Is there a way to invest in the real estate market without the risk of flushing your savings down the drain?

This question comes off the back of new data from the Australian Taxation Office (ATO) showing that there are 2.22 million Australian property investors, and 54% of them are losing money on their investment or rental property.

Of the 2.2 million property investors, 58% are under the age of 55.

Clearly, investing in real estate is an attractive investment option for many.

But is there a way to earn money while still learning the ropes of property investment?

Fortunately, there are ways to learn and earn from property investment without taking a big hit on our savings.

And in this article, we will look into the different options for investing in real estate in Australia.

Jump straight to…

Different Ways to Invest in Real Estate Without Buying Property

Investing in real estate can be lucrative and need not require a huge amount of capital.

By choosing non-traditional property investment options, you have the opportunity to invest in a rental property that could:

✓ provide a consistent revenue flow

✓ generate profit from real estate appreciation without having to take on responsibilities of building maintenance

✓ offer more possibilities in terms of location, property size, and property use

Is It Worth Investing in Australian Real Estate?

Whether you take the traditional or non-traditional route, investing in Australian real estate is seen as a no-brainer for many. Real estate can be a viable investment opportunity in terms of its potential to deliver profits consistently over time.

Here’s why:

Besides the property market being a stable long term investment, Australia provides a friendly atmosphere for investment property seekers.

Furthermore, Australia has a stable economic climate, data-driven development projects, transparent lending rates, and favourable tax laws that allow you to keep more of the income you earn.

Investing in Australian real estate can be a great idea if you know what to do.

How Do I Start Investing in Real Estate Now?

Whether it’s your first property or first investment property, buyers need to be sure of one thing:

Have a smart investment strategy.

Determining your financial goals before you begin your investment journey and planning the most efficient route to get there will save you time, reduce risk, avoid pitfalls, and reduce the time taken to enter the market.

We can’t stress enough the importance of having a smart investment strategy.

You know why?

There is risk in property investment.

With property investment, you focus on long term gains. It is not a get rich quick scheme.

Smart investing is managing the risks involved by understanding that the value of a property increases over time.

However, for some property investors, a lack of liquidity (the relative difficulty in changing an asset into cash and cash into an asset) is still a disadvantage of investing in real estate.

Having said that, there are ways to learn and earn from property investment by passively investing in property and doing so at minimal cost.

Passive Real Estate Investing

For newbie investors, looking at the following list of issues they have to deal with (all of which requires a lot of time and resources) could make them give up even before they take the plunge into property investing:

- Legal fees

- Land tax

- Mortgage repayments

- Property expenses

- Stamp duty

- Obtaining a higher rental yield

- Maintenance costs, etc.

But in life there is a solution to just about every problem, and real estate investing is no different. Passive real estate investors have a a secret when it comes to simplifying the many number of problems they need to deal with.

They employ a professional property manager.

Hiring a professional property manager enables passive real estate investors to focus on analysing capital growth, capital gains, and tax deductions while concentrating on learning the ropes without negatively impacting cash flow.

Now, are you ready to explore the different types of passive property investment vehicles?

Keep on reading to learn about these options that could help you take the first steps towards eventual property ownership.

Different Types of Passive Property Investment Vehicles:

