Everything You Need to Know About Borrowing Against Your Home

Are you feeling the brunt of skyrocketing costs of living and need some extra cash for emergency expenses? Maybe you need funds for an investment property? Or perhaps you need to renovate your house?

The solution might be the roof right above your head — the equity in your current home.

Jump straight to…

According to CoreLogic, home prices in Australia increased by 24.6 percent between the end of March 2020 and February 2022. This translates to an estimated $173,805 rise in the median Australian house value to $728,034 within that period.

Given this phenomenal rise in home values, homeowners with a significant amount of equity in their property may be able to access this for a variety of purposes.

However, before taking equity out of your home, knowing all about home equity loans is essential to ensure you end up with a pot of gold…not a mountain of debt.

This article breaks down the basics of a home equity loan to help you understand:

- What a home equity loan is used for

- The pros and cons of taking on a home equity loan

- How to pay for a home equity loan

Let’s get right to it.

What is the Purpose of a Home Equity Loan?

Let’s start with the basics.

A home equity loan is a loan for a specific amount of money that is repaid over a specific time, called a repayment period, and is secured by the equity in your home.

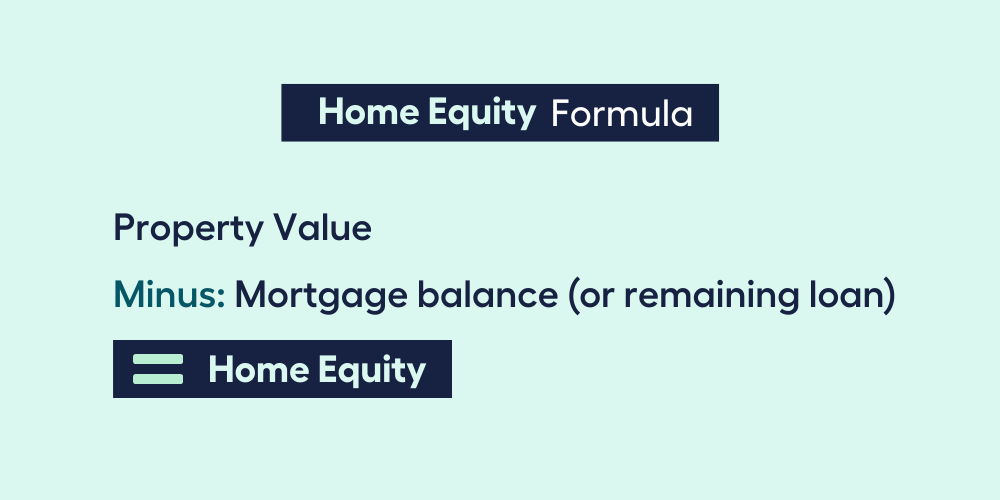

To determine how much equity there is on your home, subtract the mortgage balance (remaining loan amount) from the property value.

Your home equity fluctuates as property values fluctuate. Your equity grows as the value of your home rises due to market changes, such as the recent property market boom in Australia, or due to home improvements.

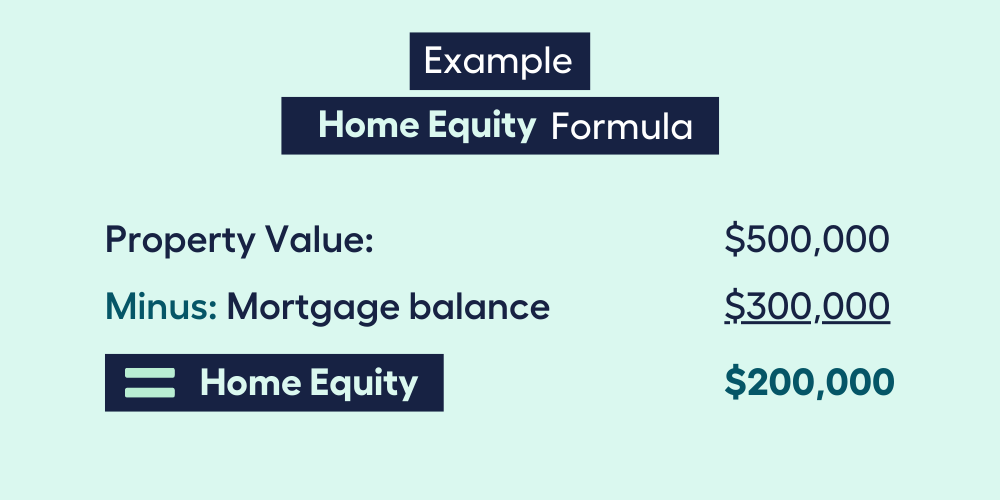

For example:

If your property is worth $500,000 and you still have $300,000 to pay on your mortgage loan, your equity will be equal to $200,000.

