Putting money into superannuation is one of many ways to secure your financial future. The earlier you start, the more time your super has to grow.

Jump straight to…

- Putting money into superannuation is one of many ways to secure your financial future. The earlier you start, the more time your super has to grow.

- What are Concessional Contributions?

- Why Do People Make Concessional Contributions?

- Concessional Contributions vs. Other Super Contributions

- Who is Eligible for Concessional and Non-Concessional Contributions?

- Make the Most of Your Super with Concessional or Non-Concessional Contributions

- Are You Looking for Financial Advisors in Australia Who Can Help Get Your Money Sorted?

Superannuation, or super as it’s often called, can provide you with income you can rely on once you retire. Super is also something you can contribute to as soon as you start working.

The best part? Aussies also have the benefit of receiving different types of contributions to beef up their super from different sources—such as your employer, who is required to contribute 10% of your income to super as well as 10% of bonuses, commissions, or loadings.

On top of this, a salary sacrifice arrangement, or personal deductible contributions made by yourself can also be excellent ways to boost your funds on top of the amounts being paid into your super under the employer’s superannuation guarantee.

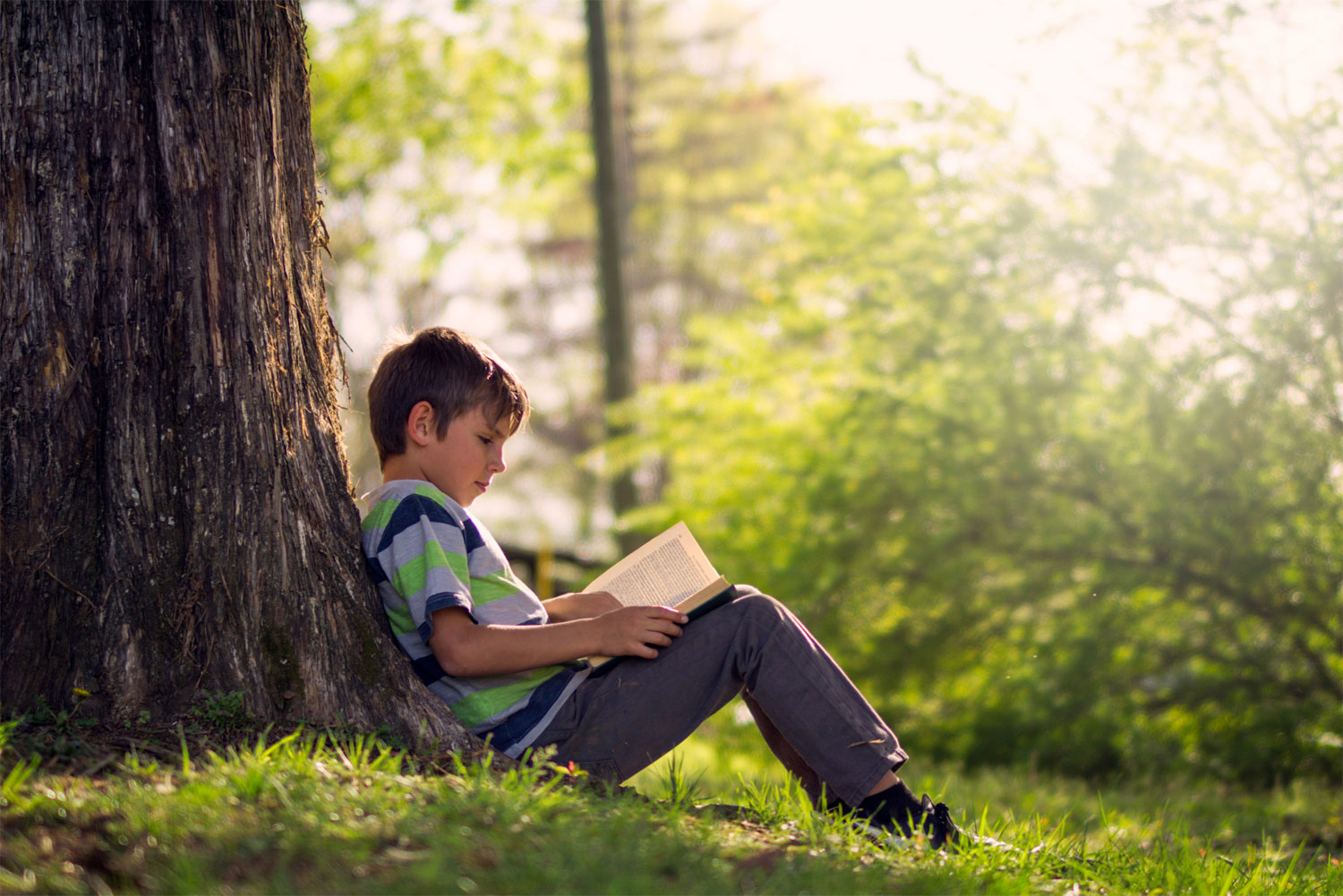

The younger you start adding to your super, the larger your balance will be by retirement age, which may afford you a higher standard of living during those golden years.

