker (such as commission or brokerage fees).

You can also consider investing in corporate bond exchange traded funds (corporate bond ETFs). Corporate bond ETFs purchase a variety of bonds using the purchasing power of pooled funds. Because the bonds they hold may have varying maturities, coupon rates, and coupon dates, they are sophisticated investment vehicles.

Before investing in a bond ETF, it’s critical to comprehend the fund’s specific characteristics and the assets it owns. It’s also crucial to keep in mind that, in contrast to bonds, shares of bond ETFs never mature or pay back a principal sum based on the cost of your share purchase.

- Corporate bond ETFs provide regular dividend payments, minimal management costs, a single position with wide exposure, and a diverse portfolio of corporate bonds.

Looking to Invest in Bonds? Book a FREE 15 min Call or Send Us Your Questions!