You can then use your home equity for debt consolidation, or to fund big-ticket items, investments, or home improvements that could further increase the value of your home.

Despite the sharp growth of the real estate market over the past couple of years, always keep in mind that you are putting your property at risk when you borrow against your home, and if real estate values fall, you may end up owing more than what your home is worth.

Before making any decision on the equity you’ve built up in your house, consult a finance expert to help you make an informed decision.

Need help in deciding if a home equity loan is the right option for you?

I want to see all my options with the help of a Finance Expert

Call your Money BuddyAnd this brings us to the next question…

Is a Home Equity Loan the Same as a Mortgage?

A home equity loan is a type of consumer debt that is also known as a second mortgage because it functions similarly to a mortgage.

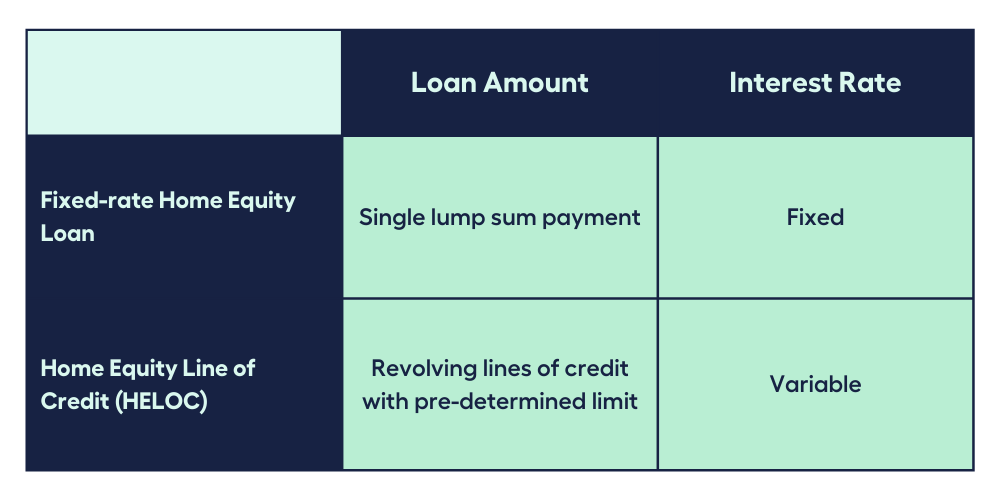

In general, there are two home equity loan types based on the loan amount and the type of interest rate that will be charged to the loan.

The fixed-rate home equity loan provides a single lump payment with a fixed interest rate, while the home equity line of credit (HELOC) is usually a variable-rate loan that provides borrowers with revolving lines of credit with a predetermined limit set by the lender.

Paying Back a Home Equity Loan

Fixed-rate home equity loan

Like a traditional mortgage loan, a fixed-rate home equity loan lends an approved amount to a borrower which needs to be paid back over a certain period, including interest. Before you can sell your home, you should be always aim to be in a position to repay this debt in full.

Home Equity Line of Credit (HELOC)

In comparison, a HELOC functions similar to a credit card. You can borrow money up to the predetermined credit limit, repay with no minimum repayments or repayment terms, and borrow again from the available line of credit during the draw period. You also only have to pay interest on the money you withdraw.