Whether you started accumulating super from a young age or not, there are some other ways to maximise super balance. As an example, in Australia, the income we generate from employment is typically taxed. For those who want to maximise the amount of money they keep from the income they generate, concessional contributions can be a great way to supercharge your retirement funds since it can be contributed before you pay tax on your working salary.

What are Concessional Contributions?

Setting aside a percentage of your income to build your super allows any hard-working individual to prepare for a comfortable retirement.

Concessional contributions include money deducted from your salary and delivered to super pre-tax.

Keep in mind the funds will still be taxed, however this may be at a much lower rate than your ordinary marginal tax rate. As an example the tax rate on concessional contributions is 15%, for those earning below $250,000 per year.

The ATO set the concessional contribution cap at $27,500 annually, though you have more leeway when you have unused concessional contributions to make into a super fund. Keep in mind that in addition to your 15% contributions tax, the Division 293 tax is also payable once you make concessional contributions.

Why Do People Make Concessional Contributions?

Concessional contributions can open a world of financial opportunities for your future – specifically your retirement.

Compound interest is a superpower that can make the most of your contributions without you having to lift a finger. Compound interest simply means the longer you invest your money, the greater your chances of achieving financial success since the interest you earn will accumulate over time and skyrocket your original balance.

Compound interest creates a snowball effect; one where your small, additional concessional contributions can become a massive source of income that can make your retirement life as easy as possible. The earlier you start to boost your contributions with smaller, manageable additions, the more momentum you’ll build as you grow your wealth.

Concessional contributions can also provide short-term benefits, which include lowering your income tax and qualifying for government co-contributions.

What are Examples of Concessional Contributions?

There are different types of concessional contributions you can use to boost your super funds, and as of 1 July 2017, these include the following:

1. Superannuation Guarantee (SG) Contributions

Every hard-working Australian is entitled to receive compulsory contributions of 10% of your ordinary time earnings (OTE) to your super account.

Note that your employer is only obligated to pay the 10% SG contributions up to a certain income limit, wherein the maximum super contribution base is at $235,680 for the year 2021-22. Exceeding the quarterly limit of $58,920 means your employer is no longer obligated to make contributions.

It can be confusing to track your super balance as there is often a difference between when you earn income and when the SG related to that income is actually paid into your super by your employer.

Here is a guide of the financial year divided into quarters which shows when cut off for SG payments:

| Financial Year Quarter | End of Quarter | Deadline for SG Contributions |

| Q1 (July–September) | 30 September | 28 October |

| Q2 (October–December) | 31 December | 28 January |

| Q3 (January–March) | 31 March | 28 April |

| Q4 (April–June) | 30 June | 28 July |

2. Employer Award Contributions

There are other ways to bump up your concessional contributions, and one of them includes receiving Employment Awards or Agreements from your employer.

The Fair Work Commission oversees the certification, but the total amount of the contributions vary for every unique Employment Award or Agreement (EA).

3. Additional Pre-Tax Contributions from Your Employer (Salary Package)

The SG legislation and EA have a set contribution amount, but your employer can also add pre-tax contributions as part of your salary package.

4. Salary-Sacrifice Contributions

When you make an arrangement with your employer to set aside a portion of your salary dedicated to your superannuation account before paying the taxes, it is called a salary-sacrifice contribution.

Instead of taking the amount as part of your take-home pay, the additional before-tax salary can help you boost your super funds every pay cycle; you can even set the specific amount with your employer.

5. Personal Contributions with a Tax Deduction

Making personal contributions to your super account may be claimable as a tax-deduction, but remember that annual cap limits still apply, so be mindful to stay within the set limitations by the ATO and avoid penalties. This is the only contribution made by self-employed individuals and even those who have already retired.

6. First Home Super Saver (FHSS) Scheme Contributions

First-time homebuyers can reap many financial benefits, and that includes having the ability to save for your real estate purchase through the FHSS scheme, which uses either your concessional (pre-tax) or non-concessional (after-tax) contributions.

While the concessional contributions are not yet taxed, your super fund will apply 15% contributions tax. If you don’t use all your annual concessional contributions, you can roll forward the unused amount and allocate it within five financial years.

