Have you recently found out that you have more than one super fund?

If you have, you‘re not alone.

In fact, more than four million Aussies have two or more super accounts.

You may be wondering if it’s okay to have multiple super funds.

More specifically…

Can I Have an SMSF and an Industry Fund?

In this article, we answer this question and review the advantages and disadvantages of industry funds, funds which have generally outperformed other funds with lower costs and better returns over the years.

We also explore the advantages and disadvantages of self-managed super funds, and the reasons why the number of Australians with SMSFs continues to grow.

Jump straight to…

Can You Have an Industry Super Fund and an SMSF?

It is possible for you to have an active Industry Super Fund and an active SMSF at the same time.

In cases where you roll over funds from your SMSF to an industry fund, it is not necessary to transfer all of the SMSF monies to an industry fund because having several superannuation accounts is permitted.

However, the majority of SMSFs in Australia (55%) were entirely in the accumulation phase (that is, just taking contributions from or on behalf of members), while the remaining 45% of funds were either partially (10%) or fully (35%) in the retirement phase.

The number of SMSFs is growing every year, and their $822 billion in assets is second only to the $927 billion invested in industry funds according to a 30 June 2021 Australian Taxation Office (ATO) report.

SMSFs have firmly established themselves in the Australian superannuation scene, which makes deciding between having an SMSF or industry fund, or having both, more tricky.

How Many Super Funds Does the Average Australian Have?

As of now, the trend is for the average Australian to have only one super fund account.

Over 12 million Australians have one super account, with over four million having two or more super accounts, as of 30 June 2020 according to the ATO.

Out of the four million who have more than one super account, around three million have two super accounts and about another million have three or more super accounts.

Is It Good to Have Two Superannuation Funds?

- Although there is no formal limit to the number of super accounts you can have, having too many would likely chip away at your balances.

Having Multiple Super Accounts Costs You Money

You’re probably paying fees and costs for each of your super accounts. Some fees and costs are based on your balance, but most funds impose a set fee – and if you have many super accounts, you pay those flat fees multiple times.

Aside from paying fees on the various super accounts, you might be paying an insurance premium in each super account as well.

What if you haven’t made a contribution to a super account for 16 months and the account balance is less than $6,000?

- It will be deemed inactive and rolled over to the ATO.

If you find yourself in this situation, you can breathe a temporary sigh of relief because when your funds are rolled over to the ATO, you will no longer be charged various fees — saving your balance from being depleted by excessive fees.

BUT…

It also means that you will not get any investment returns.

Also, in the event that the super account is inactive, the insurance coverage may be cancelled.

For these reasons, the ATO, along with the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA), encourages super fund members to consolidate their accounts.

You pay a single set of fees if you only have one superannuation account. This can have a substantial impact on the value of your superannuation when you retire.

Having a single superannuation account means fewer statements and reports to deal with. You have less administrative work and you may be able to devote more time to tracking your super fund’s performance.

Transferring all of your superannuation into one account can make it easier to manage your investment mix and keep your super on pace to fulfil your long-term financial goals.

| Single Super Fund Account | Multiple Super Fund Accounts |

| One set of fees | Multiple set of fees |

| One monthly statement | Multiple monthly statements |

| One insurance premium | Multiple insurance premiums |

| One fund to track | Multiple funds to track |

You may decide to keep two accounts, especially if it’s an SMSF where other trustees still require it, or because you hold an asset in your SMSF that you do not want to sell.

In any case, you may want to seek professional advice on whether you’re consolidating super accounts or deciding to keep more than one super account.

Don’t wait til you are at your wits’ end before making a decision on what to do with your super.

Get your super sorted with the right financial advice – book a complimentary call with our team.