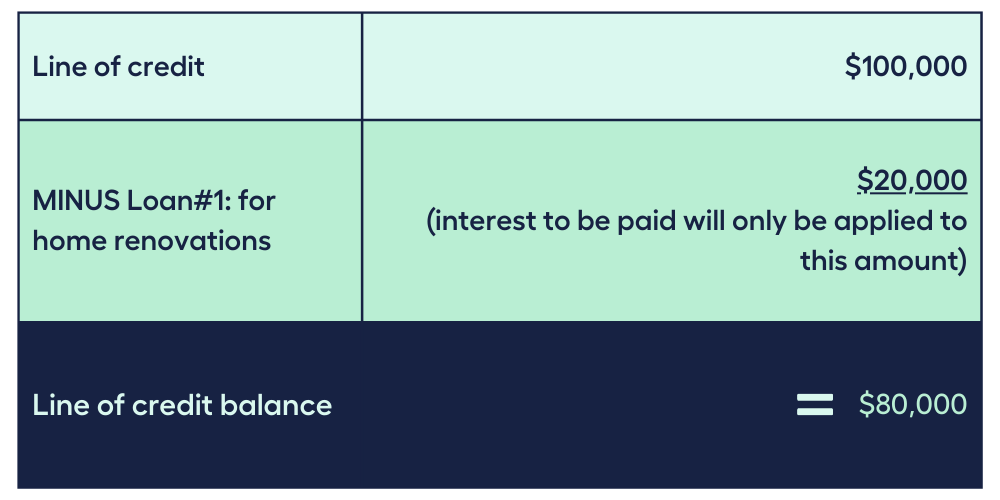

For example:

Olivia has been granted a $100,000 revolving credit line against her home equity. But Olivia only needs $20,000 for home improvements. She can choose to just use $20,000 from her $100,000 revolving credit line and only pay interest on that amount.

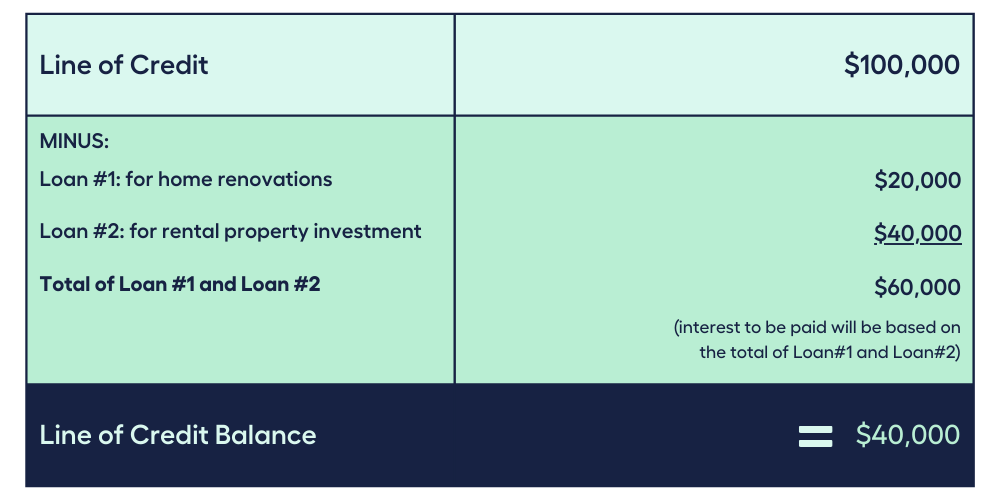

While working on her home renovations, Olivia needed an additional $40,000 from her line of credit to invest in a rental property. She would then be paying interest on the sum of the two amounts she borrowed from her line of credit: $20,000 (for home renovations) plus $40,000 (for investment in a rental property), for a total of $60,000. She will still have $40,000 ($100,000 less $60,000) left in her line of credit.

Since these are interest only payments to the amount you borrowed from your line of credit, your equity is built up by your funds that are put back into the credit facility.

However, it’s important to note that HELOC products offered by home equity lenders vary. Some have a limited time frame for the interest only payments and may transition to a principal and interest loan.

Before making any decision on the equity you’ve built up in your house, consult a finance expert to help you make an informed decision.

Need help choosing a home equity loan type that’s fit for your needs?

Furthermore, do note that even if you have equity built up, it does not imply that lenders will grant you access to the full amount.

