As the main provider, you will go above and beyond to take care of and safeguard each member of your family, right?

But in the event of your passing, would you like to leave your family worse off, just the same, or in a better financial situation?

There is a simple way to do this and protect those most valuable to you today and in the years to come!

Jump straight to…

What Is Family Life Insurance

One of the best decisions you can make for your family is to purchase Family Life Insurance. Receiving a lump sum payment in the event something were to happen to you could ease the financial burden on your loved ones and provide them peace of mind during challenging times.

Family Life Insurance, also referred to as Family Term Life Insurance, is a form of life insurance policy purchased to provide financial security for your loved ones in the event of your death, critical illness, or injury.

Although there aren’t many custom insurance plans available in Australia for families, there are some insurers that offer extra benefits and add-ons that include benefits for family members.

Family Life Insurance Benefits

What if you were going through the normal routine of your annual doctor’s checkup and test results show that you have a terminal illness with a low chance of survival?

If you have family life insurance, it will enable you to safeguard your family’s financial well-being even if you are not able to provide for them.

If I were the primary breadwinner of the household, why should I get Family Life Insurance?

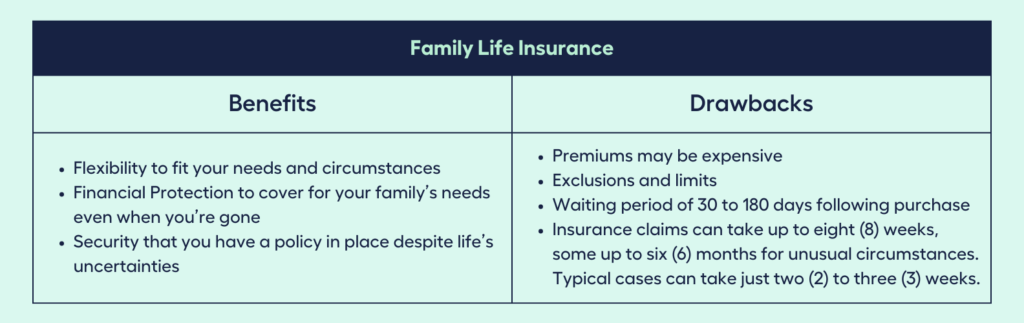

To shield your children and other dependents from financial difficulties in your absence, the following features of Family Life Insurance make it worth considering:

- Designed to cover the costs of daily living that may include food, clothing, mortgage, rent, medical needs, childcare and private education, and funeral expenses

- Also covers buying a new family home, or costs for home improvement and renovation to further add value to the house you may have left behind

- Can be tailored to your situation by choosing from a range of different policy types

- Can be tax-free depending on your individual policy

- Provides financial security, even if you never need to make a claim, since you have a policy in place

- Very affordable premiums (cost of an insurance policy) if you buy it when you’re young

Family Life Insurance Drawbacks

What are the potential downsides of having family life insurance to support and protect my family?

Should the worst happen, family life insurance can offer protection and a sense of security for your family although it may include some drawbacks such as:

- Expensive premiums

For new parents, purchasing life insurance could require regular contributions toward the premium as well as extra budget concessions in other areas of the family’s spending.

Do take note that premiums are determined by your age, family’s medical history, and your medical history. The bigger the risk, the higher the premiums you will pay.

- Exclusions and limits

There could be risks that are not covered under the policies you are considering and limits that apply to specific kinds of claims; some issues may not be covered by the policy.

- Waiting period

A policy’s claim period is typically between 30 and 180 days following purchase. The insurer may not accept a claim for unforeseeable events that might happen during the waiting time.

- Claim process

Most family term insurance claims are settled in a matter of two to three (2 to 3) weeks. Depending on the circumstances, some cases can take up to eight (8) weeks. And sometimes in exceedingly unusual situations, cases can take up to six (6) months.

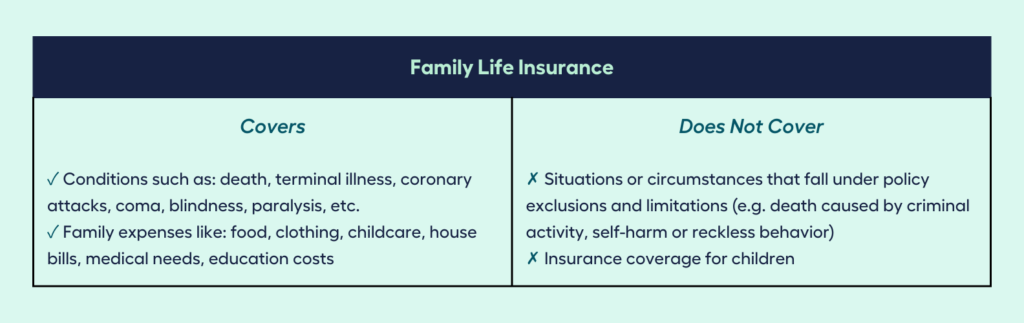

What Does Family Life Insurance Cover

Which medical events are covered by Family Life Insurance benefits?