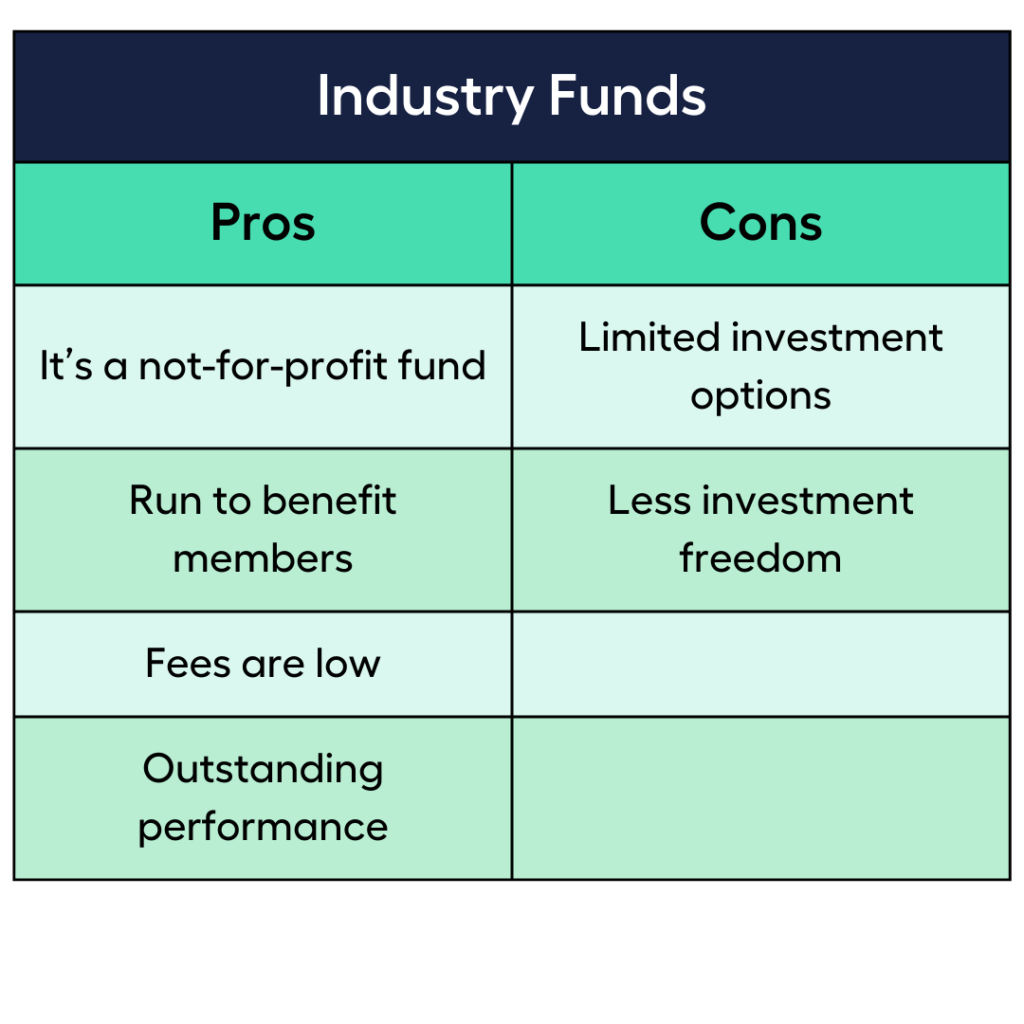

Pros and Cons of Industry Funds

An industry fund is often a low-cost to medium-cost accumulation fund. They are non-profit funds, so profits are reinvested in the fund to benefit members.

Industry funds were initially developed by trade unions and industry bodies to provide a low-cost fund to their members. They now allow access to the general public and typically provide access to a limited number of investment options as well as a simple platform.

Pros of Industry Funds

Several factors contribute to the popularity of industry funds among Australians.

- It’s a not-for-profit fund: Profits are returned to the fund and its account holders rather than paid out in dividends, as is the case with retail (e.g., bank-owned) funds.

- Run to benefit members: An industry super fund is one that is administered only for the advantage of its members, rather than for the profit of external shareholders.

- Fees are low: Because of its not-for-profit nature, Industry super funds have modest costs and historically have delivered good long-term performance, a variety of investment options, and personal insurance solutions.

- Outstanding performance: Over the last five, ten, and twenty years, Industry super funds generally outperformed retail super funds on average. This can result in higher returns and, in effect, a more comfortable retirement lifestyle for their members.

Cons of Industry Funds

As strong as their performance may be, industry funds also have disadvantages.

- Limited investment options: Industry super funds have fewer investment options when compared to other superannuation funds like SMSF.

- Less investment freedom: When it comes to selecting specific assets for yourself, industry super funds provide you less individual freedom.