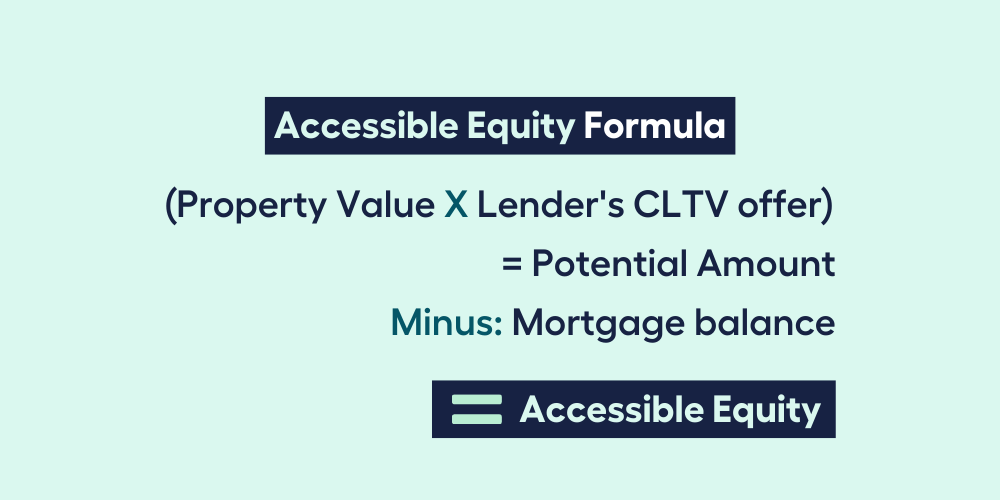

Lenders generally use a combined loan-to-value (CLTV) ratio of 80 percent to 90 percent of the home’s appraised value to determine how much a homeowner can borrow using the accessible equity formula:

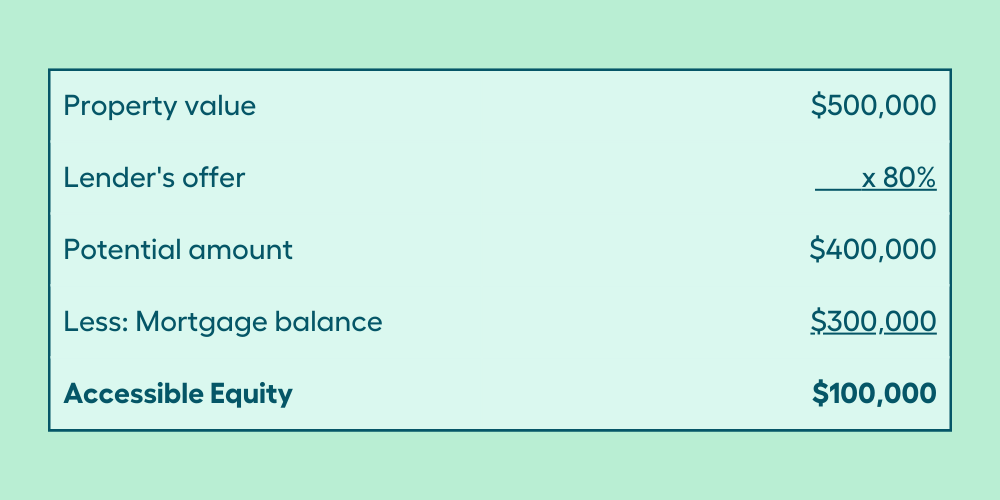

For example:

If your property is worth $500,000 and the lender offers an 80% CLTV, the accessible amount you may be able to borrow is $400,000 minus your mortgage balance, which boils down to $100,000 accessible equity.

Lenders often want you to keep at least 20% of the property’s value as collateral for your mortgage. You may be asked to pay Lenders Mortgage Insurance (LMI) if you want to access the equity in your home but the mortgage balance is still greater than 80% of the property’s value.

Can I Pay Off a Home Equity Loan Early?

Borrowers typically opt for a longer loan term to free up more cash in their monthly budget whilst paying a lower monthly payment. But some borrowers are keen on reducing their interest payments by increasing their principal payments on their line of credit.

