If you’re new to the world of investing in the stock market, understanding the different types of shares, the process of buying shares, and how to earn money from shares can be overwhelming.

With this guide, we hope you become more confident and knowledgeable about investing in shares. And hopefully, with the right information and understanding, you can make informed decisions and potentially grow your wealth.

Let’s dive in and learn more about buying shares in Australia!

Jump straight to…

Definition: Shares & ASX

Shares are just one of the many basic asset classes in which you can invest.

- A stock, more commonly known as a share, is a portion of ownership (equity) in a company.

Thus, buying shares of a company makes you a part-owner or shareholder in the company.

Depending on how many people want to buy and sell shares of a company at a particular time, the market value of its shares can rise or fall. This can be influenced by a variety of factors, including the company’s current performance and investor confidence in its future performance.

You can buy and sell shares of publicly listed companies in the Australian Securities Exchange (ASX).

The ASX lists the shares of over 2,100 companies, ranging from household names like banks and businesses to lesser-known enterprises like mines and medical equipment manufacturers.

However, keep in mind that not every Australian company is registered on the ASX. There are businesses, for example, that are privately held and do not sell shares to the general public.

Types of Shares According to Characteristics

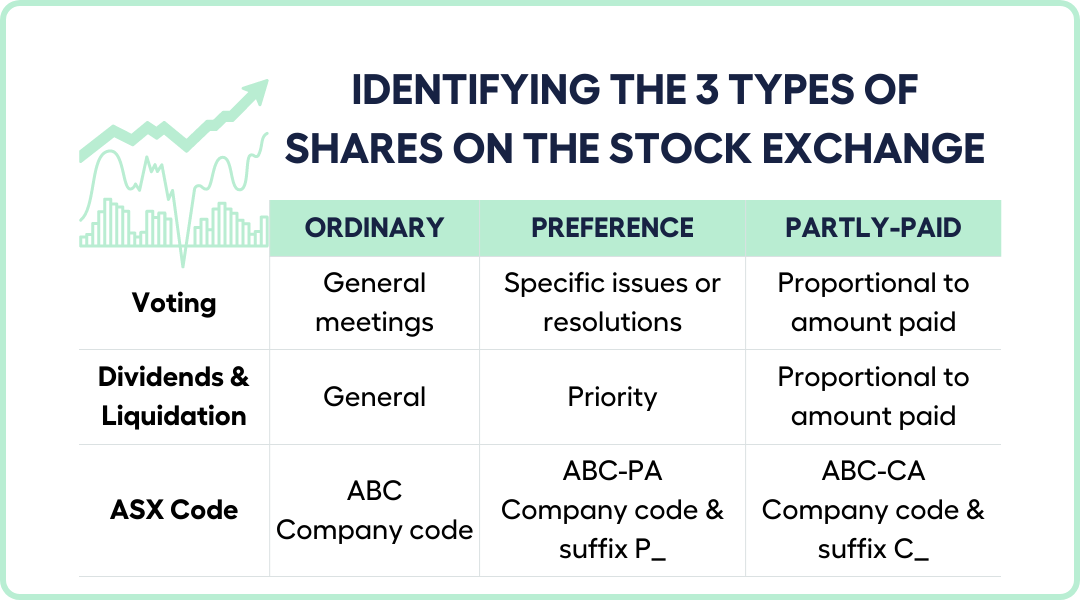

Not all shares traded on the Australian Securities Exchange (ASX) are created equal. On the ASX, three different share types are traded, each with distinctive characteristics.

It’s important to learn about the different types of shares, their rights and characteristics, and how to differentiate them if you want to invest in the stock market.

Ordinary Shares

- Ordinary shares make up the majority of shares traded on the Australian market.

As an ordinary shareholder, you have the same voting rights at general meetings of the company as other ordinary shareholders. You also have the same rights to dividends from the company’s profits and asset distributions upon the company’s dissolution.

Ordinary shares have no unique or preferred rights attached to them.

Preference Shares

If you own preference shares, you have first dibs over common shareholders when it comes to dividend payments or when the company is wound up.