While it was mentioned earlier that industry funds can outperform other super funds, investors should not use prior investment performance as an indicator of future returns because the chances of a fund performing year after year is extremely unlikely.

Instead, constantly consider a fund’s underlying investments, current market conditions, and how you feel about investing which will determine your risk profile.

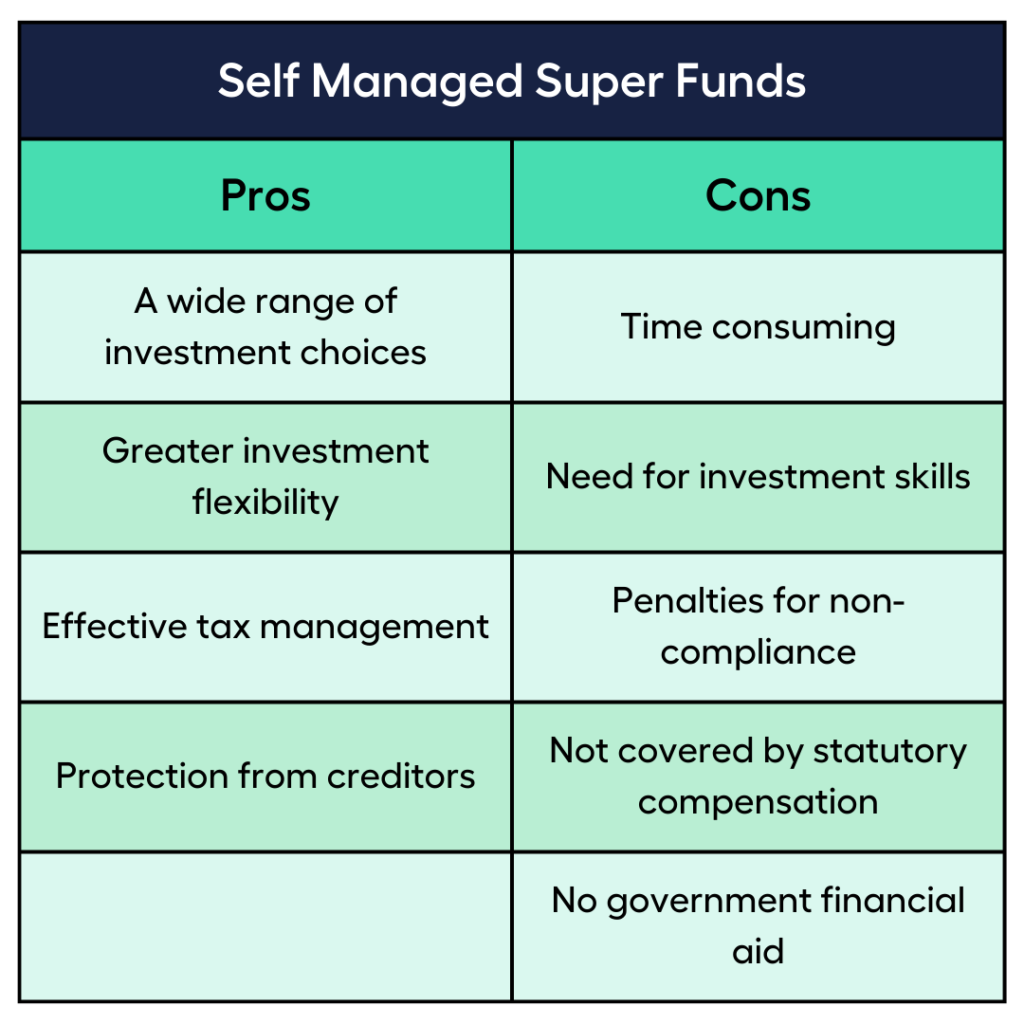

Pros and Cons of SMSF

If you’re thinking of starting your own Self Managed Super Fund, you need to know what’s involved in managing your own super fund before you get your feet wet.

What’s Involved in Managing an SMSF?

When you first set up your SMSF, you have to:

- choose your fund members (up to six members) and trustees

- form the trust and trust deed

- open a bank account

- register with the Australian Taxation Office (ATO)

- develop your investment strategy

- include an exit strategy

Once established, there is more to consider, such as:

- rolling over existing super

- organising employer contributions

- accepting contributions within limits

- making investments without breaking laws

- reviewing the investment strategy on a regular basis

- documenting and maintaining records for up to ten years

Then, each year, you have to value assets, compile accounts and financial statements, hire a certified SMSF auditor, file an annual return, and pay the SMSF levy and any applicable tax.