1. REITs (Real Estate Investment Trusts)

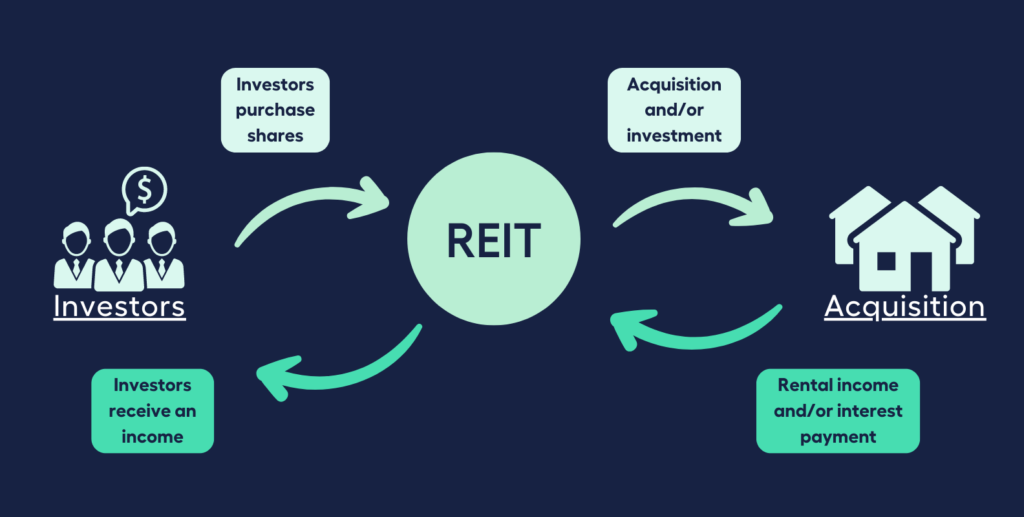

Real Estate Investment Trusts (REITs) are similar to mutual funds. REITs pool the money of many investors and a fund manager then buys and sells property assets. The income generated by the REIT company is paid out to investors in the form of dividends.

A REIT typically requires a $500 minimum initial investment. As an REIT investor, you don’t own the underlying property investments, you own “units” in the fund. The value of the units rises and falls with the value of the underlying property assets.

Unlike a physical investment property, the majority of REITs are highly liquid since they’re publicly traded like shares on the Australian Stock Exchange (ASX).

Two Types of REITs:

- Equity REITs

Equity REITs invest in and own real estate. Equity REITs typically generate income by leasing out their investment properties and collecting rental yields. They can specialise in certain property types, such as hotels, shopping centres, and apartments, or they can diversify.

- Mortgage REITs

Mortgage REITs (mREITS), which buy or create mortgages and mortgage-backed securities (MBS), provide funding for property that generates income by collecting interest from these assets. mREITs aid in supplying the property market with crucial liquidity.

Just like other investments, there are pros and cons to investing in REITs.

Advantages of Investing in REITs:

1. Ensures Investment Portfolio Diversity

2. High Yields

3. Good Potential for Return

4. Liquidity

5. Access to Commercial Real Property

The Benefits are described in more detail below:

1. Ensures Investment Portfolio Diversity

You can diversify in the property market by owning interests in various properties across several property types and geographical locations as an investor.

2. High Yields

REITs often have above-average dividend yields since they are required to distribute at least 90% of taxable income to shareholders. In contrast to the typical yield of less than 2% you receive from shares in regular companies listed on the ASX, REITs frequently have safe dividend yields of 5% or more.

3. Good Potential for Return

The possibility of a good return on investment is one of the best aspects of investing in REITs. Long-term property values typically rise, and REITs may employ several strategies to increase value. To maximise their capital, they could sell real estate assets or start from scratch developing investment properties.

4. Liquidity

Real estate transactions can take a considerable amount of time. REITs, on the other hand, make great liquid investments. With the click of a mouse, you can buy or sell REIT assets at any time. You can quickly release your funds if you need money from your investment.

5. Access to Commercial Real Property

Another benefit of REITs is that you have the option to invest in commercial property. Many investors are unable to buy a class A office building on their own. You may purchase a portion of hundreds of office buildings, apartment buildings, and even shopping centres through REITs.

Disadvantages Of Investing in REITs:

1. Vulnerable to Interest Rate Fluctuations

2. Dividend Taxes

3. Trends Impact REITs

4. Risks And High Potential Fees

5. May Only Be Effective As Long-Term Investments

Details of the drawbacks are as follows:

1. Vulnerable to Interest Rate Fluctuations

The value of REITs may suffer as a result of rising interest rates. In essence, the trust’s value is correlated with the Reserve Bank of Australia (RBA) yield, thus as interest rates rise, the REITs’ value is likely to fall.

2. Dividend Taxes

Although you don’t have to pay corporate tax with REITs, the dividends you receive are taxed at the same rate as long-term capital gains but qualify as regular income tax.