Preference shares come in a variety of forms, each with its own set of rights and characteristics. Preference shareholders often only have the ability to vote on specific issues or resolutions, though this will vary depending on the terms of the shares.

Partly-paid Shares

- Partly-paid shares (aka contributing shares) are issued by a company without requiring payment of the full issue price.

The company has the right to call for all or a portion of the outstanding issue price at a specific future date or dates, and the shareholder is legally obliged to pay the call when it’s due.

The rights of a holder of a partially paid share are generally proportional to the amount paid on the share and include the same rights to vote, dividends, and business winding up as an ordinary shareholder. Except for a vote by show of hands, where a holder of a partly paid share has one vote, the same as any ordinary shareholder.

If you’re investing in partially paid shares for the first time, you must sign a client agreement with your stockbroker to confirm that you understand the risks.

- The ASX code is the quickest way to tell if a share is anything other than an ordinary share.

All ASX shares have a distinct identification code, which is shown on ASX ticker boards and in media stock market tables. The company’s code will be included in all shares it issues. For instance, the code CBA will be present on any security issued by the Commonwealth Bank of Australia.

- An ASX-listed firm’s ordinary shares have the same three-character code as the company as a whole. The security is probably not an ordinary share if its code has more or fewer than three characters.

- A preference share is often identified by a five-letter code. The corporate code is three letters long and is followed by a two-character suffix, generally PA-PZ.

- Additionally, the code for partially paid shares is five letters long. Once more, three letters for the corporate code and a two-letter suffix, generally CA-CZ.

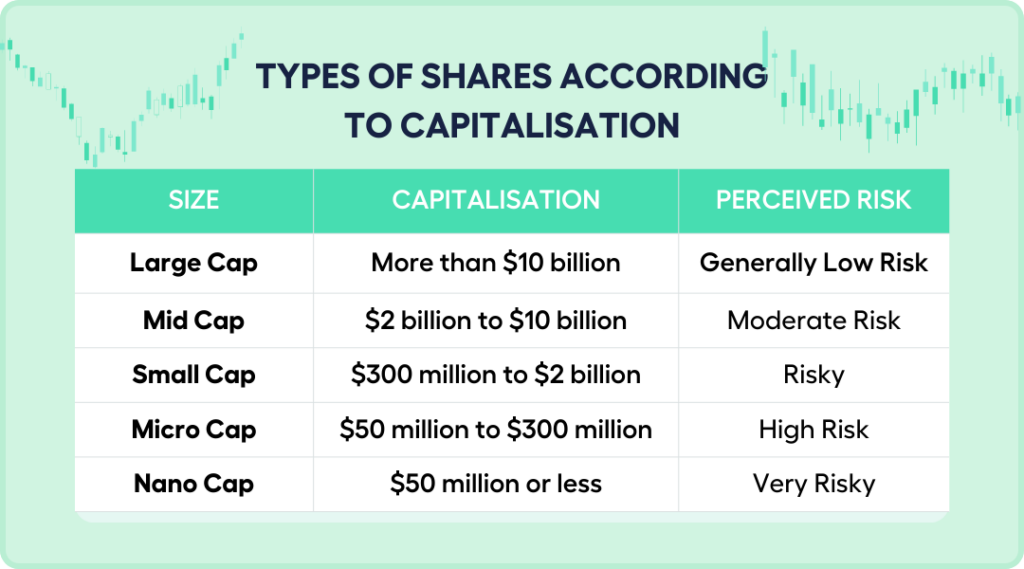

Types of Shares According to Capitalisation

Laws of supply and demand control the stock market. The price at which buyers and sellers are willing to trade shares at any given time is reflected in a company’s share price.

A company’s share price will grow if there is a greater demand for its shares, whereas demand will decline if results don’t meet expectations. Since each firm has a limited number of shares in circulation, the stock market also determines the value of the entire company by establishing the share price.

Market capitalization, aka market cap, is a measure of the entire monetary value that the stock market has currently assigned to a listed company.