As mentioned, the concessional contributions cap is currently at $27,500, though it also helps to know previous caps in the past financial years, which you can refer to in the table below:

| Income Year | Effective Date | Age | Concessional Contributions Cap |

| 2021-22 | All Ages | $27,500 | |

| 2020-21 | All Ages | $25,000 | |

| 2019-20 | All Ages | $25,000 | |

| 2018-19 | All Ages | $25,000 | |

| 2017-18 | All Ages | $25,000 | |

| 2016-17 | June 30, 2016 | Below 49-Years-Old 49-Years-Old and Above | $30,000 $35,000 |

| 2015-16 | June 30, 2015 | Below 49-Years-Old 49-Years-Old and Above | $30,000 $35,000 |

| 2014-15 | June 30, 2014 | Below 49-Years-Old 49-Years-Old and Above | $30,000 $35,000 |

| 2013-14 | June 30, 2013 | Below 59-Years-Old 59-Years-Old and Above | $25,000 $35,000 |

If you did not reach the concessional contribution cap in any relevant financial year, you have the chance to “carry forward” the difference to meet your cap in following years.

It’s important to know that the carry-forward rule is not interchangeable with the bring-forward rule, as the former only applies to unused concessional caps from July 2018 and over.

Concessional Contributions vs. Other Super Contributions

Concessional contributions are from your before-tax salary, while non-concessional contributions are from your after-tax income.

Unlike concessional contributions, your after-tax contributions will only be taxed at a rate of 15% for the future investment earnings you make. But your non-concessional contributions will be tax-free once you can access your super during retirement. This is because you have already paid tax on that money so it wouldn’t be fair to have to pay it twice.

When it comes to reaching your non-concessional contributions cap, you can refer to the table below to avoid having to refund the excess contributions or risk being taxed at the highest possible marginal tax rate.

| Superannuation Balance | Non-concessional Contribution Cap | Bring Forward Non-Concessional Contribution Cap |

| Less than $1.4 million | $100,000 | Three Years, i.e. $300,000 |

| $1.4 – <$1.5 million | $100,000 | Two Years, i.e. $300,000 |

| $1.5 – <$1.6 million | $100,000 | Nil |

| $1.6 million and more | Nil | Nil |

There are recent changes to take note of, such as the non-concessional cap is now $110,000 as of 1 July 2021, though you can also boost the amount when you apply the “bring-forward” rule. The bring-forward rule allows you to advance your non-concessional contributions caps over a three-year period, all at once or in increments.

Low to middle-income earners can also benefit from the additional super co-contribution up to $500 from the Australian Government. However, super co-contributions are not considered non-concessional contributions.

Who is Eligible for Concessional and Non-Concessional Contributions?

Aussies at any age can make concessional contributions to their super, so long as they stay within the cap of $27,500 a year.

Non-concessional contributions can only be made by individuals who are below 67-years old and reach a cap of $110,000 a year. However, the requirements mentioned are generally applied to individuals who had less than $500,000 total super balance on the 30th of June in the previous financial year.

Make the Most of Your Super with Concessional or Non-Concessional Contributions

Concessional contributions can do wonders in enhancing your retirement funds, but it’s just as important to stay within your super contributions caps. While concessional contributions receive lower tax rates, the opposite can happen when you over-contribute past the limit since the ATO sets costly consequences for going over the cap.

Voluntary super contributions can help you get your money sorted – as well as budgeting, loan monthly payments, and possible investments. If you want personalised superannuation advice, work with a qualified and licenced financial adviser who can help you navigate the complexities of your super fund.

Are You Looking for Financial Advisors in Australia Who Can Help Get Your Money Sorted?

Handling finances can be a daunting task for anyone, especially when it comes to creating a financially secure future. In between juggling different expenses, setting aside for emergencies, and then keeping up with your tax, it can be hard to put your hard-earned money towards your savings and other important investments.

My Money Sorted can help take the guesswork out of your finances by connecting you with leading experts and finance professionals who offer a wide range of services.

All of whom are dedicated to improving your money management in more ways than one. From financial planning, budgeting tips, business management, personal loans, mortgage, and how to set up superannuation, let the experts crunch the numbers for you in a way that is tailored to your unique situation.

No matter your stage in life, My Money Sorted can help simplify your money-related decisions moving forward by providing you with personalised insights to improve your financial literacy.

Register your interest today and see what we can help move you closer to your financial dreams.

The more we do to maximise and grow your super today, the more financial freedom you’ll have in years to come find out how a financial planner or adviser can help you with this and more

Track your Super