3. Trends Impact REITs

While trends affect miost investments, REITs may be affected by additional trends specific to the property type or location. An example being the decline in demand for office accomodation as a result of the global pandemic. These trends might be more difficult for investors to observe.

4. Risks And High Potential Fees

Don’t be afraid to take additional time to study the fine print before investing in a REIT. Check for interest rates, location, debt, property valuations, transaction costs and property management fees.

5. May Only Be Effective As Long-Term Investments

The values of REITs are influenced by a variety of factors. Such investments benefit from a longer time horizon. REITs might not be the right investment for you if you’re searching for a quick return on your investment.

2. Real Estate ETFs

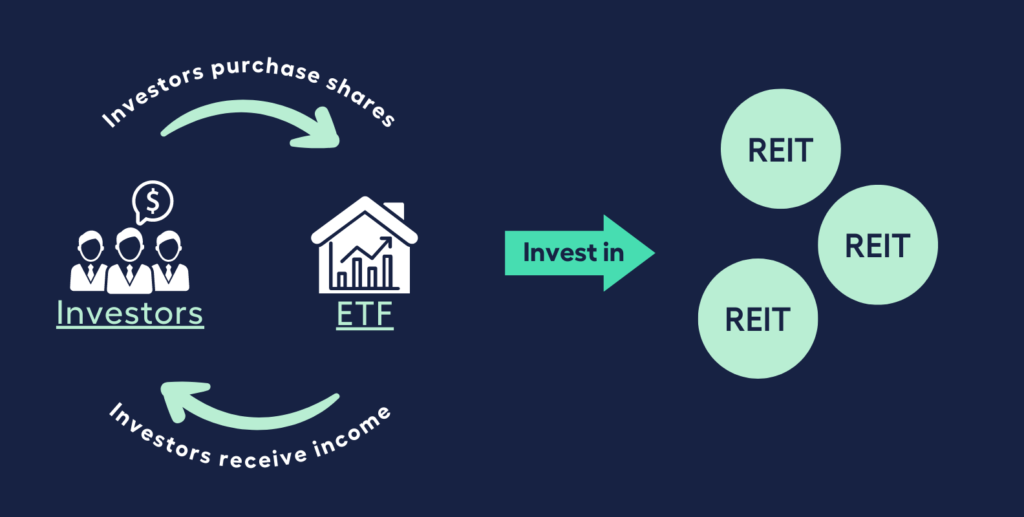

Real Estate Exchange-Traded Funds (ETFs) invest the majority of their funds in Equity REITs securities and related derivatives, which is why they’re also known as REIT ETFs.

REIT ETFs are passively managed to track indexes of publicly-traded owners of property. By tracking indexes, it’s an easy way for property investors to gain access to the broader real estate market without risking capital on a single company.

REIT ETFs typically require a $500 minimum initial investment. They are popular because of their high dividend yields.

ETFs are considered to be lower-risk investments because they hold a basket of stocks, have high diversification and are low cost. However, before you get started investing, there are a few advantages and disadvantages to consider.

The Benefits of Investing in ETFs:

1. Cost-effectiveness

2. Diversification

3. Convenience and Transparency

Consider these benefits when making a decision:

1. Cost-effectiveness

The cost-effectiveness of an ETF is one of its main advantages. The fund invests in many REITs, but you just pay one brokerage fee. Compared to actively managed funds, an ETF may also have cheaper management fees.

2. Diversification

A financial product that tracks the index can spread your money in many listed companies. You can either narrow your investment or spread broadly as you wish with the variety of ETFs available.

3. Convenience and Transparency

As a result of ETFs being listed on an online share market, investors can always view the value of their investment, and the purchasing procedure is fairly straightforward.

The Drawbacks of Investing in ETFs:

1. Can’t Match the Index

2. Fluctuation

3. Exchange Rate Risk

Take note of these drawbacks when making a decision:

1. Can’t Match the Index

Because of the management fees associated with ETFs, your return on investment will never be an exact match for the index it tracks. The buy and sell prices of the shares you own in the fund may differ from the underlying index’s net asset value, which will lower your return.

2. Fluctuation

Diversification does not ensure that your investment is immune to the volatility of the property market. You can still suffer losses in a declining market and the risks can increase with the specialisation of the REIT ETF.