The market capitalisation of a company is

- calculated by multiplying its current share price by the total number of outstanding shares.

For example:

If ABC Company has one million shares outstanding and the market values each of them at $1, it has a $1 million market capitalisation. The market capitalisation increases if the share price rises to $1.50, hence share fluctuations strongly correlate with market capitalisation.

A useful approach to organise an investment portfolio is by company size. This is due to the fact that a company’s market cap size can frequently reveal a lot about the firm itself, notably how risky an investment it is. Thus helping you create your investment strategy.

What are large caps?

While there are no set criteria defining what constitutes a large or small cap share, it is generally accepted that large caps are the biggest companies on the ASX in terms of market cap.

- The top 50 firms are represented by the S&P/ASX 50 (AFL) index.

- These securities often have a market valuation between tens of billions and over one hundred billion dollars.

Large-cap companies often (but not always) have a proven track record for success and are mature, profitable companies. Therefore, large-cap companies are typically less risky.

What are mid caps?

A mid-cap company typically has a market capitalisation ranging from two billion to ten billion dollars and can still be found on the ASX 100.

In terms of market capitalization, these are the next 50 largest firms on the ASX. The S&P/ASX MidCap 50 (XMD) is made up of S&P/ASX 100 members that are not in the S&P/ASX 50.

What are small caps?

Small cap companies have market capitalisations ranging from a few hundred million to two billion dollars. These are all the firms on the ASX that are not among the top 100 by market capitalisation.

The S&P/ASX Small Ordinaries index (XSO) represents the S&P/ASX300 index’s smaller constituents. It serves as a benchmark for Australian small-cap shares.

Small-cap enterprises are typically just getting started and have yet to earn a profit. They may even be in the research and development stage at the moment.

There are companies in the ASX with much smaller capitalisation. Companies with the smallest market capitalizations, such as microcaps and nanocaps, should be considered very speculative investments.

Micro-cap firms, also known as “penny shares,” have market capitalisations ranging from fifty million to three hundred million dollars. Many ASX investors view micro-cap shares as a ‘high-risk, high-reward’ field and avoid investing in them.

A nano cap is any listed share with a market value of fifty million dollars or less. These are very speculative transactions because retail ASX investors typically have minimal access to research or market data. Nano-cap shares may include relatively junior enterprises, mineral exploration companies trying to strike it rich, or start-ups in technology and biotechnology. Nano-cap shares are extremely hazardous, and you should be sure they fit with your investment strategy before investing in them.

What are the 4 Types of Shares?

Now that you’re familiar with the characteristics and capitalisation of shares, let’s look at the types of shares you can employ in your investment strategy. You can invest in only one type of share company for a homogeneous portfolio or have a mix for a diversified investment portfolio.