Family Life Insurance may vary from policy to policy but will generally include:

- Death

- Terminal illness

- Cancer

- Coronary attacks (heart attack, stroke)

- Coma

- Blindness

- Kidney failure

- Major burns

- Paralysis

In addition, it can also cover short-term and long-term family expenses such as:

- Childcare

- Private education/schooling costs

- Food and clothing

- Medical requirements

- On-going bills and expenses, like mortgages and loans

- House bills

- Home repairs and renovations

- Home adjustments, if the policy holder becomes disabled

What Doesn’t Family Life Insurance Cover

In the case of an unforeseen incident in my family, what may hinder a policy claim payout?

Claim payments for family life insurance may be denied or insurance cover may be voided in certain situations or circumstances.

For example, if a family member dies as a result of drink driving beyond the legal limit, the coverage payout is likely to be forfeited. Also, a medical emergency such as self-inflicted burns on the body will not be compensated.

Here’s why:

The incidents below are commonly found in the exclusions of the insurance policy’s Product Disclosure Statement (PDS):

- If your death is caused by engagement in criminal activities.

- If you’re found to be involved in suicide or self-harm.

- If your death occurs very close to buying the policy, your insurance company might not pay your policy claim but offer premium reimbursement instead.

- If your death is caused by your reckless, negligent, or irresponsible behavior (e.g. drink driving beyond the legal limit, substance abuse, disregard for public safety, etc.).

So to maximise your chances of successfully receiving a claim payout, read the inclusions and exclusions of your policy in the Product Disclosure Statement (PDS) and policy document.

Not sure if your specific needs and conditions can be covered by a family life insurance?

Find the best policy for your needs by speaking to one of our Insurance Specialists.

I want to see all my options with the help of a Finance Expert

Book a FREE Call TodayWhen Should You Take Out Family Life Insurance

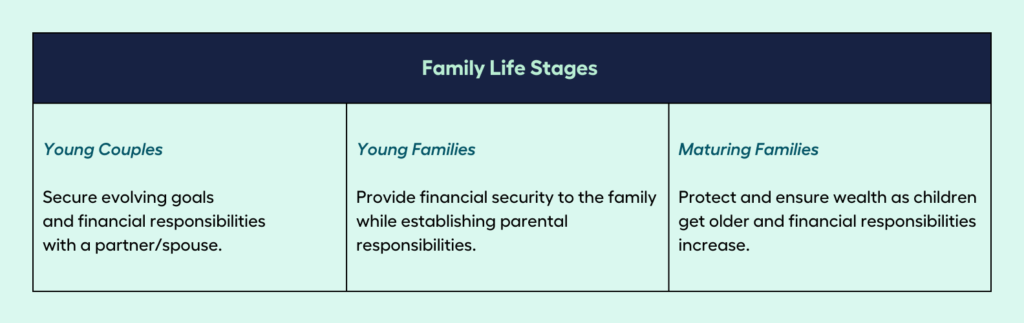

When is the best time for me to invest in Family Life Insurance?

Starting young is better but as you age and your needs alter, you should begin to give insurance a more serious consideration. Younger individuals typically pay lower premiums so taking out insurance at a younger age may make it more affordable.

Your family life stage, age, and personal circumstances determine the kind of insurance you need and how much coverage you need. Below are some life stages that may help you decide when to take out Family Life Insurance:

- Young couples: Protecting your growing goals and financial responsibilities with your partner is of utmost importance.

- Young families: Your priority is providing financial security to your family as you establish your parental responsibilities.

- Maturing families: Your work is now a significant and primary source of family income. An increasing emphasis on protecting and securing your wealth comes as a point of focus as your children get older and your financial responsibilities become larger.

Can I Take Out Life Insurance For My Child

Do I need life insurance for my child?

Children under the age of 18 cannot usually be covered by a standalone policy. A child’s policy can serve as some level of protection but most coverages aren’t adequate since they don’t provide financial support for a family.

But, let me tell you something.