3. Exchange Rate Risk

The Australian dollar’s fluctuations can affect your returns if your chosen ETF makes investments overseas. The volatility of funds with exposure to emerging markets may also increase. If the fund you invest in is located outside of Australia, you can potentially be required to pay foreign taxes.

3. Fractional Ownership & Crowdfunding Platforms

What is Fractional Ownership?

Fractional ownership is another affordable option for property investing.

You purchase the right to a portion of a property title that will be shared with a small number of other fractional owners, typically between six and fourteen parties per unit.

With fractional ownership, you and the other co-owners share any gains or losses in the property’s value. The minimum investment amount varies by property type, but it can be as low as $1,000.

This arrangement may appeal to those who want to be an owner occupier on occasion, because the portion of the property you own is yours to use as you see fit.

For example:

If you own one-sixth of a holiday home, you can use it for one-sixth of the year, and earn rental income when it is leased.

Fractional property ownership is a more sophisticated ownership model and it definitely has advantages and disadvantages you need to consider. Before you sign a fractional ownership agreement, take into account its advantages and disadvantages.

Advantages of Fractional Ownership:

1. Increased Opportunity of Owning Property

2. Deed of Ownership

3. Lower Cost of Maintenance

4. Possibility of Rental Income

Here are the advantages in brief:

1. Increased Opportunity of Owning Property

The ability to own a piece of one or more properties in desirable locations that might otherwise be out of your price range, is provided by fractional ownership. As an example, you could take advantage of all the amenities of a high-end, resort-style apartment without breaking the bank because numerous owners split the price.

2. Deed of Ownership

Fractional ownership provides you with a deed to a portion of the actual property, unlike a resort timeshare. This indicates that the value of your share in the property changes in direct proportion to its property value. Any rise in value is distributed equally to all fractional owners as gained equity.

3. Lower Cost of Maintenance

You are only accountable for a portion of the upkeep and maintenance when you own a property under the fractional ownership model. This covers the price of taxes, maintenance costs, utility costs, landscaping costs, property management fees, and other costs related to co-ownership.

4. Possibility of Rental Income

If the ownership agreement permits it, a fractionally owned property may be rented out on a short-term or long-term basis. All owners may receive a portion of the earnings from rental income, depending on the specifics of the arrangement.

Disadvantages of Fractional Ownership

1. Fewer Financing Options

2. Less Freedom and Flexibility

Here’s the lowdown on the disadvantages:

1. Fewer Financing Options

Few banks offer a home loan to people who want to buy fractional interests in properties. You might need to look for alternative financing options for a fractional ownership property.

2. Less Freedom and Flexibility

It can be inconvenient to have to go through all of the ownership partners to seek approval on things like maintenance, repairs, and renovations. The sale of a fractional property will also require the consent of the other fractional owners if you ever choose to sell it.

What are Crowdfunding Platforms?

- Real Estate or Investment Property Crowdfunding platforms raise capital from a large group of people to fund an entrepreneur’s investment property project or projects.

If you want to invest in the property market but do not want to be in the business of developing property, buying property, or having maintenance costs you can become a shareholder in a property company through a crowdfunding platform

- A crowdfunding platform earns money on management, advisory, and sales fees by connecting property developers and investors.

As an investor, profits directed to the real property venture—a portion of the profits from rental income, development profits, or property flipping—are passed on to you.

Investment property crowdfunding typically has a low entry point at $1000.

But be cautious!

Crowdfunding is an unregulated area at the moment, and you should conduct due diligence on the project’s management team.

Let’s look at the benefits and drawbacks of property crowdfunding, which are all fairly straightforward but worth repeating.

Property Crowdfunding’s Key Benefits include:

- The possibility to build a broad property portfolio with very little investment.

- Rather than putting all of your money into one property investment, property crowdfunding enables you to build a varied and balanced portfolio.

- Since you are purchasing shares, the transaction is straightforward and fairly quick..

- Since third companies are in charge of managing the properties, investors won’t personally have to deal with ongoing management issues.