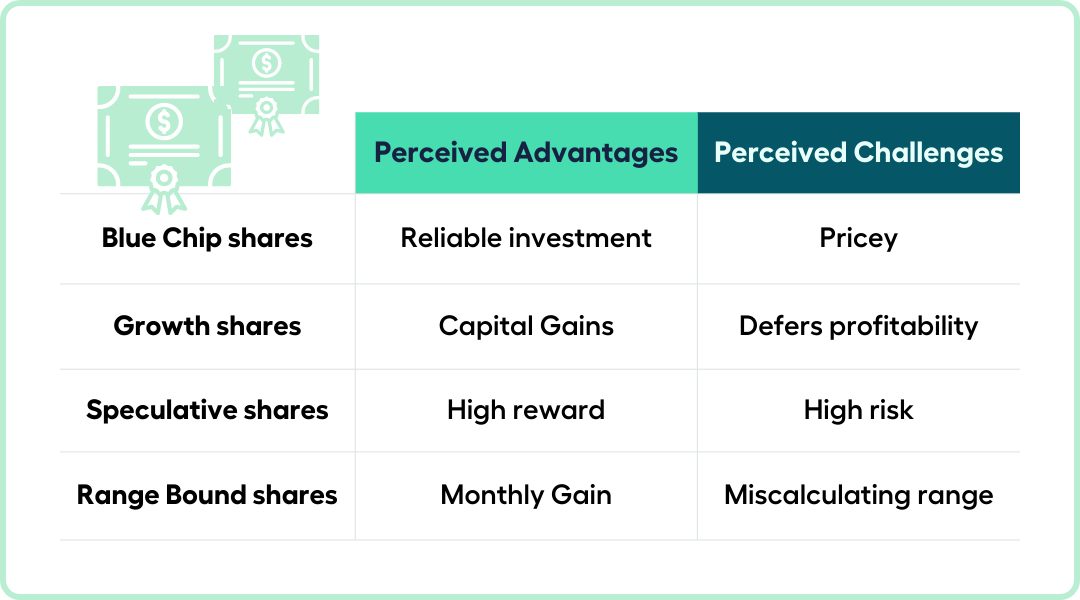

Blue Chip Shares

The name “blue chip” is derived from the game of poker, where blue chips are typically the most valuable on the table.

In stock markets, blue chips are the largest and brightest shares – the companies that investors hold with the highest respect.

Blue chip shares are regarded as solid investments due to their financial stability and track record of performance. These Australian equities are frequently featured in significant indices such as the S&P/ASX 20 or S&P/ASX 50, and they are seen as less risky than other shares.

The Australian Securities Exchange (ASX) offers a diverse choice of blue chip shares in industries such as finance, mining, and telecommunications, which can provide investors with diversification options.

Investing in blue chip shares can also provide investors with a consistent flow of dividends since many blue chip firms have a history of paying out dividends to shareholders. This can give investors a stream of income in addition to any potential capital gains from a share price rise.

Do note that because of their lower risk, consistent return potential, and lower volatility, blue chips are more expensive than shares of other companies of comparable size.

Growth Shares

A growth share is a company that investors predict to grow faster than the overall market, as measured by the S&P/ASX All Ordinaries Index (ASX: XAO) or the S&P/ASX 200 Index. (ASX: XJO).

Smaller, up-and-coming businesses are more likely to be growth companies than larger, more established businesses. They often concentrate on increasing sales and market share while deferring profitability in order to become industry leaders. The emphasis inevitably switches to maximising profits when growth companies mature.

During the growth phase, growth companies tend to reinvest their earnings rather than give them out as dividends. As a result, investors will rarely receive income from holding growth shares. However, many investors will select growth investing because of the possibility of share price growth, which translates into capital gains.

Speculative Shares

If you have a high risk tolerance, you could consider the option of investing in speculative shares.

Speculative shares are equities that are regarded as extremely risky in the stock market. Speculative shares have the potential for big profits to compensate for the substantial risk they entail. Speculative shares include penny shares with extremely low share values.

Speculative companies do not have a long market history and do not rank among Australia’s top 100.

When investing in risky equities, you may receive a high return – or a large loss. These are more appropriate for a more experienced investor who is willing to put funds at risk to earn larger returns.

Range Bound Shares

Range bound shares are shares that trade between consistent high and low prices for a period of time.

The top of a share’s trading range often provides price resistance, a price zone where selling shares happen and prevents further increase.

The bottom of the trading range typically offers price support, the price level that a share does not fall below for a period of time. It’s created when investors start buying shares whenever the share dips to a certain price level.

Buying and selling range bound shares can be a potential way to generate a monthly income by buying shares at the bottom of the range and selling at the top of the range but comes with the associated risks of trying to time the market.

The risk happens when the bottom drops from price support and you have to either hold onto the shares much longer or sell shares at a cheaper price.

Process to Buy shares

Investing in the stock market is a way to make more money over time. Even though it might seem hard at first, once you know the basics, it can potentially be easy and beneficial. But before you start buying shares, you need to be ready.

1. Make sure you have enough money to spend.

To get the most out of your investments, you need to make certain that you don’t have any high-interest debt, like credit card debt, and that you have enough money to cover your needs in a situation.