Children’s protection may be offered by some insurance companies as a separate option at an additional fee or it may already be covered as part of the family life policy.

Some life insurance policies with child cover may also offer benefits for certain medical events (e.g. loss of sight or speech, paraplegia) and carer benefits, if you must leave your full-time job to care for your child on the condition that it is specified by a medical practitioner.

If you want to safeguard your entire family, choose a family life insurance that includes benefits for children.

Can I Take Out Life Insurance For Another Family Member

How do I get Life Insurance for a family member?

If you wish to get life insurance for someone in your family, they must give you permission.

Insurance firms need signed and verified statements regarding the insured family member’s personal information (age, health, occupation) in order to assess their insurance risk.

Depending on the terms of the Life Insurance, either one of you—the policyholder or your partner—or both of you can be covered by the policy.

Types of Insurance for Families

In Australia, there are various life insurance policy options that may interest your family. You should select a type of insurance based on what is most important to you.

You might be wondering:

In the event that I or my partner were to pass away, which policy benefit could be used to provide for the needs of the entire family?

You can choose from these insurance policy options:

- Life Insurance policy covers death or the diagnosis of a terminal illness. Your family could be eligible for a lump sum payout if either of the cited events happen. It is typically available for individuals aged 18 to 79.

- Children’s Insurance can be an extra option with most life insurance policies. It covers cases where a child is diagnosed with a terminal illness or specific injury or passes away. Additional medical and educational expenses can be covered by the lump sum payment.

- Total and Permanent Disability (TPD) Insurance, which comes as an optional extra with most life insurance policies, is typically available to persons aged 18 to 64. It best covers permanent disability and the inability to ever work again. It is a lump sum payment that covers both medical and educational expenses.

- Trauma Insurance or Critical Illness Insurance is suitable for a range of serious illnesses such as cancer, heart diseases, major head injuries, organ transplants, and more. As an optional extra cover meant for individuals aged 18 to 64, it can assist with ongoing expenses associated with the illness.

- Funeral Insurance is a fixed cover (usually from $5,000 to $15,000) paid in a lump sum to your family and serves as a funeral fund when you pass away. Individuals aged 18 to 79 years are typically eligible for this insurance.

- Accidental Death Insurance provides protection in case you are involved in an accident and get injured or die. It is a lump sum payment that helps your family cope with the sudden financial loss. Persons 18 to 64 years old typically qualify to purchase this insurance.

Getting the maximum protection for your family may mean that you need more than one type of insurance.

This will be determined by answers to questions like these…

Do I need more comprehensive Life Insurance cover?

Is it possible to get extra benefits for my family to claim in the future?

You could discover that additional inclusions to your life insurance provides you with a greater level of comfort and peace of mind. Optional benefits or add-ons to your life insurance could provide you with extra benefits or coverage for all possible risks associated with your lifestyle.

Below are the typical life insurance policy combinations that you can choose from:

- Life and TPD Cover

- Trauma and Life Cover

- Trauma and TPD Insurance: If you already have a life cover policy, you may decide to keep that as a stand alone policy. In that case, you may be able to link a TPD and Trauma insurance policy.

- Life Cover, TPD and Trauma Insurance

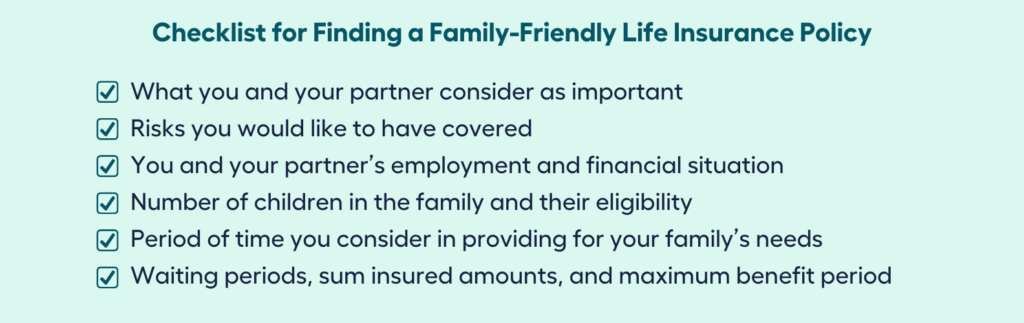

How To Find Suitable Life Insurance for Your Family

How do I determine if a Life Insurance policy is suitable for my Family?

Here are the simple steps to help you find the best life insurance for your family:

- Consider your particular family structure when deciding on the best coverage for your family.