- For prospective property investors who are unable to obtain a home loan or an investment loan, this may be an alternate investing opportunity.

The following are the Primary Disadvantages of Property Crowdfunding:

- The overall investment return is lower than acquiring a property directly as a result of fees and management charges.

- You rely heavily on the property investment company‘s ability to select a profitable investment.

- Typically, investors will not have a say on when and how the property is sold, as these issues are often decided by third-party management.

- Some property crowdfunding investments will have a lock-in period during which selling shares may be difficult.

- Because crowdfunding platforms are still relatively new, many have limited track records.

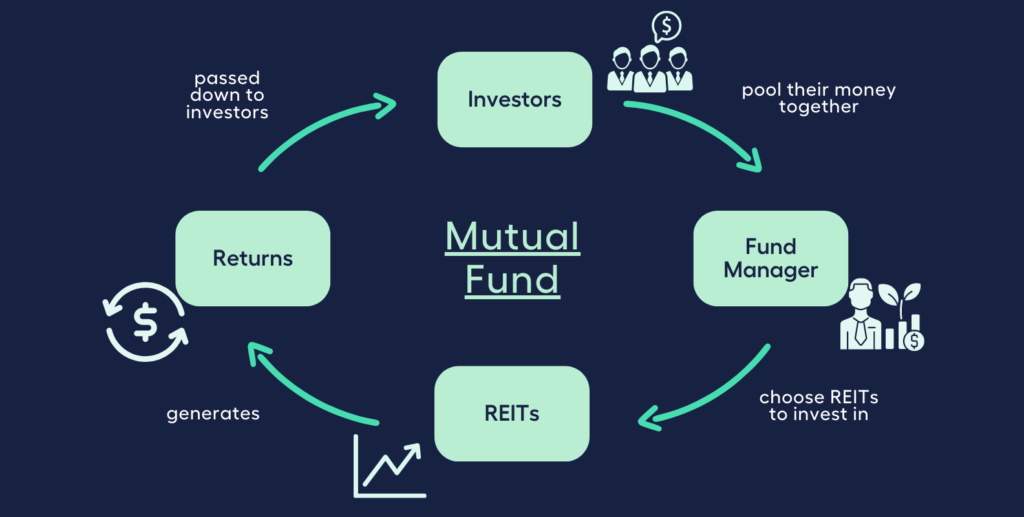

4. Real Estate Mutual Funds

Real estate mutual funds use investment portfolio managers and expert research to invest primarily in REITs and property operating companies.

They enable you to gain diversified exposure to property with a small amount of capital. The value of the assets in which the fund invests affects the unit or share price. Most managed funds require a minimum investment amount, such as $5,000.

Depending on the Mutual Funds strategy and diversification objectives, they provide property investors with a much broader asset selection than can be obtained by purchasing REIT stocks alone, as well as the flexibility of easily switching from one fund to another.

Mutual funds, even real estate mutual funds have a lot of advantages for people new to the investment housing market, but they aren’t for everybody.

The Benefits of Real Estate Mutual Funds:

1. Portfolio Management at its Finest

When you purchase a mutual fund, a management fee is included. This fee pays for the services of a portfolio manager. When you think about it, paying a fee in exchange for receiving expert assistance in the management of an investment portfolio can be a wise investment.

2. Reinvesting Dividends

As dividends and other types of interest income are declared by the fund, you can use these to buy more mutual fund shares, allowing your investment to grow.

3. Reduced Risk (Safety)

Diversification is a strategy used for lowering portfolio risk.

4. Convenience and Small Investment Commitment

Mutual funds are simple to purchase and comprehend. They often need small minimum commitments and are only traded once daily at closing net asset value (NAV). This avoids price fluctuation throughout the day.

Real Estate Mutual Funds’ Disadvantages:

1. Sales Charges and High Expense Ratios

Sales charges and cost ratios for mutual funds can go out of control if you’re not paying attention to them. Overall investment returns are lowered by fees and sale costs. Look for reliable mutual fund companies that don’t charge sales commissions.

2. Inefficiency in Taxation

Mutual fund capital gains payouts are automatic. Thus, investors typically receive distributions from the fund that are an uncontrollable tax event due to the turnover, redemptions, gains, and losses in security holdings throughout the year.