Setting up an emergency fund is also something to consider so you don’t have to use your investments or, worse, go into debt.

2. Know what you want to do with your money.

Your reasons for investing can have a big impact on how you invest, how much risk you are willing to take, and more.

Consider if you can handle big shifts in the value of your portfolio or if you will get anxious when the value of your portfolio goes up and down a lot.

If you want your investments to be your main source of income, you may want to focus only on assets that yield high dividends. On the other hand, if you want to increase your money, you could shift your focus to shares that will yield growth.

If you want to choose individual shares, you will need to set aside at least a couple of hours a week to evaluate the shares carefully and correctly before buying them. If not, ASX ETFs (exchange traded funds) could be better for you than ASX shares.

Alternatively, you could seek the advice of a professional financial adviser who can help you to determine your goals and risk appetite then construct a suitable portfolio on your behalf.

3. Know the simple rules of investing.

Invest regularly. Make it a habit to put money aside regularly to invest. This builds momentum, which could make long-term profits hit your investment goals.

Diversify. Diversification is putting money into different industries and types of assets. This can be a way to protect against volatility and risk.

Have a long-term view. Investing is about preparing for the future, not about getting rich fast. If you stay in for the long haul, your earnings could grow over time.

Keep learning. Make sure you know what you’re putting your money into. You can’t expect to know everything right away, but you need to work to increase your knowledge and wealth over time.

Buying Shares as a Beginner

To buy and sell shares or ETFs, you need a brokerage account, which lets you trade in the stock market. Generally, opening a trading account is quick and easy. It’s easy to deposit money into your trading account with BPAY or a bank transfer.

1. Choose a Financial Adviser or Broker

You need to figure out what kind of brokerage account you want. This involves choosing between a full-service brokerage account or a discount brokerage account. You can buy ASX shares, ETFs, and some managed funds with both types of accounts.

The most important thing to consider is how much extra help you want. A full-service brokerage account is the way to go if you want easy access to research on individual companies, customised investment plans, or the chance to participate in initial public offerings (IPOs).

Check brokerage fees. Brokerage fees to buy and sell shares are different for each type of broker, although, most of the time, a full-service broker has higher fees.

2. Communicate your financial goals

You may not have to put in a lot of time for research if you opt for a financial adviser or full-service broker since they will do everything for you when it comes to buying and selling shares. What’s important is to properly communicate your financial goals with your adviser or broker.

- A financial adviser or full-service broker’s job is to find out what your financial goals are and invest your money in ways that will help you reach those goals.

This way, you don’t have to go in blind and invest your money in ways you don’t really understand. However, advisers and brokers need to have a good justification for their suggestions to you and declare any potential conflicts of interest.

3. Place an order to buy the shares

When you’ve settled on a company or companies to invest in, place a purchase order with your adviser or broker. You are a shareholder after your purchase is completed!

Buy Shares On Your Own

Even if you decide to buy shares on your own, do note that you will still need a brokerage account. The process is quite similar to buying shares with a financial adviser or full service broker, but it entails more research.

1. Choose an online investment platform

If you want to take charge of your investments and learn more without the help of a broker, a discount or online investment platform could be the option for you.

Most of the time, an online investment platform has lower fees. Some online companies have even started to get rid of brokerage fees, but you may have to pay a fee to trade shares in different currencies.

2. Research shares to buy

After choosing an online investment platform, start thinking about which shares to buy. Consider which shares will help you to achieve your goals and fit your risk appetite before starting to build your portfolio.

If you wish to buy individual shares, you can start by learning how to appraise them.

The Australian Securities Exchange (ASX) has over 2,100 listed companies, making it challenging to decide which shares to buy.

Take your time and follow news on the economy and market changes, read reports and forecasts from reputable sources, and review company annual reports for information on the strategy, business activities, and financial performance. You can also get updates with announcements from the Australia Securities and Investments Commission (ASIC) and ASX.

While newsletters and stock picks can be useful for generating ideas, conducting your own research and seeking professional financial advice is important. It’s also crucial to remember that past performance is not indicative of future performance.