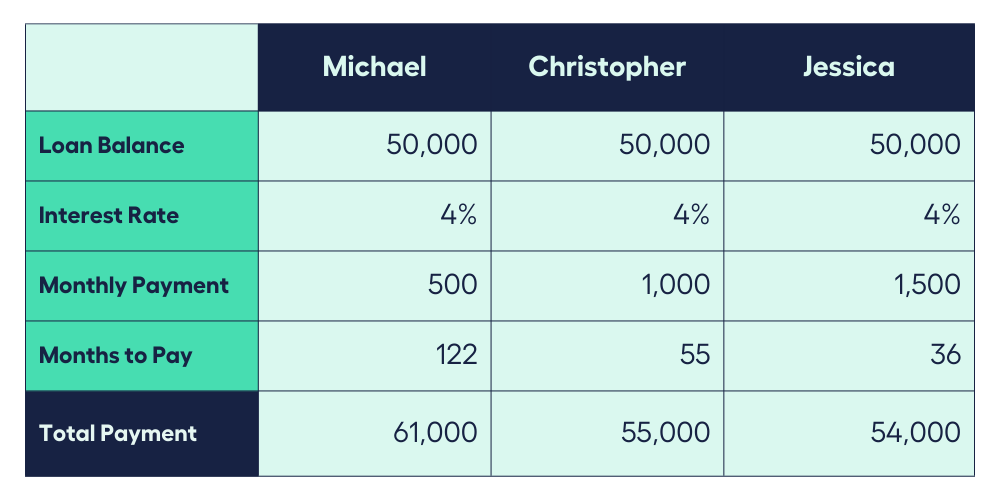

Let’s compare Michael, Christopher, and Jessica who have the same loan balance on their home equity line of credit and fixed interest rate but they differ in repayment period.

Are you the same as Christopher who prefers an affordable line of credit with a moderate monthly payment amount that doesn’t last beyond five years?

Or are you similar to Jessica who would rather pay off her credit line within three years and save $1000?

Maybe you’re just like Michael who opts for a longer home equity loan repayment option and doesn’t mind paying $7000 more than Jessica does as long as his monthly payments are small.

Your decision will depend on your goal:

Do you want to optimise your money where it can earn more for you

in investment products with higher interest rates?

Or

Do you want to shorten your repayment period

and eliminate monthly payments as soon as possible?

If your goal is to optimise and grow your money:

- Calculate how much you’ll save by paying off your loan early before you start making extra payments.

- It could be worth sticking to your repayment schedule if you have a low interest rate and instead decide to invest the money you would have spent to shorten your repayment period.

But if eliminating monthly payments is your priority over earning interest from other investments, then you may be able to pay off a home equity loan early by:

1. Making a lump sum payment towards the balance of your loan amount

2. Making additional principal payments to reduce the principal that is accruing interest

3. Making sporadic payments whenever you have extra cash.

Paying off your home equity loan early might help you get out of the woods and save on money paid for interest, but note that lenders would prefer that a full loan term is followed because they earn their income from the interest rates charged on any loan.

Whilst most home equity loans do not include early payoff penalties, please do read your loan contract details or speak to a finance expert to help you weigh up your options.

Need help weighing your home equity loan repayment options?

I want to see all my options with the help of a Finance Expert

Book a FREE Call TodayNow, here’s the exciting part…what can you do with a home equity loan?

Advantages and Disadvantages of a Home Equity Loan

Can I use my home equity loan for anything?

A home equity loan is a convenient way to access cash at a potentially lower interest rate than personal loans, as long as:

✓ You are a prudent borrower

✓ You have a stable, reliable monthly income, and

✓ You know you can meet the repayment period

It can typically be used for many things specific to your needs, such as:

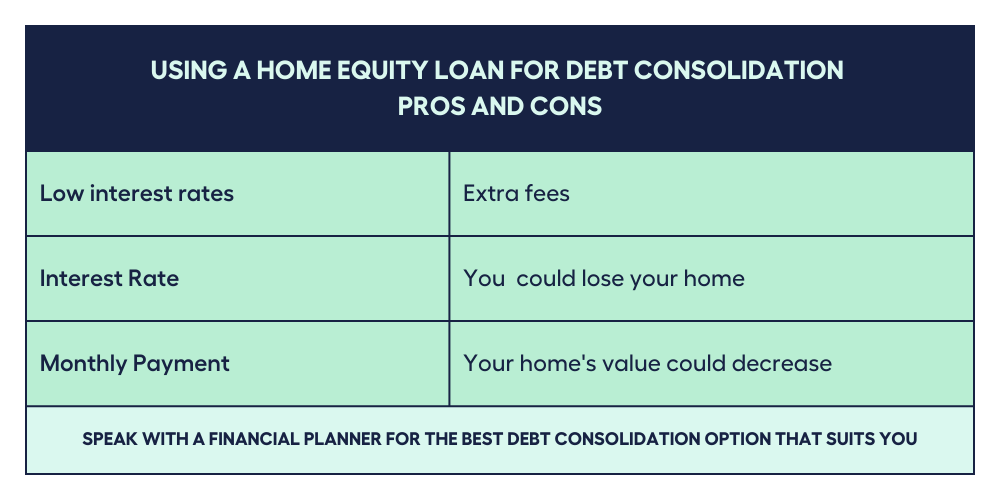

- Consolidate Debt: credit cards, HECS debts

Home equity loans can be used to consolidate other higher-interest debt by combining all of your obligations into one payment. It offers lower interest than credit card debt because the loan is secured by your house. A reduced interest rate could translate to smaller monthly payments.