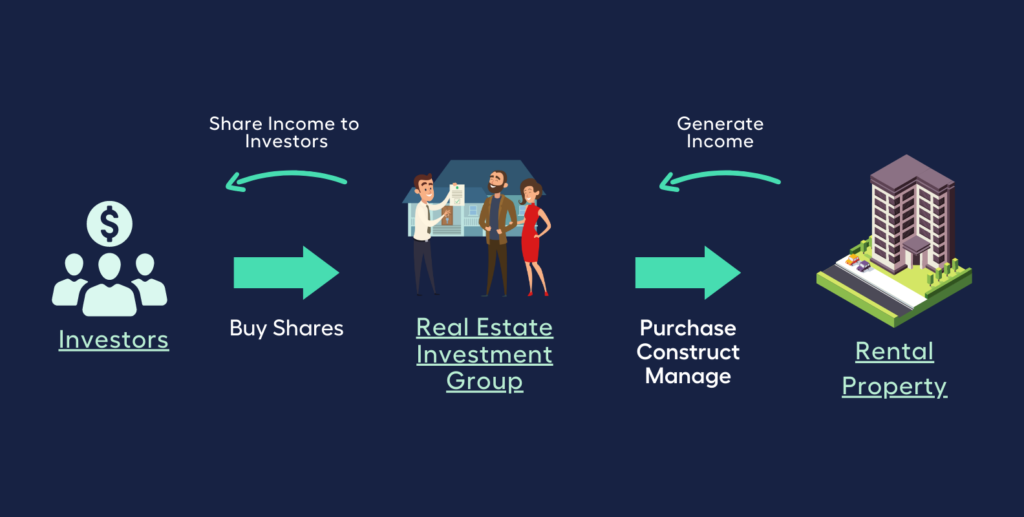

5. Buy Shares in Real Estate Companies or Developers

Real Estate Investment Groups (REIGs) are the perfect option for individuals who want to own rental property without performing the task of a property manager.

In a typical REIG, the company purchases or constructs a collection of apartment buildings or units, then allows investors to purchase them through the company to become members of the group.

A single investor can own one or more residential units, but the property investment company also functions as property manager of all the units collectively. The company takes a percentage of the monthly rental income as property management fees.

A typical property investment group lease is in the name of the investor, and all of the units pool a portion of the rental income to protect against vacancies. As a result, even if your unit is empty, you may still receive some income.

Buying shares in a real estate company or developer may or may not be ideal for you. Consider these advantages and disadvantages before diving in.

Advantages of Buying Shares in Real Estate Companies;

- You don’t need a lot of cash to invest and can be part of large investment property deals.

- You don’t need experience in the property market to be a shareholder.

- You don’t need to invest considerable amounts of your time; the investment is managed by others.

- Your investment is not limited to one type of property.

Disadvantages of Buying Shares in Real Estate Companies:

- They might tack on a membership fee, which would lower your payout.

- Depending on the conditions of your contract, it could be challenging to withdraw your money.

- You are not in control of where the company invests.

What to Consider Before Investing in Real Estate Alternatives

A diversified investment portfolio allows you to manage risk and most of the above mentioned investment vehicles allow you to do this in the property game.

However, risks still exist even in these investment vehicles.

The best way to reduce risk is to learn as much as you can about what you’re getting into.

This way, you won’t be blindsided when your expected income is much lower due to hidden costs such as capital gains tax, management expenses, ongoing repairs, and other expenses.

What if reading the fine print and relevant product disclosure statement brings you more confusion?

Wouldn’t it be nice to tap into the wisdom of an experienced financial adviser instead of taking the all too common ‘hit-and-hope’ approach?

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Financial Adviser for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your property investment options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with the right financial adviser who can help simplify your family’s journey to financial wellness

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick property investment alternatives session with My Money Sorted

Step 2: Get matched with a licensed Finance Adviser that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Financial Adviser

It’s that easy!

Want to Learn More About Real Estate Investing Options? Our Money Buddies Can Help You Start Your Investing Journey