3. Place an order to buy the shares

Once you’ve chosen the company or companies you want to invest in, the next step is to put money into your investment account on the trading platform to pay for the shares and any brokerage fee.

Then, you can use the platform to make an order to buy shares by entering the company’s stock code, the number of shares you want to buy, or just the amount of money you want to invest.

The broker will then buy the shares on your behalf, usually at the best price available at the time – called a market order. You can also place a limit order if you want to set a maximum price at which you’re willing to buy. With a limit order, you won’t be able to buy shares until the price of the share hits or falls below an upper limit you set.

How Much Money is Enough to Invest in Shares?

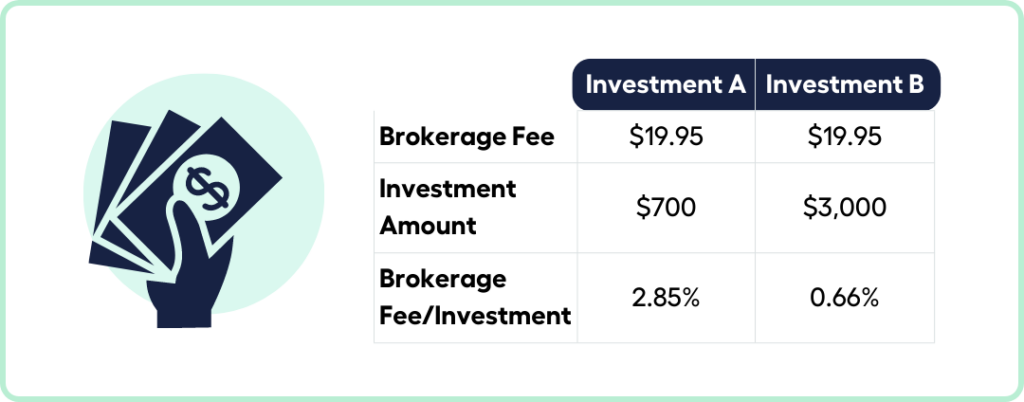

Shares can be purchased for as little as $500 plus brokerage fee. Less than $20 can be spent on purchasing and selling shares through a broker. If you want access to research about a company or receive advice, you may have to pay more.

Your decision over how much to invest has to be aided by considering the associated costs.

Each transaction involving the purchase or sale of shares is subject to a brokerage fee in addition to the cost of the shares themselves. This indicates that the fees will increase as a percentage of your overall investment the less you contribute.

For example:

If you pay $19.95 for brokerage and invest $700 in shares, the brokerage portion of your investment will be a little over 2.85%. However, if your brokerage fee is $19.95 and you invest $3,000 in shares, the brokerage will account for 0.66% of your total investment.

The point is, if you start out with a modest sum of money, the business you invest in may need to perform considerably above the average rate of return for you to break even, let alone make a profit when you eventually sell your shares.

However, it’s crucial to remember that shares are the riskiest kind of investing and that the more money you put into them, the more of your resources you are essentially exposing to that risk. You must be at ease with the idea of possibly losing the money you invested in the stock market.

How Do You Earn Money From Shares?

There are two basic ways to earn money from shares:

Capital gain and dividends.

With capital gain, you have the potential to earn by buying low and selling high. As for dividends, you have the potential to earn by buying shares from companies that give dividends regularly whether quarterly or annually. Simple enough.

It is possible to generate higher returns from shares by implementing an investment strategy that goes beyond the fundamental principles. In this context, we will check out four approaches that can help to boost your earnings in the stock market.

Buy and Hold

Remember this:

Time in the market trumps timing the market.

Using a buy-and-hold approach, where you keep shares or other securities for a long period instead of often purchasing and selling them to generate capital gains, is one common way to make money with shares.

Keep in mind that there is a brokerage cost for each transaction, so frequent trading reduces your profit.

To make the most of the stock market when it is performing at its best, adopting a long-term investment strategy is advisable. Employing a purchase and hold approach could be beneficial in attaining this goal.