Also, when you consolidate credit card debt, you have the advantage of eliminating multiple lenders and the annual fee on credit cards.

That being said, avoid falling into another rabbit hole of debt by treating your home loan like a credit card because you run the risk of losing your home if you fail to make repayments on time.

Plus, home loans used to pay off credit cards or HECS debts are not tax-deductible.

- Big-ticket items and lifestyle expenses: vehicle, holiday, travel

While you can definitely borrow money to pay for a trip abroad, a new sports vehicle, or even going on a shopping spree, you need to carefully consider if splurging for that flashy car is worth diminishing your equity.

Remember:

Tap into your equity only when you absolutely need to.

- Supplementary retirement income through the Home Equity Access Scheme (HEAS)

Many seniors are considering options to supplement their retirement income now that interest rates have dipped and investment markets are robust.

The federal government’s Home Equity Access Scheme (formerly known as the Pension Loans Scheme) could be one option to supplement retirement income or to pay for home care expenses.

As a reverse mortgage type of loan, borrowers of pension age can receive a tax-free fortnightly income stream by borrowing against the equity in their home. (Note: Borrowers will be allowed to withdraw lump sum payments beginning 1 July 2022.)

It has a 3.95% annual interest rate and compounds fortnightly on the outstanding loan balance. The longer a borrower waits to pay back the loan, the more interest will be paid.

Check out the Services Australia page for details or consult a finance expert to see if this is the option for you.

- Investments

The dream of growing your wealth could be made possible through a home equity loan. It could be used to purchase investment products like stocks, bonds, rental property, or to start a business.

According to the Australian Taxation Office (ATO), if you use a home equity loan for investment purposes, it may be tax-deductible.

Deductible costs incurred when investing in shares

- Renovations

Thinking of updating the look of your home? Or perhaps you’re considering adding a deck?

Home improvement projects that raise the value of your property are one of the best ways to use a home equity line of credit. It can boost your home’s potential equity whilst also making it more attractive to potential buyers.

Furthermore, be cautious not to over-capitalise when renovating your home by spending more on home improvements than what your property is worth. This can cause a dip in your property’s equity, instead of helping it increase.

Because a home equity loan provides relatively simple access to finances, it can be easy to overlook how the funds will be spent. Discipline is key when tapping into your home’s equity.

Which brings us to the final question…

Does closing a home equity line of credit hurt your credit score?

If you’ve already paid off the balance from your line of credit and don’t need any more money, closing your HELOC is naturally the next step.

However, there are borrowers who are concerned that doing so might hurt their credit score.

Your credit usage, or how much credit you’re utilising, accounts for a portion of your credit score. Closing a HELOC reduces your available credit, which might temporarily lower your total credit score. But if you have additional credit lines, such as credit cards, cancelling the HELOC may only have a minor impact on your credit score.

Whether you’re consolidating debt, investing in wealth products, planning for your retirement, or financing home improvements, borrowers should use prudence when taking out home equity loans. If too much equity is taken out on a mortgage, it can be easy to fall behind on repayments, leaving a borrower with a bad credit rating and a home at risk of repossession.

If spending tens of hours scouring the web for home loan equity options is not for you, have that conversation with a finance expert who can help highlight important details you need to know.

Check Your Borrowing Power with MMS Mortgage Calculator

Knowing your borrowing power is just the first step. A mortgage is a big investment of both time and money, which is why It’s often best to receive guidance from a financial expert like a mortgage broker.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the right Mortgage Broker for you with the help of My Money Sorted.

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help you reach your goals

✓ be matched with a mortgage broker who can help develop the best home loan strategy for your situation

My Money Sorted is your stress-free pathway to getting ahead with your home loan.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a licensed Mortgage Broker that’s right for your financial situation

Step 3: Take the first step towards your financial goals with a clear roadmap that makes sense prepared by an experienced Mortgage Broker.

It’s that easy!

Get Ahead Of Your Home Loan by Speaking with My Money Sorted Today