When you begin making payments out of the fund, you must determine whether any assets must be sold, guarantee that minimum payments are made each year, and you may also need to appoint an actuary, withholding tax, and provide payment summaries to members and the ATO.

Finally, once the fund’s term ends, you must obtain a final audit and file your final return, as well as pay any unpaid taxes and payout or rollover all assets.

As you can see, there is a lot to consider.

If you feel you can manage everything yourself or are willing to pay an SMSF professional for assistance, then it’s best to consider the pros and cons of Self Managed Superannuation Funds.

Pros of SMSF

An SMSF has a lot of advantages. As a trustee, you have control over how your super resources are invested and managed.

Here are some benefits of SMSF:

A Wide Range of Investment Choices:

Most superannuation funds will allow you to invest in assets such as shares, bonds, and real estate through managed funds (often with restrictions).

SMSFs can also provide direct property (commercial or residential), physical gold and other commodities, collectibles like artwork (subject to strict regulations), and managed portfolios.

Greater Investment Flexibility:

Because fund members are also trustees, they have the ability to modify the SMSF rules to their own requirements and circumstances. Other superannuation funds do not offer this.

Directly managing your own super assets allows you to make quick changes to your portfolio in response to market developments or to take advantage of unexpected investment possibilities.

Effective Tax Management:

SMSFs have the same tax rates as other superannuation funds, but you can more readily implement tax strategies that benefit you and your situation through an SMSF.

For example:

When revenue is generated entirely by assets that sustain an income stream, such as a pension, tax is typically not payable inside the fund on that income.

Because of the difference in tax rates, you may be able to decrease or even eliminate a capital gains tax payment by exercising control over the disposition of assets.

Protection from Creditors:

Creditors normally do not have access to an individual’s superannuation. That is unless clawback rules apply and someone has purposefully transferred assets into an SMSF to avoid paying creditors.

Cons of SMSF

Self Managed Super Funds have many advantages, but they are not for everyone.

The following are some of the drawbacks of owning an SMSF:

Time-Consuming:

Running your own SMSF can take up a lot of your time, and while most trustees use an SMSF administration service, there are major activities that must be undertaken throughout the year.

Need for Investment Skills:

All superannuation members should be familiar with the financial markets and asset classes in which their super benefits are and may be invested. This is especially crucial for SMSF trustees, who must make and implement the fund’s investment decisions.

When running your own SMSF, you must develop and review an investment plan that takes into account the fund’s risk, diversification, liquidity, solvency, and insurance requirements.

Penalties for Non-Compliance:

Being a trustee of an SMSF means you are administering your own superannuation fund, thus you must observe super rules. If you fail to comply, the ATO can assess a variety of penalties, including mandatory education and/or fines, depending on the severity of the infringement. For major misconduct, the spenalties can be severe.

Not Covered by Statutory Compensation:

If the SMSF suffers a loss as a result of theft or fraud in the underlying investment assets, members of SMSFs are not eligible for compensation under superannuation laws (unlike members of traditional funds).

No Government Financial Aid Available to SMSFs:

If there is fraudulent activity or theft, no government financial aid is available to SMSF members although members may have legal remedies under Corporations Law. Disputes can be settled with the Australian Financial Complaints Authority (AFCA) or in court, at the expense of the members.

If you need help deciding on self-managed super funds, industry funds, and the best alternative for your circumstances, but don’t know where to find sound financial advice, have a free chat with our My Money Sorted team.

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

Find the Right Financial Advice for You with the Help of the My Money Sorted team.

When you book a call with My Money Sorted, you will:

✓ get a better understanding of your financial options

✓ have an idea of the experts you can call on to help manage your super funds

✓ be matched with the right financial professional who can help simplify the process

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick FREE call with a My Money Sorted team member

Step 2: Get matched with a licensed Finance Adviser that’s right for your money situation

Step 3: Take the first step towards your money goals with a clear and sound roadmap prepared by an experienced Financial Adviser

It’s that easy!

Speak with Our Team About Your Superannuation Needs and Get Your Money Sorted Today