Reinvest Dividends

A dividend is a regular payment made to shareholders by many companies that is dependent on their profits.

Even though the dividend payments you receive may seem insignificant, especially when you initially begin investing, they have historically contributed significantly to the growth of the stock market.

Why reinvest your dividends?

Because each dividend you reinvest allows you to purchase more shares and, in effect, your earnings compound even more quickly.

Buy and hold investors take advantage of the enhanced compounding by reinvesting their dividends rather than cashing in. Most brokerage firms let you sign up for a dividend reinvestment program, or DRIP, that will immediately reinvest your dividends.

Short-Selling

For novice investors, short selling can be a challenging concept to understand.

The strategy involves making a profit from a market that is on the decline. This is done by “borrowing” shares in a company, selling them at the current market price, and then purchasing the same number of shares at a later date once the price has dropped. The profit is determined by the difference between the initial selling price and the subsequent buyback price.

Comparing the idea to conventional share investing makes it the most understandable.

Going Long. The conventional method of investing in the stock market is to ‘go long’; you benefit when the share price increases.

For example:

You anticipate an increase in a company’s share price. You invest $35 in shares. Shares increase in price to $50. You sell the shares for a $15 per share profit.

Short Selling. The opposite of ‘going long’ is ‘short selling.’ It’s when you make money when a share’s price drops.

For example:

You anticipate a decline in a company’s share price. You exchange 1,000 ‘borrowed’ shares for $50. The share drops to $38 per share. To complete the trade, you purchase 1,000 shares at $38. You earned $12 per share.

The most common type of short selling is known as “Covered Short Selling,” and it entails “borrowing” the shares from another party (arranged by your stockbroker).

To start a trade, you borrow shares and sell them at the going rate on the market.

To complete the transaction, you must repurchase the same number of shares and return them to the original shareholder.

Keep in mind that computers are used for everything. The only thing that is required is for the numbers in the regulator’s computer to “even out” at the end.

What’s in it for the original shareholder?

Borrowing fees can be charged by lenders and passed on to short sellers. This is also why short sales have a shorter investment period than long trades.

Short selling is above board but it’s allowed only for a limited number of ASX companies.

Furthermore, it depends on speculation and timing the market, meaning it is a very risky means of trying to achieve profits.

Choose Funds Over Individual Shares

Seasoned investors understand that diversification is critical to reducing risk and potentially increasing returns over time. Consider it the financial equivalent of not placing all of your eggs in one basket.

Although many investors choose individual shares or shares funds, such as managed funds or exchange-traded funds (ETFs), the latter may be suitable for beginners.

It’s because a managed fund or an exchange-traded fund maximises your diversification.

While you can buy a variety of individual shares to mimic the diversification found in funds or an index, doing so successfully can take time and a sizable capital commitment. A single share, for example, can cost hundreds of dollars.

In contrast, funds allow you to purchase exposure to hundreds (or thousands) of individual investments with a single share.

By investing in funds that passively track large indexes such as the ASX200, you are in a position to profit from the stock market’s near 10% average yearly returns as easily (and cheaply) as feasible.

As with any other share purchase, you need to do your due diligence and research your options to ensure they are the right fit for your goals and risk appetite.

Seeking professional guidance from a qualified financial advisor is a smart way to ensure you have an expert guiding you, as you begin building your share portfolio and lay the foundation to build your wealth.

Wanting to Buy shares? Book a FREE 15 min Call or Send Us Your Questions!

I want to see all my options with the help of a Finance Expert

Call Our Team TodaySOURCES:

https://www2.asx.com.au/investors/learn-about-our-investment-solutions/shares/types-of-shares

marketindex.com.au/all-ordinaries

https://www2.asx.com.au/markets/trade-our-cash-market/directory

asic.gov.au/online-services/alerts/

https://www2.asx.com.au/investors/start-investing

https://www.marketindex.com.au/short-selling#tutorial

moneysmart.gov.au/managed-funds-and-etfs/exchange-traded-funds-etfs