- Discuss with your partner what you both consider as important and the risks you would like to have covered.

- Base how much insurance you could require on your specific circumstances like your family’s current and future finances.

- Consider these factors when evaluating the best insurance cover for your family:

a. You and your spouse/partner’s respective ages

b. Your financial situation – current income and anticipated future earnings

c. You and your spouse/partner’s employment situation

d. The amount that each parent contributes to the family (household expenses, family savings and debts)

e. The number of children in your family and their age

f. The period of time you’re considering to cover your family’s current needs

g. The eligibility criteria, if in case you are adding children to a policy

h. Variables such as waiting periods (duration of policy ownership before you can claim benefits), sum insured amounts, the appropriate maximum benefit period

After a thorough review of these factors, you are ready for the next step…

- Obtain and compare multiple insurance policy quotes to get a sense of what is offered by various companies. Meticulously read the product disclosure statement (PDS) and target market determination (TMD) when evaluating policies to be aware of what is and isn’t covered, what limitations apply, and whether the policy is appropriate for you.

Here are quick tips to help you find suitable Life Insurance for your family:

- Get as many quotes as you can from various providers to find the insurance policy that provides you with the most comprehensive coverage without compromising cost.

- Consider purchasing jointly-owned life insurance with your significant other because this option is slightly cheaper since you only pay one plan fee and stamp duty.

- Determine whether including children’s coverage is an essential addition to your family life insurance policy to provide the entire family an additional layer of security.

- Speak with an insurance expert as it can take a lot of time and effort to thoroughly investigate the various types of family life insurance on your own. They can evaluate your requirements and unique situation and suggest life insurance plans that are suited to your requirements.

- As your family grows, remember to regularly review your insurance cover.

How Much Life Insurance Does My Family Need?

Raising a family may be costly, particularly if one parent is no longer alive. Make sure your insurance coverage would provide you with enough money to cover your family’s expenses.

Your lifestyle, expenses, and financial status influence how much family insurance you need.

Consider the following when figuring out how much coverage your family requires:

- Family living expenses

- How much does your family spend on food, clothing, rent, bills, education, etc.?

- Loans and debts

- How much is your outstanding loan or debt? Eg. your home loan.

- How do you pay for it each month?

- How will your family be able to repay it if you’re gone?

- Financial security

- How much money do you have in savings?

- Do you have other assets or insurance policies that might help your family when you’re gone?

- Cover period

- Based on your household income, expenses, family size, debts and total savings, how much and how long do you want to be covered by your insurance policy?

How Much Does a Family Life Insurance Premium Cost

The cost of life insurance depends on your age, occupation, lifestyle, and the amount of coverage you choose to purchase. The decision to purchase insurance earlier in life may also have financial advantages because rates are typically lower when you’re young and healthy.

A policy that covers more than one person (jointly-owned or couple’s life insurance policy) or a policy with family-related add-ons will likely cost more than one that is just for you.

Multi-life discounts, offered by some insurance companies, is a policy that covers more than one person and is less expensive than two individual policies.

In Australia, life insurance premiums depend on many factors like:

- Whether you’re covering one parent or both

- Whether you require cover for children

- The age, health, lifestyle, and occupation of the individuals to be insured

- The preferred level of cover chosen

- Sum insured or benefit amount (how much money is paid out)

- Policy features (additional cover, special conditions)

- Premium structure (stepped vs level premiums)

Now that you know all about Family Life Insurance, I hope you find this article helpful in your search for the best life insurance for your family.

Remember:

Your life is your most priceless possession.

Protect it with the best life insurance tailored for your family!

Still not sure where to start, or want help securing the right insurance faster?

That’s okay!

Many people may be unaware of this…but just like you, 41% of Aussies intend to get financial advice rather than going it alone, according to an Australian Securities and Investments Commission (ASIC) report.

You can reach out to My Money Sorted to guide you for free before you seek professional advice from an insurance expert!

When you book a call with My Money Sorted, you’ll:

✓ get a better understanding of your money matters

✓ have an idea of your money goals

✓ be matched with the right insurance expert who can help simplify your search for an insurance policy that fits your needs

My Money Sorted is your stress-free pathway to getting ahead with your money.

Here’s what your journey will look like:

Step 1: Start off with a quick money matters session with My Money Sorted

Step 2: Get matched with a Insurance Expert that’s right for your money situation

Step 3: Take the first step towards getting the protection you need with a clear and sound roadmap prepared by an Insurance Expert

It’s that easy!